Get the free Uk State Pension Claim Form

Get, Create, Make and Sign uk state pension claim

How to edit uk state pension claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uk state pension claim

How to fill out uk state pension claim

Who needs uk state pension claim?

Complete Guide to the UK State Pension Claim Form

Understanding the UK State Pension

The UK State Pension is a crucial component of retirement planning for millions of individuals. It provides a regular income to eligible citizens, helping them maintain a decent standard of living once they retire. Designed to support individuals in their later years, the state pension is funded through National Insurance contributions made during one's working life.

Eligibility for receiving the UK State Pension typically includes reaching a specific age and having made sufficient National Insurance contributions. The pension system primarily consists of the Basic State Pension and the New State Pension, with the latter being applicable to those who reached retirement age after April 2016. Understanding these aspects is essential to maximize your retirement benefits.

Preparing to claim your state pension

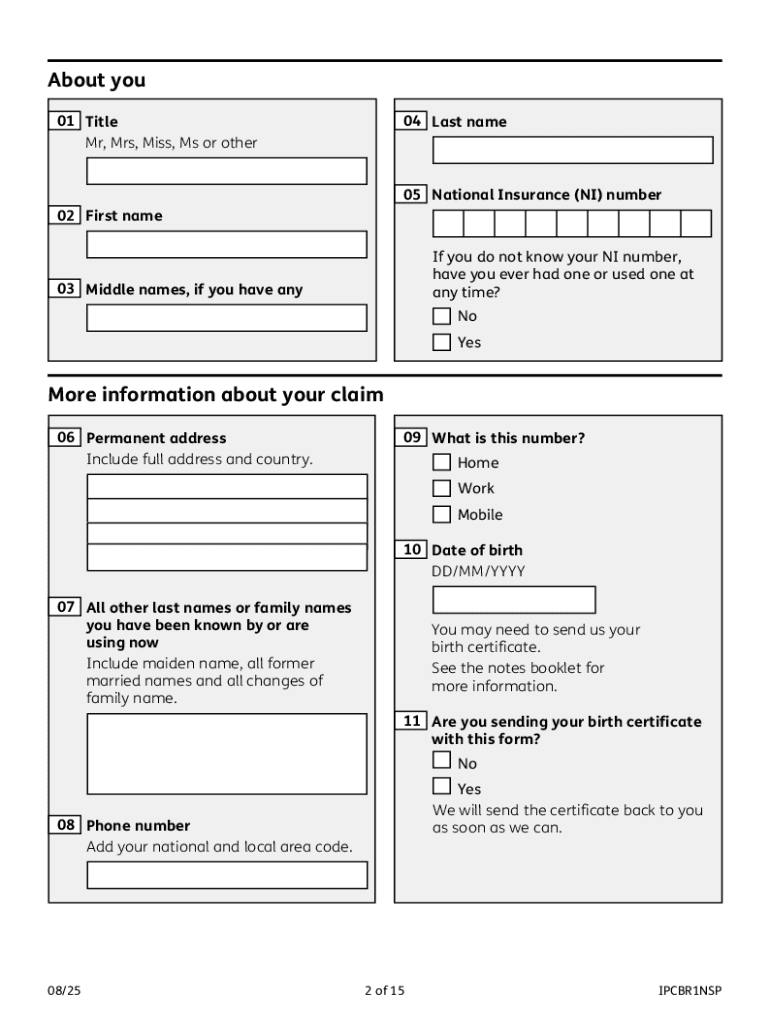

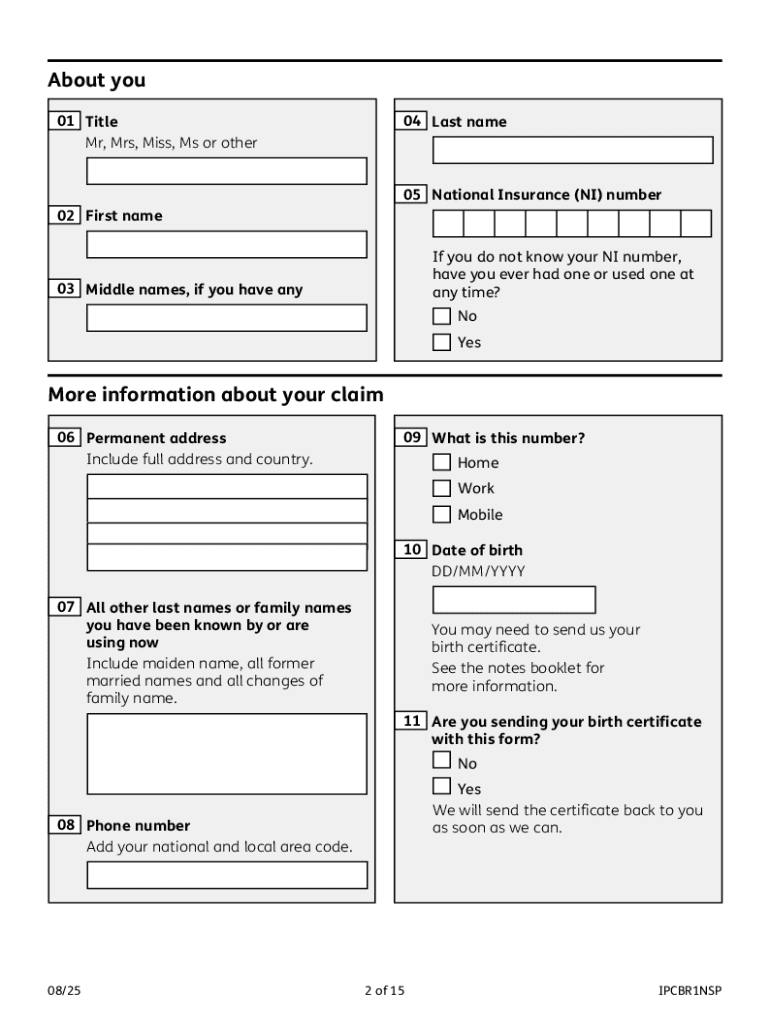

Before you can fill out the UK state pension claim form, it is crucial to gather all necessary personal information. Key details include your National Insurance number, which is integral to tracking your contributions and eligibility. Additionally, having your birth certificate and valid identification on hand can streamline the verification process.

Understanding your state pension age is another pivotal step. This age can vary based on your birth date, and knowing it can help you plan effectively. To assess your entitlement, you can check your state pension amount online through government resources, which will outline how much you can expect to receive based on your contribution history.

How to claim your state pension

Claiming your state pension involves several straightforward steps. One of the easiest ways to apply is via the online application procedure, which can be completed on the official government website. Alternatively, if you prefer to speak with someone directly, claiming by phone is also an option; ensure that you have all necessary details ready at the time of the call.

If neither online nor phone applications suit your needs, you may submit a paper application form. Each method requires certain key information, such as your employment details and banking information for your pension payments. After submitting your claim, you can expect a confirmation of receipt and a timeline for processing, ensuring you stay informed throughout the process.

Important documents for the claim

When you submit your UK state pension claim form, certain mandatory documents must be included. Proof of identity and residence is critical, as is documentation detailing your National Insurance contributions. These documents ensure that your application is processed without delays and confirms your entitlement to the pension.

To avoid common mistakes, ensure all your documents are clear and legible, and double-check that you've provided complete information before submission. It’s beneficial to keep copies of everything you send for your records. This helps not just for personal tracking but serves as a reference should any issues arise during processing.

