Get the free Health Savings Account (HSA) Death Beneficiary Form

Get, Create, Make and Sign health savings account hsa

How to edit health savings account hsa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health savings account hsa

How to fill out health savings account hsa

Who needs health savings account hsa?

Health Savings Account (HSA) Form: Your Complete Guide

Understanding Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged savings account designed for individuals with high-deductible health plans (HDHPs). HSAs allow users to save and pay for qualified medical expenses using pre-tax dollars, effectively reducing taxable income. The fundamental appeal of an HSA lies in its trifecta of tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. Many people overlook HSAs, but they serve as an efficient way to manage healthcare costs and save for future medical expenses.

To qualify for an HSA, individuals must have a high-deductible health plan that meets specific criteria outlined by the IRS. In 2023, for an individual coverage, the HDHP must have a minimum annual deductible of $1,500, while for family coverage, the minimum is $3,000. Additionally, individuals must not have other health coverage that disqualifies them from HSA participation, such as Medicare or a non-HDHP.

Importance of the HSA form

Completing the HSA form accurately is crucial for establishing and managing your Health Savings Account. Improperly filled forms can lead to delays in account setup, missed contributions, and even tax implications. For instance, submitting a form with a missing signature or incorrect financial details might result in rejection, which could jeopardize your ability to maximize the tax benefits of HSAs.

You will need to fill out the HSA form when opening an account, making contributions, or withdrawing funds for medical expenses. Each scenario requires a specific form and adherence to guidelines to ensure compliance with IRS regulations. Understanding these nuances is essential for effective financial management within your healthcare plan.

