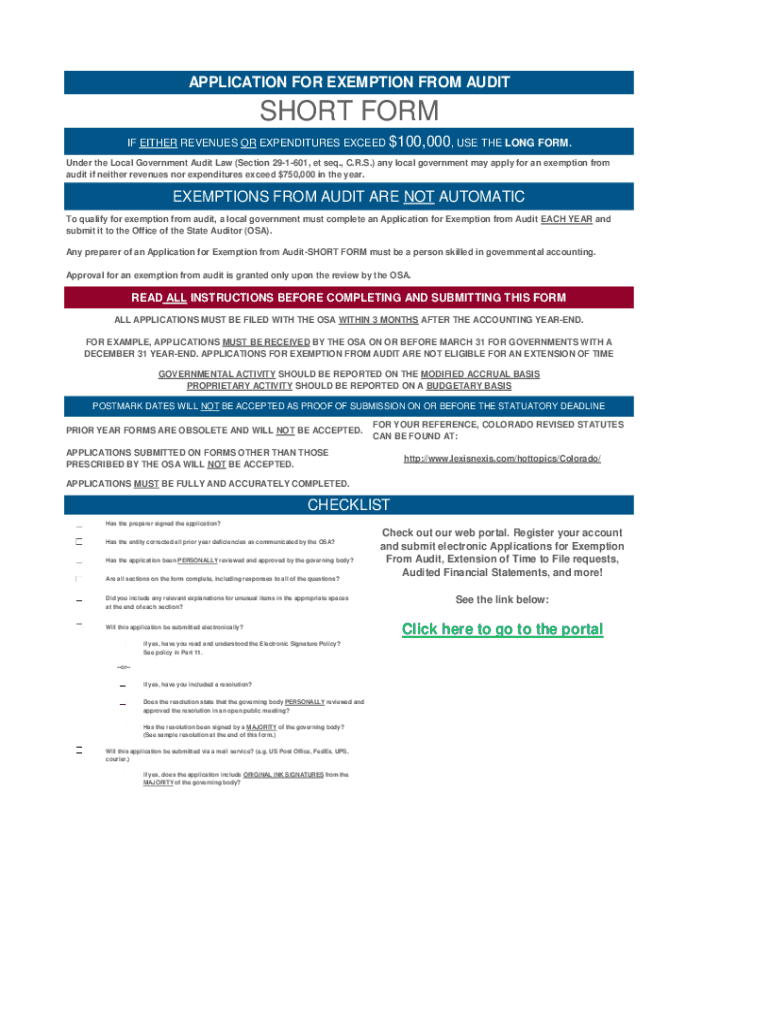

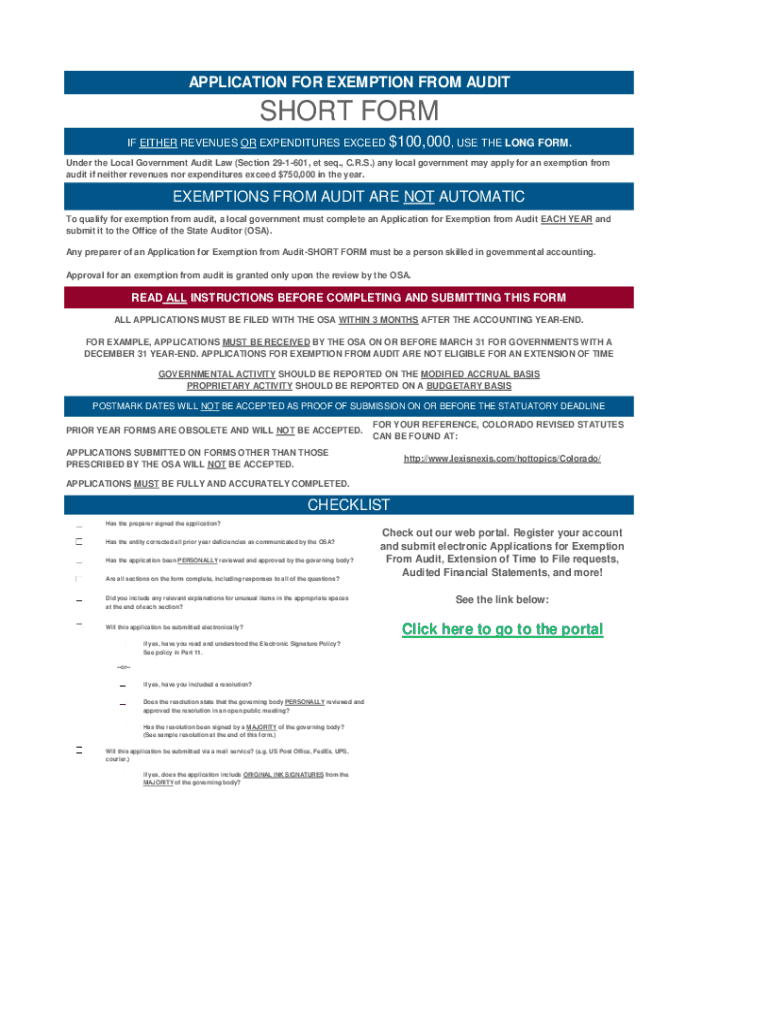

Get the free Application for Exemption From Audit

Get, Create, Make and Sign application for exemption from

Editing application for exemption from online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for exemption from

How to fill out application for exemption from

Who needs application for exemption from?

