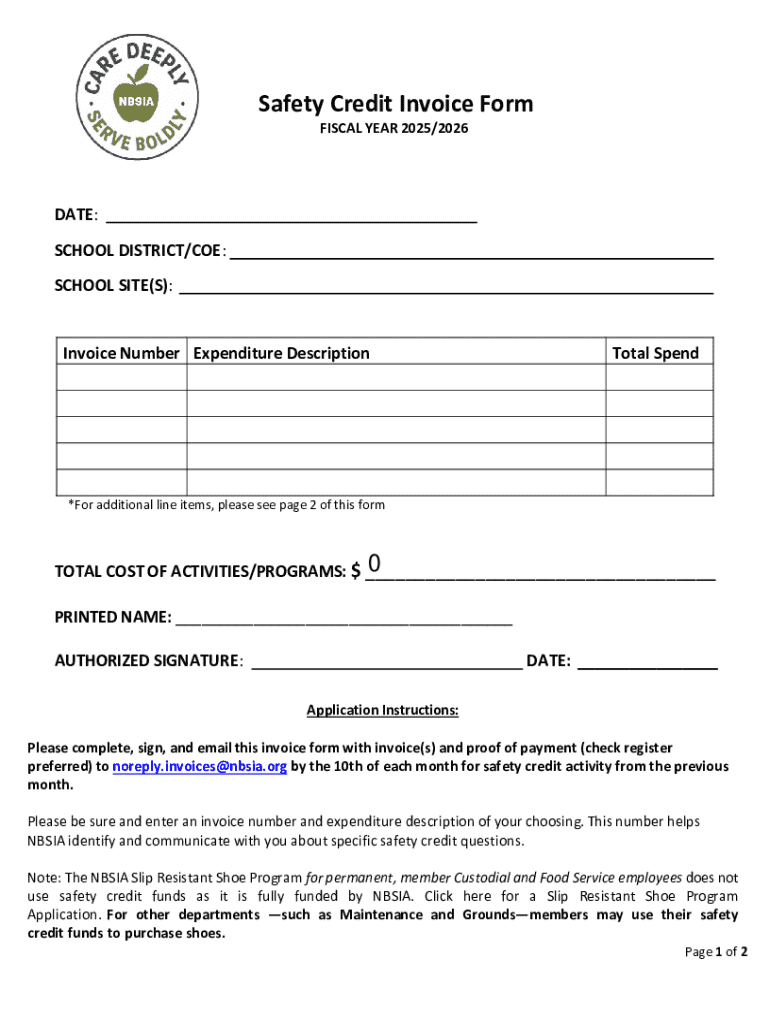

Get the free Safety Credit Invoice Form

Get, Create, Make and Sign safety credit invoice form

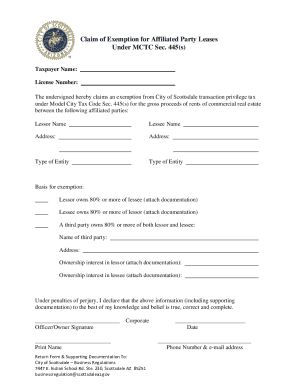

Editing safety credit invoice form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out safety credit invoice form

How to fill out safety credit invoice form

Who needs safety credit invoice form?

Comprehensive Guide to the Safety Credit Invoice Form

Understanding the safety credit invoice form

A safety credit invoice is a crucial document in the realm of business transactions, acting as a formal request for payment while accommodating safety protocols designed to protect both parties involved. By specifically outlining the terms of a credit transaction, it helps in mitigating potential disputes and fosters trust between businesses and clients.

Using a safety credit invoice boosts professionalism and transparency in financial dealings. It not only conveys essential transaction details but also serves as a protective measure, ensuring compliance with various regulations and safeguarding sensitive financial information.

The role of safety in credit transactions

Safety in credit transactions is paramount as it underscores the integrity of the financial exchange. It protects both the creditor and the debtor, ensuring a stable and secure business environment. When financial transactions lack adequate safety measures, they may open avenues for fraud, data breaches, and misinterpretation of payment agreements.

Identifying the common risks in credit transactions is essential. Issues such as payment fraud, invoicing errors, and misappropriation of funds can hinder business relationships. Adopting best practices to enhance the security of invoicing procedures is critical in combating these risks.

Steps to create a safety credit invoice

Creating a safety credit invoice can be streamlined through careful planning and selecting the right template. Many online platforms, such as pdfFiller, offer customizable templates that suit various business needs. These interactive tools allow users to tailor invoices quickly and efficiently.

In addition to choosing a template, several essential elements must be included in a safety credit invoice. Not only should there be an itemized list of services or products provided, but it’s equally important to clearly articulate credit terms, conditions, and specific safety measures.

Ensuring accuracy in invoice details is vital for avoiding disputes. This involves double-checking all figures and terms before sending the invoice and considering including compliance details related to safety and regulatory standards.

Editing and customizing your safety credit invoice

When utilizing platforms like pdfFiller, users have the advantage of powerful editing tools for personalizing their safety credit invoices. Users can easily modify invoices to suit their branding and business needs, providing a professional touch.

Incorporating necessary disclaimers and safety clauses in your invoices not only helps in reinforcing compliance but also protects your business from potential liabilities. By integrating these elements, you ensure that your invoices are robust and align with safety standards.

