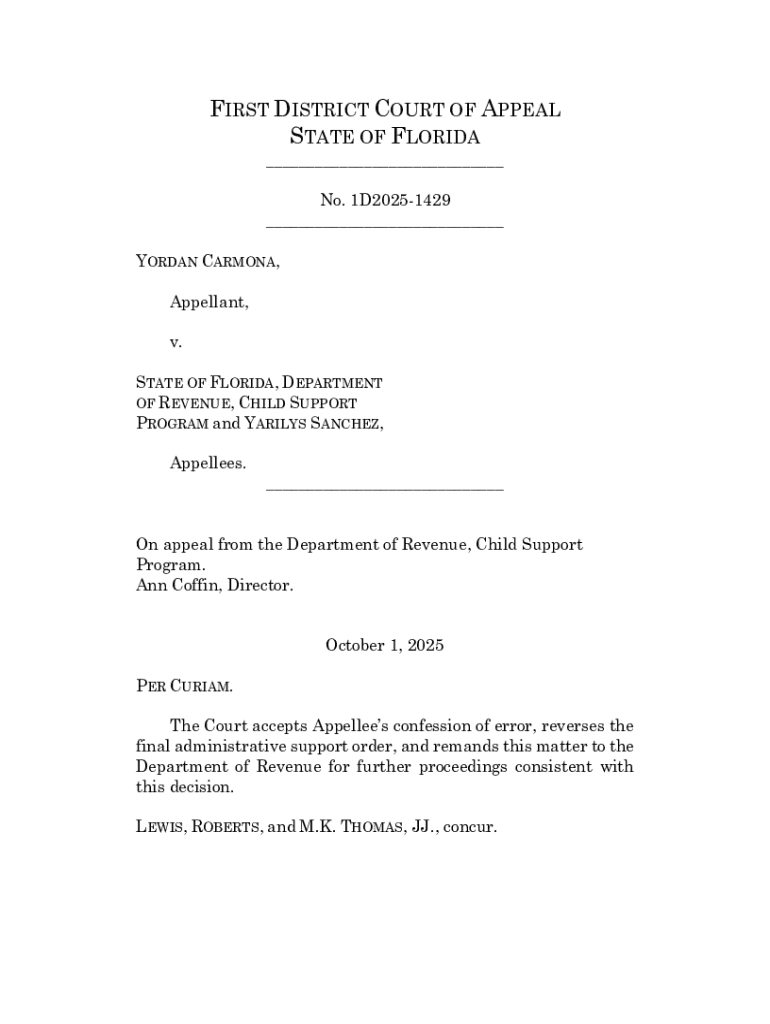

Get the free OF REVENUE, CHILD SUPPORT

Get, Create, Make and Sign of revenue child support

Editing of revenue child support online

Uncompromising security for your PDF editing and eSignature needs

How to fill out of revenue child support

How to fill out of revenue child support

Who needs of revenue child support?

How to Fill Out the Revenue Child Support Form

Understanding the revenue child support form

The Revenue Child Support Form is a critical document used to establish or modify child support orders. It serves as a key tool in ensuring that children receive the necessary financial support from their non-custodial parents. Understanding its purpose and importance is essential for anyone involved in the child support process.

The purpose of the Revenue Child Support Form is to collect vital information regarding the custodial parent, the child or children, and the non-custodial parent’s financial situation. This information helps determine fair support obligations based on varying factors, including income, living expenses, and the needs of the child(ren).

Typically, the individuals required to complete this form include custodial parents seeking to establish child support and non-custodial parents who need to submit income details for an existing agreement review or modification. Understanding these requirements helps ensure compliance with legal standards and the best interests of the child.

Gather necessary information and documents

Before initiating the form-filling process, it’s essential to gather all necessary personal and financial information. The more accurate and thorough your data, the smoother your child support process will be. Start by collecting basic personal information, including the full name, Social Security number, and address of both parents. You will also need details about the children involved, such as their full names, dates of birth, and Social Security numbers.

In addition to personal information, financial details play a crucial role in filling out the Revenue Child Support Form. You will need to provide information about your income, including your gross income sources like wages, bonuses, or alimony. Moreover, documenting your employment details, such as the name of your employer and your job title, will further support your claim.

Lastly, compile supporting documentation that reinforces your submitted information. This includes any previous child support agreements or court orders, alongside proof of income like recent pay stubs, tax returns, or bank statements. Ensuring these documents are ready will facilitate the verification process and support your claims during review.

Accessing the revenue child support form

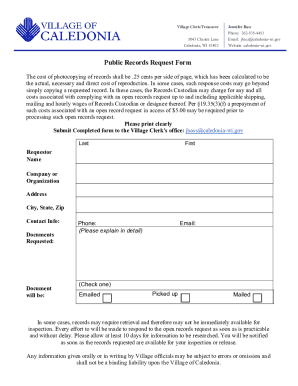

To start the process, you must first access the Revenue Child Support Form. Fortunately, this form is readily available online, making it easily accessible for parents or guardians from anywhere. You can typically find the form through your state’s Department of Revenue or Child Support Agency website, which should provide a direct link to download the form.

