Get the free Direct Deposit/electronic Fund Transfer (eft) Authorization Form

Get, Create, Make and Sign direct depositelectronic fund transfer

How to edit direct depositelectronic fund transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct depositelectronic fund transfer

How to fill out direct depositelectronic fund transfer

Who needs direct depositelectronic fund transfer?

Understanding and Managing Your Direct Deposit Electronic Fund Transfer Form

Understanding direct deposit and electronic funds transfer

Direct deposit is a digital payment method used by employers to deposit employees' paychecks directly into their bank accounts, eliminating the need for checks. This modern payment solution offers a safer, quicker, and more efficient alternative to traditional paper checks, which can take days to clear and pose risks of being lost or stolen.

The electronic funds transfer (EFT) process involves moving money electronically from one bank account to another. It relies on a network of financial institutions that communicate through secure protocols, ensuring that the transfer is completed smoothly. Key stakeholders in this process include the sending and receiving banks, the account holders, and the tools that facilitate secure transfers.

Benefits of using direct deposit

The advantages of utilizing direct deposit through an electronic funds transfer form extend beyond mere convenience. One key benefit is accessibility; employees can access their funds immediately upon payment without the hassle of visiting the bank or waiting for a check to clear. This instantaneous access to wages means no more delays in receiving your hard-earned money.

Security is another major advantage. Direct deposits cut down the risk of lost or stolen checks, as funds are transferred directly to bank accounts. Furthermore, banks implement strong encryption methods and safety measures to protect sensitive information during transfers, ensuring that your financial data remains secure and confidential.

