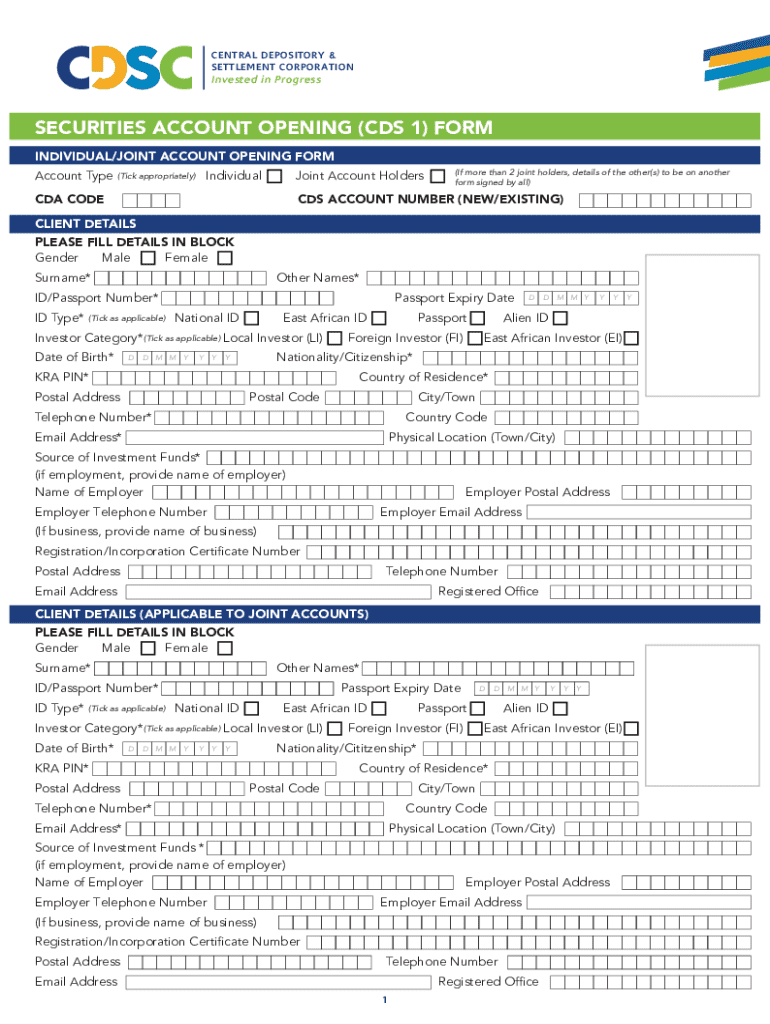

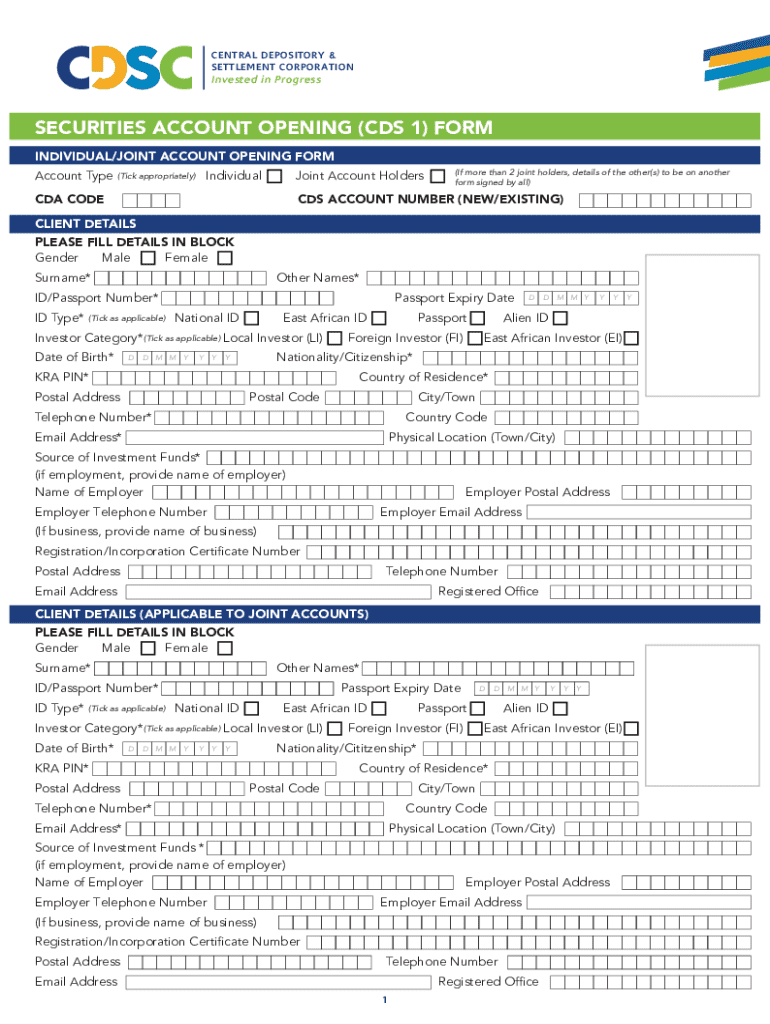

Get the free CDS 1 1 INDIVIDUAL-JOINT ACCOUNT OPENING FORM

Get, Create, Make and Sign cds 1 1 individual-joint

How to edit cds 1 1 individual-joint online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cds 1 1 individual-joint

How to fill out cds 1 1 individual-joint

Who needs cds 1 1 individual-joint?

Comprehensive Guide to the CDS 1 1 Individual-Joint Form

Understanding the CDS 1 1 Individual-Joint Form

The CDS 1 1 Individual-Joint Form is an essential document used primarily in the financial sector to manage accounts held individually or jointly. This form serves a vital role in facilitating clear communication and agreement between account holders and financial institutions. It is commonly utilized by individuals, couples, and entities to document their financial relationships, whether for a bank account, investment account, or similar financial purpose.

Properly completing the CDS 1 1 form is crucial, as errors can lead to significant implications regarding account management and access. For instance, incorrect data entry can result in delayed transactions, issues with account access, and even legal complications. Accurately filling out this form enables individuals and joint account holders to manage their finances smoothly, paving the way for effective financial planning and transparent record-keeping.

Preparing to Fill Out the CDS 1 1 Individual-Joint Form

Before you begin filling out the CDS 1 1 Individual-Joint Form, it’s imperative to gather all necessary information. This includes personal identification details such as full names, addresses, and Social Security Numbers (SSNs) for all account holders. Additionally, you will need to collate financial details, such as account numbers, current balances, and transaction history relevant to the accounts involved.

Understanding the terminology used in financial documents is equally important. Key terms such as 'joint account' indicate an account shared between two or more individuals, while 'individual holder' refers to a single account owner. Familiarizing yourself with these terms will make the form-filling process smoother and help avoid potential pitfalls related to misunderstandings.

Step-by-Step Guide to Completing the Form

Completing the CDS 1 1 Individual-Joint Form can be broken down into clear sections. Start with the first section, where you will provide personal information of the primary account holder, including their name, address, and Social Security Number. Be meticulous here, as accuracy is key.

The next sections will require the details of the joint account holder. Follow a similar format, ensuring that all names and information match legal documentation to avoid discrepancies. Lastly, you will need to report any existing accounts you wish to link or reference, including account numbers and associated financial institutions.

While completing the form, it's crucial to be aware of common pitfalls. Frequent mistakes include misspellings of names, incorrect Social Security Numbers, or mismatched information between what is listed in the form and what is on file with financial institutions. To mitigate these issues, double-check every entry before submission.

Utilizing tools like pdfFiller can significantly streamline this process. Access the form online, take advantage of the fillable fields, and use guidance notes provided to ensure correct entries.

