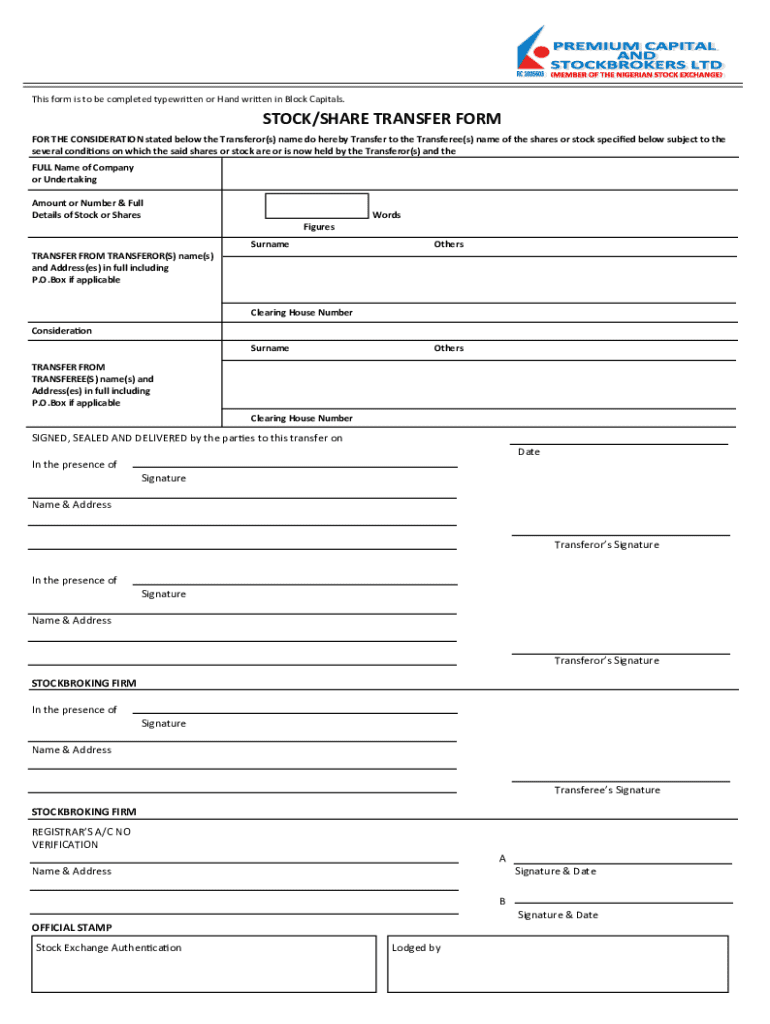

Get the free Stock/share Transfer Form

Get, Create, Make and Sign stockshare transfer form

Editing stockshare transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stockshare transfer form

How to fill out stockshare transfer form

Who needs stockshare transfer form?

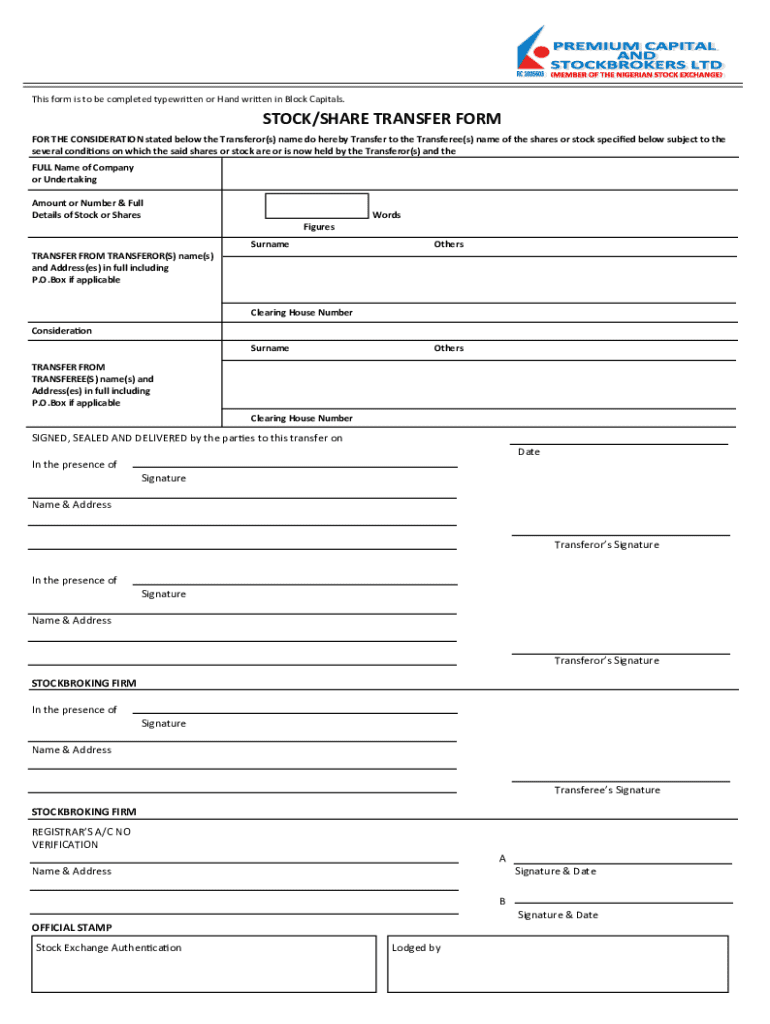

Understanding the Stock Share Transfer Form: A Comprehensive Guide

Understanding stock share transfers

A stock share transfer involves the process of exchanging ownership of shares from one party to another. This can occur for various reasons, including selling shares, gifting them, or during a business restructure. Formally documenting the transfer is crucial, as it protects the rights of both parties and ensures compliance with regulations.

