Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: Essential Insights for Companies

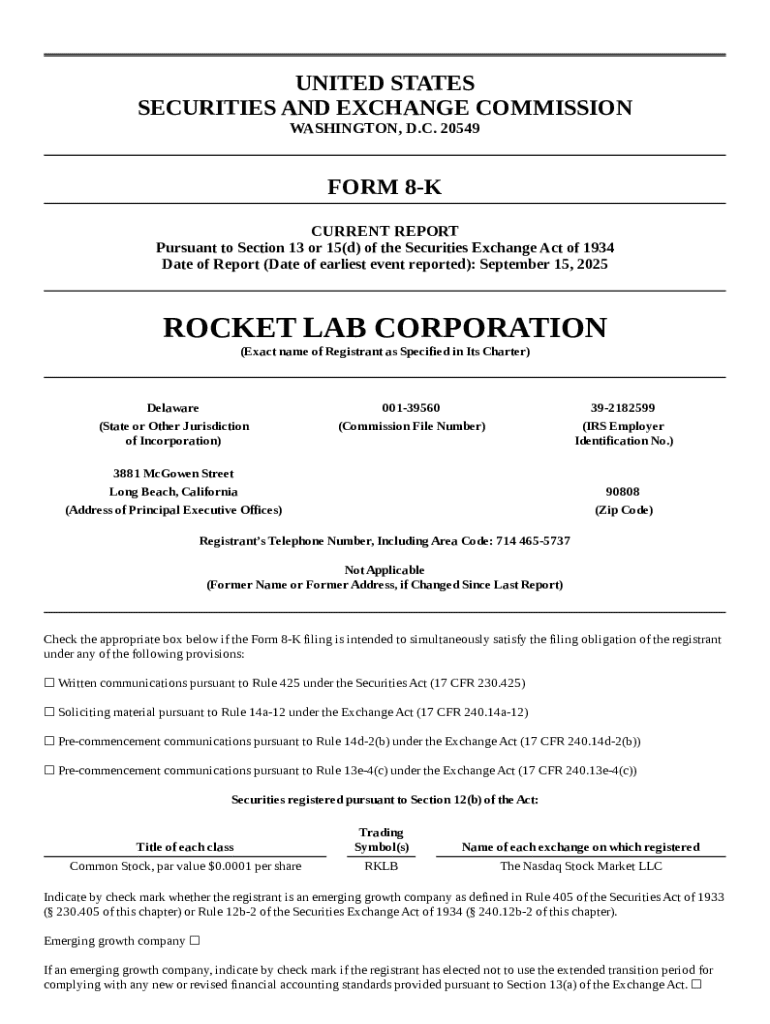

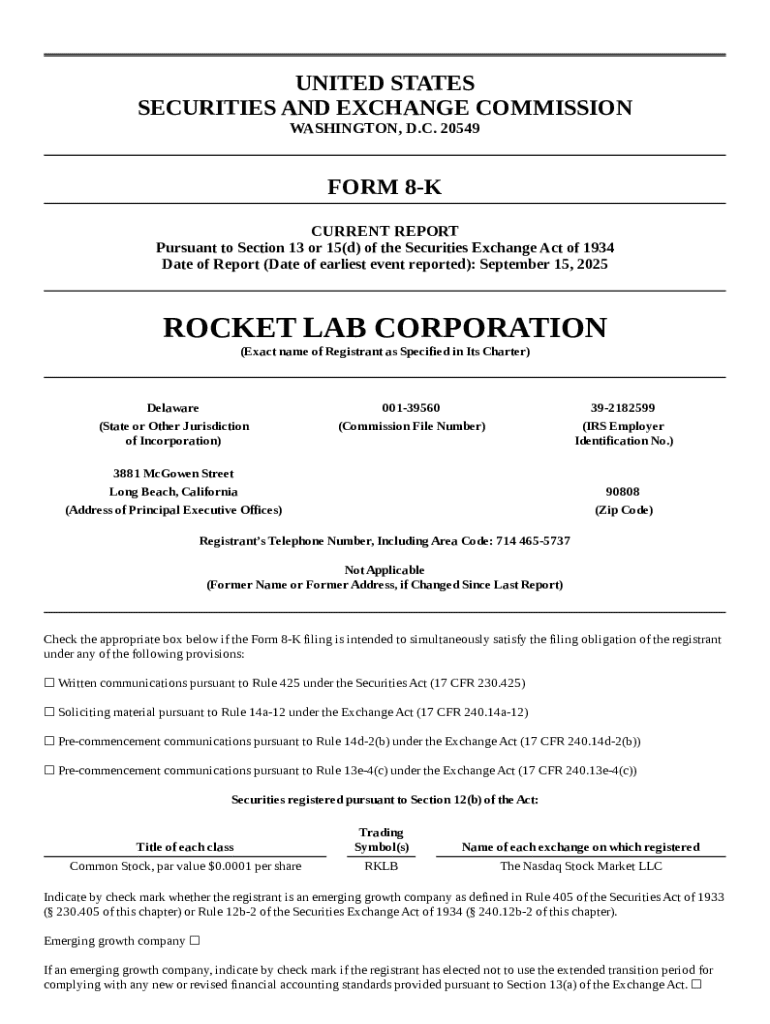

What is Form 8-K?

