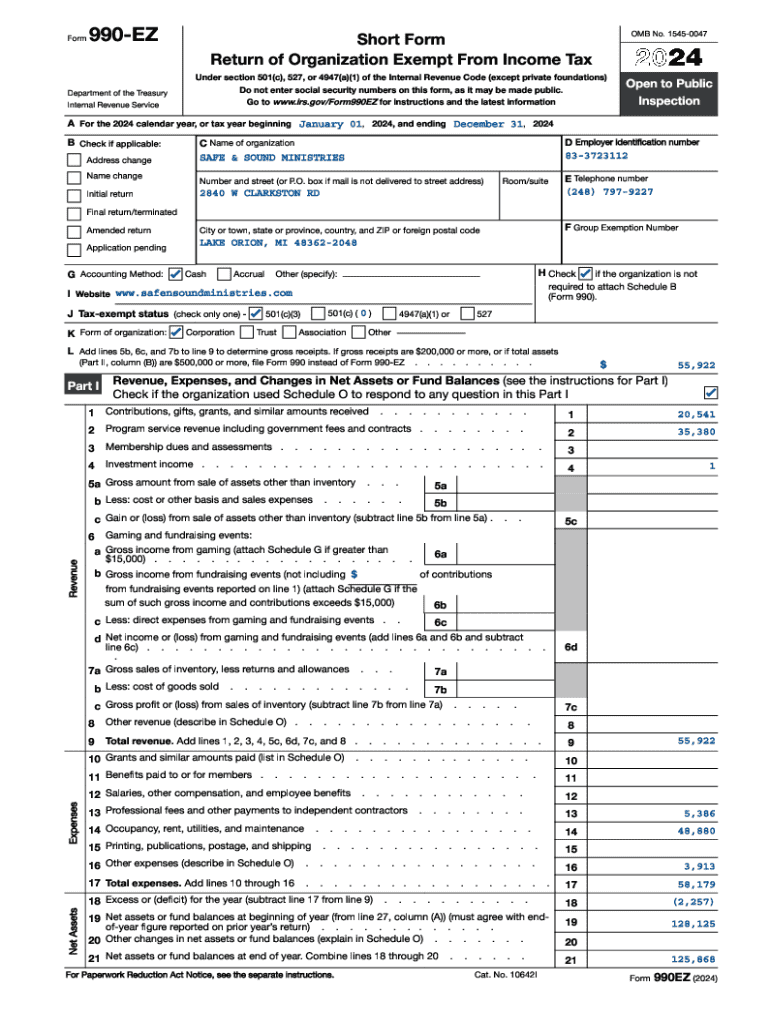

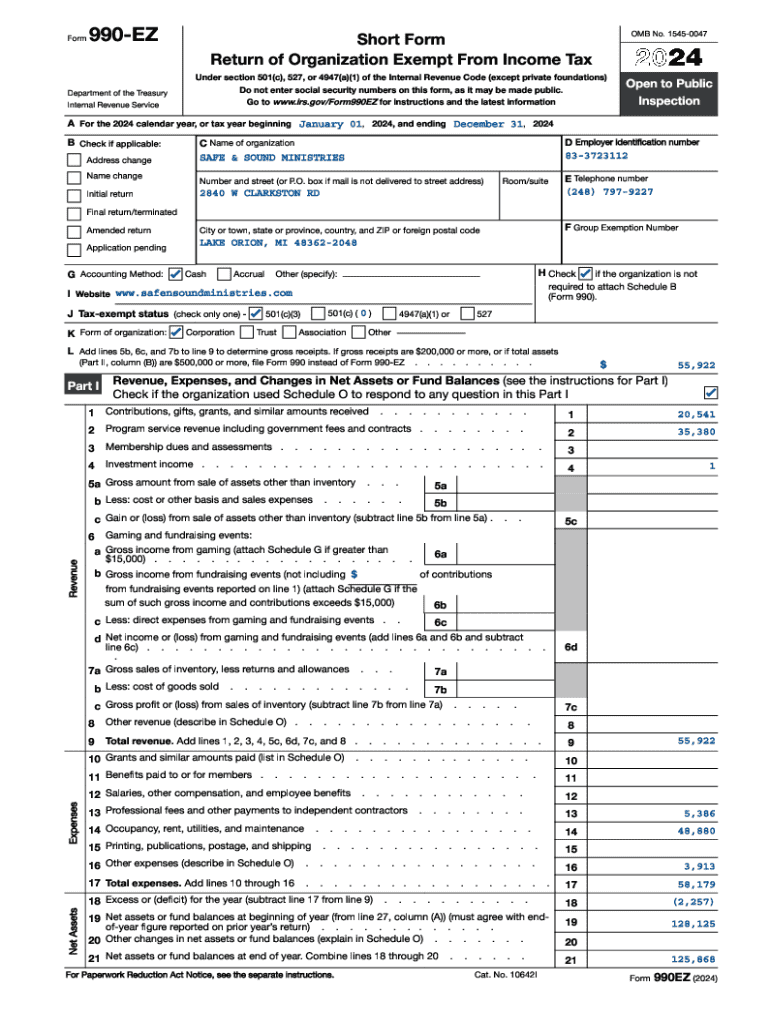

Get the free A For the 2024 calendar year, or tax year beginning January 01, 2024, and ending Dec...

Get, Create, Make and Sign a for form 2024

How to edit a for form 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a for form 2024

How to fill out a for form 2024

Who needs a for form 2024?

