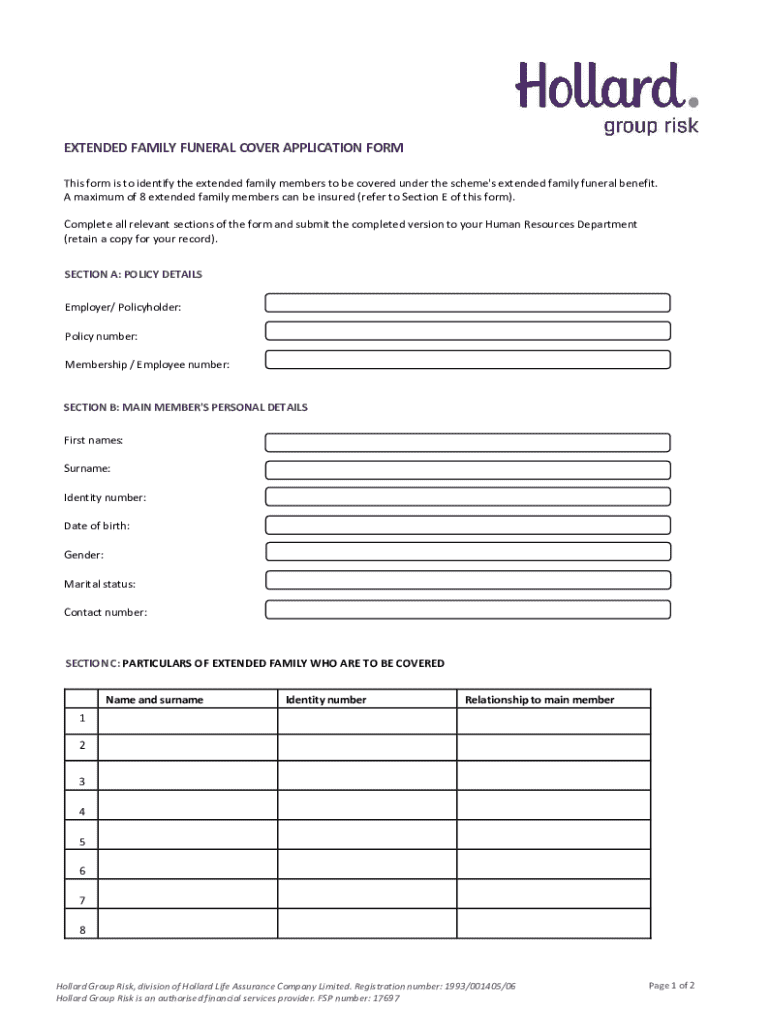

Get the free Extended Family Funeral Cover Application Form

Get, Create, Make and Sign extended family funeral cover

How to edit extended family funeral cover online

Uncompromising security for your PDF editing and eSignature needs

How to fill out extended family funeral cover

How to fill out extended family funeral cover

Who needs extended family funeral cover?

Extended Family Funeral Cover Form: A Comprehensive How-to Guide

Understanding extended family funeral cover

Extended family funeral cover provides essential financial protection to families during one of life's most challenging times — the loss of a loved one. This specific type of funeral cover not only includes immediate family members, such as spouses and children, but also extends to grandparents, aunts, uncles, and cousins, ensuring a broader safety net. Understanding its importance is crucial, as it alleviates the financial burdens associated with funeral expenses, allowing families to focus on grieving and celebrating their loved ones' lives, rather than worrying about costs.

Having extended family funeral cover in place can have significant advantages. It provides peace of mind, knowing that unexpected funeral costs won’t jeopardize a family’s finances. Instead of scrambling to gather funds, families can have a predetermined amount set aside, which can help streamline the logistical processes required during such an emotional period. By investing in this coverage, families forge a protective layer of security against unforeseen expenses, helping to ensure that all members of the extended family receive dignified farewells.

Who qualifies for extended family funeral cover?

Eligibility for extended family funeral cover typically includes immediate and extended family members. This often encompasses spouses and children, as well as additional relatives such as grandparents, aunts, uncles, and cousins. The sheer breadth of eligibility helps address family dynamics, especially in cultures where extended families play a significant role in everyday life. Understanding who qualifies is foundational, as it can directly influence how effectively the coverage meets the family's needs.

Age requirements must also be taken into consideration when applying for extended family funeral cover. Generally, individuals must meet minimum age criteria, often set at 18 or older, to be included in the policy. This requirement safeguards against potential underage applicants who may not have the legal capacity to enter into such contracts. Additionally, some policies may have upper age limits, ensuring that the insurance provider can manage risks effectively while providing comprehensive coverage.

Premium and benefit coverage

When deciding on extended family funeral cover, understanding the premium structures is vital. Most insurance policies offer flexible payment options that can be adapted to fit family budgets. Customers can choose between monthly and annual payment plans, allowing families to maintain manageable cash flow while securing necessary protection. Assessing which option fits best is essential for long-term adherence to the coverage plan, to avoid any lapses that could leave families vulnerable.

Benefit cover amounts can range based on individual coverage levels, with standard limits set for individuals. Comprehensive packages are often available for larger families, designed to cover multiple members, which may be essential in scenarios where several family members are being included in one policy. Moreover, talented providers like pdfFiller allow for customization options, enabling families to tailor their coverage to meet specific needs or expectations, ensuring all aspects of family members are respected posthumously.

