Get the free Annuities - A Guide For Consumers

Get, Create, Make and Sign annuities - a guide

How to edit annuities - a guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annuities - a guide

How to fill out annuities - a guide

Who needs annuities - a guide?

Annuities - A Comprehensive Guide Form

Understanding annuities

Annuities are financial products designed primarily for retirement income, providing a steady cash flow in exchange for either a lump sum payment or series of payments made over time. They are structured to assist in long-term financial planning and wealth management.

There are several types of annuities, each catering to different financial strategies. Fixed annuities guarantee a predetermined payout, offering stability in investment returns. Variable annuities, on the other hand, allow investments in various securities, providing the potential for growth, albeit with higher risk. Indexed annuities link returns to a specific index, combining features of both fixed and variable annuities.

The purpose of annuities

Annuities primarily serve two purposes: income generation during retirement and risk management for long-term financial stability. They provide a consistent source of income, which is especially vital as individuals transition from employment to retirement. This ensures that financial obligations can be met without the stress of market fluctuations affecting the capital.

In addition, annuities offer a mechanism for risk management. For those concerned about longevity risk—outliving their savings—annuities can provide peace of mind by guaranteeing income regardless of lifespan. This feature is increasingly appealing in an age where retirement can last several decades.

Key features of annuities

Annuities come with distinct features that can affect their performance and suitability for personal finance goals. A key aspect is the payment structure, which defines how and when payments are received. Immediate annuities start payouts right away, making them ideal for those who need immediate income, while deferred annuities delay payments and usually grow in value over time.

Payment options can be categorized into lump-sum payments—where an individual pays a one-time sum—or periodic payments that provide regular income. It's crucial to understand the terms connected with these structures, including any surrender periods and the fees associated with early withdrawal.

How to choose the right annuity

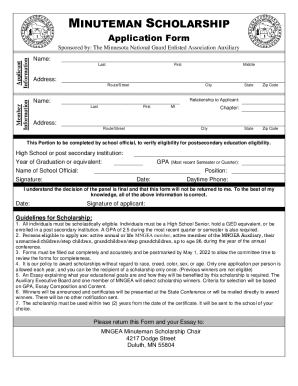

Selecting the right annuity requires a clear understanding of personal financial goals. Begin by assessing your retirement income needs, which may include considering current and future expenses, lifestyle expectations, and healthcare costs. Determining how much income you require monthly can aid in choosing the right product.

Another important factor is evaluating your investment risk tolerance. If you prefer stability, fixed annuities may suit you best. Conversely, if you're comfortable with market fluctuations for potentially higher returns, then variable or indexed options may be the way to go. Additionally, comparing different providers by assessing their financial strength ratings and historical performance can guide your decision.

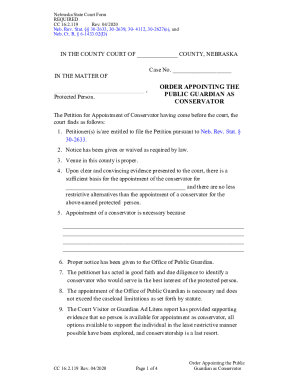

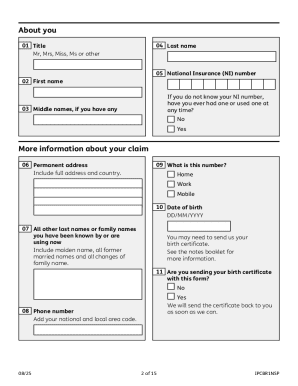

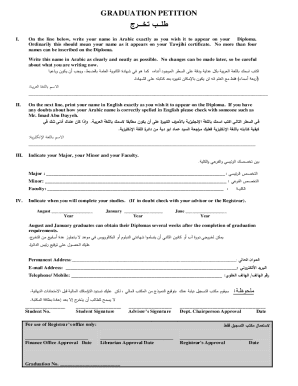

Filling out the annuity form

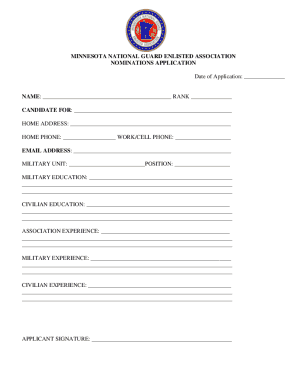

To acquire an annuity, prospective buyers must complete an annuity form, which typically requires specific personal information. Essential details include your name, address, and Social Security number; these elements help the provider assess eligibility and ensure compliance with regulatory requirements.

