Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Your Comprehensive Guide to SEC Form 4: Insights and Practical Tools

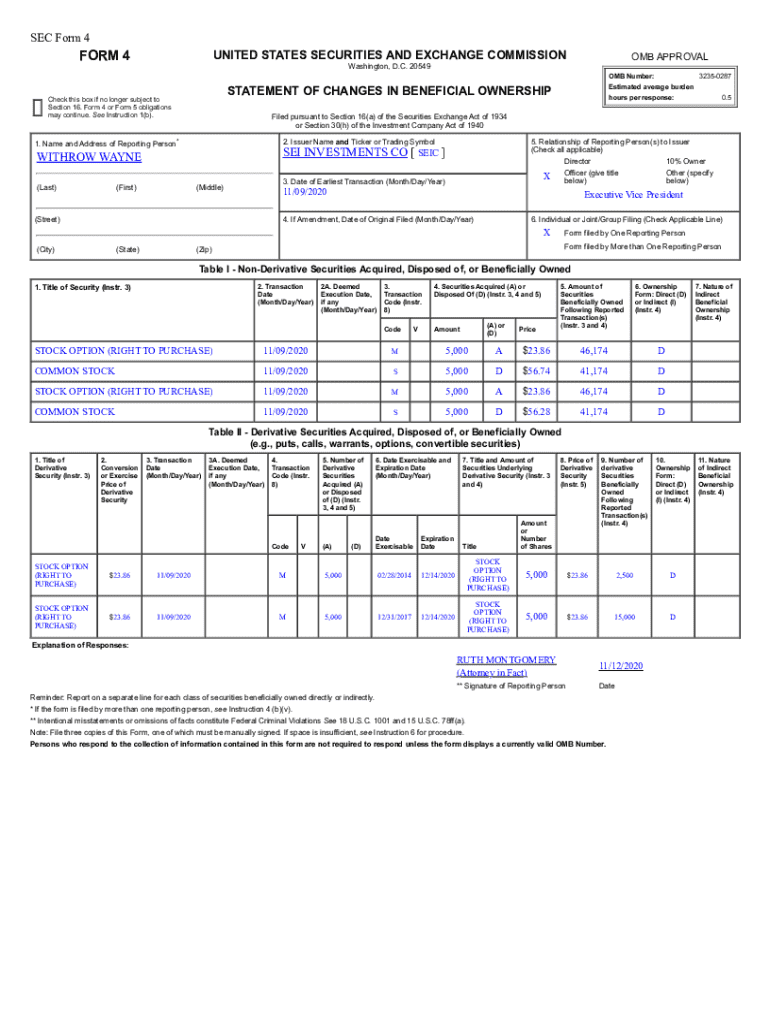

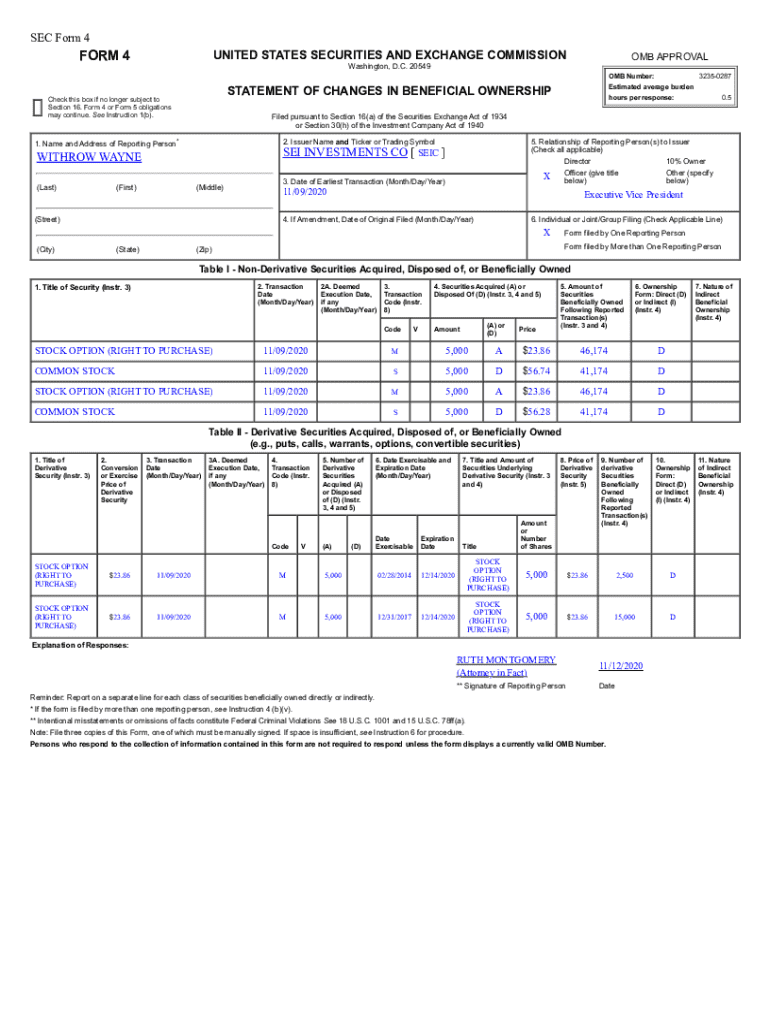

Understanding SEC Form 4: An overview

SEC Form 4 is a crucial document that insiders of publicly traded companies must file with the U.S. Securities and Exchange Commission (SEC). This form discloses the purchase or sale of equity securities by company insiders, including executives and directors, ensuring transparency in insider trading activities. The primary purpose of SEC Form 4 is to provide investors and regulators with timely insights into ownership changes that may impact stock prices.

