Get the free C: 6

Get, Create, Make and Sign c 6

How to edit c 6 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out c 6

How to fill out c 6

Who needs c 6?

Comprehensive Guide to the 6 Form: Everything You Need to Know

What is the 6 form?

The c 6 form is an essential document used by various organizations in the United States to obtain tax-exempt status under Section 501(c)(6) of the Internal Revenue Code. This form is particularly designed for business leagues, chambers of commerce, and trade associations that engage in activities aimed at promoting common business interests. By filing the c 6 form, organizations can position themselves to receive tax exemptions related to their income, allowing them to focus more resources on their objectives rather than funding the government.

The primary purpose of the c 6 form is to ensure these organizations operate primarily for the benefit of their members, providing networking opportunities, advocacy, and shared resources. Unlike 501(c)(3) organizations, c 6 entities are not classified as charitable organizations; instead, they support business-related activities that enhance their industry or profession.

Importance of the 6 form for organizations

Obtaining c 6 status brings numerous benefits to organizations. One of the most significant advantages is the exemption from federal income tax, which allows them to reinvest their funds into initiatives that support their members and industry growth. Additionally, c 6 organizations can improve their credibility among members and stakeholders, making it easier to attract new members and secure sponsorships or partnerships.

Furthermore, being recognized as a c 6 organization opens doors to various grants and funding opportunities specific to business-related initiatives. This status not only enhances the ability to host events or training programs but also informs members about legislative updates that may impact their business interests. Overall, the proper completion and submission of the c 6 form can significantly contribute to the organizational growth and compliance.

Eligibility criteria for 6 organizations

To qualify for c 6 status, organizations must meet specific eligibility criteria. Primarily, these entities should be organized as business leagues or associations that focus on improving business conditions for their members. This includes chambers of commerce, real estate boards, and associations for specific industries or professions.

Examples of eligible organizations include local chambers of commerce, trade associations for specific sectors like construction or technology, and real estate boards. These entities exemplify how c 6 organizations operate around common business interests, thereby qualifying for the benefits that come with this status.

