Get the free Annual Financial Statements of Deutsche Bank AG 2024

Get, Create, Make and Sign annual financial statements of

Editing annual financial statements of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual financial statements of

How to fill out annual financial statements of

Who needs annual financial statements of?

Understanding Annual Financial Statements of Form

Understanding annual financial statements

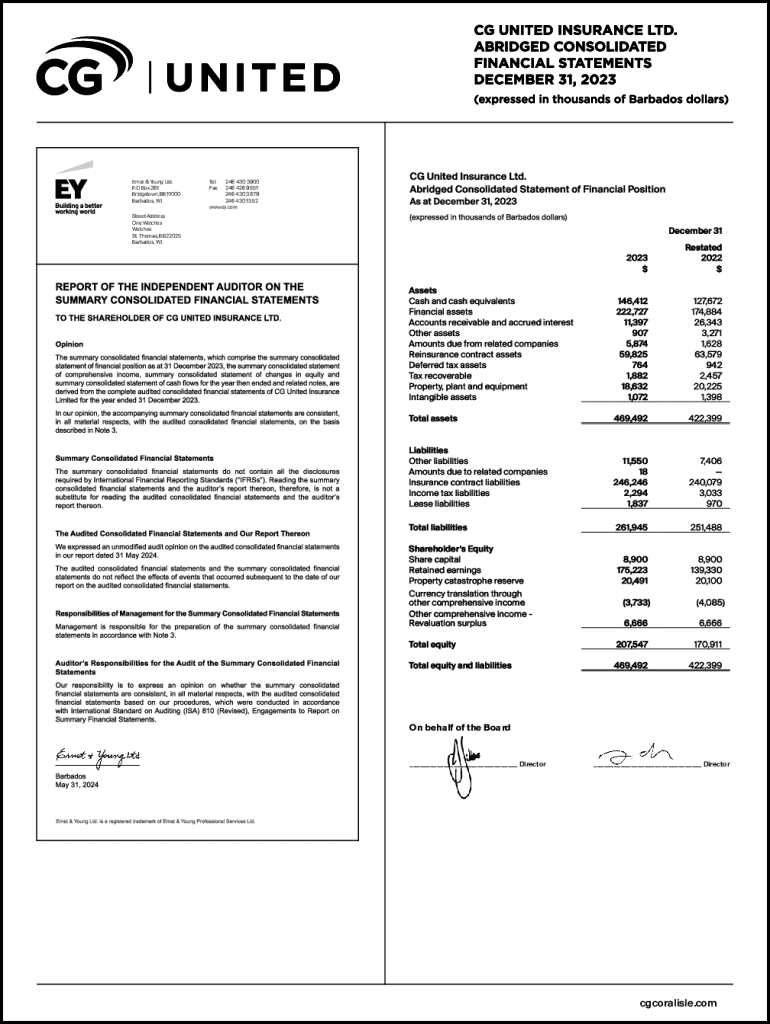

Annual financial statements are structured reports that summarize the financial activities and condition of a business over a fiscal year. These statements serve as a comprehensive overview of a company's financial health, detailing how well it is performing and how its resources are being utilized. For public companies, these statements are vital for compliance with regulatory bodies, while private firms also find them indispensable for internal management and strategic decision-making.

The importance of annual financial statements cannot be overstated, as they provide critical information to various stakeholders, including investors, creditors, and management. The key components typically include the balance sheet, income statement, cash flow statement, and statement of changes in equity, which together offer a full picture of financial performance and financial position.

Types of annual financial statements

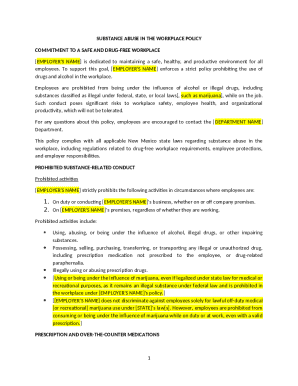

Annual financial statements can differ significantly between public and private entities. Public companies are required to follow stringent regulatory frameworks, such as those set by the Securities and Exchange Commission (SEC) in the U.S., while private companies have more flexibility. Industry-specific variations can also arise; for example, non-profits may emphasize a statement of functional expenses to highlight their allocation of resources versus profit generation.