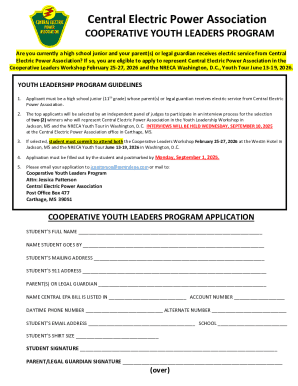

Navigating the extended family funeral cover form

Completing the extended family funeral cover form can seem daunting, but breaking it down into key sections helps streamline the process. The first section generally involves personal information fields where applicants must provide accurate details such as names, addresses, dates of birth, and contact information. This data is critical for proper identification and quick execution of any claims that may arise.

The next important section is the coverage selection process. Here, individuals must carefully evaluate which family members they wish to include and what types of coverage they deem necessary. Beneficiary designation steps follow closely, where applicants will specify who will receive the benefits in the unfortunate event of a claim. Providing clear and accurate information throughout these stages minimizes potential delays in policy activation or claims processing.

Common mistakes to avoid when filling out the form

When completing the extended family funeral cover form, several common mistakes often occur. One of the most frequent errors is overlooking required signatures. Each section requiring a signature must be completed correctly to validate the policy. Missing signatures can lead to delays or, worse, the rejection of the application altogether, causing undue stress when the protection is needed most.

Incomplete information sections are another prevalent issue. Families should ensure every field is filled accurately to avoid complications later. Additionally, it’s essential to understand eligibility criteria thoroughly; mistakenly including ineligible family members can create challenges in both the activation and claims processes. Attention to detail throughout the form can save families from future distress.

Interactive tools for managing your cover

The use of interactive tools like pdfFiller greatly enhances the experience while managing your extended family funeral cover form. By utilizing editing features, users can fill out and customize the form with ease. The platform offers a step-by-step guide for editing the form, allowing users to make corrections or add additional family members seamlessly. Furthermore, electronically signing documents is straightforward, ensuring that your cover is initiated efficiently.

Collaboration options are also available for families looking to review the form collectively. With the ability to invite family members to contribute, everyone can stay informed and engaged in the process. Furthermore, tracking changes and updates via cloud storage can keep all pertinent documentation organized, ensuring that your extended family funeral cover remains current and accurately reflects your family's needs.

Submitting the extended family funeral cover form

Before submitting the extended family funeral cover form, preparation is crucial. Families should double-check the completed form to ensure all sections are filled accurately, and all required signatures are present. Gathering necessary documentation, such as identification and possibly previous insurance policies, will help avoid unnecessary delays. Being thorough in these preparations plays a significant role in successful coverage activation.

Submission methods vary, with online submission through pdfFiller being a favored option due to its convenience and efficiency. Users can easily upload their forms, sign, and securely submit them all within one platform. Alternatively, traditional methods like postal mail or fax can also be used for those who may prefer a paper-based approach. Regardless of the method chosen, ensuring adherence to submission guidelines is vital for prompt processing.

What happens next?

Once the extended family funeral cover form has been submitted, the next step is awaiting confirmation of coverage. Families will usually receive a notification from the insurance provider detailing whether the policy has been activated. Verifying the activation of your policy is crucial; keep an eye out for any additional documentation required on your side to ensure everything is in order.

Understanding the claims process is also vital for handling eventualities post-loss. In the event a claim needs to be filed, users should follow the specified steps from their provider to ensure smooth processing. Being knowledgeable about important timelines and documentation required helps prevent hiccups in claiming benefits, allowing families to receive support without unnecessary complications.

Customer support and resources

Connecting with customer support when using pdfFiller provides families with reassurance throughout the form-filling process. They offer various channels for support, including live chat, email, and hotline information, ensuring users can receive timely assistance. Maintaining a clear line of communication with the support team can help clarify any confusion or obstacles faced during form completion.

Moreover, pdfFiller offers community support resources and a comprehensive FAQ section, addressing common queries and offering valuable insights. Families can utilize these tools to optimize their understanding of extended family funeral cover, enhancing their experience while filling out necessary forms. Access to improved tools and features continually enhances user experience, allowing families to feel empowered in managing their documentation.

Real-life scenarios and testimonials

Real-life applications of extended family funeral cover highlight just how invaluable this form of protection can be. Many families have successfully utilized cover to ease the monetary burden during loss, allowing them to focus on healing and remembrance instead of financial strain. These testimonials illustrate the emotional and practical benefits of having this cover in place, underscoring its importance for family units of all structures.

For instance, Jane, a mother of three, shared her experience navigating the complexities of family funeral costs following the passing of her elderly father. With the extended family funeral cover, Jane felt reassured knowing her financial responsibilities were handled during an overwhelming time, enabling her to honor her father’s legacy fully. Such cases emphasize the power and significance of securing an extended family funeral cover that resonates with diverse family arrangements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit extended family funeral cover from Google Drive?

How do I edit extended family funeral cover online?

Can I edit extended family funeral cover on an iOS device?

What is extended family funeral cover?

Who is required to file extended family funeral cover?

How to fill out extended family funeral cover?

What is the purpose of extended family funeral cover?

What information must be reported on extended family funeral cover?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.