Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A comprehensive guide to SEC Form 4: What you need to know

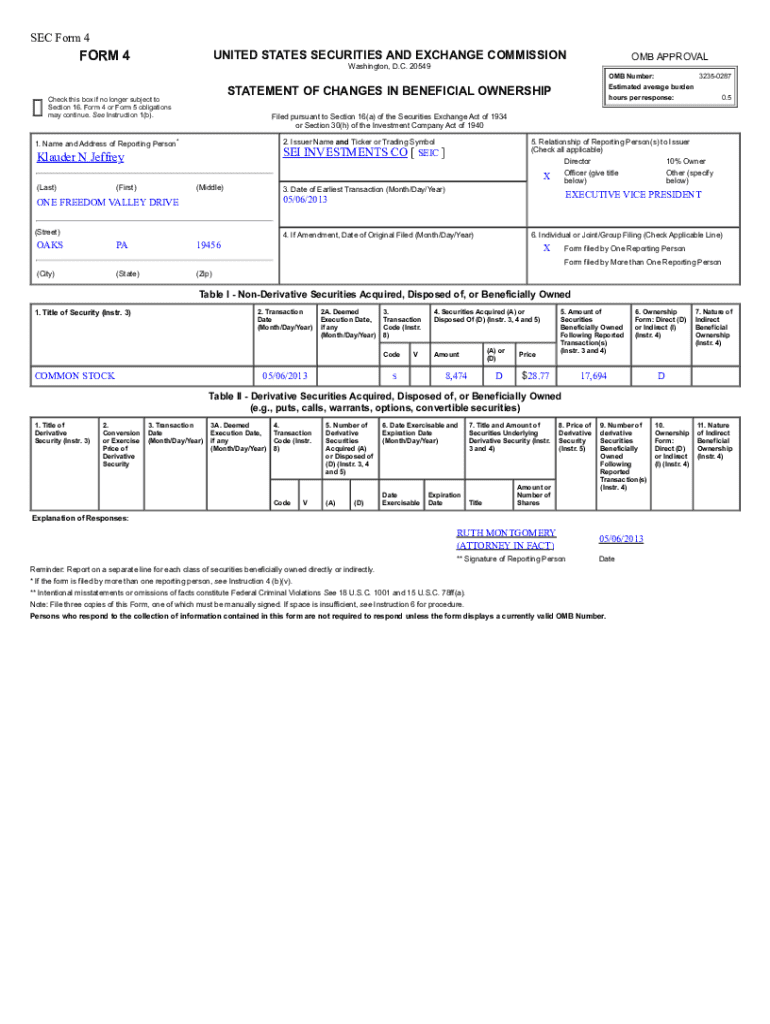

Understanding SEC Form 4

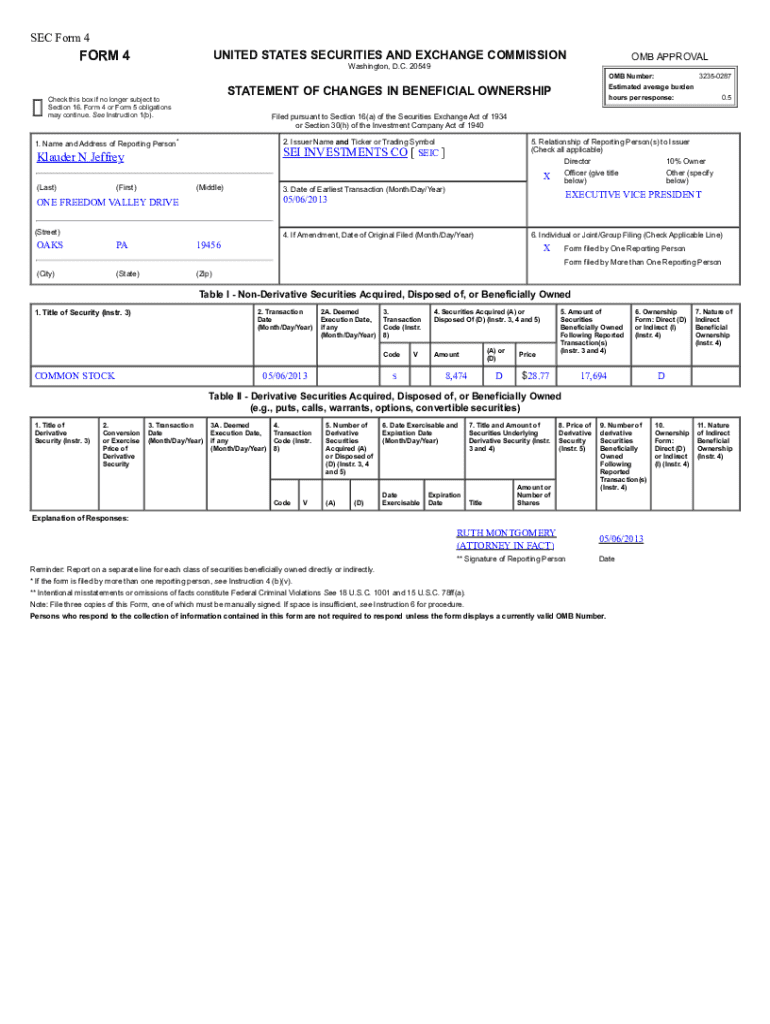

SEC Form 4 is a crucial document mandated by the U.S. Securities and Exchange Commission (SEC) for insiders of publicly traded companies. This form must be filed to disclose changes in their ownership of the company's stock. Individuals such as executives, directors, and significant shareholders, defined as those owning more than 10% of a company's stock, are subject to this requirement.

The importance of SEC Form 4 in securities regulation cannot be overstated. It fosters transparency and accountability, which are fundamental to maintaining trust in capital markets. By making this information publicly available, SEC Form 4 helps prevent insider trading and encourages fair trading practices.

Those required to file SEC Form 4 include corporate officers, directors, and beneficial owners with more than 10% of any class of the company's equity securities. The timely filing of this document is paramount to compliance and helps in monitoring insider trades, which can influence market trends.

Key components of SEC Form 4

SEC Form 4 includes several key components that filers must accurately complete to ensure compliance. Understanding these components is crucial for anyone involved in the filing process.

