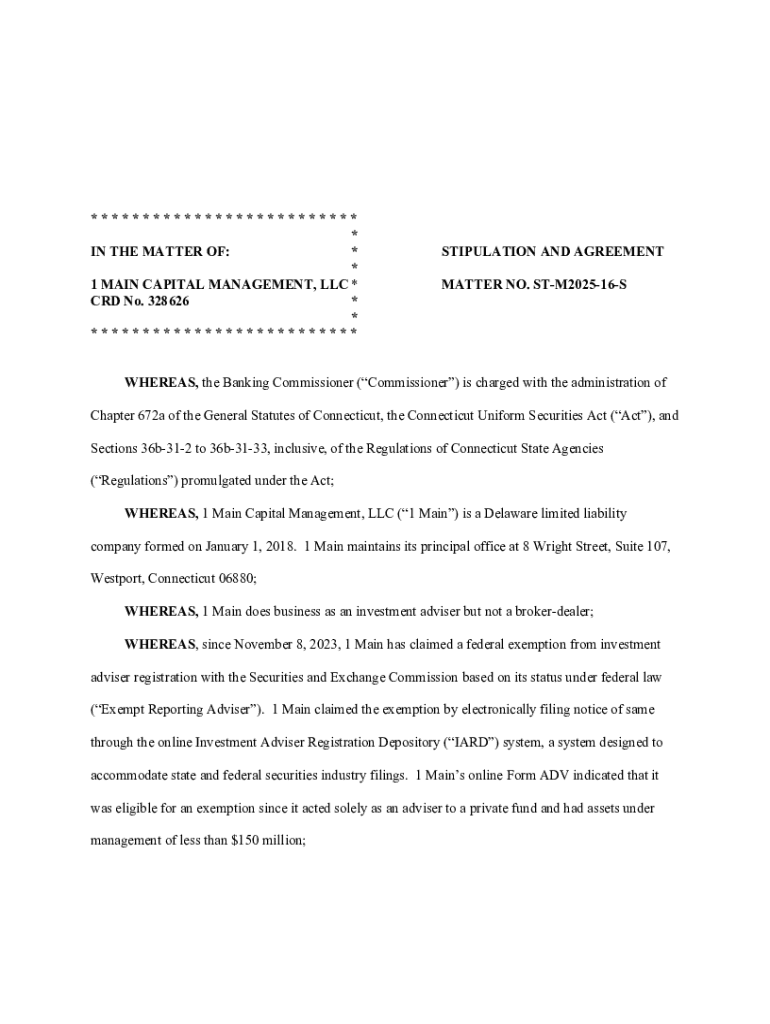

Get the free 1 MAIN CAPITAL MANAGEMENT, LLC *

Get, Create, Make and Sign 1 main capital management

Editing 1 main capital management online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1 main capital management

How to fill out 1 main capital management

Who needs 1 main capital management?

Mastering the 1 Main Capital Management Form for Enhanced Financial Strategy

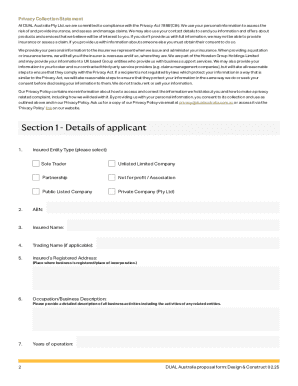

Understanding the main capital management form

The 1 main capital management form is a comprehensive template designed to aid financial planners and businesses in tracking and organizing their capital resources. This template serves a critical purpose: it provides a structured framework to assess sources of capital, outline investment strategies, and project cash flow requirements. By using this form, individuals and organizations can ensure more strategic capital allocation, thereby enhancing overall financial performance.

In financial planning and management, the importance of the main capital management form cannot be overstated. It equips users with the necessary insights to make informed decisions about investments, expenditures, and growth opportunities. Whether you are a startup looking to allocate your initial funding efficiently or an established company aiming to optimize your existing resources, this form is invaluable for understanding and managing capital efficiently.

Key features of the main capital management form

The main capital management form is composed of essential sections critical to effective financial planning. These sections include details on capital sources, investment allocation, and cash flow projections. Each component plays a vital role in the overall financial health of an organization.

To elevate the user experience, utilizing interactive PDF tools can significantly enhance the management of the main capital management form. Features such as editable fields, automatic calculations, and digital signatures streamline the data input and validation process.

Step-by-step guide to filling out the main capital management form

Filling out the main capital management form accurately is crucial for effective financial management. Start by preparing your financial data: gather all relevant documents, including balance sheets, cash flow statements, and investment records. With these, you can formulate a clear capital strategy and make confident decisions about allocation.

Here’s how to fill out each section effectively:

Editing and customizing your form

One of the strengths of the main capital management form is its flexibility. With tools like pdfFiller, users can easily customize and edit the form to meet specific needs. This includes adding or removing sections based on individual requirements, ensuring that all relevant information is captured effectively.

Additionally, various formatting options allow for a more professional appearance. Adjusting fonts, colors, and layouts can enhance readability and provide a polished final product, making it suitable for presentations to stakeholders or financial institutions.

Signing and securing your main capital management form

Securing the main capital management form is essential, especially when sensitive financial information is involved. It is crucial to understand the legal implications associated with digital signatures. Implementing eSignature through pdfFiller can simplify the signing process, providing a legally binding signature without the need for physical paperwork.

To eSign your document, simply follow these steps: upload your form, select your signature preferences, and finalize by adding your digital signature. Moreover, pdfFiller offers various security features, like encryption and secure storage, ensuring that your sensitive information is protected against unauthorized access.

