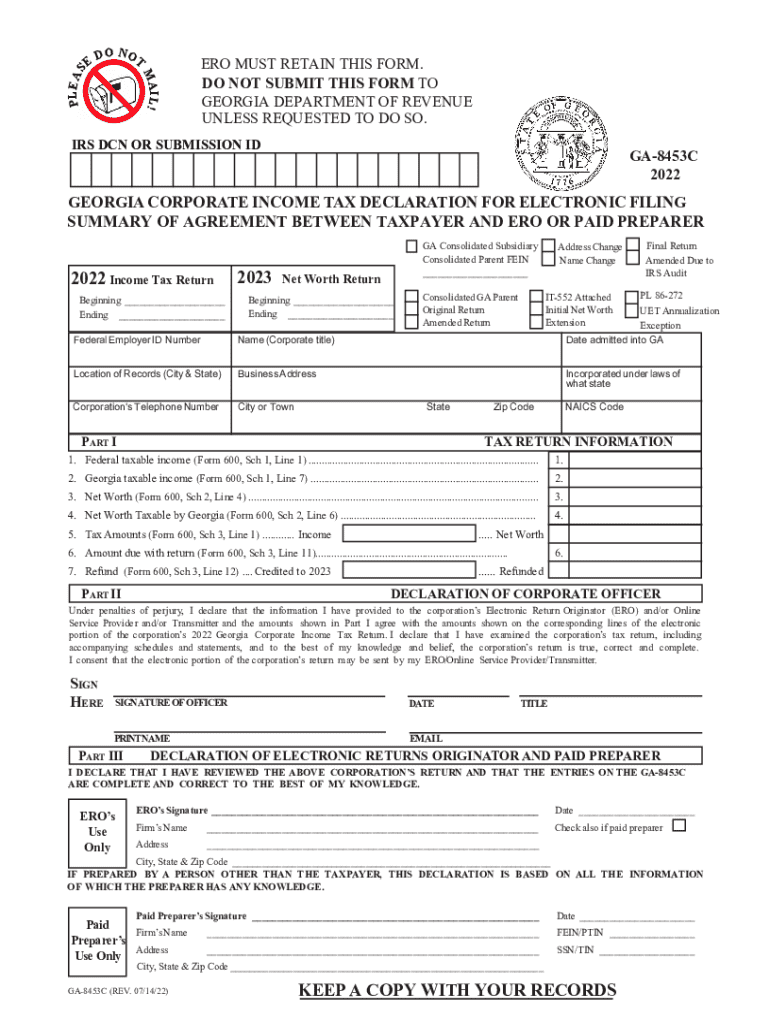

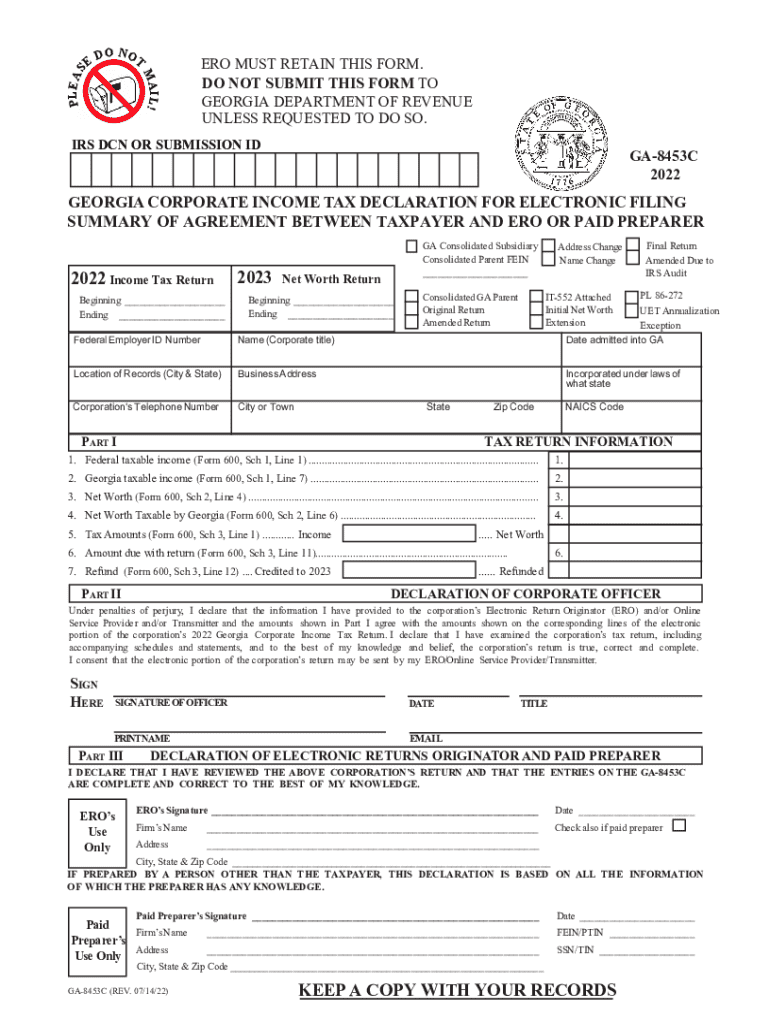

Get the free Corporate Electronic FilingDepartment of Revenue

Get, Create, Make and Sign corporate electronic filingdepartment of

How to edit corporate electronic filingdepartment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate electronic filingdepartment of

How to fill out corporate electronic filingdepartment of

Who needs corporate electronic filingdepartment of?