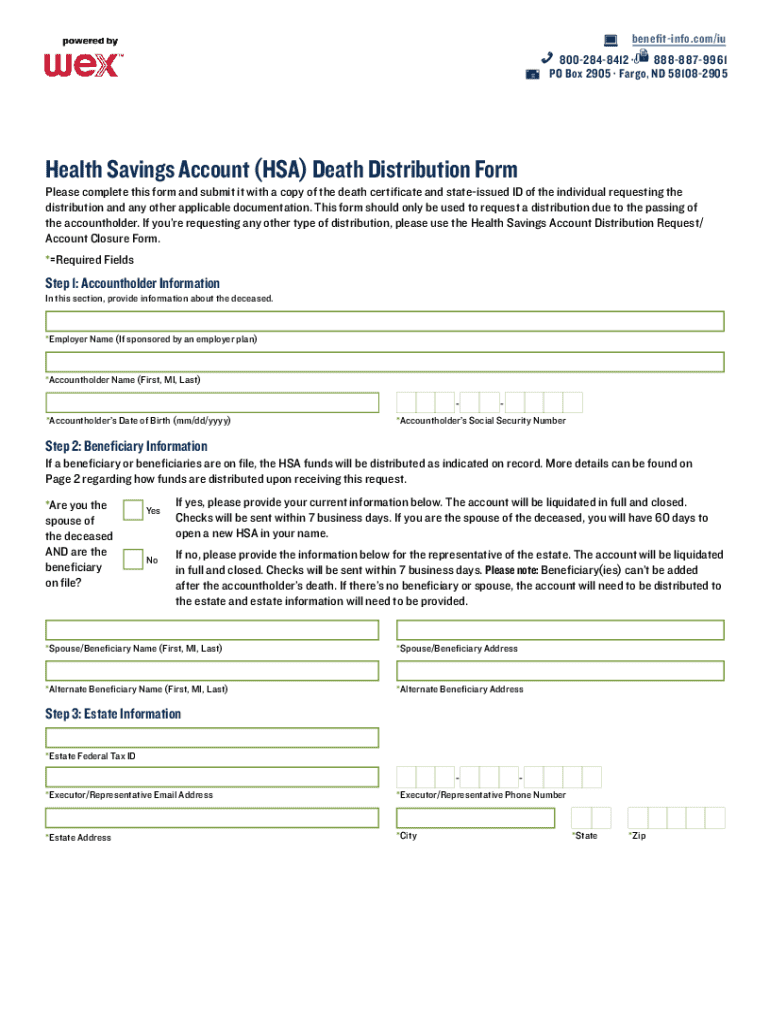

Navigating the HSA form

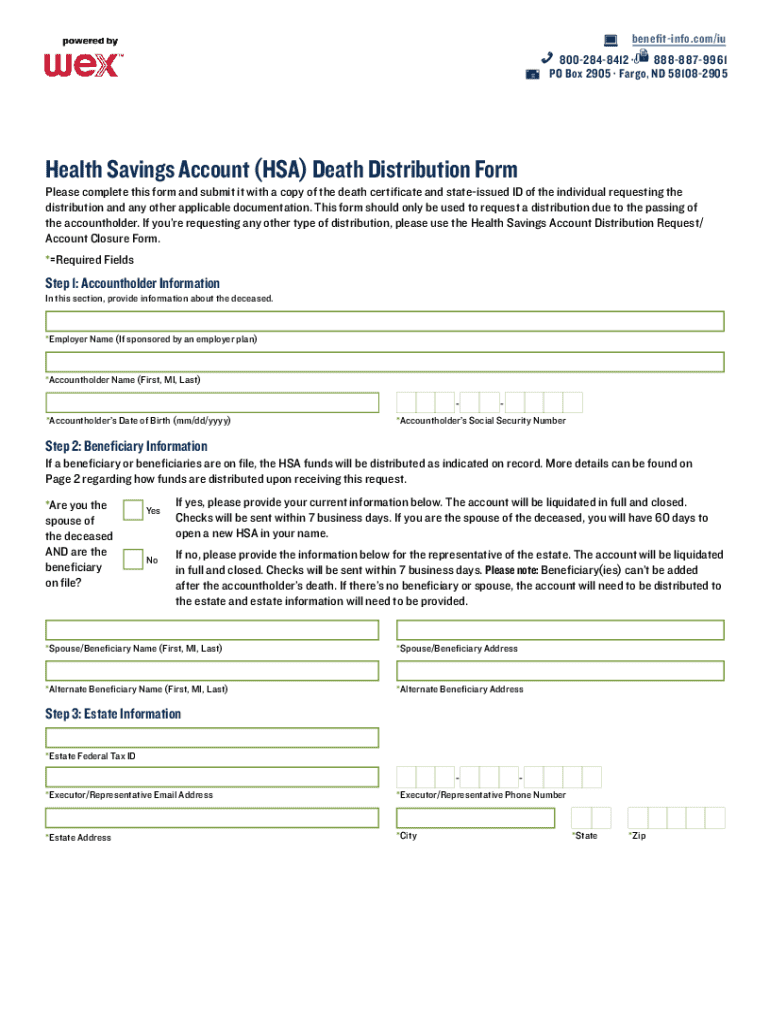

HSA forms come in various types depending on your needs: enrollment, contribution, and distribution request forms. Enrollment forms allow you to set up your account, while contribution forms are used for making deposits, either individually or through your employer. Distribution forms are needed when you want to withdraw funds from your HSA for qualified medical expenses.

Common fields in the HSA form typically include personal information such as name, Social Security number, and address. Financial details are also crucial, particularly regarding the contribution amounts you wish to make. Lastly, the form usually requires your signature and date to acknowledge your consent and accuracy of the information provided.

Step-by-step guide to filling out the HSA form

Before you embark on filling out your HSA form, it's essential to prepare your information thoroughly. Gather necessary documents such as your health insurance policy, identification proof, and any previous years' tax returns that might influence your HSA contributions. Make sure to have your Social Security number and financial information on hand for accuracy.

To complete the HSA enrollment form, start by filling in your personal and contact details. Next, designate your coverage type, whether individual or family, and select the desired coverage options. Make sure to indicate your contribution amount clearly. Lastly, provide your banking information to facilitate the contributions efficiently. This ensures your account is set up in a straightforward manner.

For contributions or withdrawals, make sure to complete the corresponding forms accurately. Indicate the required contribution amounts or specify the withdrawal request and ensure all signatures are included to avoid compliance issues.

Editing and finalizing your HSA form using pdfFiller

Using pdfFiller offers invaluable tools for managing and editing your HSA form. The platform provides features that simplify PDF editing, allowing users to easily modify, fill, and sign documents. This instant access to tools aids in avoiding errors during form completion. Especially for teams, collaborative options enable enhanced teamwork in managing documents.

pdfFiller also provides eSign functionality, which enables quick approvals and turnaround. Reviewing your completed HSA form for errors is essential, and pdfFiller's intuitive interface streamlines this process. Utilize the review features to correct any mistakes before securely submitting your form.

Frequently asked questions about HSAs and the HSA form

Common issues with HSA forms often stem from submission rejections or errors discovered post-submission. To troubleshoot any rejection, check the confirmation emails or notifications from your HSA provider. Usually, they will indicate specific reasons for the rejection, allowing you to rectify the issues promptly, such as correcting any missing signatures or adjusting contribution amounts.

If you notice a mistake after submitting the form, contact your HSA provider immediately for guidance. They may require you to fill out a correction form or provide additional information to fix the error. For inquiries, pdfFiller offers customer support options via their platform, facilitating easy access to assistance.

Best practices for managing your HSA

To maximize your HSA benefits, adopt a proactive approach toward managing your account. Regularly review your contributions and ensure they align with IRS limits. Keep meticulous records of all medical expenses to make the most of tax-free withdrawals. Investing any unused funds in interest-bearing accounts can further enhance your savings.

Staying compliant with IRS regulations is equally important. Be sure to maintain accurate records of your contributions, withdrawals, and the related transactions. Understanding the IRS guidelines regarding qualified medical expenses will help you avoid complications when it’s time to file your taxes. Most importantly, ensure your records accurately reflect all contributions, withdrawals, and supporting documents.

Interactive tools for HSA management by pdfFiller

pdfFiller provides users with easy access to the latest HSA forms. The platform features intuitive search tools that allow users to find and utilize the right forms efficiently. This feature significantly streamlines the process of filling out the HSA form, eliminating confusion over which form to use for specific situations.

In addition, pdfFiller offers educational resources such as webinars, guides, and articles that provide in-depth knowledge on HSAs. Community forums can also serve as helpful spaces where users share advice and experiences related to HSA management.

Real-life scenarios: utilizing the HSA form efficiently

To illustrate effective HSA management, consider the case of a family that leveraged their HSA to create a sustainable healthcare expense plan. By regularly contributing the maximum allowed amount, they maximized their tax advantages. This proactive approach allowed them to save substantial amounts over the years, ultimately covering significant medical expenses without drawing from their regular savings.

Conversely, it's important to learn from common pitfalls. For instance, some users fail to monitor contribution limits, leading to costly penalties. Regular communication with their HSA provider helped this family adjust their contributions and maintain compliance. User testimonials on pdfFiller's HSA form management indicate that users appreciated the simplified process and robust features that contributed to better financial outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute health savings account hsa online?

How can I edit health savings account hsa on a smartphone?

Can I edit health savings account hsa on an Android device?

What is health savings account hsa?

Who is required to file health savings account hsa?

How to fill out health savings account hsa?

What is the purpose of health savings account hsa?

What information must be reported on health savings account hsa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.