Get the free Stamp Duty Ordinance

Get, Create, Make and Sign stamp duty ordinance

How to edit stamp duty ordinance online

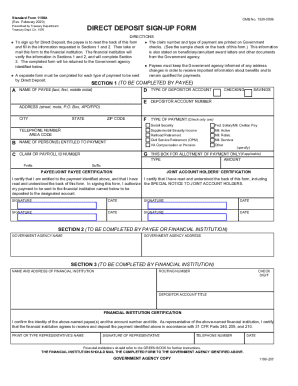

Uncompromising security for your PDF editing and eSignature needs

How to fill out stamp duty ordinance

How to fill out stamp duty ordinance

Who needs stamp duty ordinance?

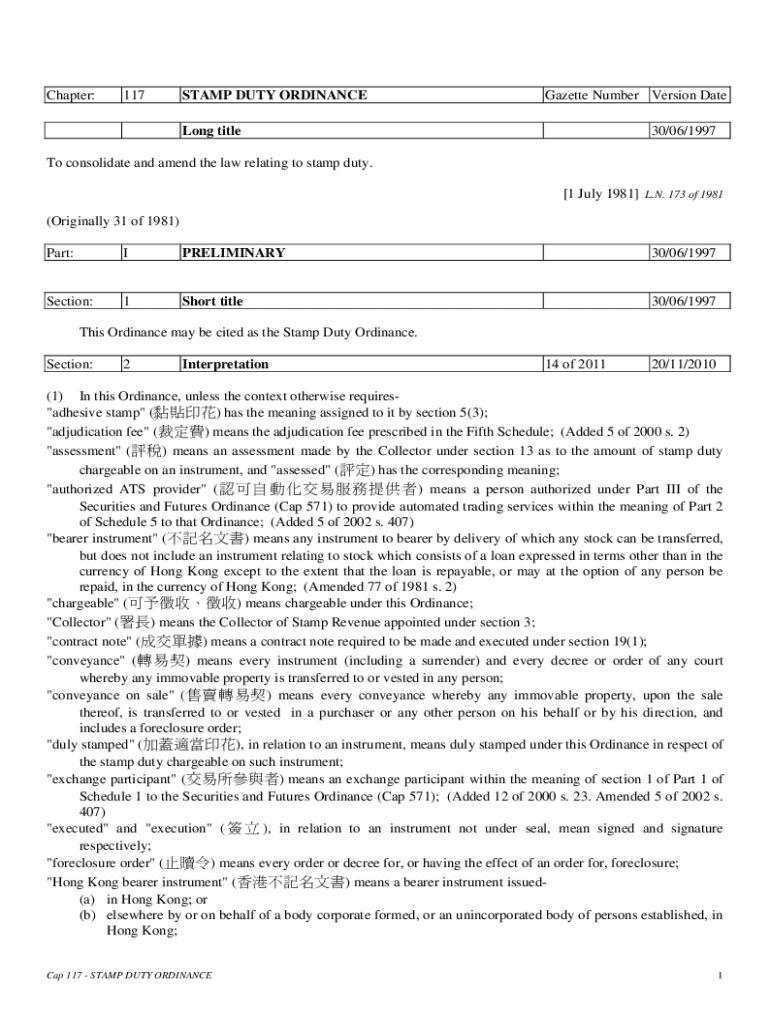

A comprehensive guide to the stamp duty ordinance form

Understanding stamp duty

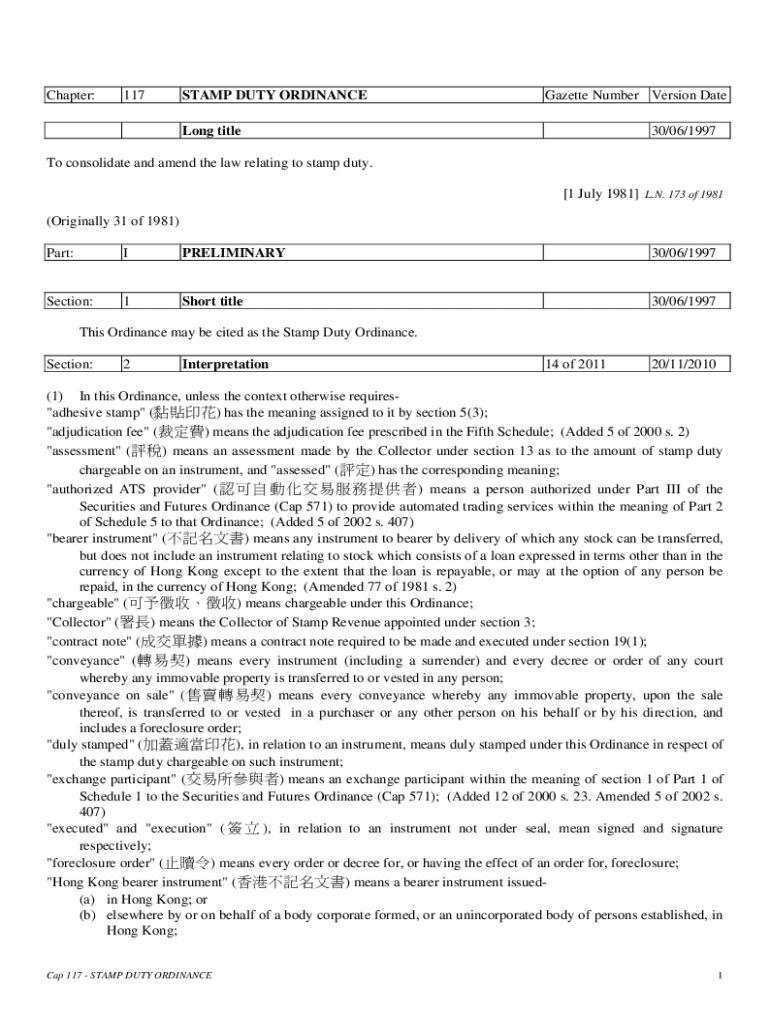

Stamp duty is a tax imposed on legal documents, usually in the context of property transactions, vehicle registrations, and certain contractual agreements. It is vital for validating the authenticity of these documents and ensuring legal recognition. The Stamp Duty Ordinance lays the framework for how stamp duty is assessed and collected, establishing various rules and rates applicable across different jurisdictions.

Understanding the Stamp Duty Ordinance is crucial for individuals and businesses alike. It highlights the obligations to pay and how adjustments in rates can affect the overall cost of transactions. Compliance with stamp duty requirements helps to prevent legal disputes and fines, ensuring a smooth process in legal and financial dealings.

Key documents subject to stamp duty

