Get the free Tax Form Design Standards & Guidelines

Get, Create, Make and Sign tax form design standards

How to edit tax form design standards online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax form design standards

How to fill out tax form design standards

Who needs tax form design standards?

Understanding Tax Form Design Standards Form

Understanding tax form design standards

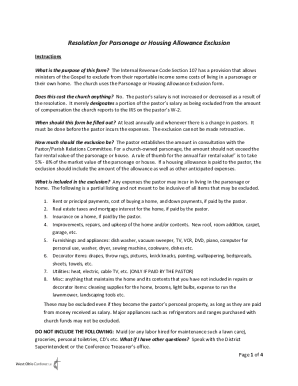

Tax form design standards are crucial for ensuring that tax documentation is clear, compliant, and user-friendly. These standards dictate how information is presented on forms, which can affect the ease with which users can complete them accurately. Compliance with these standards is not just a legal requirement; it enhances the overall functionality of tax forms, playing a vital role in the efficiency of tax collections and submissions.

The importance of compliance in tax documentation cannot be overstated. Failure to adhere to design standards can result in rejected forms, which delay processing and potentially lead to penalties. Consequently, both individuals and businesses must prioritize adherence to these standards to avoid complications during tax season.

Regulatory bodies such as the Internal Revenue Service (IRS) and other governmental agencies are tasked with outlining these standards. They provide guidelines on format and content, ensuring consistency across various forms. Understanding the purpose behind these regulations aids in creating effective tax forms that meet compliance requirements.