Having a formal stock share transfer form helps prevent disputes and misunderstandings. It serves as an official record of the transaction, including details about the shares being transferred, the parties involved, and the transaction date. This documentation is essential for maintaining clear and accurate records of share ownership.

Types of stock share transfers

Stock share transfers can be categorized mainly into two types: voluntary and involuntary transfers. Voluntary transfers occur when a shareowner chooses to sell or gift their shares. Involuntary transfers, on the other hand, can happen due to legal reasons such as court orders, death, or bankruptcy.

Additionally, transfers can also be classified as free transfers or restricted transfers. Free transfers allow for the easy movement of stock shares without significant limitations, while restricted transfers may involve conditions set by company bylaws or regulatory requirements that dictate when and how shares can be transferred.

The stock share transfer process

Understanding the stock share transfer process involves recognizing the different parties involved, which often include the shareowner (transferor) and the new owner (transferee). The process can vary depending on the company policies and local regulations, but key steps typically remain consistent across transactions.

The steps for completing a stock share transfer begin with a thorough review of the company's articles of incorporation, bylaws, and any purchase agreements. It’s crucial to identify any restrictions that may apply to transferring shares. Following this review, obtaining the appropriate stock share transfer form from the issuer is vital to ensure compliance with company standards.

Steps for completing a stock share transfer

Once you’ve reviewed the necessary corporate documents and received the stock share transfer form, it’s time to fill it out accurately. Required information typically includes details about the issuer, shareowner, and transferee, along with the number of shares being transferred. It’s essential to ensure that all entries are clear and free of errors, as inaccuracies can lead to processing delays.

After completing the form, it must be signed by the shareowner and, in some cases, may require the signatures of witnesses or notaries. Proper signatures validate the transfer. Once the form has been signed, submit it to the appropriate department or individual for processing, and be mindful of expected timelines for completion and transfer of ownership.

Legal considerations and compliance

Legal considerations are paramount in stock share transfers. Each jurisdiction may have specific laws and regulations governing share transfers. Failing to comply can result in delayed transactions, financial penalties, or disputes. It’s advisable to consult legal professionals or resources to understand relevance to your location and specific circumstances.

Corporate governance issues also arise during stock transfers. The role of the Board of Directors typically involves approving transfers and ensuring compliance with company bylaws. Additionally, stock transfers can impact shareholder rights, including voting and dividend rights, which necessitates careful management and record-keeping.

Tax implications of stock transfers

Tax implications related to stock transfers can vary significantly by jurisdiction. This includes capital gains taxes, transfer taxes, and other relevant taxation on the value of the shares exchanged. Understanding these implications is essential for both the seller and buyer to avoid unexpected tax liabilities.

Moreover, there are specific reporting requirements tied to stock share transfers. This may include deadlines for reporting the transfer to tax authorities. Engaging with a tax professional can provide clarity on both the tax obligations and how best to manage them to comply with local laws.

Utilizing the stock share transfer form effectively

Accurate completion of the stock share transfer form is critical. Ensure that all information is filled out correctly, as mistakes can complicate or nullify the transfer process. Using online tools can help streamline the preparation of necessary documentation. pdfFiller offers an intuitive platform that supports easy editing, sharing, and electronic signatures, simplifying the whole experience.

Additionally, keeping a copy of all documentation related to stock transfers is a best practice. This includes copies of the signed transfer form and any correspondence regarding the transaction. Efficient document management strategies can prevent loss and ensure the accurate tracking of transfer history.

Engaging with pdfFiller for your stock share transfers

pdfFiller offers comprehensive support for all your stock transfer needs. The user-friendly interface allows for easy management of documents, including stock share transfer forms. Features like cloud storage ensure you can access your documents anywhere, making it easier to collaborate with others involved in the transaction.

Moreover, pdfFiller facilitates a smooth experience with its electronic signing options, allowing all parties to sign documents securely and without delay. The platform provides editable templates that can be tailored specifically for stock share transfers, enhancing the efficiency of the process.

Sample stock share transfer agreement

To help illustrate the process, having a sample stock share transfer agreement is beneficial. Key components to look for include the parties' names, details of the shares being transferred (such as number or class), and specific terms outlining the transaction. It's crucial to customize the agreement to fit the transaction’s unique context.

Utilizing pdfFiller’s editable templates can enhance the process further. The platform provides a sample format with annotations that helps users grasp the essential clauses, ensuring all critical terms are included. This can save time and reduce errors during the actual transfer.

Common FAQs about stock share transfers

Navigating stock share transfers often prompts several questions. One common concern is what happens if a stock share transfer form is incorrect. Typically, minor mistakes can be rectified, but significant errors might necessitate a re-submission. It's critical to double-check all entries before submitting the form.

Another frequent query involves the duration of the transfer process, which can vary based on company protocols. Some transfers may be processed within days, while others could take weeks—hence the importance of maintaining communication with the relevant department. Additionally, parties often wonder if stock transfer taxes are deductible, which largely depends on individual tax situations and local regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send stockshare transfer form to be eSigned by others?

Can I sign the stockshare transfer form electronically in Chrome?

How do I fill out the stockshare transfer form form on my smartphone?

What is stockshare transfer form?

Who is required to file stockshare transfer form?

How to fill out stockshare transfer form?

What is the purpose of stockshare transfer form?

What information must be reported on stockshare transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.