Editing and Reviewing the Completed Form

Once you’ve completed the initial entries on the CDS 1 1 form, you may need to edit or incorporate changes. With pdfFiller, this process is straightforward. If any information changes or if there was a mistake, you can easily edit existing data. Be sure that the co-signers, or joint account holders, also review and sign off on the document to ensure mutual agreement.

Having a structured review checklist is incredibly helpful. Before submitting, verify the following points: Have you included all necessary signatures and dates? Is the account information accurately filled out? Confirm that all entries reflect official documents, reducing the likelihood of processing delays.

Signing and Submitting the CDS 1 1 Individual-Joint Form

When it comes to signing the CDS 1 1 Individual-Joint Form, pdfFiller offers a variety of options, including e-signing. This digital signature method is not only convenient but also legally binding, thus ensuring the authenticity and legality of your signed document. To e-sign your form, follow this straightforward process: navigate to the designated signature area, select your digital signature option, and confirm.

Regarding submission methods, you can choose between digital submission directly through pdfFiller or traditional postal mail. Digital submission is often the quickest route, as it reduces the risk of delays inherent in postal services. Whichever method you choose, always track your submission to confirm that it reaches the intended recipient efficiently.

Managing Your CDS 1 1 Form Post-Submission

After submitting your CDS 1 1 Individual-Joint Form, monitoring the application status is crucial. This step ensures that you are informed of any processing delays or requirements for additional documentation. Many institutions provide an online portal for users to track the status of their submitted forms, making it easier to stay updated.

Maintaining copies and organizing records is another essential aspect of document management. Always keep copies of your submitted forms for future reference. Utilize pdfFiller features for effective document management, which allows you to backup and retrieve records effortlessly as needed.

FAQs About the CDS 1 1 Individual-Joint Form

Many users commonly have inquiries regarding the CDS 1 1 Individual-Joint Form. A frequent question concerns the differences between joint and individual accounts. It is essential to understand that a joint account involves two or more individuals sharing access and responsibility for the funds, whereas an individual account is owned by a single person, providing them full control over the funds.

Other queries may arise when individuals encounter errors after submission. If you need to resubmit a form due to inaccuracies, it is prudent to contact your institution's customer service for guidance on their specific policies regarding corrections and resubmissions. They can provide tailored advice on how best to proceed.

Contacting Support

When managing the CDS 1 1 Individual-Joint Form, knowing when and how to contact pdfFiller support can be incredibly beneficial. If you encounter any issues using the platform, such as technical difficulties or questions about specific features, don't hesitate to reach out to their customer support team. They are equipped to assist with a wide range of document-related queries, ensuring that your experience remains smooth and efficient.

Utilize available support resources, including FAQs, live chat, or direct email contact, and take advantage of their resources to make the most out of pdfFiller's capabilities. Effective customer support can significantly ease the process of managing your documents, making your journey through the complexities of the CDS 1 1 form straightforward.

Additional tools and resources

pdfFiller offers a variety of additional tools and services that can enhance your document management experience. Apart from the CDS 1 1 Individual-Joint Form, users can access a wide array of document templates designed to cater to various needs—be it legal forms, tax documents, or business proposals. These resources can save you time and effort in finding the right document.

Optimizing your workflow with pdfFiller is also possible through its collaborative tools. These features are particularly beneficial for teams and organizations handling multiple documents at once. By integrating pdfFiller into your everyday tasks, you streamline processes, improve accuracy, and ensure that all team members are aligned on document-related matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cds 1 1 individual-joint from Google Drive?

How can I send cds 1 1 individual-joint to be eSigned by others?

Where do I find cds 1 1 individual-joint?

What is cds 1 1 individual-joint?

Who is required to file cds 1 1 individual-joint?

How to fill out cds 1 1 individual-joint?

What is the purpose of cds 1 1 individual-joint?

What information must be reported on cds 1 1 individual-joint?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.