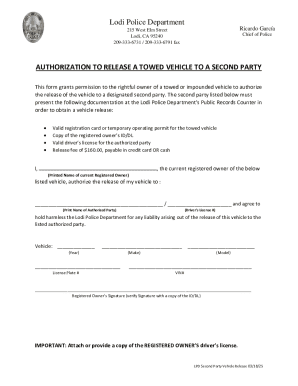

Signing your safety credit invoice

The importance of eSigning cannot be overstated, as it adds an additional layer of security and verification to your safety credit Invoice. Digital signatures not only expedite the signing process but also ensure that both parties are committed to the terms laid out.

pdfFiller provides a user-friendly system for eSigning invoices. Users can easily follow a step-by-step guide that walks them through the eSigning process, ensuring each invoice legibly bears the necessary signatures for it to be legally binding.

It's crucial to note that eSignatures have legal validity across various jurisdictions, making them a reliable choice for modern invoicing.

Managing and storing your safety credit invoices

Organizing invoices for easy retrieval is essential for maintaining streamlined business operations. Utilizing folders, tagging systems, or cloud storage solutions helps in sorting invoices based on client names, dates, or project types.

The benefits of cloud storage solutions are numerous. With the right platform, businesses can access their invoices from anywhere, ensuring that teams can operate seamlessly regardless of their location. The powerful search functionalities often provided within these systems increase overall efficiency.

Frequently asked questions about safety credit invoices

Addressing common concerns about safety credit invoices can help demystify the invoicing process for businesses new to credit transactions. One crucial aspect is ensuring that your safety credit invoice is secure. Consider using platforms that emphasize security features, such as encryption and access controls.

If a client disputes a safety credit invoice, it’s prudent to have all documentation and correspondence readily available. This data will help clarify the situation and facilitate smoother resolutions. Additionally, businesses engaging in international transactions should familiarize themselves with the specific regulations and considerations that apply to cross-border invoicing.

Real-world use cases of safety credit invoices

Exploring case studies can illustrate the effectiveness of safety credit invoices in varied industries. Take property management, for instance. Companies in this sector have successfully implemented safety credit invoices to keep track of service fees and enhance transparency with tenants, thereby improving payment compliance.

Moreover, security companies often rely on safety credit invoices to manage service charges while ensuring that clients remain informed about transaction specifics. This helps build trust and reinforces strong client relationships, proving that transparent financial practices yield positive results.

Advanced features of pdfFiller for enhanced security

pdfFiller stands out as a comprehensive document management solution, offering advanced security features that enhance the safety of your invoicing process. With the emphasis on document integrity, businesses can trust pdfFiller to keep their data secure while allowing for seamless editing and sharing.

The platform not only provides encryption but also allows businesses to control who has access to sensitive invoice data. Further integrations with other tools streamline workflow management and make it easier to handle invoices alongside other business documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit safety credit invoice form from Google Drive?

How do I edit safety credit invoice form in Chrome?

How do I fill out safety credit invoice form using my mobile device?

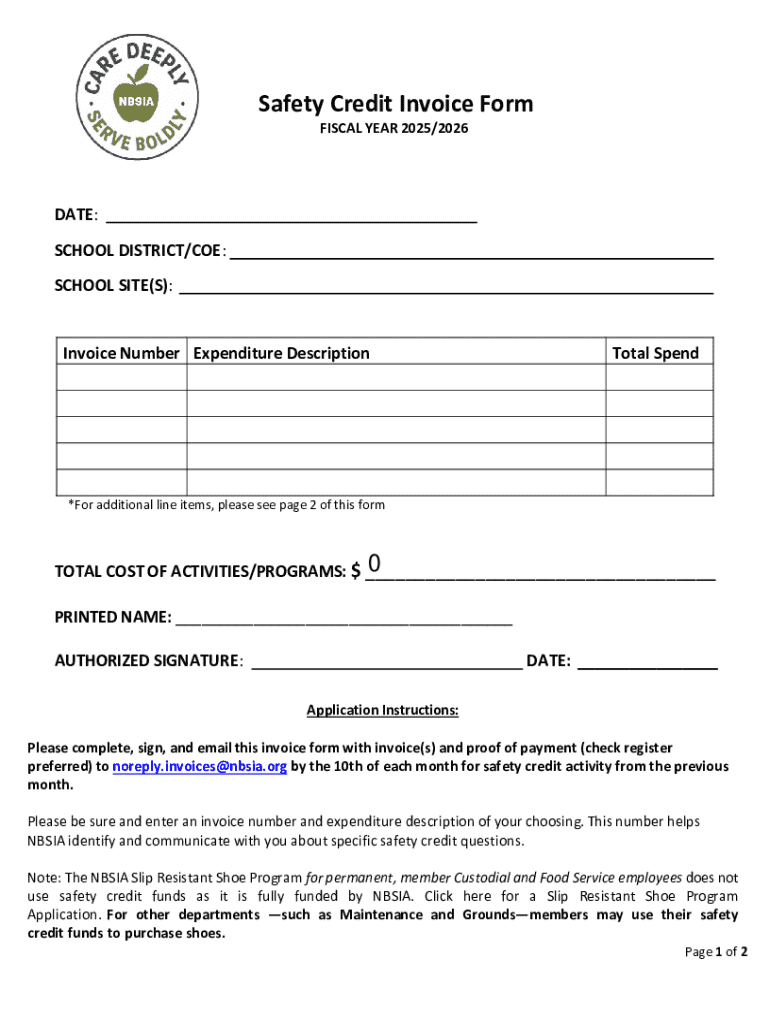

What is safety credit invoice form?

Who is required to file safety credit invoice form?

How to fill out safety credit invoice form?

What is the purpose of safety credit invoice form?

What information must be reported on safety credit invoice form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.