Get the free map-931 (e) explanation of the surplus income program. ...

Get, Create, Make and Sign map-931 e explanation of

How to edit map-931 e explanation of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out map-931 e explanation of

How to fill out map-931 e explanation of

Who needs map-931 e explanation of?

Map-931 e: Explanation of Form

Understanding map-931 e: Overview of the Form

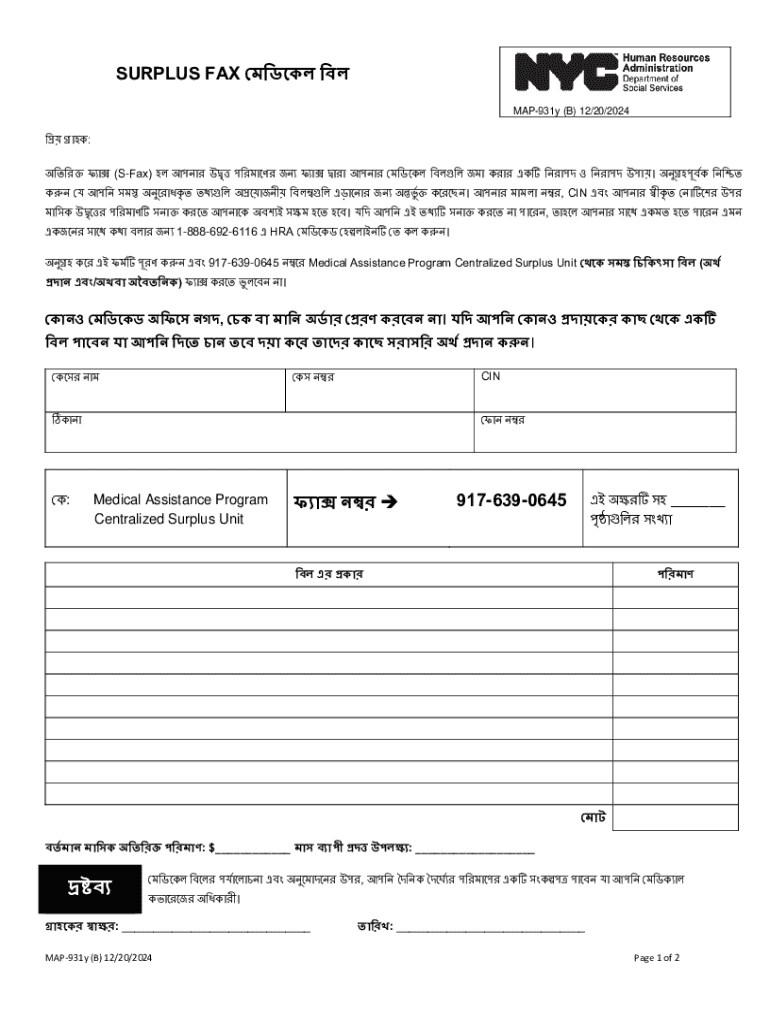

Map-931 e is a form utilized primarily for documenting financial eligibility in relation to specific programs, often associated with benefit assessments. This form serves a key purpose in determining the financial status of applicants by evaluating their income, assets, and general expense distributions. Having a clear understanding of this form is imperative for individuals seeking access to benefits that aim to support those in financial need.

The importance of map-931 e in document management cannot be overstated. It not only aids in streamlining the assessment process for aid applications but also ensures that the documentation submitted is consistent and standardized. This leads to reduced processing times and minimizes errors that may arise through inconsistent submissions. In a collaborative environment, map-931 e enhances clarity and serves as a pivotal reference point for individuals and teams alike.

Key components of map-931 e

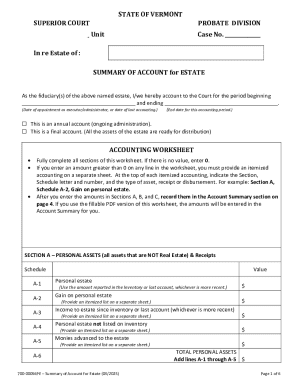

Understanding the key components of map-931 e is crucial for anyone tasked with filling it out. The form consists of several distinct sections, each designed to collect specific information that supports the financial assessment process. This enables reviewers to make informed decisions regarding eligibility for financial assistance programs.

