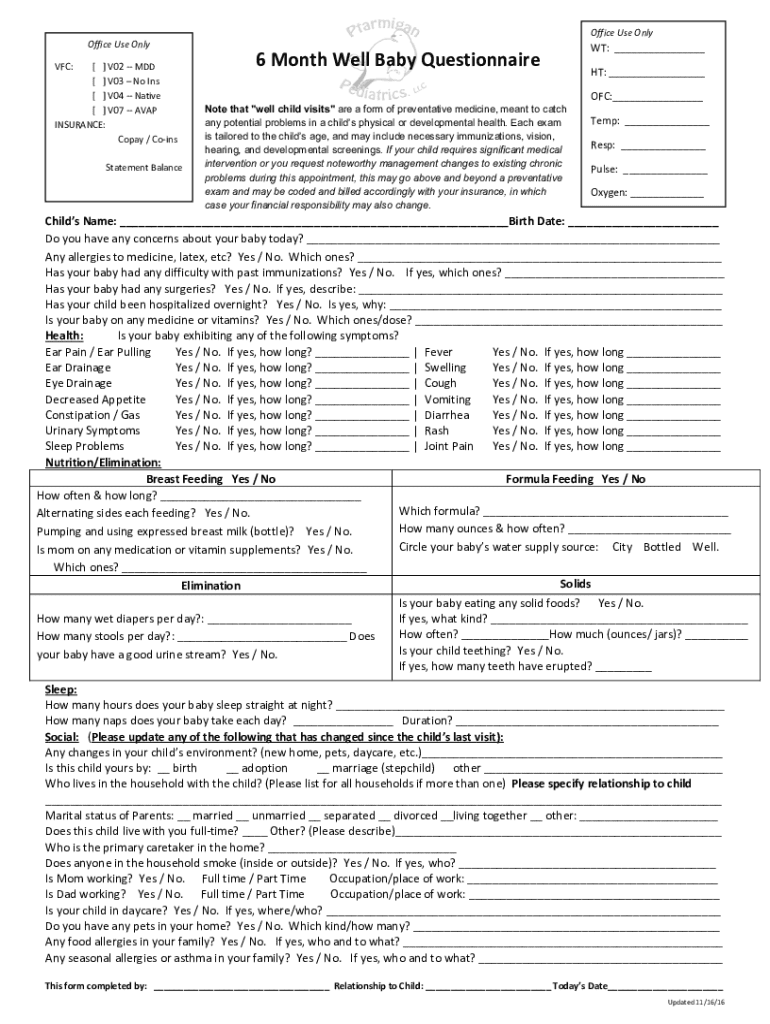

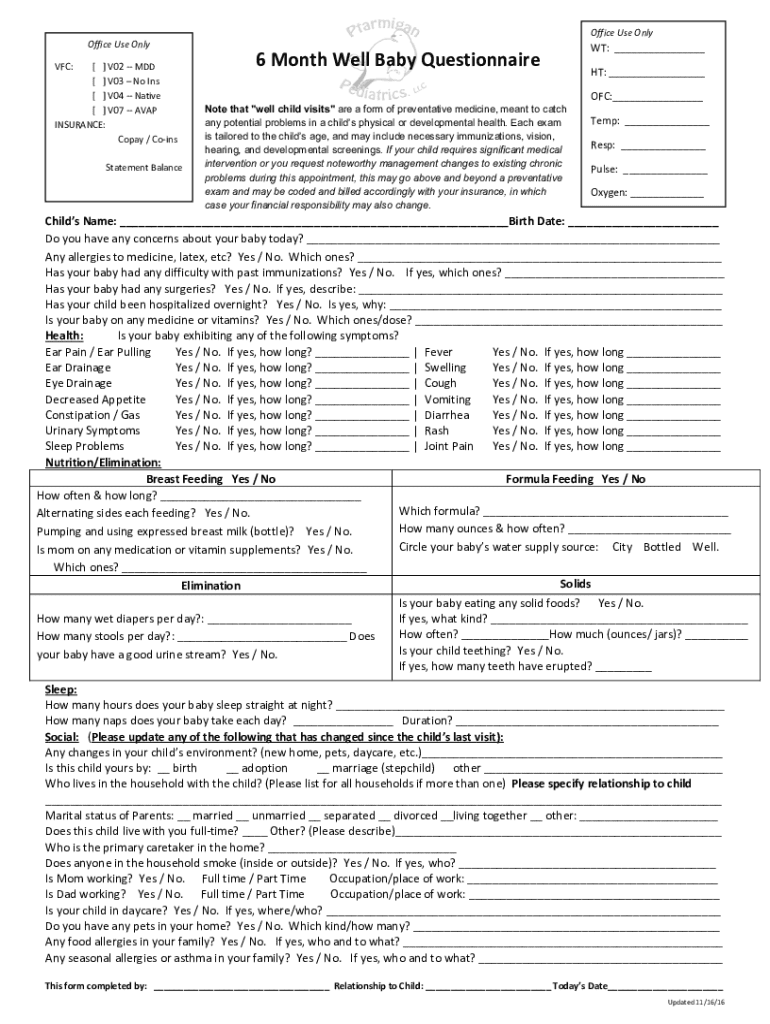

Get the free Copay / Co-ins

Get, Create, Make and Sign copay co-ins

Editing copay co-ins online

Uncompromising security for your PDF editing and eSignature needs

How to fill out copay co-ins

How to fill out copay co-ins

Who needs copay co-ins?

Mastering the Copay Co-ins Form: A Comprehensive Guide

Understanding the copay co-ins form

The copay co-ins form plays a significant role in the healthcare landscape by detailing the financial responsibilities patients share with their insurance providers. This form outlines the specifics of co-payments and co-insurance, which are key components in health insurance terms. A co-payment (or co-pay) is a fixed amount paid by the patient at the time of a medical service, while co-insurance is a percentage of the total costs that the patient must pay after hitting their deductible. Understanding this distinction is crucial, as it affects how patients navigate their healthcare expenses.

The importance of the copay co-ins form cannot be overstated—it acts as a crucial binder between medical services and patient finances. Accurate completion can significantly influence out-of-pocket costs, making managing medical invoices and bills more transparent for patients. In a country where healthcare expenses can quickly escalate, being well-informed about one’s financial obligations through this form empowers individuals to make sound decisions regarding their healthcare choices.

Key components of the copay co-ins form

Diving into the specifics, the copay co-ins form comprises several crucial sections that require careful attention. Typically, the form includes the following components:

