Get the free Application for First Home Owner Grant

Get, Create, Make and Sign application for first home

How to edit application for first home online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for first home

How to fill out application for first home

Who needs application for first home?

Application for First Home Form: A Comprehensive How-to Guide

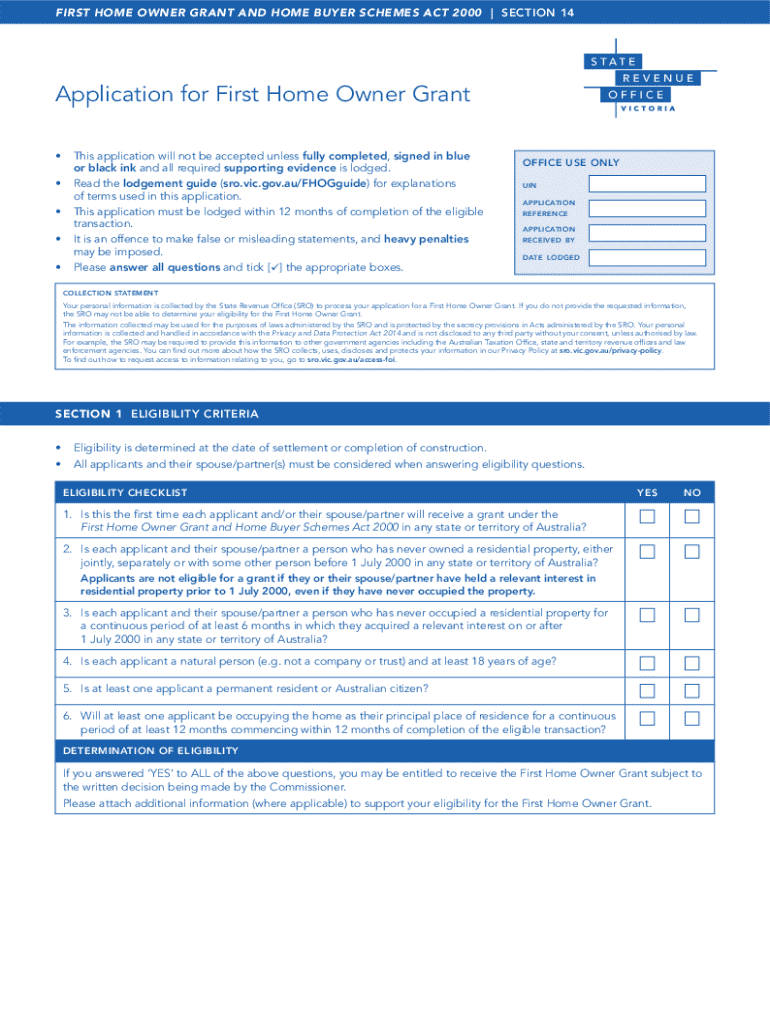

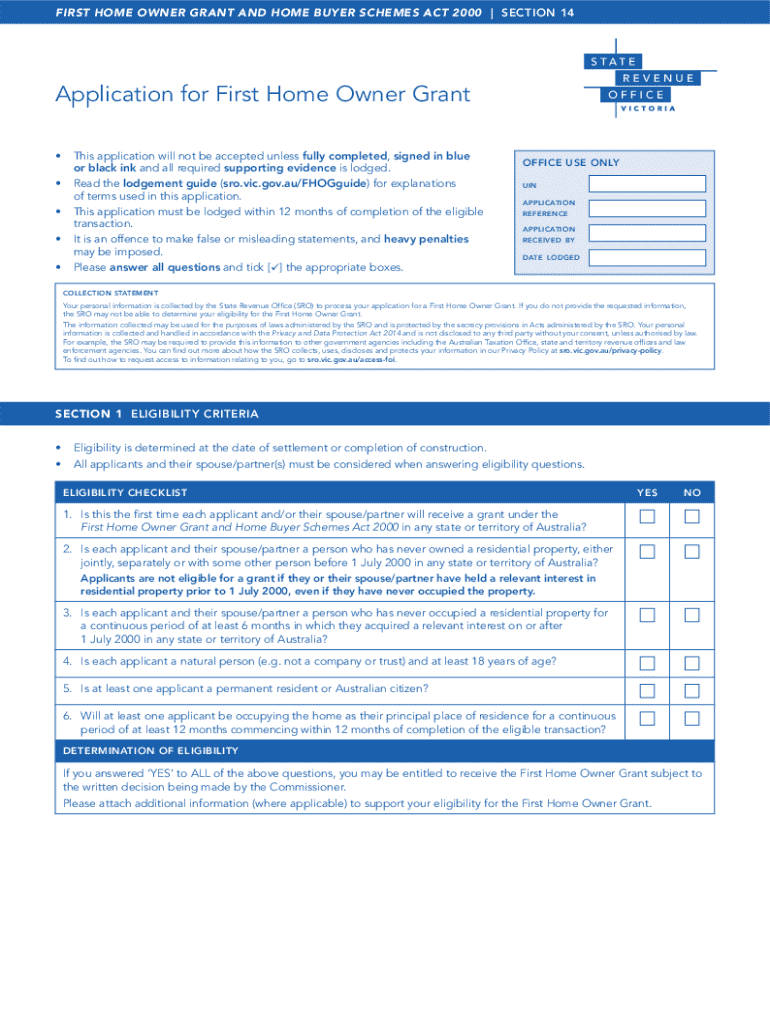

Understanding the First Home Owner Grant (FHOG)

The First Home Owner Grant (FHOG) is a financial incentive designed to assist first-time homebuyers in purchasing their first residential property. This initiative aims to make home ownership more accessible, helping individuals transition from renting to owning. For many first-time buyers, the FHOG serves as a crucial source of funding that can reduce the financial burden associated with buying a home. Understanding the functionality of the FHOG is vital for applicants, as it directly impacts your ability to achieve homeownership.

