Get the free Academy Mortgage

Get, Create, Make and Sign academy mortgage

How to edit academy mortgage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out academy mortgage

How to fill out academy mortgage

Who needs academy mortgage?

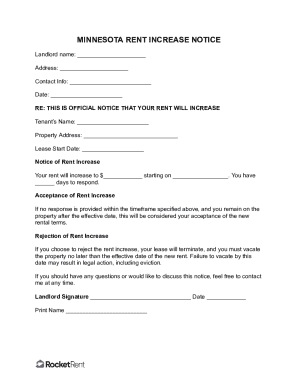

Understanding the Academy Mortgage Form: A Comprehensive Guide

Understanding the Academy Mortgage Form

The Academy Mortgage Form is a crucial document used in the home loan application process that allows applicants to provide comprehensive information to lenders. This form plays a vital role in determining a borrower’s eligibility for various mortgage products, including VA loans, by consolidating essential details about the applicant's financial situation and property information.

The importance of the Academy Mortgage Form cannot be overstated. Whether you are a veteran seeking a VA loan or a first-time homebuyer, this form serves as a foundational element in your loan application. Lenders rely on the data provided in this form to assess risk, evaluate financial stability, and make informed decisions regarding loan approval.

The key components of the Academy Mortgage Form typically include sections for personal identification, employment history, financial information, property details, and loan specifications. Understanding these components ensures that applicants can provide accurate and relevant information, which can help streamline the loan process.

Preparing to complete the Academy Mortgage Form

Before diving into the Academy Mortgage Form, it's essential to gather all required documents and information. Being prepared not only saves time but also enhances the accuracy of your submission. Start by collecting personal identification documents, such as a driver’s license and Social Security Number (SSN).

Next, gather your financial documents, including recent income statements and tax returns. These documents provide lenders with a clear picture of your earning potential, ensuring they can fully assess your financial situation. Additionally, you’ll need detailed information about the property you wish to finance, such as the purchase agreement and property address.

Understanding your credit score is also crucial, as it significantly impacts your application. Most lenders examine your credit history to evaluate your creditworthiness. A strong credit score can improve your chances of loan approval and may lead to better interest rates.

Step-by-step guide to filling out the Academy Mortgage Form

Filling out the Academy Mortgage Form can seem daunting, but following a structured approach simplifies the process. Begin with Section 1, which involves providing your personal information. Ensure that all details mirror those found on your official documents to avoid discrepancies.

In Section 2, you will document your employment history. Clearly outlining your job status and history demonstrates stability to lenders. For freelancers or self-employed individuals, consider including multiple income statements to validate your income.

Move on to Section 3 to list your financial information. Here, you’ll detail various income sources and monthly expenses. Understanding the debt-to-income (DTI) ratio is essential; it is a key metric lenders use to evaluate your financial health in relation to your loan amount.

Next, Section 4 requests specific property information. Provide a detailed description of the property being financed, and make sure to include any relevant attachments such as photographs and documents associated with the purchase agreement.

Finally, Section 5 focuses on loan details. Clearly specify your desired loan amounts and preferred terms. At this stage, you might also compare fixed and adjustable-rate mortgages to select the best option for your financial situation.

Editing and managing your Academy Mortgage Form

Once you've filled out the Academy Mortgage Form, it's essential to review and edit the document for accuracy. Utilizing pdfFiller tools allows you to edit and modify your form as needed before submission. This ensures that all information is current and correctly formatted.

Collaborative features provided by pdfFiller can be particularly valuable, especially if you are working in a team. You can easily share the form and collaborate on changes to ensure that all vital details are captured accurately. Moreover, pdfFiller’s eSign tools facilitate quicker completion by allowing electronic signatures, expediting the signing process.

Common pitfalls to avoid when completing the Academy Mortgage Form

Completing the Academy Mortgage Form is straightforward, but applicants should be wary of common pitfalls that could delay the loan process. One frequent issue is overlooking signature requirements; ensure that all necessary signatures are provided, as missing signatures can lead to processing delays.

Another mistake to avoid is providing inaccurate financial information. Verify all details about your income and debts before submitting the form. It is also crucial to read the instructions thoroughly; overlooking any specific format or details could result in complications that hinder your application's progress.

After submission: Next steps

After submitting your Academy Mortgage Form, it’s essential to understand what comes next in the process. The lender will begin reviewing your application, which may take several days to a few weeks depending on the volume of applications they are processing.

During this period, staying in contact with your lender is key. Regularly check in for updates and be prepared to provide any additional documentation if requested. Understanding the review process and its timeline can help alleviate any anxiety you might have while waiting for a decision.

Troubleshooting and financial hardship assistance

If you encounter issues with your application, it's important to address them promptly. Reach out to your lender as soon as possible to rectify any problems. Whether it's an inconsistency in your financial information or questions regarding your loan status, clear communication can help mitigate obstacles.

For individuals experiencing financial hardships during the mortgage process, resources are available. Many lenders provide assistance programs designed for those facing challenges. Don’t hesitate to ask your lender about options that can help alleviate financial pressure as you navigate the mortgage landscape.

Expert tips for a successful mortgage application

To strengthen your Academy Mortgage Form application, consider obtaining a pre-approval before you start house hunting. Pre-approval offers a clearer picture of your financing capabilities and can make you a more attractive buyer in a competitive market.

Building a solid relationship with your lender is also beneficial. Maintaining open lines of communication allows for a smoother application process and can lead to personalized advice that may not be readily available in standard documentation. Seek insights from professionals in the industry to gain a better understanding of how to present your application most effectively.

Frequently asked questions (FAQ) about the Academy Mortgage Form

Many individuals have common concerns regarding the Academy Mortgage Form. One frequent question revolves around the types of loans available through this application process. Understanding the differences among loan options can drastically improve decision-making.

Another common inquiry pertains to credit score requirements. Applicants often wonder how their credit scores impact loan approval. Having a clear understanding of these elements equips borrowers with the knowledge they need to enhance their applications effectively.

Conclusion: Embracing the power of pdfFiller for your document needs

The Academy Mortgage Form is a foundational component of your mortgage journey, and leveraging technology can make the process smoother. pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. By utilizing its robust features, applicants can confidently navigate the complexities of the loan process.

Embrace the convenience of pdfFiller for all your document management needs, ensuring a streamlined approach to filling out, editing, and signing the Academy Mortgage Form and more. With the right tools at your disposal, you'll be well on your way to securing your dream home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get academy mortgage?

How do I complete academy mortgage online?

How do I fill out the academy mortgage form on my smartphone?

What is academy mortgage?

Who is required to file academy mortgage?

How to fill out academy mortgage?

What is the purpose of academy mortgage?

What information must be reported on academy mortgage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.