Form 8-K is a crucial document required by the U.S. Securities and Exchange Commission (SEC) for public companies. It serves to provide shareholders and the general public with timely information on significant events that may affect the company’s financial status or operations. This form plays an integral role in corporate transparency, ensuring that stakeholders are kept informed about key developments.

Legally, public companies are mandated to submit Form 8-K under specific conditions that impact the company. This regulatory measure ensures compliance and protects investors from being blindsided by changes that could potentially influence stock valuations. Form 8-K reinforces investor trust by providing essential updates post significant corporate events.

When is Form 8-K required?

Filing Form 8-K is not a routine task; it’s prompted by specific key events. Companies must file this form under various triggering events, which include:

The timeliness of filing Form 8-K is paramount. Companies are required to file the form within four business days of the triggering event to maintain compliance with SEC regulations.

Understanding the structure of Form 8-K

Form 8-K is organized into designated sections, each addressing specific disclosures. The typical structure includes itemized sections numbered from 1.01 to 9.00. These sections facilitate detailed reporting of diverse events, with each item requiring specific narratives and documentation.

The common terms encountered within Form 8-K include: 'materiality,' referring to the significance of an event, and 'disclosure,' which pertains to the information shared. Understanding the jargon used in Form 8-K is vital for companies, ensuring accurate and complete filings.

Benefits of filing Form 8-K for companies

Filing Form 8-K offers a plethora of advantages for public companies. Primarily, it enhances transparency and strengthens investor relations. By consistently updating stakeholders, companies build credibility and trust, which can positively influence their stock price and market reputation.

In addition to fostering transparency, timely filing helps maintain legal compliance, thus mitigating risks of penalties or legal repercussions. Organizations that prioritize filing updates demonstrate a commitment to regulatory standards, further enhancing their reputation.

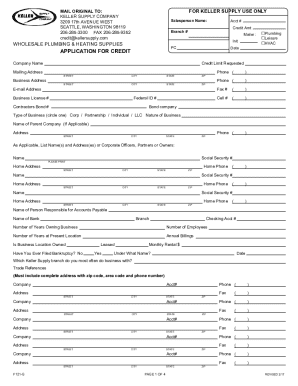

How to prepare and file Form 8-K

Preparing and filing Form 8-K requires a systematic approach. Companies can follow these step-by-step instructions:

Tips for efficient document management include establishing a filing schedule, staying organized, and utilizing digital document management solutions, such as pdfFiller, which provides tools for editing, signing, and managing forms seamlessly.

Analyzing recent Form 8-K filings

Recent Form 8-K filings offer valuable insights into corporate behavior and market trends. By examining case studies of noteworthy 8-K filings, companies can learn from others’ experiences, which can highlight the importance of prompt and accurate disclosures.

Lessons learned from recent events included better communication strategies and the necessity of keeping detailed records to support future filings. Trends in 8-K disclosures can also be indicative of broader financial patterns and can help predict potential market movements.

Frequently asked questions about Form 8-K

Several common questions arise concerning Form 8-K, including the implications of failing to file on time. Companies that miss deadlines can face enforcement actions from the SEC, which may result in fines or reputational damage.

Investors can access Form 8-K filings through the SEC's EDGAR database, which is publicly available. Additionally, it is important to note that while certain events may generally trigger a filing, there are instances where companies might be exempt under specific conditions outlined by the SEC.

Tools for managing Form 8-K filings

To streamline the filing process, companies can utilize a range of tools designed to enhance document management. Solutions like pdfFiller offer features that facilitate PDF editing and e-signing, crucial for finalizing Form 8-K submissions.

The platform enhances collaboration for teams, allowing multiple stakeholders to contribute to the filing process effectively. pdfFiller’s cloud-based accessibility ensures that documents can be managed anytime, anywhere, making compliance efforts much more efficient.

Best practices for companies filing Form 8-K

Establishing a robust protocol for filing Form 8-K is essential for companies. This includes creating a timeline for filing, assigning team members responsibilities, and centralizing relevant documents for quick access.

Training team members on compliance ensures everyone understands the filing requirements and the importance of timely submissions. Regularly reviewing changes in SEC regulations will also help maintain adherence to updated standards and practices.

Resources for further information

For comprehensive guidelines on Form 8-K and other regulatory aspects, companies can access the SEC’s official website. Additionally, literature related to investor relations and compliance provides deeper insights into the requirements surrounding financial reporting.

Understanding other financial reporting forms can also aid companies in navigating their regulatory landscape, ensuring they remain informed and compliant with industry standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 8-k?

Can I create an electronic signature for the form 8-k in Chrome?

Can I create an eSignature for the form 8-k in Gmail?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.