Essential components of tax forms

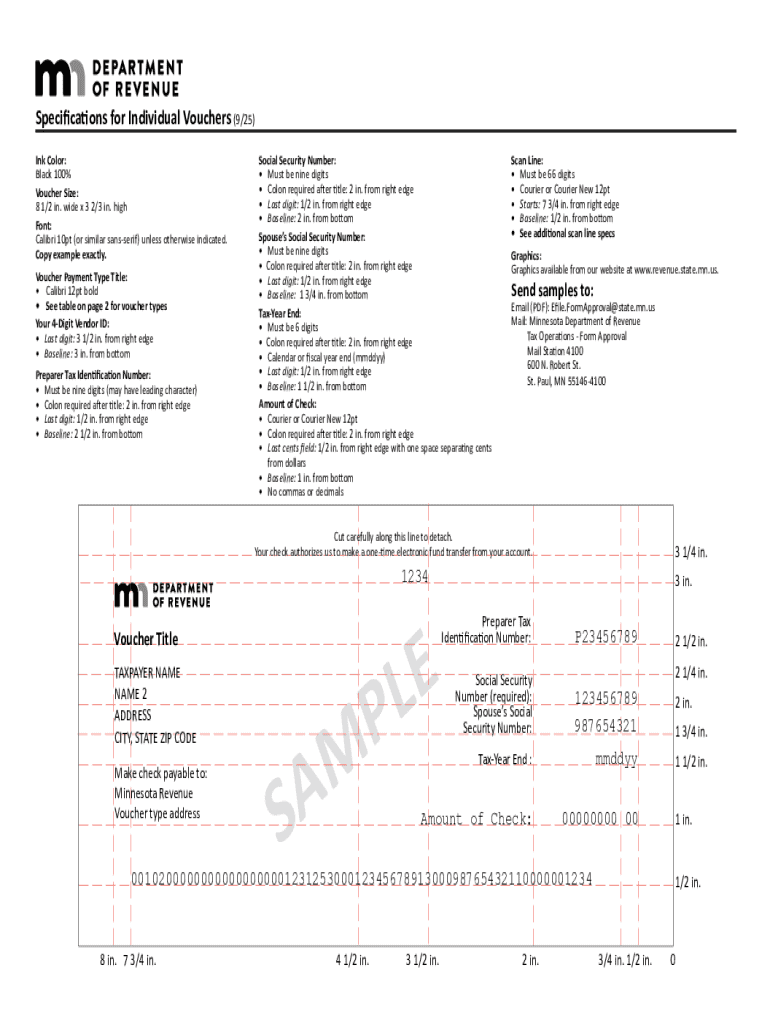

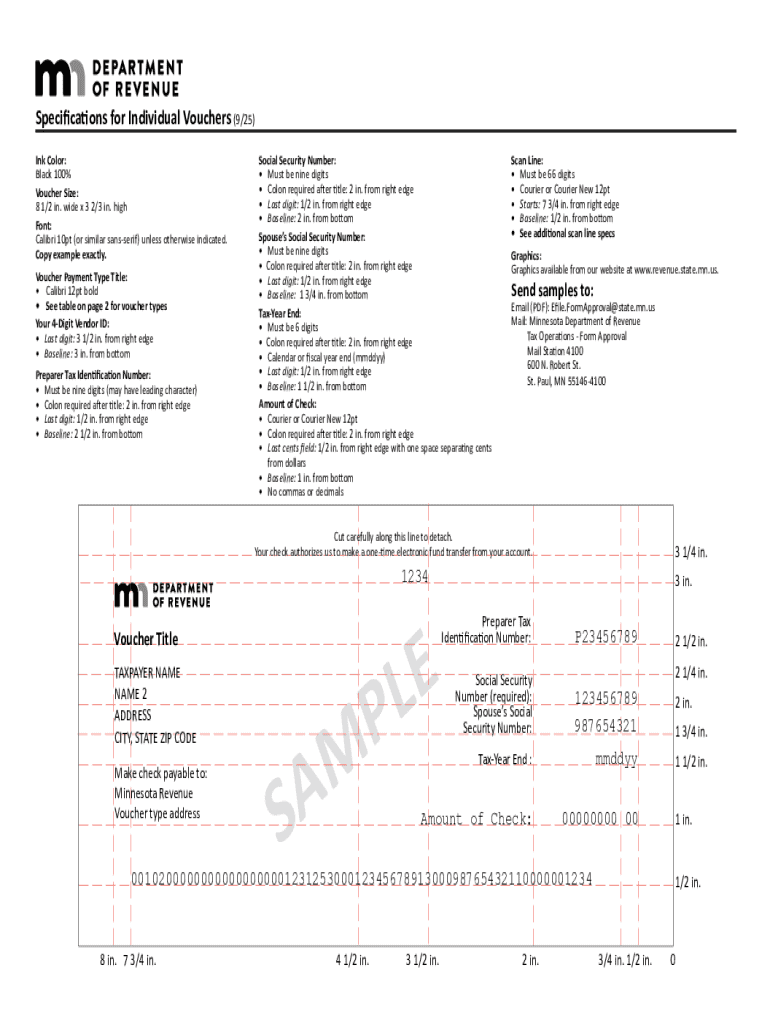

Every tax form must include mandatory information required by regulatory bodies. This includes personal identification such as the taxpayer's name, Social Security Number, and address. Comprehensive financial data, including income details and deductions, must also be documented accurately. Furthermore, tax withholding data is essential for calculating the taxpayer's liability or refund.

Design elements of tax forms play a significant role in their usability. Layout considerations should facilitate easy reading and filling. Common practices include grouping related information logically and employing clearly marked sections. It's vital to follow font and size requirements to ensure readability, with standard recommendations favoring sans-serif fonts in sizes between 10 and 12 points. Color schemes should be chosen with accessibility in mind, avoiding any combinations that may hinder readability, particularly for individuals with color vision deficiencies.

Common types of tax forms and their uses

Tax forms generally fall into several categories. Individual tax forms, like the 1040 and 1040EZ, allow citizens to report income and calculate taxes owed. Business tax forms, such as Form 1065 for partnerships and Form 1120 for corporations, are used to report business income, expenses, and other relevant financial information.