When to file SEC Form 4

Understanding when to file SEC Form 4 is critical for compliance. The form must be filed when any insider completes a transaction affecting their ownership stake in the company. This encompasses trades, option exercises, or any acquisitions or disposals of securities.

Timelines for submission are strict: the form must be filed within two business days of the transaction. This provides a real-time insight into the trading activities of those privy to nonpublic information. Failure to adhere to this timeline can result in penalties, including fines from the SEC, which further underscores the necessity of strict compliance.

Consequences of late filing can not only lead to financial penalties but can also harm the reputations of those involved. Insiders must be vigilant in their reporting practices to maintain credibility with shareholders and regulatory bodies alike.

Step-by-step guide to filling out SEC Form 4

Filling out SEC Form 4 requires precision and attention to detail. The process begins with preparing to file, which involves gathering all necessary information and understanding the specific document requirements.

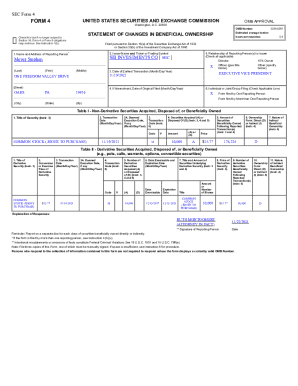

When actually filling out the form, it is essential to break it down section-by-section. Key sections include:

Common errors to avoid include misreporting ownership amounts and incorrect dates, which can lead to complications and regulatory scrutiny.

