Get the free Mortgage Foreclosure Prevention Program Intake Form

Get, Create, Make and Sign mortgage foreclosure prevention program

How to edit mortgage foreclosure prevention program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage foreclosure prevention program

How to fill out mortgage foreclosure prevention program

Who needs mortgage foreclosure prevention program?

Mortgage Foreclosure Prevention Program Form - Detailed How-to Guide

Understanding mortgage foreclosure prevention

Mortgage foreclosure is a legal process whereby a lender seeks to recover the balance of a loan from a borrower who has stopped making payments. This process can lead to the loss of a home, often severely impacting the homeowner's credit score and financial stability. Understanding the implications of foreclosure is crucial as it can affect future borrowing and housing options.

Foreclosure prevention programs exist to help struggling homeowners find alternatives that optimize their financial situations while keeping their properties. These programs provide assistance in various forms—be it counseling, temporary financial aid, or modification of loan terms—to help avoid the drastic measure of foreclosure.

The Mortgage Foreclosure Prevention Program is designed to provide financial support and resources to homeowners facing potential foreclosure. It aims to stabilize housing markets by reducing the number of foreclosures and ensuring more families can retain ownership of their homes.

Evaluating eligibility for the mortgage foreclosure prevention program

Before applying for the Mortgage Foreclosure Prevention Program, it is essential to evaluate whether you meet the eligibility criteria set by the program. This typically includes several factors such as your income level, current mortgage payment status, and whether you occupy the property as a primary residence.

To determine if you qualify, reviewing your financial standing and current situation is vital. Gathering recent pay stubs, bank statements, and any correspondence with your lender may assist in your assessment.

Key benefits of the mortgage foreclosure prevention program

Participating in the Mortgage Foreclosure Prevention Program can provide numerous benefits that greatly impact financially distressed homeowners. First and foremost, financial assistance can cover missed mortgage payments and associated fees, which alleviates immediate pressure on families struggling to keep their homes.

Additionally, the program may provide pathways to modify your loan terms, potentially lowering monthly payments and making your mortgage more manageable. Long-term, applicants often see improved financial stability, enhanced credit scores, and a greater chance of retaining homeownership, which is often the main goal for most families.

Preparing to apply: what you need

When preparing to apply for the Mortgage Foreclosure Prevention Program, organization and adequate documentation are key. Essential documents you will need to gather include proof of income, such as pay stubs, tax returns, and bank statements, to demonstrate your financial status.

In addition, ensure you locate mortgage statements that detail your outstanding balance and payment history. Identification documents, such as a driver’s license or Social Security card, might also be required to confirm your identity and ownership of the property.

Thoroughly organizing these documents ahead of time can streamline the application process, reducing time spent searching for items once your application begins.