Once you locate the form, you will have the option to download it in several formats, including PDF and Word. It's essential to choose a format that allows for easy editing and filling out to streamline the process. If you use pdfFiller, for instance, you can upload the downloaded form directly into their system for seamless editing, ensuring that you do not lose any critical formatting.

Step-by-step guide to completing the revenue child support form

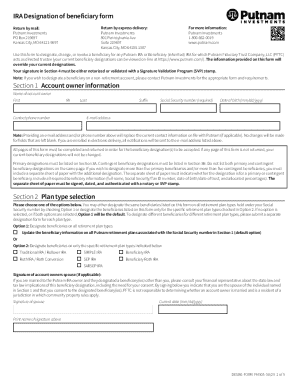

Completing the Revenue Child Support Form can seem daunting, but breaking it down section by section simplifies the task. Start with **Section 1: Personal Information**, where you will input your name, Social Security number, and address. It's crucial to ensure accuracy at this stage to avoid unnecessary delays.

Moving to **Section 2: Child Information**, you must provide details about the child, including their names and social security numbers. Review this section carefully, as common pitfalls include typographical errors that can lead to confusion or delays.

Next is **Section 3: Financial Details**. Here you will declare your income sources, providing an overview of your employment situation, gross income, and any other supporting financial information. Missing or misrepresenting data in this section may adversely affect your child support calculations.

In **Section 4: Previous Agreements**, provide any existing agreements or orders to provide context for your current request. This information can help in determining any modifications needed and ensure all parties are aware of existing obligations.

If using pdfFiller, you can upload the completed form to the platform, allowing for advanced editing. Use features like annotation tools, highlighting, or text insertion to ensure clarity and precision in your submission.

eSigning the form

Once you have meticulously filled out the Revenue Child Support Form, it's important to finalize your submission with an electronic signature (eSigning). This signature serves as a legal affirmation of the accuracy of the information you provided. eSigning enhances the form's legal validity and expedites the processing time.

To eSign the Revenue Child Support Form using pdfFiller, follow these steps: first, click on the eSign button located prominently on the interface. This will enable you to draw, type, or upload an image of your signature. Once completed, you can save your changes and prepare for submission. If there are multiple signatories, pdfFiller allows for collaborative signing, facilitating a smoother process for all parties involved.

Submitting the revenue child support form

After completing and signing the Revenue Child Support Form, the next step is submission. It's critical to know where to submit the form to ensure it reaches the appropriate agency. Typically, this will be your local child support enforcement agency or county court where child support cases are handled.

When submitting the form, follow best practices to ensure proper handling. Double-check that all required fields have been filled out and that your attached documents are included. Sending the form via certified mail can provide you with tracking, confirming submission and receipt. After submission, keeping a record of your tracking number allows you to monitor the status of your application effectively.

Common questions and troubleshooting

Navigating the complexities of the Revenue Child Support Form often leads to questions regarding specific requirements and how to address issues that arise. Common questions include: How long does the submission process take? What if I made a mistake after submitting the form? Can I modify an existing agreement instead of filing a new form?

To resolve such issues, it’s key to contact your local child support agency directly for guidance. They can provide clarity on processing timelines and how to handle any inaccuracies in your submission. Furthermore, pdfFiller offers customer support if you encounter technical difficulties while filling out or submitting the form.

Tools and resources available on pdfFiller

For users looking to streamline their document management, pdfFiller offers a range of interactive tools tailored to support the filling out and managing of forms like the Revenue Child Support Form. These tools intuitively simplify the process, allowing for easy editing and collaboration.

Templates for related forms are also readily available, enabling users to access compliant documentation that meets their specific needs. Additionally, pdfFiller provides support and tutorials to help users navigate their services effectively, ensuring they can maximize their document management capabilities.

Maintaining compliance and record-keeping

After submitting the Revenue Child Support Form, maintaining compliance and proper record-keeping becomes essential. Keeping copies of all submitted documents, including the completed form and evidence of submission, is crucial. This documentation can safeguard your interests should any disputes arise.

Utilizing pdfFiller's secure cloud platform for storage allows you to keep your files organized and easily accessible. Regularly reviewing your forms and staying updated on any changes in child support regulations ensures you remain compliant and informed about your obligations and rights moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get of revenue child support?

Can I create an electronic signature for the of revenue child support in Chrome?

Can I create an eSignature for the of revenue child support in Gmail?

What is of revenue child support?

Who is required to file of revenue child support?

How to fill out of revenue child support?

What is the purpose of of revenue child support?

What information must be reported on of revenue child support?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.