Moreover, selecting the type of annuity that best fits your needs is crucial. The form will often have sections to indicate preferences—be it fixed, variable, or indexed. It's also necessary to specify payment options; deciding between periodic payments or lump-sum investments at this stage is key to achieving your financial objectives.

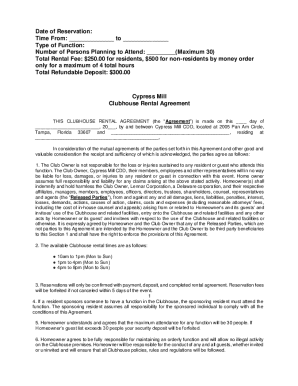

Tips for editing and customizing your annuity form

After gathering all required information, utilizing digital tools for editing your annuity form can enhance accuracy and clarity. Platforms like pdfFiller provide a user-friendly interface to edit, PDF documents, making it seamless to input or revise details.

In addition, ensuring the form is properly signed and dated is essential for validity. Many online platforms also allow for e-signatures, which simplifies the process of signing documents securely without the hassle of printing or physical delivery.

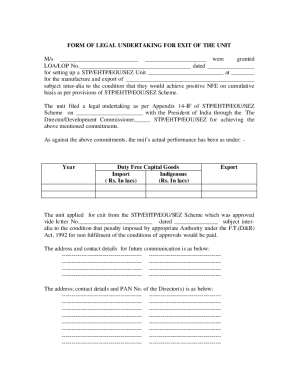

Managing and storing your annuity documents

Once your annuity form is submitted, it’s vital to manage and store the resulting documents securely. Cloud-based document management systems present significant advantages, enabling users to store sensitive information safely while maintaining access from anywhere, at any time.

Regularly monitoring annuity updates and changes in terms is equally important. Annuities can be affected by changes in legislation or the financial standing of the provider, so keeping all records up-to-date and readily accessible can help avoid complications in the future.

Common questions and answers about annuities

Many prospective buyers have questions when considering annuities. A common query is what to consider before purchasing; essential factors include the type of annuity, provider’s fees, and understanding how the product fits into your retirement strategy. Also, it is crucial to consider potential penalties for withdrawal before the surrender period ends.

Another frequent concern is related to form submission. Mistakes on the annuity form can lead to delays. It's essential to double-check all information before submission. If a mistake occurs, contact the provider immediately to rectify issues, which is often more straightforward if the form is submitted digitally.

Legislative considerations surrounding annuities

The landscape of annuities is impacted by legislative changes that can affect both their structure and the protections afforded to consumers. Recent updates include regulations aimed at increasing transparency from annuity providers, ensuring clients are fully informed about terms and fees associated with their products.

Understanding consumer protections is also vital for annuity holders. Laws have been put in place to safeguard consumers from unfair practices and to establish clear standards for disclosures, helping individuals make more informed decisions regarding their investments.

Interactive tools for annuity calculation

Utilizing interactive tools for annuity calculation can significantly aid in decision-making processes. Online annuity calculators allow individuals to estimate potential payouts based on various parameters, such as investment amount, duration, and type of annuity selected.

Additionally, platforms may provide comparison tables that enable users to evaluate different annuities side by side. These resources are invaluable for determining which products align best with personal financial goals, ensuring a well-informed decision.

Additional resources for understanding annuities

For individuals seeking to deepen their understanding of annuities, a wealth of educational materials is available. eBooks, webinars, and specialized courses focus on different facets of annuities, ensuring a broad comprehension of potential pitfalls and benefits.

Connecting with trusted financial advisors can also provide personalized guidance tailored to unique financial situations. Finding an advisor knowledgeable about annuities can facilitate smarter investment decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find annuities - a guide?

How do I fill out the annuities - a guide form on my smartphone?

Can I edit annuities - a guide on an Android device?

What is annuities - a guide?

Who is required to file annuities - a guide?

How to fill out annuities - a guide?

What is the purpose of annuities - a guide?

What information must be reported on annuities - a guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.