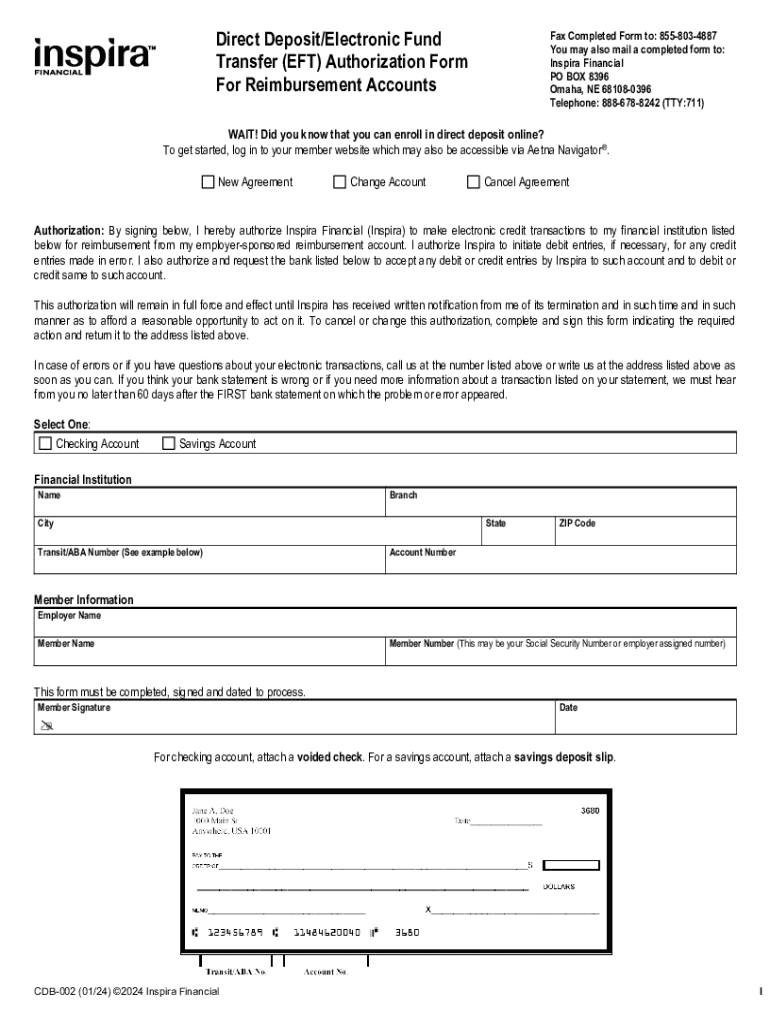

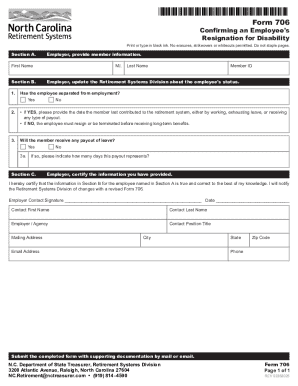

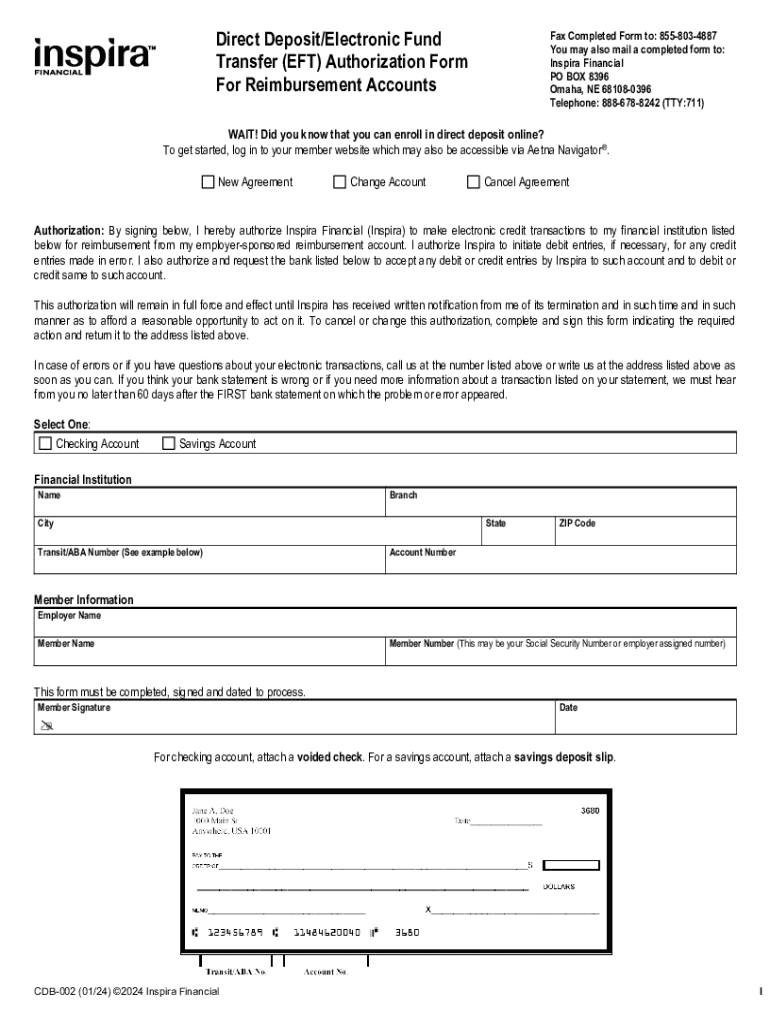

Preparing the direct deposit electronic fund transfer form

Before you fill out the direct deposit electronic fund transfer form, it's crucial to gather all necessary information. This includes personal identification details such as your name, address, Social Security number, and contact information. Equally important are your banking details, which include your bank’s routing number and your account number. These ensure that your funds are deposited accurately into your selected account.

Understanding the requirements is also essential. Depending on your institution or employer, you might need to provide documentation such as a government-issued ID, recent bank statements, or direct deposit authorization forms. Having everything ready can streamline the process and help avoid any delays in setting up your direct deposit.

Step-by-step instructions for filling out the form

Using pdfFiller to access the direct deposit form is straightforward. Simply navigate to the pdfFiller website and locate the template for the direct deposit electronic fund transfer form. Once you have the form, begin by filling in your personal information in the designated fields.