A comprehensive guide to the 2024 'a for' form

Overview of the 2024 'a for' form

The 2024 'a for' form is a crucial document necessary for individuals gearing up to file their income taxes for the year. This form serves as a reporting tool for various types of income, deductions, and credits applicable for the 2024 tax year. Using the appropriate year’s form ensures compliance with current tax regulations and accurate reporting of one's financial status to the IRS.

It's essential to understand the importance of accurately utilizing the 2024 version of the 'a for' form, as tax laws and required information can shift from year to year. Filing with an outdated form can result in delays, incorrect assessments, and even potential penalties.

The 2024 version introduces several amendments, such as changes in income thresholds for specific deductions and new regulations surrounding credits. Taxpayers need to stay informed about these updates to maximize their filing benefits and ensure a smooth submission process.

Who needs to use the 2024 'a for' form?

Any individual or entity whose financial activities involve taxable income must utilize the 2024 'a for' form. This includes self-employed individuals, employees with additional income sources, and businesses generating taxable revenue. It’s crucial to recognize the variety of filers who are obligated to submit this form, as it varies based on personal financial circumstances and income levels.

Exceptions exist for certain low-income earners or specific demographic groups who may not need to file, such as some students or retirees. However, even if you are not required to file, doing so may yield refunds or credits that could benefit your financial situation.

Failing to file the 2024 'a for' form on time can have serious implications. Penalties can accumulate, and in some instances, the IRS may impose charges on unpaid taxes or even audits in extreme cases. Therefore, it's crucial to be aware of filing deadlines and the importance of timely submissions.

Step-by-step guide to filling out the 2024 'a for' form

Filling out the 2024 'a for' form may feel daunting, but with proper preparation and understanding, you can streamline the process. Preparation starts with gathering necessary documentation, including W-2s, 1099s, and any relevant receipts related to deductions. Additionally, familiarize yourself with the key filing deadlines to avoid missing out.

Preparation before you start

Completing the form

When completing the form, start with Section 1, where you'll provide personal information. Ensure accuracy with details such as your name and address. Mistakes in this section could cause delays or miscommunication with the IRS. Moving on to Section 2, be vigilant while reporting income from various sources, including wages, freelance earnings, and investment income. It’s essential to avoid common mistakes, like omitting a necessary 1099.

In Section 3, detail your deductions and credits. Be sure to familiarize yourself with the list of eligible deductions to maximize your claims effectively. Lastly, in Section 4, you will finalize your submission; therefore, it’s crucial to ensure your signature is affixed correctly for either digital or printable formats.

Interactive tools for a seamless filing experience

Taking advantage of interactive tools significantly eases the filing process for the 2024 'a for' form. Utilizing PDF editing features allows users to directly input their information without overwhelming formats or confusion. With eSigning capabilities, clients can finalize their forms quickly and securely without the need for physical signatures.

Collaborative tools are beneficial for teams that are working on collective filings. Built-in features facilitate real-time guidance and suggestions, reducing the confusion often experienced in financial documentation. Employing a robust platform like pdfFiller allows users to streamline their filing experience, reducing the possibility of human error.

Common errors to avoid when submitting the 2024 'a for' form

When filing the 2024 'a for' form, attentiveness to detail can make all the difference. Frequent mistakes include incorrect Social Security Numbers, underestimated income, or overlooked deductions. Each of these errors can result in complications or delays in processing.

To mitigate these issues, incorporate a system to double-check your work before submission. The impact of errors can lead to longer processing times or increased scrutiny from tax authorities, which can be easily avoided by ensuring your form is filled out accurately.

Post-submission steps and document management

Once you have successfully submitted your 2024 'a for' form, it’s vital to know what to expect next. Generally, the IRS will process your form and send confirmation of receipt. Tracking your submission status can be done through the IRS website, providing peace of mind throughout the waiting period.

Before filing, ensure your document management process is robust. Organize a digital folder for all tax-related documents to ensure they are easily accessible in future years. Cloud solutions like pdfFiller allow you to store and manage your forms securely, facilitating easier retrieval and record-keeping over time.

FAQs about the 2024 'a for' form

Understanding the intricacies involved with the 2024 'a for' form can lead to many questions. Commonly, filers inquire about specific deductions they might qualify for or the consequences of late filings. Moreover, questions regarding the use of software for electronic filings are frequently asked.

Resources on the IRS website can provide guidance on these frequently asked questions. If you encounter persistent issues, consider reaching out to tax professionals who can offer specialized assistance.

Comparative analysis of document solutions

When it comes to preparing your 2024 'a for' form, using the right tools is paramount. pdfFiller stands out uniquely by offering an all-in-one platform that enhances your document management experience. Its cloud-based capabilities enable users to edit PDFs, eSign, collaborate on forms, and rank high on ease of use and accessibility.

Client testimonials often highlight the seamless integration of pdfFiller's features, which drastically improve their overall filing experiences. Users appreciate the efficiency gained in managing forms and documents, ultimately stressing how these tools contribute to an effective filing process.

Future-proofing your filing process

Adapting to annual changes in tax regulations requires vigilance and adaptability. Staying updated with alterations in tax laws ensures that you are using the correct forms each year, including the ever-important 2024 'a for' form. Best practices for future filings include keeping an organized record of your documents and leveraging technology to your advantage.

By utilizing solutions like pdfFiller, taxpayers can effectively future-proof their filing processes. Continuously refining your approach by staying informed and using technology for streamlined filing can lead to a more efficient tax season, minimizing stress and maximizing accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify a for form 2024 without leaving Google Drive?

How do I fill out the a for form 2024 form on my smartphone?

How do I fill out a for form 2024 on an Android device?

What is a for form?

Who is required to file a for form?

How to fill out a for form?

What is the purpose of a for form?

What information must be reported on a for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.