Additionally, understanding accounting standards is crucial in this context. Generally Accepted Accounting Principles (GAAP) are followed in the U.S., while International Financial Reporting Standards (IFRS) are utilized in many other parts of the world. The primary differences between GAAP and IFRS can affect how financial results are reported, thus influencing stakeholders' perception of financial health.

The financial statement preparation process

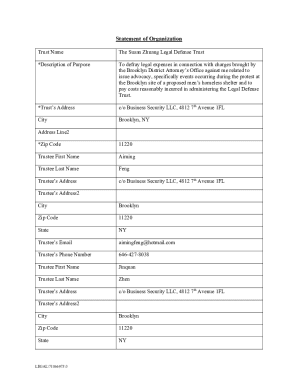

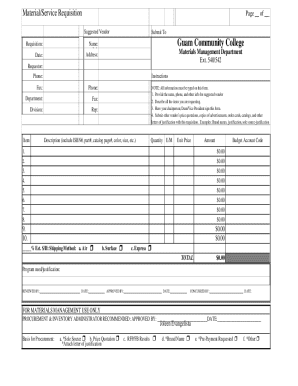

Preparing annual financial statements requires a methodical approach, starting with careful data collection. Businesses must gather a variety of financial data, including sales records documenting revenue, expense reports detailing operational costs, and asset valuations assessing the worth of physical and intangible assets. This data serves as the foundation for accurate financial reporting.

Setting up accounting software is an essential step for streamlining report generation. Cloud-based solutions, such as pdfFiller, facilitate the preparation process by allowing teams to access data remotely, ensuring collaborative inputs are integrated efficiently. Once the data is compiled, preliminary statements are drafted, incorporating all relevant information.

Key steps in filling out annual financial statements

Understanding the layout of each section is fundamental when filling out annual financial statements. Each component has specific requirements, and adhering to these can significantly affect the accuracy and reliability of the statements. For instance, the balance sheet should clearly present the totals for assets, liabilities, and equity, ensuring that the accounting equation balances.

To avoid common mistakes, it's essential to follow detailed guidelines for each part of the financial statement. pdfFiller can be particularly helpful, offering seamless data entry features and editing capabilities to ensure accuracy. Important here is the ability to review the document thoroughly, addressing any discrepancies before finalizing the statements.

Collaborating with team members

Collaboration is a key aspect of preparing annual financial statements. Assigning clear roles within the team can streamline the process and enhance accuracy. For example, one person may manage data gathering while another focuses on drafting the final statements. pdfFiller’s collaboration features enable team members to work together in real-time, providing feedback and sharing document updates seamlessly.

Ensuring consistency across the various statements is indispensable. With pdfFiller's capabilities, teams can track changes and revisions, making certain that all components align and adhere to necessary guidelines. As financial statements are often subject to audits, this level of rigor in collaboration can mitigate issues before submission.

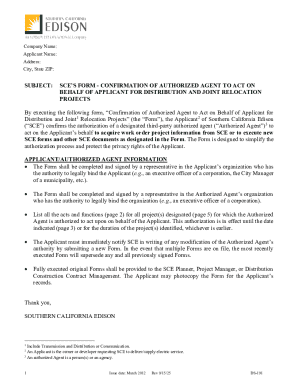

eSigning and finalizing financial statements

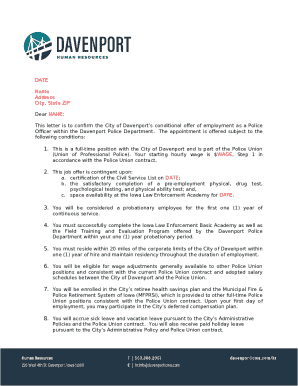

The significance of signatures on annual financial statements cannot be undervalued. Signatures affirm the authenticity of the documents and ensure compliance with regulatory requirements. This step typically involves executing an eSignature, which is a secure and efficient method for document validation that can be facilitated through platforms like pdfFiller.