Special purpose tax forms, including Form W-2 and Form 1099, serve specific functions like reporting wages earned or payments made to contractors. Each form type has defined filing locations and frequencies depending on the tax situation—individuals might file annually, while businesses may have quarterly or monthly obligations based on their operations.

Interactive tools for designing tax forms

Utilizing advanced interactive tools can streamline the tax form design process. PDF editors provide essential features for compliance, allowing users to manipulate form elements effortlessly. These editors often come with templates specific to tax forms, ensuring adherence to design standards.

Additionally, eSign solutions are indispensable for secure submission of tax forms. They enable users to sign documents digitally, maintaining legality and security. Customization options tailored to unique tax scenarios reduce the risk of errors, enhancing user experience and compliance.

Step-by-step guide to creating a compliant tax form

Creating a compliant tax form may seem daunting, but following a clear step-by-step guide simplifies the process. The first step involves selecting the appropriate template for the tax scenario at hand. Ensure that the selected template aligns with the form designation you need.

Step two requires inputting the required data accurately. It’s crucial to double-check all entries to prevent future complications. The third step focuses on formatting the document correctly, adhering to layout standards and font guidelines. A review and validation checklist forms the fourth step, where you can check for missing information and formatting errors. Finally, you will finalize the tax form by eSigning it, ensuring secure and legal submission.

Managing and storing tax forms effectively

Efficient management and storage of tax forms are critical for personal and business compliance. Best practices for document storage involve both physical and digital options; digitizing documents allows for easy access and improved organization. Keeping track of filing deadlines and maintaining an orderly structure makes retrieving forms less cumbersome.

When considering digital versus physical storage, bear in mind that digital storage often provides enhanced security features, such as encryption and password protection. Regularly accessing and updating previous tax forms ensures that your records are accurate and current, which is vital for any future tax inquiries or audits.

Troubleshooting common issues

Even with careful planning, issues can arise when dealing with tax forms. For instance, one common concern is missing information. To address this, always conduct a thorough review before submission to minimize errors. If you find yourself facing formatting errors, identify specific guidelines in your chosen tax form template to rectify the problem.

Assistance with eSigning issues is also crucial, especially for digital submissions. If you encounter difficulties, consult the customer service specialists offered by your document management solution. They can provide guidance and support to ensure your tax documents are submitted successfully.

Additional considerations for teams

For teams working collaboratively on tax documentation, several additional considerations enhance effectiveness. Collaborative document editing features are paramount, allowing multiple users to contribute and modify forms simultaneously. This functionality can significantly streamline the tax preparation process.

Maintaining version control is another critical aspect. It ensures that everyone is working on the most updated version of a document, reducing the risk of discrepancies. Furthermore, user access management in shared environments helps protect sensitive information, granting access only to those who require it for their tasks.

Seeking professional help

While many individuals can manage their own tax forms, there are instances when consulting a tax professional is advisable. Complex financial situations or uncertainties regarding compliance can benefit from expert advice. Professionals can help ensure that your documents adhere to current tax form design standards.

Leveraging platforms like pdfFiller for professional review services allows you to get a second opinion on your completed forms. This ensures that your submissions are error-free and compliant with all legal regulations, providing peace of mind as your tax documents reach government agencies.

Frequently asked questions about tax form design

Individuals often have questions regarding tax forms, including common types and their purposes. The most common forms include W-2s, 1099s, and the 1040 series, each serving specific reporting functions. Tax forms must be updated annually to reflect changes in tax laws and personal situations.

Lastly, many wonder if they can fill out tax forms electronically and whether it’s secure. The answer is yes; many platforms, including pdfFiller, provide secure options for electronic submissions. Adhering to digital security measures, such as encryption, ensures that sensitive information remains protected throughout the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax form design standards directly from Gmail?

How do I make changes in tax form design standards?

Can I create an electronic signature for the tax form design standards in Chrome?

What is tax form design standards?

Who is required to file tax form design standards?

How to fill out tax form design standards?

What is the purpose of tax form design standards?

What information must be reported on tax form design standards?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.