For investors, understanding SEC Form 4 is imperative. It illustrates insider moves, which can signal potential shifts in company performance or future stock movements. Thus, keeping track of these forms aids investors in making more informed decisions based on available insider information.

Navigating the SEC Form 4 process

Completing SEC Form 4 may seem daunting, but a structured step-by-step approach can ease the process significantly. The initial step involves gathering essential information, such as the reporting person's details, their ownership interest in the company, and transaction specifics. One must also familiarize themselves with the reporting obligations that govern these filings, as compliance is critical to avoid penalties.

Once equipped with the necessary information, the next phase is accurately filling out each section of the form. Double-checking for completeness and accuracy is essential before signing and submitting the form. Below is a detailed breakdown of this process:

Common scenarios for SEC Form 4 filings

Insider transactions, which necessitate SEC Form 4 filings, can arise from various scenarios. Commonly, these forms are filed when an executive buys or sells shares in their own company. Such transactions can occur due to personal financial planning or as part of a stock option program, and they may need to be reported promptly to ensure compliance with SEC regulations.

Understanding when and why these filings are essential protects both the company and its shareholders. Investors closely monitor these filings as they can provide insights into insider confidence in the company’s future. Common transactions that require SEC Form 4 include:

Interactive tools for managing Form 4 filings

pdfFiller provides a suite of tools dedicated to facilitating the completion of SEC Form 4. By offering features specifically designed for form editing and online submission, pdfFiller streamlines the process, making it efficient and user-friendly. For instance, users can easily edit and sign SEC Form 4 online without hassle.

Collaborating with team members on form preparation becomes seamless with pdfFiller’s sharing capabilities. Certain features enable real-time feedback and collaborative editing, ensuring that all aspects of the form are attended to before submission.

Regulatory compliance and best practices

Filing SEC Form 4 is not just a matter of filling out a few blanks; it is governed by stringent regulations that must be respected. Understanding these regulations helps in ensuring compliance and avoiding costly penalties. Timeliness is a key aspect of this process, as certain transactions must be reported within two business days of their occurrence, which is a requirement mandated by the SEC.

Adopting best practices can greatly assist in maintaining compliance when filing Form 4. This includes being aware of potential mistakes that can occur during reporting, such as inaccuracies or omissions that might lead to regulatory scrutiny. Here are some best practices to keep in mind:

Analyzing insider trading through Form 4 data

SEC Form 4 data serves as a rich resource for analyzing insider trading activities. Investors leverage these filings to gauge insider sentiment regarding company performance and investment strategies. Understanding trends related to insider transactions can provide investment insights that may not be immediately apparent through traditional financial analysis.

For example, a surge in insider selling may suggest that executives expect market challenges, while consistent insider buying can indicate that leadership is confident about the future. Investors often use this data to adapt their strategies accordingly and anticipate shifts in market dynamics.

Staying informed: Recent changes and updates to SEC Form 4

The SEC regularly updates its regulations and guidelines concerning Form 4, creating a fluid landscape for compliance and reporting. Staying informed of recent changes can aid companies in aligning their procedures accordingly. One significant change over recent years includes the push for electronic submission of all filings, which promotes efficiency and accessibility.

Furthermore, anticipated future changes may involve stricter reporting requirements aimed at enhancing transparency in insider trading practices. Remaining diligent about updates from the SEC can provide an edge for stakeholders in anticipating market movements.

Frequently asked questions about SEC Form 4

Many individuals and teams have questions about SEC Form 4, particularly regarding its necessity and workflows. Here are some common inquiries that arise concerning this essential regulatory document:

Utilizing pdfFiller for your SEC Form 4 needs

pdfFiller serves as a robust platform for managing SEC Form 4 filings. Its features cater specifically to compliance needs, allowing users to craft, edit, and submit forms smoothly. The platform’s capability to store previous submissions also ensures that users have easy access to their filing history, which can be crucial for audits or reference.

Moreover, pdfFiller enables electronic signatures, providing an additional layer of convenience for users. By utilizing this comprehensive tool, teams can effectively manage their SEC compliance obligations and streamline their document workflows.

Maximizing your document workflow

Integrating SEC Form 4 with other compliance documentation not only streamlines the filing process but also enhances overall organizational efficiency. By using pdfFiller, users can access a unique cloud-based solution that consolidates all compliance forms and documentation in one location, reducing administrative burdens.

Moreover, leveraging a coherent document management system ensures adherence to deadlines and minimizes the risks associated with missed filings or inaccurate submissions. Here are essential tips for maximizing your document workflow:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 4 directly from Gmail?

How do I execute sec form 4 online?

How can I fill out sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.