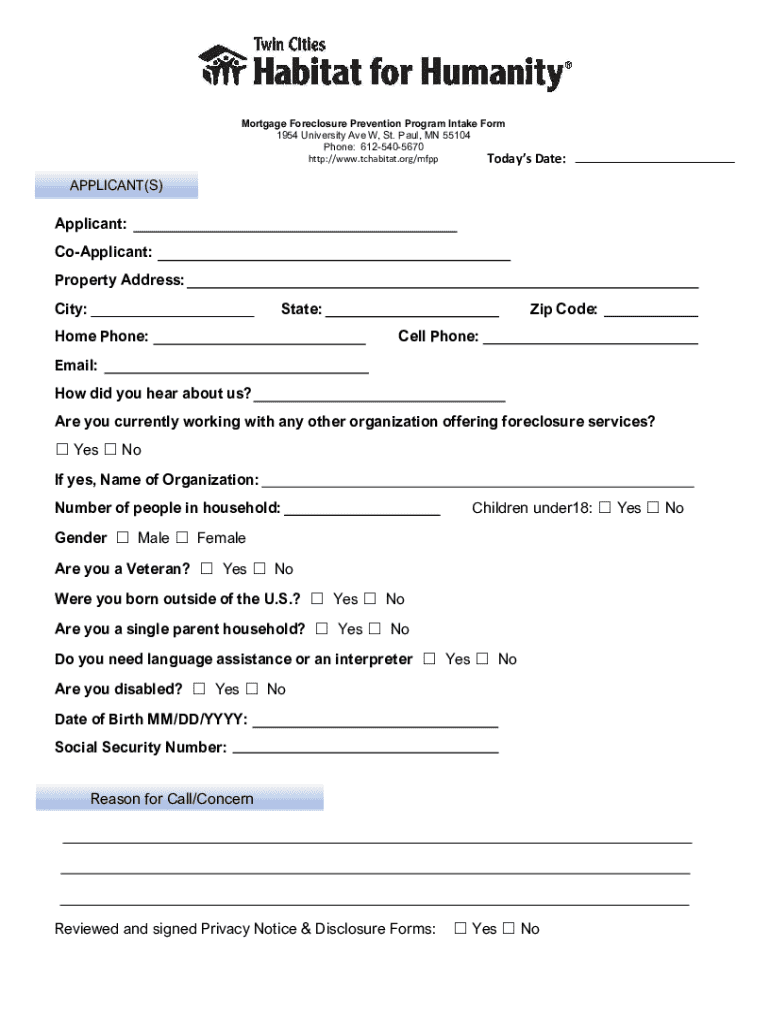

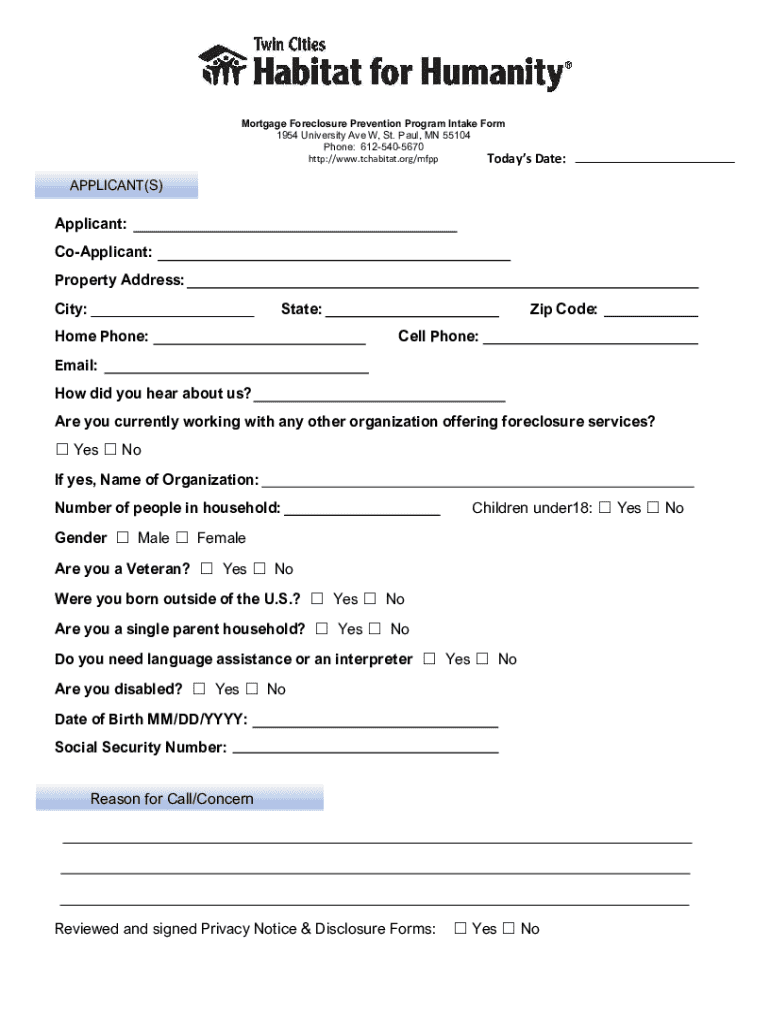

Step-by-step guide to completing the mortgage foreclosure prevention program form

To begin your application for the Mortgage Foreclosure Prevention Program, you need to access the form specific to your state's housing agency or foreclosure program website. These forms are often available online for easy access.