Reviewing your form is a fundamental step in ensuring completeness and accuracy. Double-check every section for missing information or mistakes, as these could lead to compliance issues.

Utilization of interactive tools on pdfFiller

pdfFiller offers a straightforward solution for handling SEC Form 4. To load SEC Form 4 on pdfFiller, simply access the platform with your account and locate the form via the search function.

Utilizing pdfFiller's editing features allows users to enhance their document handling processes. Here are some key features:

Once complete, you can save and share the SEC Form 4 directly from pdfFiller. This helps maintain an organized filing system, ensuring easy access and retrieval when needed.

eSigning SEC Form 4

eSigning SEC Form 4 is an essential part of the filing process, especially when time is of the essence. An eSignature makes it easier to comply with filing deadlines, and it’s legally recognized, simplifying the signature process.

Guidelines for eSigning on pdfFiller ensure that you follow the necessary steps for legal and effective signing. These include selecting the appropriate signature type, ensuring document integrity, and confirming the identity of the signers involved.

The legal validity of eSignatures has been affirmed in various jurisdictions, further simplifying the process for insiders who need to file SEC Form 4 promptly and accurately.

Managing your SEC Form 4 filings

Efficient management of SEC Form 4 filings is crucial for regulatory compliance. pdfFiller allows users to track their filings efficiently, which is important for keeping a clear record of insider trading activities.

Organizing and storing SEC documents in the cloud ensures that they are readily accessible whenever needed, making it easier to reference past transactions. This organization is beneficial for executives, auditors, and compliance teams who require access to historical filings.

Accessing past filings and previous data through pdfFiller helps users maintain compliance and track ownership trends, which can be crucial for monitoring insider trading patterns and market implications.

Frequently asked questions about SEC Form 4

FAQ sections are important for addressing common concerns surrounding SEC Form 4. For example, many might ask: 'What should I do if I make an error on my filing?' In such cases, filers can often correct their submissions by filing an amended form with the proper information.

Another common question is how to modify a filed SEC Form 4. This usually involves submitting another form to provide updated details, abiding by the same reporting timelines.

Understanding the penalties for non-compliance is equally necessary. The SEC imposes fines and may initiate further civil or criminal actions against filers who do not comply with the reporting requirements, emphasizing the importance of timely and accurate filings.

Best practices for SEC Form 4 compliance

Maintaining compliance with SEC Form 4 requires diligence. Understanding the importance of accuracy and timeliness in filings cannot be overstated. Insiders must ensure that every transaction is reported precisely to avoid legal repercussions and uphold market integrity.

Utilizing technology, such as pdfFiller, can simplify the process. Keeping a meticulous digital record of filings aids in managing transparency and compliance with securities regulations.

Staying updated with SEC regulations and changes is critical for insiders. Regularly reviewing changes in securities law and compliance guidelines ensures that you remain in good standing with regulatory requirements.

Insights into SEC Form 4 trends

Analysis of recent SEC Form 4 filings can yield valuable insights into insider trading behavior. For instance, spikes in filings might indicate shifts in hedge fund activity or alterations in executive strategies during volatile market conditions.

Monitoring changes in filing patterns may provide investors with clues regarding market sentiments or potential corporate governance issues, making it an essential tool for informed decision-making.

Recent legislation also impacts the reporting of insider trades and ownership trends. By understanding these dynamics, insiders can better navigate the complexities of compliance and reporting, thus safeguarding their interests.

Conclusion and next steps

In conclusion, navigating SEC Form 4 is a vital aspect of being an insider in today’s market. Utilizing pdfFiller can significantly enhance the document management experience by providing tools for seamless editing, eSigning, collaboration, and secure storage.

Moreover, consulting with legal and compliance advisors ensures that all statutory obligations are met, ultimately fostering a culture of transparency and regulatory adherence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sec form 4?

Can I create an eSignature for the sec form 4 in Gmail?

How do I edit sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.