This grant varies between regions and is influenced by several factors, including state regulations and available funds. For aspiring homeowners, the FHOG not only provides a monetary boost but also acknowledges the significant investment involved in securing property in today's competitive market.

Eligibility criteria for the FHOG

To qualify for the FHOG, applicants must meet specific eligibility criteria set forth by their respective state or territory governments. Here are some key eligibility standards:

Preparing to apply for the First Home Owner Grant

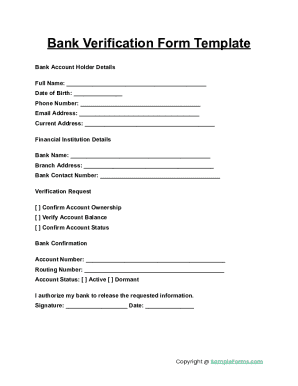

Before you embark on the application process for the First Home Owner Grant (FHOG), it’s critical to ensure all necessary documentation is in order. Gather the essential documents that will support your application to enhance your odds of success. Commonly required documentation includes proof of identity, financial records, and information pertaining to the property you're purchasing.

To organize effectively, create a checklist that details all required documents. This will not only help streamline the application process but also prevent the stress of missing information later. Moreover, knowing the application process is essential to know what to expect at each phase.

Understanding the application process

The FHOG application process typically involves several key steps, which could take a few weeks to a few months depending on various factors such as submission method and state offices' processing times. Understanding these steps can provide clarity and help manage expectations.

Step-by-step guide to applying for the FHOG

Following a systematic approach to completing the application for the First Home Owner Grant is crucial. Let’s break down the steps:

Step 1: Accessing the application form

Access the official application form through the appropriate state or territory government website. For further assistance, you can visit pdfFiller to locate and edit the document online seamlessly. Ensure you're on the correct platform, as alternate documents might be provided based on local regulations.

Step 2: Filling out the application form

When filling out the application form, carefully navigate through each section, ensuring all information is accurate. Each segment typically focuses on specific information. For clarity:

Step 3: Submitting your application

Once your application form is fully completed, submit it through the available channels—this could be online, in-person, or through traditional mail. Whichever method you choose, ensure that you double-check your application for any inaccuracies or missing information before sending it off.

Step 4: Follow-up on your application status

Tracking the status of your application post-submission is vital. Many states offer an online tracking system, allowing applicants to stay informed. If your application encounters delays or issues, contact your local office for guidance, as timely follow-up can significantly improve your chances of resolution.

Understanding the First Home Owner Rate of Duty (FHOR)

In addition to the FHOG, first-time homebuyers may also be eligible for the First Home Owner Rate of Duty (FHOR). This program serves to reduce the transfer duty for eligible applicants, culminating in substantial savings during the purchase process.

Understanding the specifics of FHOR is crucial, as it directly correlates with the financial commitments of buying a home. Utilizing both the FHOG and FHOR can significantly ease the financial pressure associated with becoming a homeowner.

How to apply for the FHOR

The application for the FHOR typically aligns with the steps for the FHOG. However, you must check your state's specific requirements and documentation, as these may vary. Key aspects may include:

Related services and information

Alongside the FHOG and FHOR, first-time homebuyers may explore additional financial assistance options. Programs vary by region, with many states offering grants, loans, and educational resources specifically designed to aid first-time purchases.

Consider researching government-backed schemes that provide guidance on mortgages, budgeting tools, and support throughout the home buying journey. Websites like pdfFiller can also serve as valuable resources, helping you create and manage essential documents throughout this process.

Tips for a successful application

Navigating the application process can be daunting, but several strategies can enhance your chances of success. Avoiding common pitfalls is crucial. For instance, incomplete documentation or inaccuracies can hinder your application's approval.

Frequently asked questions

The application process often generates numerous queries. Common concerns include:

Additional tools and resources

Making informed decisions when purchasing your first home entails utilizing appropriate tools. An interactive calculator can assist you in determining your budget and eligibility for grants effectively.

Additionally, downloadable checklists can help streamline your application process, ensuring you don’t miss essential steps. Platforms like pdfFiller provide various resources to assist applicants in managing their documents efficiently.

Contact information for support

Finding assistance during the application process is crucial. You can reach out to relevant government agencies overseeing the FHOG and FHOR. Moreover, exploring legal or financial advisory services can provide you with tailored support as you navigate this significant transaction.

Share your experience

Your journey as a first-time homebuyer is unique and valuable. Sharing experiences—whether triumphs or challenges—can aid others in their quest for homeownership. Joining community forums or social media groups focused on first-time buyers can create a sense of belonging.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get application for first home?

How do I edit application for first home in Chrome?

How do I edit application for first home on an iOS device?

What is application for first home?

Who is required to file application for first home?

How to fill out application for first home?

What is the purpose of application for first home?

What information must be reported on application for first home?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.