Medical terminology commonly found on this form may include key phrases such as 'deductible', 'out-of-pocket maximum', and 'network provider'. Patients need to be familiar with these terms to accurately assess their responsibilities. Additionally, accompanying documents may be required, such as proof of income or current insurance cards, which can validate the provided information.

Step-by-step instructions for filling out the copay co-ins form

Filling out the copay co-ins form successfully can streamline the payment process for both patients and healthcare providers. Follow these steps for a hassle-free experience:

Editing and customizing your copay co-ins form

After you've filled out your copay co-ins form, editing may be necessary for clarity and accuracy. Utilizing pdfFiller’s advanced editing tools ensures that your document meets all necessary requirements. One useful feature is the ability to format text for clarity, making important information stand out. You can also add an eSignature easily, which can facilitate not just your patient services but also enhance document authenticity.

The platform allows for easy customization, whether adding commentary or reformatting sections to suit your needs. Make sure to review your edits to strike a balance between personalization and adhering to standard requirements. The goal is to create a document that clearly communicates your information while remaining in compliance with healthcare norms.

Submitting the copay co-ins form

Understanding the submission process is essential for ensuring timely processing of your copay co-ins form. Various options are available for submission, which can include online uploads, mailing physical copies, or delivering in-person to your healthcare provider's office.