Editing and managing your claim form with pdfFiller

pdfFiller offers a user-friendly solution for managing your UK state pension claim form. With its editing options, you can easily fill out your details and make corrections as necessary. The platform allows for seamless eSigning, ensuring that your completed form is securely signed and ready for submission.

Additionally, pdfFiller facilitates collaboration by letting you invite family members or advisors to review your application. This feature enhances the accuracy of your claim as multiple eyes can catch errors or omissions. The cloud-based environment means you can manage comments and changes on your application anytime, anywhere, making the process smoother and more efficient.

FAQs about the UK state pension claim process

Navigating the UK State Pension claim process can bring up various concerns and questions. Common queries include how long it takes to receive your first payment after claim submission, what steps to take if your claim is rejected, and how to update your claim details if your circumstances change.

For accurate answers and support, contacting the Pension Service is the best course of action. They provide comprehensive assistance that can help clarify any issues. Additionally, numerous online resources offer valuable information and guidance regarding state pensions, ensuring users remain well-informed.

Keeping track of your state pension after claiming

Once you've submitted your UK state pension claim form and begun receiving payments, it's vital to monitor those payments regularly. Keeping track ensures that you receive the correct amount and helps you identify any discrepancies that may arise.

As circumstances can change — such as marriage, relocation, or any life changes — it's important to inform the Pension Service of these changes swiftly. This ensures that your pension remains accurate and benefits you adequately based on your situation. Planning ahead for potential future updates in the state pension system will also aid in managing your pension effectively.

User experience feedback and testimonials

The process of claiming the UK state pension can be quite an experience, and many have shared their thoughts on the journey. From the initial steps of gathering documents to the final submission of the claim form, insights from real users can be instrumental in guiding others through the process.

If you've utilized the UK state pension claim form process, consider sharing your experience! Highlight what worked well and offer tips for improvement, as user feedback is vital for continual enhancements to this essential service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in uk state pension claim?

Can I edit uk state pension claim on an iOS device?

How do I complete uk state pension claim on an Android device?

What is uk state pension claim?

Who is required to file uk state pension claim?

How to fill out uk state pension claim?

What is the purpose of uk state pension claim?

What information must be reported on uk state pension claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.