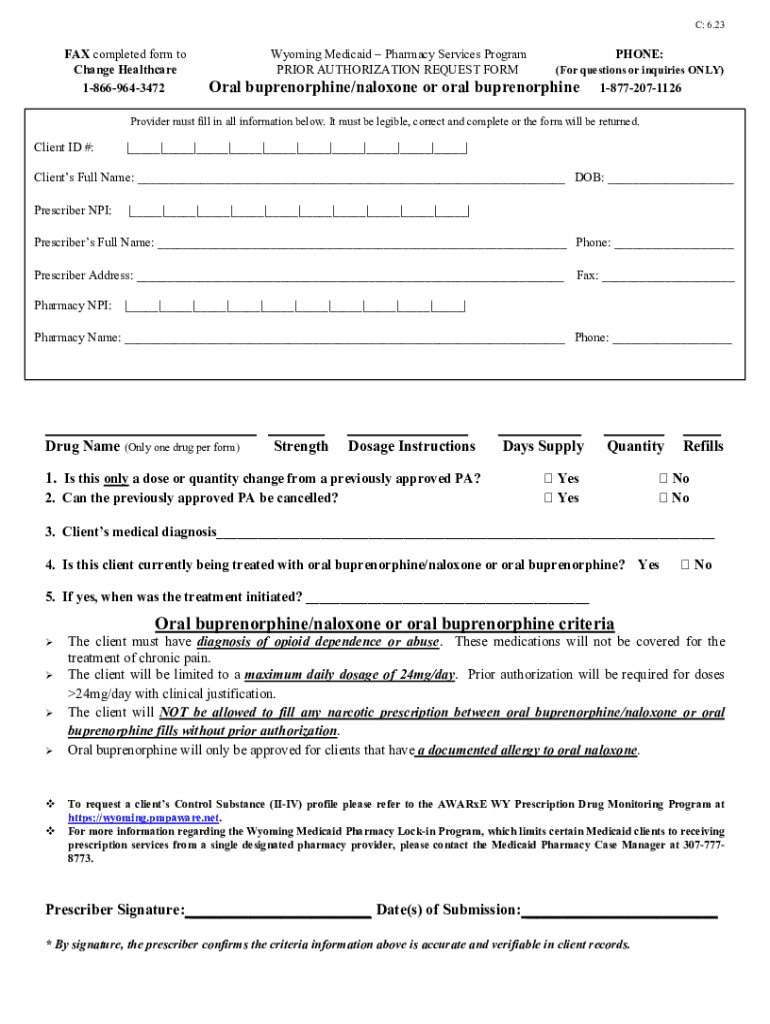

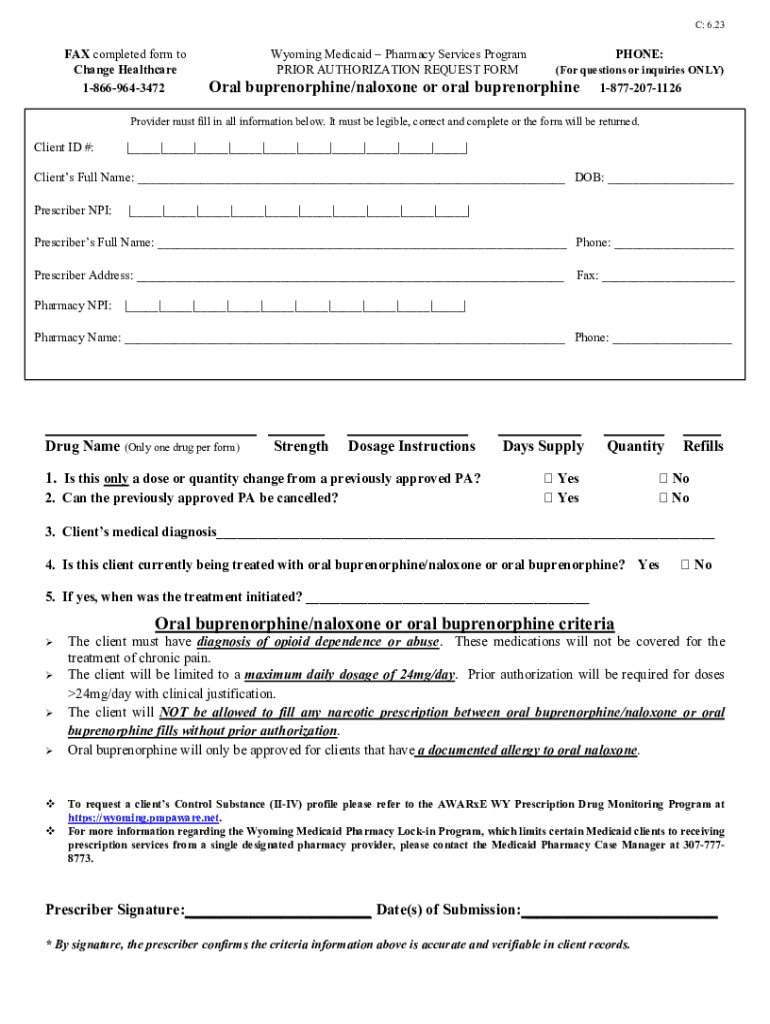

Detailed steps to complete the 6 form

Step 1: Preparing required documents

Before filling out the c 6 form, ensure you have all necessary documents ready. This typically includes the organization’s bylaws, a statement of activities, and copies of IRS exempt status letters if applicable. It is also beneficial to gather information regarding your organization's structure, including board members and their roles, to accurately represent your entity on the form.

Step 2: Filling out each section of the form

The c 6 form comprises several key sections that need careful attention. Start with the organizational details, including name, address, and contact information. Next, provide a detailed mission statement that clarifies your organization’s purpose. It’s critical to describe your activities accurately, highlighting how these efforts benefit members and their businesses.

Step 3: Common mistakes to avoid

Many applicants make mistakes that can delay approval. Common errors include incomplete sections, outdated organizational information, and lack of clarity in describing activities. To avoid these pitfalls, review the form carefully and consider having a third party review it to ensure all information is accurate and complete.

Step 4: Understanding the fees and submission process

Filing the c 6 form typically involves a fee, which can vary based on the state and organization type. After completing the form, ensure it is submitted to the proper IRS address, depending on your location. You can file the application either electronically or via mail, but electronic submissions may expedite the process.

Frequently asked questions about the 6 form

How long does approval take?

Approval times for the c 6 form can vary widely based on several factors including the completeness of your application and the volume of requests the IRS is handling. Generally, organizations can expect a processing time ranging from three to six months, though it may take longer during peak seasons or if additional information is requested from the organization.

Can amendments be made after submission?

Yes, amendments can be made to the c 6 form even after submission. If you need to make changes, such as updates to your organization’s leadership or activities, submit a written request detailing the specific changes and any supporting documentation. The IRS will consider these amendments as they review your application.

What to do if you receive a rejection notice?

Receiving a rejection notice can be disheartening, but it's essential to address the reasons for rejection promptly. Review the notice carefully for specific details on why your application was denied. Often, the issues can be resolved by providing additional information or clarifications. If necessary, you can appeal the decision or reapply by correcting identified issues.

Utilizing pdfFiller for streamlined form management

Editing the 6 form easily online

pdfFiller enables users to edit the c 6 form online without the hassle of scanning or printing. By uploading the document to the platform, you can make real-time changes to any section, ensuring your form is always accurate and up-to-date.

Signing and eSigning options

With pdfFiller, digitally signing the c 6 form is straightforward. The platform provides secure eSigning options that allow you to add your signature electronically, which can significantly speed up the submission process and enhance document security.

Collaborating with team members in real-time

If your organization works in teams, pdfFiller’s collaboration tools let multiple users work on the c 6 form simultaneously. This can improve efficiency as team members provide inputs and feedback in real-time, ensuring that the final submission reflects collective insights and meets compliance requirements.

Tips for successful 6 form submission

To maximize the likelihood of a successful c 6 form submission, adhere to best practices for compliance. Always review all sections thoroughly before submission to ensure accuracy, alignment with IRS requirements, and completeness. Keeping an organized record of all documents and correspondence related to your application can facilitate tracking and further inquiries.

Utilizing tools for online tracking can greatly help in monitoring your submission's status. Many organizations find it useful to set reminders for renewal dates and any reporting obligations post-approval, which can help maintain compliance and uninterrupted access to the benefits of c 6 status.

Maintaining compliance as a 6 organization

Once designated as a c 6 organization, ongoing compliance is critical for retaining that status. Annually, organizations are required to submit specific reports to the IRS, detailing income, expenses, and updates on activities. This process not only ensures transparency but also reinforces the organization's commitment to its members and stakeholders.

Additionally, staying informed about regulatory changes that may impact c 6 organizations is essential. Regularly checking IRS announcements and industry news is a proactive approach to ensuring ongoing compliance. Engaging with legal counsel or consultants knowledgeable about nonprofit law can also assist organizations in navigating complex compliance landscapes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send c 6 for eSignature?

How do I execute c 6 online?

Can I sign the c 6 electronically in Chrome?

What is c 6?

Who is required to file c 6?

How to fill out c 6?

What is the purpose of c 6?

What information must be reported on c 6?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.