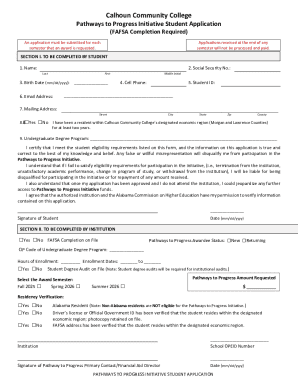

Get the free Form 11 – Nomination of Overseas Buyers for Hotel Sponsorship

Get, Create, Make and Sign form 11 nomination of

Editing form 11 nomination of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 11 nomination of

How to fill out form 11 nomination of

Who needs form 11 nomination of?

Comprehensive Guide to Form 11 Nomination of Form

Understanding Form 11: What you need to know

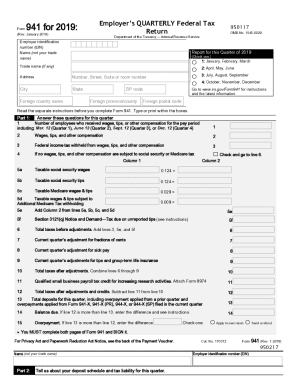

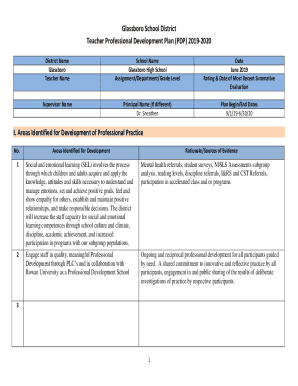

Form 11 is a crucial document commonly associated with tax reporting and compliance in various jurisdictions. This form is primarily used to report income, assets, and tax obligations to the relevant authorities. The submission of Form 11 ensures transparency in an individual's financial activities and assists government entities in administering tax laws effectively.

Understanding its purpose and significance can make a significant difference in your tax preparation process. Form 11 is particularly relevant for those with more complex income streams, including self-employment income, investments, or multiple sources of income. By accurately completing and submitting this form, taxpayers can minimize their chances of tax audits and ensure they are paying the correct amount in taxes.

Preparing for Form 11 Submission

Preparation for completing Form 11 starts with gathering essential documents and information. You will need financial records such as income statements, expense reports, and previous tax returns. Additionally, having clarity on your tax deductions, credits, and any special considerations pertaining to your income stream can facilitate a smooth submission process.

Common pitfalls include overlooking necessary documents or misreporting income, which can lead to discrepancies and audits. To avoid these issues, create a checklist of required documents and ensure that all figures are accurate and corresponding with your financial records.

Step-by-step guide to filling out Form 11

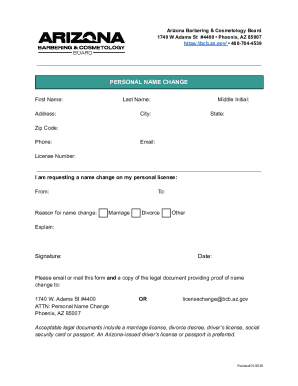

Filling out Form 11 can be straightforward if approached methodically. Begin by familiarizing yourself with its structure, typically composed of multiple sections, including Personal Information, Declaration of Assets, and Tax Obligations. Each section serves a unique purpose in providing the revenue authorities with a comprehensive overview of your financial situation.

For instance, the Personal Information section captures basic data like your name, address, and tax identification number, while the Declaration of Assets requires a detailed account of your assets, including real estate and financial holdings. In the Tax Obligations segment, you will outline your tax liabilities, ensuring these figures reflect any applicable deductions.

Special attention should be paid to specific fields to avoid misrepresentation. For example, ensure all income is wholly included without exemptions unless legally permitted.

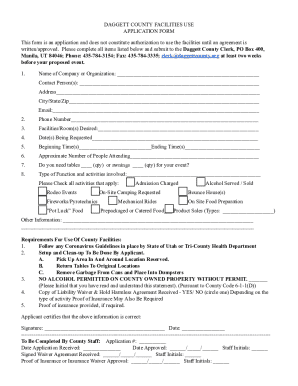

Interactive tools for efficient form completion

Digital tools like pdfFiller facilitate a seamless experience in filling out Form 11. Using pdfFiller’s features, you can digitally complete the form with interactive fields that make entering information easy and efficient. This method ensures that the necessary fields are clearly marked and reduces the possibility of errors that can occur with handwritten forms.