Next, enter your bank account details, including the routing number and account number. It’s critical to input these numbers accurately, as any errors could result in misdirected funds. After completing the form, take a moment to review and verify your entries for accuracy to prevent complications during processing.

Editing and customizing your form

pdfFiller offers an array of editing tools that allow you to make changes or customizations to your direct deposit form easily. You can highlight important sections, add notes, or make comments directly on the document to draw attention to specific details. This functionality enhances the clarity of your submissions and helps prevent misunderstandings.

Additionally, if you collaborate with team members or HR personnel when filling out the form, pdfFiller facilitates seamless collaboration. You can invite others to review the document, and set permissions to control who can edit what, making the review process more efficient.

Signing the direct deposit form electronically

eSigning has become a standard practice, providing a legally binding way to sign documents without physical signatures. The eSigning feature within pdfFiller ensures that your signature is valid and recognized, streamlining the finalization of your direct deposit electronic funds transfer form. You can sign documents by choosing to draw your signature, upload a scanned image, or simply type it with the platform’s font options.

This electronic signature process saves time while maintaining security and compliance with legal standards. It's crucial to familiarize yourself with how to utilize these features for a smooth signing experience.

Submitting the direct deposit electronic fund transfer form

Once your direct deposit form is complete and signed, the next step is submission. Depending on your employer's requirements, you may have digital submission protocols in place, allowing you to send the form directly to HR or payroll departments via their preferred channels. It’s important to follow these protocols meticulously to ensure it reaches the right hands securely.

After submission, tracking the status of your direct deposit form is vital. Confirming that your form was received can save you from future payment issues. Keep a copy of the submission confirmation and don’t hesitate to follow up if you don’t receive acknowledgment after a reasonable time.

Managing your direct deposit

Managing your direct deposit information is as critical as initial setup. Should you change your banking institution or wish to modify the personal information associated with your account, returning to the direct deposit electronic fund transfer form is necessary. Follow the same steps you did for the initial setup, ensuring all new details are accurate.

Encountering issues such as delays in deposits is also possible. If payments aren't appearing in your account as expected, it’s important to check with your employer and your bank to identify the source of the problem. Additionally, pdfFiller provides customer support options to help you address any documentation concerns promptly.

Frequently asked questions (FAQs)

Many individuals have specific questions about direct deposit processes and forms. Common queries include what to do if payments are deposited incorrectly. In such cases, promptly notify your employer and your bank to rectify any discrepancies. It's also crucial to know how to cancel a direct deposit arrangement if your employment situation changes. Simply submit a cancellation request in writing, adhering to any employer protocols.

Clearing up misconceptions regarding direct deposit is equally critical. Some individuals may doubt its reliability; however, direct deposit is widely used across industries, backed by robust technological frameworks that ensure accurate payments. Understanding these facts can alleviate fears and encourage more users to embrace this modern payment solution.

Staying informed: news and updates

Regulations surrounding direct deposit and electronic funds transfers can change, affecting compliance requirements for employers and financial institutions. Staying informed about such updates is crucial, particularly if you are responsible for managing payroll or financial systems at your workplace. Look out for announcements from regulatory agencies that provide guidance on these matters.

Additionally, pdfFiller continually innovates to enhance its document management capabilities. Upcoming features, such as improved user interfaces and added functionalities, may further streamline the process of filling out, signing, and managing your forms, making it even more user-friendly for individuals and businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my direct depositelectronic fund transfer directly from Gmail?

How do I complete direct depositelectronic fund transfer online?

Can I edit direct depositelectronic fund transfer on an Android device?

What is direct deposit electronic fund transfer?

Who is required to file direct deposit electronic fund transfer?

How to fill out direct deposit electronic fund transfer?

What is the purpose of direct deposit electronic fund transfer?

What information must be reported on direct deposit electronic fund transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.