Get the free W-9 - www meridiancity

Get, Create, Make and Sign w-9 - www meridiancity

Editing w-9 - www meridiancity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9 - www meridiancity

How to fill out w-9

Who needs w-9?

Comprehensive Guide To Completing the W-9 Form on pdfFiller

Understanding the W-9 form

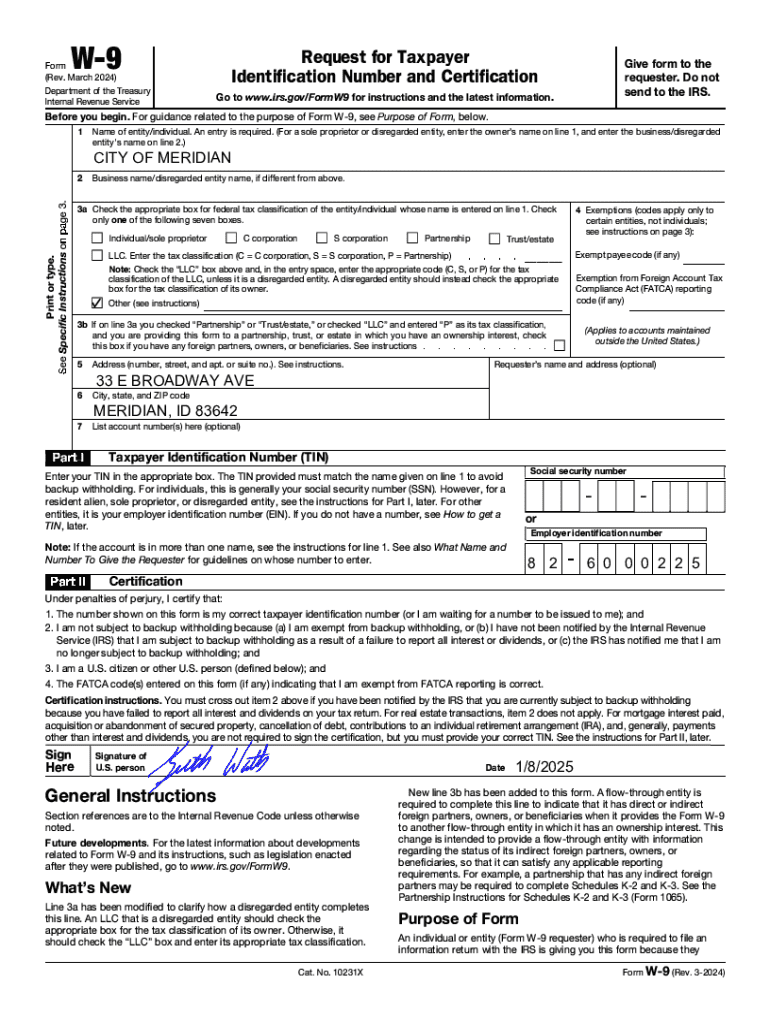

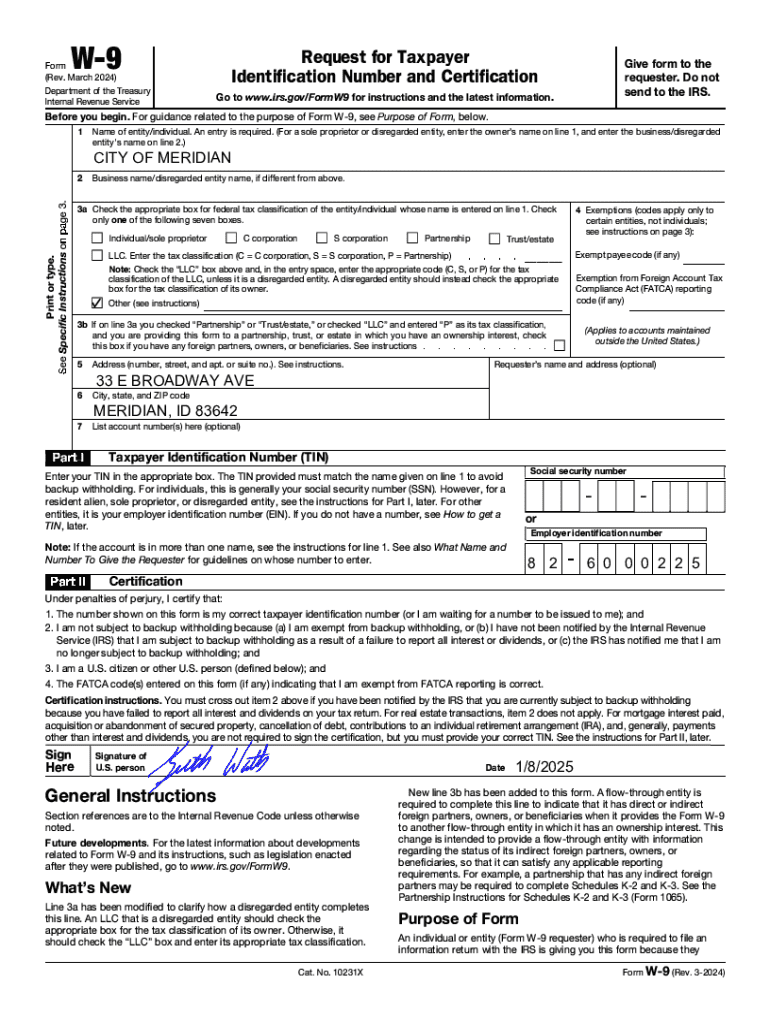

The W-9 form is an essential document used by individuals and entities in the United States to provide their taxpayer identification information. Its primary purpose is to inform third parties, such as clients or employers, about your taxpayer status so that they can appropriately report any payments to the IRS. This form is critical for independent contractors, freelancers, and businesses providing services requiring 1099 reporting, ensuring compliance with tax regulations.

Completing the W-9 form is necessary for various scenarios. For instance, if you are a freelance graphic designer in Meridian, Idaho, and you take a project from a local company based at 33 E. Broadway Ave., you would need to submit a filled-out W-9 to ensure they can report your income accurately. Understanding these implications helps individuals and businesses maintain their tax compliance.

Accessing the W-9 form via pdfFiller

To access the W-9 form on pdfFiller, start by navigating to the official website. The homepage provides a user-friendly interface that directs you towards templates. Follow these straightforward steps: first, click on the 'Forms' tab at the top of the page. Then, type 'W-9' into the search bar to locate the template quickly. The pdfFiller platform makes it extremely easy to find specific forms without sifting through irrelevant documents.