Various documents are subject to stamp duty, which can vary significantly by region and transaction type. It is essential to identify which documents require payment to remain compliant with local laws.

Additionally, certain documents may be exempt from stamp duty. For instance, documents executed by government entities or non-profit organizations may qualify for exemptions under specific regulations.

Persons liable for stamp duty

Understanding who is responsible for paying stamp duty is paramount for compliance. Both individuals and corporations are typically required to pay stamp duty on applicable transactions. For individuals, this may include anyone entering into a contract or purchasing property. Corporations likewise have obligations, especially regarding the documents they execute.

Failing to pay the requisite stamp duty can lead to several consequences. These could range from financial penalties to legal complications, potentially rendering transactions unenforceable. Ensuring timely and correct payments safeguards your legal interests and upholds the validity of your documents.

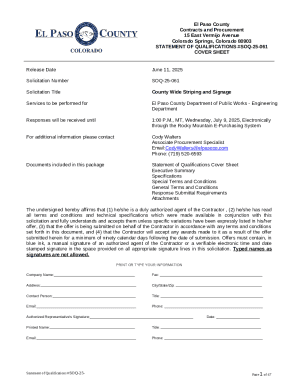

How to locate and access the stamp duty ordinance form

Accessing the stamp duty ordinance form has been streamlined through digital platforms like pdfFiller, which enables easy access to necessary documents anytime, anywhere. Users can quickly search for the stamp duty ordinance form, ensuring efficiency in the document preparation process.