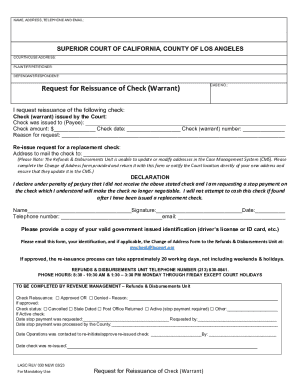

The first section typically focuses on identification information, capturing the applicant's personal details such as name, address, and social security number. The second section addresses the financial information requirements, where applicants must outline their income sources, expenses, and any relevant asset information. Finally, the certification statements affirm that the information provided is truthful and complete, holding the applicant accountable for the data submitted.

Step-by-step instructions for completing map-931 e

Filling out map-931 e can be a straightforward process if you prepare adequately. First, gather all necessary information. This includes details about your income sources, any bills that must be reported, and essential personal documentation. Tools like pdfFiller provide an intuitive platform for completing this form.

When you sit down to fill out the form, ensure each section is completed accurately. A common pitfall is failing to disclose all income or asset categories which can lead to complications in processing applications. Pay attention to the specific income limits set for various programs, as applicants must fall within these ranges to qualify for assistance.

After filling out the sections, take the time to review your work. Create a checklist that includes looking over the completed entries, verifying income limits, and ensuring you've attached all necessary documentation before submitting the form.

Interactive tools and features on pdfFiller for map-931 e

pdfFiller offers several interactive tools that streamline the completion and management of map-931 e. Among these are advanced editing capabilities that allow users to modify existing fields or add new information seamlessly. This adaptability ensures that the document meets the specific needs of the applicant while remaining compliant with form requirements.

Additionally, pdfFiller's eSignature feature allows for quick validations, enabling applicants to sign electronically, which expedites the submission process. Collaborating with teams is made easier through functionalities such as sharing the document and providing comments or feedback directly on the document. This enhances communication and ensures that everyone involved is on the same page regarding the application's details.

Managing your map-931 e after submission

Once you submit map-931 e, managing the submission thereafter becomes critical. The ability to track the submission status ensures that applicants can monitor their application's progress and anticipate any required actions. This visibility can alleviate anxiety and help in planning further steps depending on the outcome.

Storage options provided by pdfFiller enable users to keep their completed forms secure. This prevents loss of vital documents, ensuring they are accessible when needed. If revisions are necessary, pdfFiller supports easy amendments and resubmissions to adjust your application as per financial changes or extra documentation that may arise during the review process.

FAQs about map-931 e

Navigating through map-931 e can present challenges, and it's essential to know where to seek help when you encounter issues. Common issues might include trouble understanding specific sections or needing clarification on when documentation is required. The first step in resolving these problems is to reach out for support directly through the relevant program’s hotline or via email. Understanding different variants of map-931 e based on local or state requirements will also facilitate a smoother application process.

Additionally, remaining informed about changes or updates to the submission requirements is paramount. Keeping abreast of these revisions can enhance your ability to submit forms that meet current standards. Lastly, having a reliable point of contact for support can reduce stress for applicants by ensuring that they have access to guidance when needed.

Additional tips and best practices

Ensuring compliance with regulations regarding map-931 e is critical. Applicants should familiarize themselves with both state and federal guidelines that govern income limits and asset declarations. Researching these standards can save you time and prevent potential rejections by ensuring adherence to requirements. Utilize pdfFiller's resources to access information that outlines necessary compliance elements.

Furthermore, leveraging pdfFiller for similar forms beyond map-931 e can centralize your document management process. Keeping all necessary forms in a single, accessible location promotes efficiency, especially for those who routinely apply for various assistance programs. Lastly, staying updated on any changes to form requirements will ensure you are always prepared and able to provide accurate information during the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit map-931 e explanation of online?

Can I edit map-931 e explanation of on an iOS device?

How can I fill out map-931 e explanation of on an iOS device?

What is map-931 e explanation of?

Who is required to file map-931 e explanation of?

How to fill out map-931 e explanation of?

What is the purpose of map-931 e explanation of?

What information must be reported on map-931 e explanation of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.