Final review comes next, ensuring every detail has been checked and validated for accuracy and completeness. By conducting a thorough inspection at this stage, businesses can avoid costly mistakes or omissions that may arise after submission and during the audit processes.

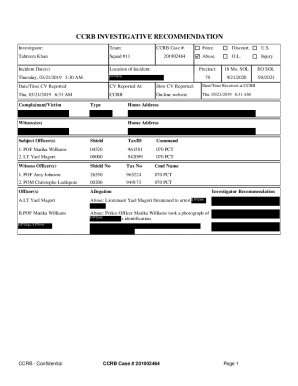

Common challenges in preparing annual financial statements

Preparing annual financial statements is not without its challenges. Common errors include miscalculated figures, understated expenses, or improperly classified assets. Recognizing these issues early in the preparation process can save significant time and resources. It's essential to establish rigorous review procedures, allowing for identifying and correcting errors proactively.

In cases where a company cannot complete the form accurately or on time, seeking assistance from a financial expert is advisable. Experts can offer insights that streamline the process, ensuring compliance with applicable standards and laws, especially relevant in complex situations.

Filing and submitting annual financial statements

The submission process for annual financial statements can vary widely, particularly between electronic and paper filing. Many companies opt for online filing due to its efficiency and ease of tracking. Deadlines for submission are critical, with businesses needing to be aware of important dates to ensure compliance. Failing to meet these deadlines can result in penalties or extended scrutiny by regulatory bodies.

Additionally, tracking submission status is crucial. Companies should implement mechanisms to ensure they can verify that their statements have been received and accepted. This can also include strategies for amending submitted documents if necessary, which is an important aspect of maintaining regulatory compliance.

Post-submission: what happens next?

After submitting annual financial statements, companies must prepare for potential audits or reviews. An understanding of what regulatory bodies may focus on can aid in this preparation. Businesses should manage feedback diligently, addressing any concerns raised by auditors or regulators promptly. This responsiveness can positively influence future audits and overall public perception.

Another key consideration involves comprehending the implications of financial statement results. Analyzing results helps businesses understand their financial health, guiding strategies for improvement or adjustment in operations. Whether the results indicate growth or necessitate a change in approach, leveraging this information is crucial for ongoing success.

Future considerations for annual financial statements

As the landscape of financial reporting evolves, businesses must remain attuned to trends impacting the preparation and presentation of annual financial statements. Modern technology plays a significant role, providing tools that streamline processes and enhance accuracy. Keeping updated with regulatory changes is paramount as well, especially for entities operating across different jurisdictions, such as in the state of North Dakota.

Staying ahead of these developments helps organizations adapt and thrive, ensuring that they can meet both current and future compliance requirements. Companies that effectively leverage technology and adopt best practices in reporting are better positioned for success in a competitive environment.

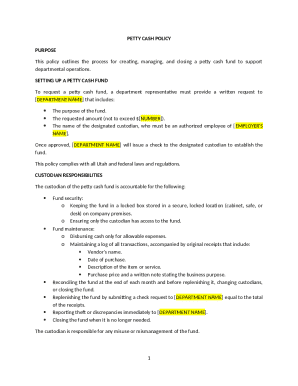

Enhancing your annual financial statements with pdfFiller

pdfFiller offers comprehensive features for document management that can greatly enhance the preparation of annual financial statements. Its cloud-based solutions allow for seamless collaboration among remote teams, ensuring that all parties can easily access, edit, and review documents from anywhere. This flexibility is particularly beneficial for businesses operating across different locations or time zones.

Additionally, testimonials from satisfied users highlight how pdfFiller simplifies financial reporting, transforming what can often be a tedious process into an efficient workflow. By utilizing the platform's capabilities for eSigning, document editing, and sharing, users can focus more on analysis and strategy rather than getting bogged down in administrative tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the annual financial statements of electronically in Chrome?

How do I complete annual financial statements of on an iOS device?

Can I edit annual financial statements of on an Android device?

What is annual financial statements of?

Who is required to file annual financial statements of?

How to fill out annual financial statements of?

What is the purpose of annual financial statements of?

What information must be reported on annual financial statements of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.