Get the free Vic 7th Annual Tax Forum

Get, Create, Make and Sign vic 7th annual tax

Editing vic 7th annual tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vic 7th annual tax

How to fill out vic 7th annual tax

Who needs vic 7th annual tax?

Your Essential Guide to the 7th Annual Tax Form

Overview of the 7th Annual Tax Form

The VIC 7th Annual Tax Form is a critical document designed for the thorough reporting of income and tax liabilities at the end of the fiscal year. This form serves both individuals and teams, enabling them to accurately summarize their financial activities and ensure compliance with local tax regulations.

Understanding the significance of the VIC 7th Annual Tax Form is paramount, especially for employers and teams. By properly completing this form, one can maximize potential deductions and credits, thereby minimizing overall tax liability. Key dates for submission provide a structure for timely filing, ensuring avoidable penalties are mitigated.

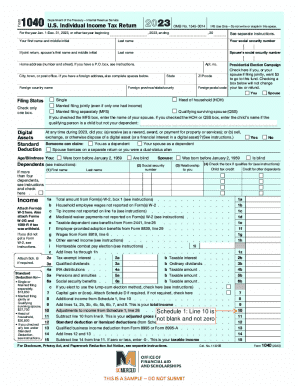

Understanding the structure of the 7th Annual Tax Form

The VIC 7th Annual Tax Form is structured to cover several crucial sections of tax information, providing a clear path for tax preparation. Each part contains specific guidelines on what information needs to be reported, helping both individuals and teams navigate their financial responsibilities effectively.

The critical sections include: Personal Information, Income Details, Deductions and Credits, and a Summary and Declaration. Filling out these interactive elements correctly will ensure compliance and maximize potential returns.

Detailed instructions for filling out the 7th Annual Tax Form

To ensure precise completion of the VIC 7th Annual Tax Form, a systematic approach is essential. Start with the Personal Information section, which includes vital details about the taxpayer. Avoid common mistakes like misentering identification numbers or addresses.

Next, the Income Reporting section requires clarity on various sources of income, including wages, bonuses, and other compensation. For those with international earnings, clear guidelines are available on how to report foreign income accurately and effectively.

Editing and collaborating on the 7th Annual Tax Form

Once the form is filled out, utilizing tools such as pdfFiller enables easy editing and revising. The platform offers robust features to modify any section of the VIC 7th Annual Tax Form before finalizing it for submission.

Collaboration is especially valuable for teams; pdfFiller facilitates this through commenting features and real-time feedback mechanisms. Team members can review and suggest changes directly on the document, ensuring comprehensive input before the final submission.

eSigning the 7th Annual Tax Form

Once all details are confirmed and the form is edited, eSigning is the next crucial step. pdfFiller’s eSigning features provide a secure method for incorporating electronic signatures on the VIC 7th Annual Tax Form, aligning with relevant electronic signature laws.

Additionally, securely storing and sharing the signed document is attainable through the platform's cloud-based capabilities, allowing users to access their documents from anywhere while ensuring sensitive data remains protected.

Common errors and troubleshooting

Even the most diligent individuals can overlook details when completing the VIC 7th Annual Tax Form. Common errors might include incorrect calculations or misreported income. Using pdfFiller’s troubleshooting tools can greatly assist in identifying these errors before submission.

If issues arise, pdfFiller offers comprehensive support to help users navigate through their questions. This can range from simple errors to more complex tax questions that might involve employer-related payroll tax calculations.

Managing your completed 7th Annual Tax Form

Completion of the VIC 7th Annual Tax Form does not conclude the process. It's essential to securely store the submitted form in the cloud for future reference and easy access. pdfFiller provides features that allow users to manage their forms efficiently.

Options for printing and sharing completed documents add an extra layer of convenience, ensuring that whether for personal records or employer relations, everything is neatly organized and stored away.

Additional tools and resources on pdfFiller for tax season

pdfFiller stands out during tax season with various interactive tools to aid users, such as tax calculators to estimate potential liabilities or refunds based on the information provided within the VIC 7th Annual Tax Form.

Additionally, access to related tax forms and templates can simplify the process of gathering all necessary documentation to ensure complete and accurate filing. Community forums and educational videos also enhance the experience, providing insights and tips from fellow users.

Best practices for future tax filings

Preparing for next year’s tax season can be much simpler when proper practices are adhered to year-round. Maintaining accurate records is vital, and utilizing pdfFiller can aid users in organizing their financial data efficiently.

Consider creating digital folders for each tax year, categorizing documents such as receipts or payroll tax returns for easy access when completing future VIC 7th Annual Tax Forms. Staying proactive can minimize stress as deadlines approach.

Next steps after filing your 7th Annual Tax Form

After filing the VIC 7th Annual Tax Form, it’s important to understand what to expect. Typically, the tax authority may take several weeks to process the submission. Staying informed about your filing status is advisable, especially if you anticipate a refund.

Additionally, preparations for potential audits can alleviate future stress. Understanding the documentation required if an audit occurs can provide peace of mind. Keeping organized records and digital copies of submitted forms can facilitate the process if contacted by tax authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vic 7th annual tax in Gmail?

How do I complete vic 7th annual tax on an iOS device?

Can I edit vic 7th annual tax on an Android device?

What is vic 7th annual tax?

Who is required to file vic 7th annual tax?

How to fill out vic 7th annual tax?

What is the purpose of vic 7th annual tax?

What information must be reported on vic 7th annual tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.