Collaborating on your main capital management form

Collaboration is increasingly vital in capital management. With pdfFiller, users can easily share the main capital management form with team members, facilitating real-time edits and feedback. This ensures alignment among all stakeholders and expedites the decision-making process.

Best practices for managing your capital management form

Managing the main capital management form effectively entails regular updates and reviews. Financial summaries and assumptions should evolve as market conditions and organizational priorities shift. Integrating this form with financial tracking software can streamline your data input and analysis, making it easier to adapt to changes swiftly.

Troubleshooting common issues

Using the main capital management form may lead to questions or technical issues that need addressing. A comprehensive FAQ section can assist users, offering solutions to common problems such as navigating pdfFiller’s features or filling out specific sections.

Success stories: Case studies of effective capital management

Examining successful implementations of capital management strategies can provide invaluable insights. One noteworthy case involved a startup in the tech sector that utilized the main capital management form to streamline their funding process. By clearly outlining capital sources and calculating projected turnover for their products, they secured a $500 million investment based on well-prepared performances and projections.

Lessons learned from various industries reveal that effective capital management can significantly impact company growth. Whether it's a manufacturing company optimizing production purchases or a financial firm managing securities portfolios, those utilizing a strategic capital management approach frequently outperform their competitors.

Beyond the form: Leveraging pdfFiller for comprehensive document management

Utilizing the main capital management form through pdfFiller is just one aspect of an efficient financial management strategy. The platform offers various templates tailor-made for different financial planning needs, ensuring users have resources readily available for budgeting, forecasting, and strategic planning.

Exploring additional document templates for financial planning can further enhance your management capabilities. For instance, cash flow management worksheets or investment tracking forms can complement your main capital management form, allowing for a more holistic view of financial health.

Feedback and iteration process

Regular feedback from stakeholders is essential to improving the main capital management form. By gathering input from team members or financial advisors, users can identify areas requiring adjustment or enhancement within the form, driving continuous improvement of the process.

Adding interactive tools and features to your form

Incorporating interactive tools within the main capital management form can significantly enhance its functionality and user engagement. For instance, adding financial calculators can help users model various investment scenarios based on capital allocation. Visual aids, such as charts and graphs, can present data in a clear, comprehensible manner, making complex projections more accessible.

These enhancements create a more dynamic user experience. Users can interact with data, helping them understand patterns and implications of their capital management decisions more intuitively.

Exploring further with the main capital management form

The main capital management form is not an isolated tool; it opens doors to wider financial management and planning strategies. Leveraging the resources connected to pdfFiller, such as tutorials, webinars, and community forums, can lead to richer insights and strategies tailored to individual financial circumstances.

By continuously educating yourself and engaging with financial communities, you can better understand market trends and shifts, thereby enhancing the effectiveness of your capital management practices for 2025 and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1 main capital management directly from Gmail?

How can I send 1 main capital management for eSignature?

How do I fill out 1 main capital management on an Android device?

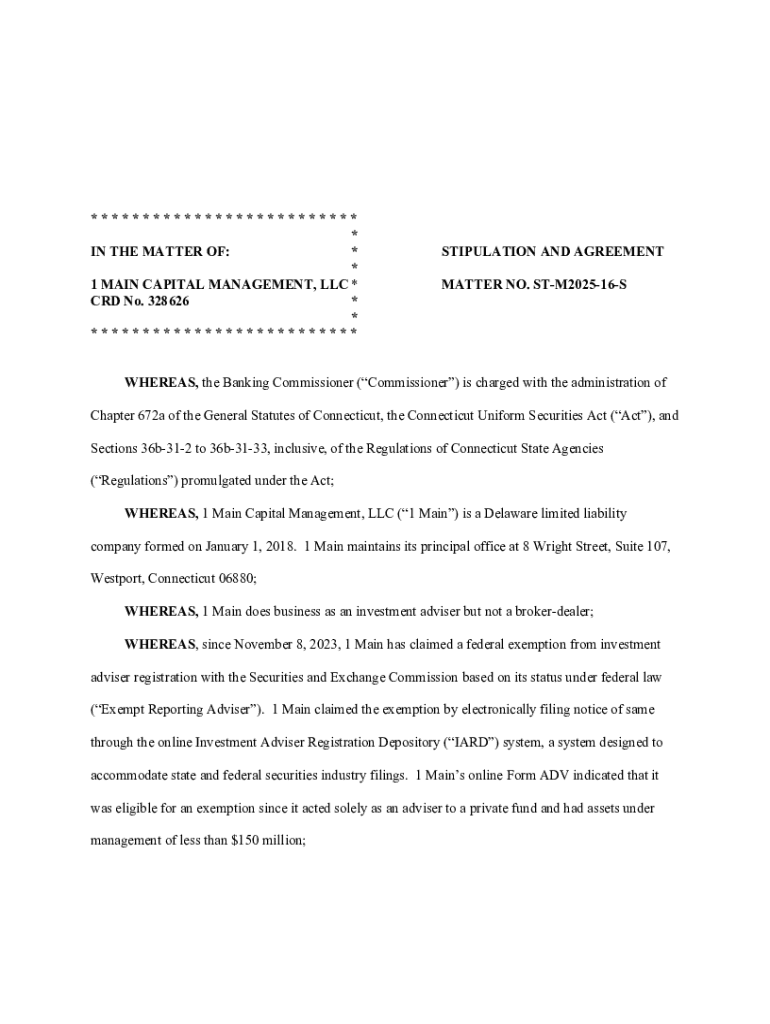

What is 1 main capital management?

Who is required to file 1 main capital management?

How to fill out 1 main capital management?

What is the purpose of 1 main capital management?

What information must be reported on 1 main capital management?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.