Corporate Electronic Filing: A Comprehensive Guide for Document Submission

Understanding the corporate electronic filing system

Corporate electronic filing refers to the process of submitting corporate documents through an online platform as opposed to traditional paper submission. This system has become essential for modern businesses, significantly enhancing efficiency and accuracy. It allows corporations to manage their paperwork more effectively by eliminating the delays associated with mail and in-person filings.

Many corporate forms can now be filed electronically, including annual reports, tax documents, and compliance forms. The importance of using an electronic filing system cannot be overstated; it allows for faster processing times, reduces the risk of human error, and ensures that documents are submitted in compliance with current regulations. Embracing electronic filing is not just a trend, but a necessity for companies aiming to streamline their operations.

Key components of electronic filing

Electronic filing involves several key components that ensure documents are submitted in a standardized format. One of the first requirements is a digital signature. This signature guarantees the authenticity of the document and the identity of the person submitting it. Additionally, authentication and verification processes are in place to ensure that the documents filed are legitimate and comply with regulations.

Moreover, different formats and standards are acceptable for corporate filings. Formats such as PDF and DOCX are commonly used, but it is crucial to comply with any specific regulatory standards that pertain to your filings to avoid rejections or delays.

Preparing your document for electronic filing

Before you file your corporate documents electronically, it's vital to prepare them meticulously. Start by selecting an appropriate template that suits your document type. Tools such as pdfFiller provide various templates tailored for specific corporate filings, making this step easier.

Once you have the right template, use pdfFiller's editing tools to enhance your document. This includes adding text, images, and utilizing the e-signature feature for a professional finish. After editing, ensure the document is saved and converted into the required format, usually PDF, for smooth submission. There are common pitfalls to avoid; overlooking necessary signatures or failing to adhere to format guidelines are frequent mistakes that can delay processing.

Filing your document electronically

Filing your corporate document electronically encompasses several key steps. First, access the specific filing portal where the document needs to be submitted. After logging in, you can upload your prepared document. This step usually involves selecting the file from your device and ensuring it meets the platform’s requirements.

Following the upload, you’ll fill out required fields that typically include information such as your business name, address, and the type of document you are filing. Finally, after reviewing all information, you submit the document, which may entail fees based on the type of filing. Once submitted, tracking your submission is equally important; keep an eye out for confirmation emails or notifications regarding the status of your document, and know how to address any issues in case of errors.

Managing and storing filed documents

Organizing your filed documents is a critical aspect of electronic filing. Adopt best practices for document management, such as creating clearly labeled folders that are easy to navigate. Employ notification alerts for updates on important documents to stay proactive and informed.

Furthermore, it's essential to consider legal aspects of storing electronic documents. Implement robust data security measures to protect sensitive information, and familiarize yourself with retention policies to understand how long records must be kept. This ensures compliance with regulations while safeguarding vital corporate information.

Collaborative features in pdfFiller for corporate teams

pdfFiller offers robust collaborative features that empower corporate teams during the electronic filing process. With team-based capabilities, multiple users can work on document submissions, ensuring efficiency and streamlined workflows. Features such as real-time collaboration tools allow team members to provide comments and feedback directly within documents, facilitating easier communication.

Additionally, version control is crucial when multiple individuals are editing a document. pdfFiller helps ensure that everyone is working with the latest version, reducing confusion and minimizing errors. Collaborative efforts can enhance overall productivity in electronic filing, as demonstrated by numerous teams that have successfully streamlined their submission processes through effective collaboration.

Advanced tips for efficient electronic filing

To further enhance the electronic filing experience, automation can play a pivotal role. Utilizing integrations provided by pdfFiller allows companies to streamline their filings, reducing manual input and speeding up the overall process. Reviewing compliance with changing regulations should also be prioritized; staying informed about updates ensures that filing practices align with current laws.

Moreover, employing analytics can provide valuable insights into submission patterns, helping teams identify bottlenecks and optimize workflows. Tracking the performance of your electronic filings can lead to continuous improvements, ultimately enhancing the overall efficiency of your corporate filing operations.

Troubleshooting common electronic filing issues

While electronic filing systems are designed to simplify document submissions, issues can arise. Identifying and resolving technical problems swiftly is crucial. Common issues may include file size limitations, compatibility errors, or problems with digital signatures. Being aware of these potential challenges will help you navigate them effectively.

When contacting support for assistance, prepare specific information such as your account details, document type, and the nature of the issue. Providing these details can expedite the troubleshooting process, allowing you to resolve any impediments quickly and maintain your filing schedule.

Future trends in corporate electronic filing

As technology continues to evolve, so does the landscape of corporate electronic filing. Emerging technologies, such as artificial intelligence (AI) and blockchain, hold the potential to revolutionize the filing process. AI could automate processes, reduce human errors, and improve compliance through predictive analytics, while blockchain may introduce enhanced security measures for document integrity.

Predictions indicate that regulatory changes will be forthcoming, reflecting increased emphasis on transparency and accountability. Corporations need to stay adaptable and prepare for these shifts to ensure that their electronic filing practices remain compliant and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit corporate electronic filingdepartment of from Google Drive?

How can I edit corporate electronic filingdepartment of on a smartphone?

Can I edit corporate electronic filingdepartment of on an Android device?

What is corporate electronic filing department of?

Who is required to file corporate electronic filing department of?

How to fill out corporate electronic filing department of?

What is the purpose of corporate electronic filing department of?

What information must be reported on corporate electronic filing department of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.