Breaking down the form: typically, it includes several sections that require detailed information. Starting with personal information, list your name, contact information, and details about the property in question.

While filling out the form, be thorough yet concise. One common pitfall is leaving sections incomplete; double-checking all entries can prevent delays in processing your application.

Submitting your application

Once your Mortgage Foreclosure Prevention Program form is complete, it’s time to submit it. Applications can typically be submitted online, through the mail, or in-person at designated office locations. Each method has specific instructions, which should be followed to the letter.

When submitting, ensure that all required documents are included and organized. Double-check everything for completeness before sending your application. After submission, consider following up within a few days to ensure it was received and is being processed.

What assistance is available?

The Mortgage Foreclosure Prevention Program can offer various types of financial assistance to eligible homeowners facing foreclosure. This assistance may cover missed mortgage payments, including late fees and other related costs in extreme circumstances.

It’s essential to understand the types of financial aid accessible, encompassing potential payment plans that facilitate managing outstanding payments. The timeline for receiving assistance often varies, so staying informed through updates provided by the program is crucial.

Repayment considerations

A primary concern for many homeowners receiving assistance is whether they will need to repay the funds granted through the Mortgage Foreclosure Prevention Program. Generally, this depends on the type of aid received. Some forms of assistance may require repayment over time, while others are structured as grants that do not.

Understanding the conditions for repayment, if applicable, is critical. Familiarize yourself with any repayment options available, as failing to repay funds when required can lead to further complications and potentially more profound financial difficulties.

Collaborating with mortgage companies

Effective communication with your mortgage company is crucial when facing foreclosure. After submitting your Mortgage Foreclosure Prevention Program application, ensure you continue to engage with your lender to explore further options and demonstrate your commitment to resolving your situation.

Strategies for effective communication include being transparent about your financial state, expressing your intentions clearly, and responding promptly to any inquiries. Knowing your rights as a borrower, including protection against predatory practices, can empower you to navigate this challenging situation effectively.

Frequently asked questions about the mortgage foreclosure prevention program

It’s common for applicants to have several questions when considering the Mortgage Foreclosure Prevention Program. Addressing these common inquiries can assist applicants in understanding the application process and eligibility requirements better.

If any concerns arise around applying, reviewing resources provided by the program can further clarify the details needed for your application. Additionally, keeping updated on privacy and data security within the forms can help alleviate applicant fears.

Utilizing pdfFiller for your mortgage foreclosure prevention needs

When managing the application process for the Mortgage Foreclosure Prevention Program, utilizing pdfFiller can significantly streamline your experience. This powerful cloud-based platform enables users to seamlessly edit PDFs, add signatures, and collaborate on documents from virtually anywhere.

By leveraging pdfFiller’s features, individuals can easily fill out the Mortgage Foreclosure Prevention Program form, ensuring all necessary fields are completed accurately. Effective document management and adaptability to your needs can enhance your overall experience during a challenging time.

Next steps after application submission

Once you've submitted your Mortgage Foreclosure Prevention Program application, the next steps revolve around waiting for responses and actively preparing for what comes next. Make yourself available for any follow-up interviews or additional documentation that may be requested to complete your submission.

Additionally, staying informed about program updates or changes in eligibility criteria is essential. Being proactive in checking in with the agency handling your application can help clarify any uncertainties and ensure you receive the assistance you need promptly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mortgage foreclosure prevention program online?

Can I create an electronic signature for the mortgage foreclosure prevention program in Chrome?

Can I create an electronic signature for signing my mortgage foreclosure prevention program in Gmail?

What is mortgage foreclosure prevention program?

Who is required to file mortgage foreclosure prevention program?

How to fill out mortgage foreclosure prevention program?

What is the purpose of mortgage foreclosure prevention program?

What information must be reported on mortgage foreclosure prevention program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.