To download the form, navigate to pdfFiller’s website and use their search functionality to locate the specific stamp duty ordinance form. Make sure to verify that you are downloading the latest version of the form to ensure compliance with current regulations and rates.

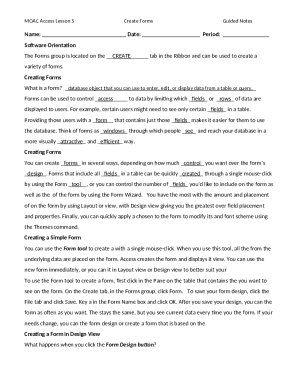

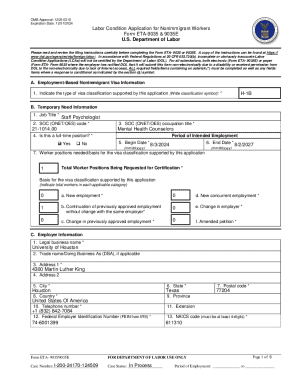

Step-by-step guide to completing the stamp duty ordinance form

Completing the stamp duty ordinance form can be straightforward if you follow a series of organized steps. Here’s a detailed guide to help you through the process:

Editing and modifying the stamp duty ordinance form

Once the stamp duty ordinance form is filled out, there may be instances where edits are necessary. Using pdfFiller’s editing tools, users can easily modify the form without hassle. Accuracy in amendments is paramount, as incorrect information can lead to delays or complications in processing your form.

When saving and exporting your completed forms, ensure that you keep copies for your records. This will aid in future transactions and serve as proof should any questions arise regarding your submission.

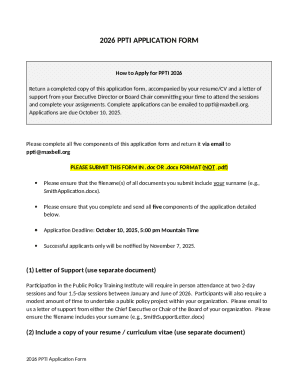

Collaborating on the stamp duty ordinance form

For teams working together on stamp duty-related transactions, pdfFiller offers robust collaboration tools to assist in sharing forms with colleagues seamlessly. These features support real-time collaboration, allowing multiple users to view and edit the form simultaneously.

Managing document permissions is also crucial. You can secure portions of the form or restrict access to specific editors, ensuring that your sensitive information remains protected while enhancing teamwork efficiency.

Frequently asked questions (FAQs)

As with any official form, users often encounter common queries regarding the stamp duty ordinance form. Here are some frequently asked questions that can help clarify the form's usage and the payment process.

Related forms and resources

In addition to the stamp duty ordinance form, various other government forms may relate to stamp duties. Acquiring a complete understanding of these forms can streamline both personal and business transactions.

Language and accessibility options

The stamp duty ordinance form may be available in multiple languages, enabling non-native speakers to access, understand, and fill out necessary paperwork without barriers. pdfFiller is committed to offering services catering to a diverse user base, ensuring that every individual can navigate the process with ease.

Additionally, pdfFiller provides accessibility features, allowing modifications for individuals with disabilities. This commitment to inclusivity helps create a seamless experience for users from all backgrounds.

Navigation and support

Navigating the pdfFiller website is designed to be user-friendly, simplifying the search for and completion of the stamp duty ordinance form. Clear menus and search options allow users to find their required documents quickly.

If you require assistance throughout the process, pdfFiller provides several customer support options. Whether through chat, email, or phone, help is readily available for any questions you may have about filling out the stamp duty ordinance form or using the platform efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find stamp duty ordinance?

How do I edit stamp duty ordinance in Chrome?

How do I edit stamp duty ordinance straight from my smartphone?

What is stamp duty ordinance?

Who is required to file stamp duty ordinance?

How to fill out stamp duty ordinance?

What is the purpose of stamp duty ordinance?

What information must be reported on stamp duty ordinance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.