For a step-by-step tutorial on using interactive fields in pdfFiller, start by selecting the Form 11 template on the platform. Once you've opened the document, proceed to fill in the required fields directly.

Editing and finalizing your Form 11

Before submitting your Form 11, it's essential to review and thoroughly edit all entries. Double-check all figures and information to ensure accuracy and alignment with supporting documents. This review process is crucial as even minor errors can lead to substantial delays or penalties from tax authorities.

Best practices include setting aside a specific time to focus on this review, consulting with a tax advisor if uncertain, and utilizing pdfFiller’s editing features to make any necessary adjustments. Make sure to verify all sections, as missing a field could result in compliance issues.

eSigning your Form 11: A seamless approach

In today's fast-paced world, eSignatures are becoming increasingly essential. For Form 11, eSigning offers a secure and efficient way to affirm your submission without the need for physical paperwork. Using pdfFiller, you can eSign your form seamlessly, ensuring your consent is explicit and legally binding.

To eSign your Form 11 using pdfFiller, start by navigating to the eSignature tab after completing your document. Follow the prompts to add your signature electronically using a trackpad, mouse, or by uploading an image of your signature.

It's important to remember that eSignatures hold the same legal standing as handwritten signatures, provided they comply with eSignature laws.

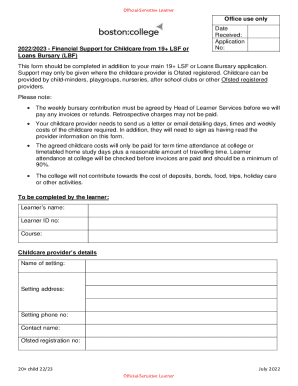

Managing and storing your completed Form 11

Once you have completed your Form 11 and finalized it with your eSignature, the next step is managing and storing the document responsibly. Utilizing cloud-based storage solutions, such as those provided by pdfFiller, ensures that your form is accessible from any device with an internet connection, enhancing your document management capabilities.

Organizing your forms will help you easily reference them when needed, particularly during tax season or if required by financial institutions. Sharing your Form 11 securely is also simplified through these cloud platforms, allowing designated parties to access the document without compromising security.

Troubleshooting common issues

If you encounter issues while completing or submitting Form 11, you’re not alone. Many users have questions regarding specific fields, common mistakes, or even submission errors. Addressing these concerns early on is vital to prevent any delays or compliance issues.

Start by consulting the FAQ section available on pdfFiller’s website for potential solutions to common problems. If you still face difficulties, don't hesitate to reach out for support. pdfFiller offers dedicated assistance to help users navigate any challenges they might face.

Additional tools for document management

Beyond Form 11, pdfFiller offers a range of capabilities that enhance document management overall. Features like document templates, collaboration tools, and streamlined workflows allow users and teams to manage their documents efficiently. Integrating Form 11 into these broader workflows can significantly improve productivity.

Collaboration features enable multiple users to work on forms or documents simultaneously, enhancing team efficiency. This can be especially useful in scenarios involving audits or shared financial responsibilities.

Real-life examples of using Form 11

Real-life applications of Form 11 bring to light its importance across various sectors. Individuals who are self-employed often utilize Form 11 to declare their income and expenses accurately, allowing them to benefit from lawful deductions and tax credits. Businesses may use Form 11 to ensure compliance with tax obligations and for transparency to stakeholders.

Numerous testimonials highlight user experiences while navigating the Form 11 process. These authentic insights reflect the ease of use and efficiency that pdfFiller provides, allowing users to spend less time worrying about forms and more time growing their businesses.

Keeping up-to-date with Form 11 requirements

Tax regulations change regularly, making it vital to stay updated on Form 11 requirements. Various online resources, including tax authority websites and financial news outlets, offer ongoing education regarding tax forms and processes. Engaging with these resources can empower taxpayers to remain compliant and prepared for changes.

Regular reviews and updates of your documents ensure you are not only compliant but also maximizing potential deductions in accordance with the latest regulations. Keeping your information accurate and current can save you potential headaches and expenses in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 11 nomination of without leaving Chrome?

Can I create an electronic signature for signing my form 11 nomination of in Gmail?

How do I edit form 11 nomination of on an Android device?

What is form 11 nomination of?

Who is required to file form 11 nomination of?

How to fill out form 11 nomination of?

What is the purpose of form 11 nomination of?

What information must be reported on form 11 nomination of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.