Before submitting, consider the following important details:

Common issues and troubleshooting

Filling out the copay co-ins form can sometimes lead to challenges, especially for those unfamiliar with health insurance language or documentation. Understanding common pitfalls can prepare you for a smoother experience. Misunderstanding insurance terms often leads to incomplete forms, causing delays in processing. Additionally, missing required information can result in financial consequences if not rectified promptly.

To combat these issues, ensure you clearly understand critical terms and definitions. Familiarize yourself with who to contact should any problems arise. This could include patient support services or customer service at your insurance company, where trained professionals can assist you in navigating your healthcare financial obligations.

Always keep lines of communication open with healthcare providers and your insurance companies, as they can offer clarification and support during times of need.

Interactive tools for enhanced management

pdfFiller offers excellent tools that can significantly streamline the management of your copay co-ins form. Features such as document signing, collaborative editing, and template creation simplify the process and save time. By leveraging these interactive features, you can ensure that all stakeholders—be it organizations or individuals—have access to necessary documents without hassle.

Accessing and utilizing these tools is seamless. Whether you need to create a new copy of your form or collaborate with a financial advisor in completing it, pdfFiller provides a robust solution that enables efficient document management.

Best practices for managing your healthcare forms

To effectively manage your healthcare forms, organizing your documents can make a world of difference. This includes keeping physical copies filed away and utilizing digital storage solutions to avoid misplacing essential paperwork. Regularly reviewing these documents allows you to stay ahead of submission deadlines and maintain an updated overview of your medical expenses.

Tracking submission deadlines can help alleviate last-minute stress. Using calendar alerts and reminders can also prove beneficial for managing co-pays and co-insurance responsibilities. Knowledge is power when it comes to healthcare expenses and maintaining a clear picture can lead to better financial planning.

Real-world scenarios and case studies

Seeing how properly filled copay co-ins forms can benefit patients provides invaluable insight. In many instances, patients report that having accurate forms leads to quicker reimbursements and reduced financial anxiety surrounding healthcare expenses. One noteworthy example involves a patient who filled the form correctly and gained immediate access to patient programs that relieved significant financial burdens associated with chronic conditions.

In testimonials, users have praised pdfFiller for its efficiency in form management. The ease of use and support systems in place, such as customer service for immediate concerns, have significantly improved how they handle paperwork. These real-world cases highlight not just the importance of completing the copay co-ins form correctly but also how leveraging document management software can transform patient experiences.

Conclusion: Mastering your copay co-ins form with pdfFiller

Navigating healthcare costs can be overwhelming, but mastering your copay co-ins form with tools like pdfFiller empowers you to take control of your financial responsibilities. Its comprehensive capabilities allow for seamless editing, signing, and collaboration—all crucial for effectively managing healthcare documents. By understanding each component of the form and utilizing pdfFiller’s features, you equip yourself for a more transparent and stress-free healthcare experience.

The challenges that come with healthcare documentation can create complications, but with accessible document solutions, you can focus on living life and managing any illnesses without the added burden of paperwork.

Bonus section: FAQs regarding the copay co-ins form

Addressing common questions about the copay co-ins form process can demystify concerns surrounding insurance terms and obligations. Many patients often wonder if co-pays and co-insurance are interchangeable when, in fact, they serve different functions in cost-sharing. Understanding this distinction is crucial for effectively managing financial responsibilities in healthcare.

Another frequent concern is regarding submission timelines and how quickly funds should be expected to be processed. Most healthcare providers and insurance companies state estimated processing times that can assist patients in tracking when they should receive reimbursement or confirmation. Navigating these elements can greatly reduce stress, allowing you to focus on what matters most: your health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the copay co-ins in Gmail?

How do I fill out the copay co-ins form on my smartphone?

Can I edit copay co-ins on an iOS device?

What is copay co-ins?

Who is required to file copay co-ins?

How to fill out copay co-ins?

What is the purpose of copay co-ins?

What information must be reported on copay co-ins?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.