Application for Exemption from Form: A Comprehensive Guide

Understanding the application for exemption

An application for exemption is a formal request for relief from a specific regulation, obligation, or requirement outlined in a governmental or organizational form. Exemptions can vary widely, from tax exemptions to educational waivers, and they play a critical role in enabling individuals and entities to operate more flexibly in certain restricted situations. Understanding the significance of these exemptions is paramount, as they can significantly impact financial liabilities, operational capabilities, and legal compliance.

Exemptions serve various purposes across different contexts, including easing the burden on certain demographics, promoting education, and recognizing unique circumstances. Common reasons for applying for exemptions often include financial hardship, special educational needs, or compliance with unique business circumstances. This guide will provide a structured approach to understanding, applying for, and managing exemptions effectively.

Who qualifies for an exemption?

Eligibility for exemptions often varies based on the type of exemption sought. Typically, individuals, educational institutions, and businesses may apply depending on context. For example, tax exemptions may be available to non-profit organizations and low-income families, while educational exemptions could be relevant for students facing learning disabilities.

Key criteria for qualification generally include proof of financial need, specific conditions met during enrollment for students, or operational limitations for businesses. Considerations might include age, income level, residency, and prior compliance with related regulations. Real-life examples of situations warranting an exemption include a low-income family applying for a property tax exemption or a student getting a fee waiver based on economic status.

Types of exemptions explained

A variety of exemptions are available across different sectors, each with its distinct implications. Broadly categorized, these include tax exemptions, educational exemptions, and health-related exemptions. Each type is subject to its requirements and helps alleviate burdens on specific groups.

For example, in the educational sector, the exemptions could entail admissions or tuition waivers for students with disabilities. In taxation, non-profit organizations might qualify for exemptions from sales taxes. Understanding these distinctions informs applicants about their potential eligibility and the responsibilities tied to maintaining these exemptions.

The role of pdfFiller in managing exemption applications

pdfFiller stands out as a powerful tool for users navigating the complexities of exemption applications. The platform not only simplifies the application process but also incorporates advanced features that enhance user experience. Whether you're an individual or a team, the ability to create, edit, and manage documents is crucial in ensuring efficient processes.

Key features of pdfFiller include eSigning capabilities, allowing users to sign documents electronically, and collaboration tools that facilitate teamwork for group applications. Additionally, its document storage and management features ensure that all necessary materials are easily accessible. Importantly, pdfFiller can be accessed from anywhere with internet access, offering significant advantages for users on the go, such as flexibility and convenience.

Step-by-step guide to completing your application for exemption

Completing an application for exemption requires careful preparation and attention to detail. The following step-by-step guide ensures that you gather the necessary information and submit your application successfully:

Common mistakes to avoid when applying for exemption

When applying for an exemption, applicants often make several common mistakes that can hinder their chances of approval. Such errors include incomplete forms, failure to provide necessary documentation, and inaccuracies in personal information. These mistakes can lead to delays or outright denial of the application.

To enhance your application’s success, ensure that every section is completed thoroughly. Pay special attention to required fields and double-check all information against supporting documentation. It's advisable to have someone read over your application to catch errors you may have overlooked. This extra diligence can save time and stress in the long run.

What happens after you submit your application?

After submitting your application for exemption, it enters a review process. The timeframe for this review can vary substantially based on the type of exemption and the specific agency handling your request. Generally, you can expect a response within a few weeks, although it may take longer during peak application periods.

Once reviewed, you will receive either an approval or a denial. If your application is approved, ensure that you understand the stipulations associated with your exemption, while a denial will require you to explore options for reapplying or appealing the decision. In any case, maintaining open lines of communication with the agency can provide clarity on your next steps.

FAQs about applications for exemption

Several frequently asked questions arise regarding the application for exemption process. Questions often cover the duration of the application process, the ability to amend submitted applications, and what to do if personal circumstances change after submission.

Typically, the exemption application process may take several weeks, depending on the specific requirements and review workload. If you find that you need to amend your application, it's essential to contact the reviewing agency directly. Lastly, if your circumstances change, you should inform the agency at your earliest convenience, as this may influence the outcome of your exemption status.

Success stories: Real-life examples of exemption applications

A number of individuals and organizations have successfully navigated the exemption application process, often sharing their journeys to highlight common challenges and effective strategies. For instance, a local non-profit organization was able to secure tax exemption status, significantly reducing its operating costs and allowing it to allocate more resources to its community initiatives.

Feedback from users emphasizes how pdfFiller facilitated their experiences—by enabling smooth document creation, fast eSigning, and easy collaboration among team members. Testimonials often underline the importance of having a reliable document management platform during this process.

Staying compliant: What to do after receiving an exemption

After the approval of your exemption, it’s crucial to understand the obligations that accompany it. Compliance often involves adhering to specific guidelines and timelines to maintain your exemption status. For example, in taxation, non-profit organizations may need to provide annual disclosures to confirm their continued eligibility.

Failure to comply can lead to consequences, including financial penalties or revocation of your exemption. Regularly reviewing your obligations and maintaining organized documentation can help avoid pitfalls associated with non-compliance, ensuring that you benefit from the exemptions for as long as necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the application for exemption from in Gmail?

How do I edit application for exemption from on an iOS device?

How do I complete application for exemption from on an Android device?

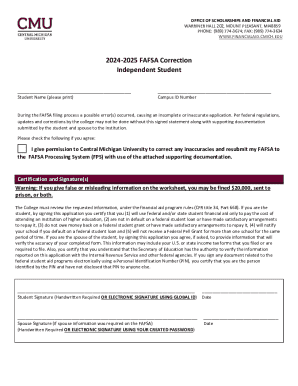

What is application for exemption from?

Who is required to file application for exemption from?

How to fill out application for exemption from?

What is the purpose of application for exemption from?

What information must be reported on application for exemption from?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.