pdfFiller stands out for its advantages, including cloud-based access, allowing users to fill out and edit their forms from anywhere with an internet connection. This is particularly beneficial for individuals and teams working remotely or on different schedules. Additionally, the platform provides secure storage options and straightforward document management features to keep your forms organized and accessible.

Step-by-step instructions for completing the W-9 form

Filling out the personal information section of the W-9 form can be streamlined when using pdfFiller's interactive interface. Begin by providing your legal name as registered with the IRS. It's crucial to ensure accuracy here because any discrepancies could lead to tax issues later. Next, provide your business name if applicable. Fill in your address details, including street, city, state, and ZIP code, paying close attention to local regulations if you reside in areas like Meridian, ID, which has specific tax guidelines.

Your Taxpayer Identification Number (TIN) is a vital component of the W-9 form. If you are an individual, this will typically be your Social Security Number (SSN). For businesses, however, you will need your Employer Identification Number (EIN). To avoid mistakes, double-check that you enter the correct numbers as the IRS utilizes this information to match income reports with the right taxpayer.

Choosing the correct tax classification is another critical step on the W-9 form. You will encounter various classifications, including individual/sole proprietor, partnership, corporation, S corporation, and limited liability company (LLC). The classification impacts how your income is reported and the corresponding tax rates that need to be addressed, making it necessary to choose the one that accurately reflects your status. For example, a sole proprietor in Meridian should select the first option, while a business registered as an LLC must select the corresponding checkbox.

Finally, be sure to provide your signature and date on the form to validate your information. Understanding the importance of your signature is essential, as it confirms the information given is accurate and that you understand your tax obligations. pdfFiller allows you to include an electronic signature easily, which helps streamline the process further.

Editing and customizing the W-9 form

One of the standout features of pdfFiller is its robust editing tools that allow users to make necessary adjustments to their W-9 forms seamlessly. You can edit text, add images, or annotate directly on the form. If you need to correct any mistakes after completing the form, these tools make the process efficient. The intuitive interface enables users to quickly navigate through the document, ensuring that changes are easy to implement without needing to start from scratch.

Collaboration is another crucial aspect of document management in pdfFiller. The platform allows users to invite others—like accountants or business partners—to review the completed W-9 form. You can easily set permissions to restrict editing or require signatures, making it simple to maintain control over your documents. This is particularly useful for teams who work together remotely and need to ensure all information is accurate before submission.

Storing and managing your W-9 forms

Organizing your W-9 forms and other documents in pdfFiller is straightforward. Users can utilize the folder creation feature to categorize various tax forms and related documents systematically. For instance, you can create a dedicated folder for 2023 tax documents and another for other years, ensuring that each are organized and easily retrievable. This is especially helpful during tax season when the need for quick access to forms is at its peak.

When it comes to long-term management of your tax-related documents, adopting best practices is essential. Regularly review and update the stored forms to prevent confusion or errors. Keeping your contact and financial information current helps to avoid issues with tax authorities. Additionally, pdfFiller ensures that all documents are stored securely within its cloud-based platform, offering peace of mind regarding data protection.

Additional tips for W-9 form compliance

It's vital to avoid common mistakes when completing the W-9 form. Frequent errors include providing outdated information, missing a signature, or selecting the wrong tax classification. Such inaccuracies can lead to late fees or complications during audits. Therefore, double-checking all entries, specifically your TIN and classifications, is advisable. Additionally, you should verify the details against IRS guidelines to ensure compliance.

If circumstances change, and you need to amend your W-9 form, the process is quite straightforward. To revise a submitted form, fill out a new W-9 form with the corrected information and submit it to the requester, ensuring they update their records accordingly. Keeping your information up to date is essential as it affects how your income is reported to tax authorities annually.

Frequently asked questions

Several questions often arise regarding the W-9 form. Many users wonder about the timeline for submitting the form or who their form should be submitted to. The W-9 is typically submitted to the person or organization requesting it, who will use it to prepare Form 1099 at the end of the year. It's crucial also to be aware that you should not send the W-9 directly to the IRS unless specified. Additionally, questions about what to do if an error is found on a W-9 are common; the recommended action is to submit a corrected form immediately.

If you encounter any issues or need support while using pdfFiller, help is readily available. The website offers a dedicated help center, providing answers to common inquiries and direct access to customer support representatives. This resource ensures users receive assistance with form management and other technical issues promptly, allowing for a smoother experience with the platform.

Leveraging pdfFiller for other forms and documents

Beyond the W-9 form, pdfFiller allows users to expand their document management capabilities by accessing a plethora of other forms. This can include sales tax exempt forms essential for Idaho businesses, financial forms, and legal documents. The sheer variety and convenience of pdfFiller’s platform enable users to manage all essential paperwork efficiently.

Anyone in need of document creation solutions can benefit from using pdfFiller. Its advantages include the ease of filling out multiple forms, securely storing information, and collaborating with others without hassle. Leveraging these tools can boost productivity, particularly for individuals and teams focusing on tax compliance and effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify w-9 - www meridiancity without leaving Google Drive?

How can I send w-9 - www meridiancity for eSignature?

How can I edit w-9 - www meridiancity on a smartphone?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.