Get the free irs form 709 instructions

Get, Create, Make and Sign irs form 709 instructions

Editing irs form 709 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 709 instructions

How to fill out instructions for form 709

Who needs instructions for form 709?

Instructions for Form 709: A Comprehensive Guide

Overview of Form 709

Form 709, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is essential for individuals who make significant transfers of wealth. This form must be filed with the IRS when you give gifts exceeding the annual exclusion limit. Understanding the intricacies of Form 709 is crucial as it helps ensure compliance with tax laws and aids in effective financial planning.

The importance of Form 709 cannot be understated. Unlike other tax forms, such as the 1040, which is predominantly focused on income tax, Form 709 specifically addresses gift tax obligations. This separation is crucial for tracking wealth transfers and their implications on one's lifetime gift tax exemption.

Who needs to file Form 709?

Generally, if you gift someone cash or property that exceeds the gift tax exclusion limit set by the IRS, you're required to file Form 709. This applies to individuals with a gross estate that may be impacted by the gift tax when they pass away. Thus, even if the individual does not owe any tax, filing may still be necessary to record the gifts properly.

Certain exceptions exist where you may not need to file Form 709. For instance, gifts that fall below the annual exclusion limit, currently set at $17,000 per recipient (as of 2023), do not require filing. Moreover, gifts made to a spouse, which qualify for the marital deduction, are also exempt from filing this form.

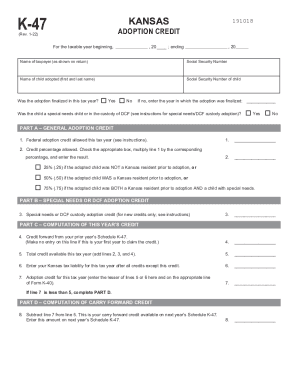

Understanding gift tax basics

The gift tax is a federal tax applied to an individual giving something of value to another person. Gift tax complications arise when transfers exceed the annual exclusion limit, which might be taxed, reducing your lifetime gift exemption. Understanding how the gift tax operates is vital for anyone engaged in significant transfers of wealth.

Gift taxes are calculated based on the fair market value of the gift at the time of giving. While many individuals think of gift tax in terms of cash alone, it extends to all types of assets, including property and securities. Additionally, it's important to note that the tax rate increases, meaning larger gifts incur higher tax obligations.

What counts toward the gift tax?

When determining the value of a gift for tax purposes, the IRS defines 'gifts' broadly. This includes not just cash but also property, stocks, and any other assets with tangible value. Understanding the fair market value (FMV) versus appraised value is critical, as FMV is typically the price at which the asset would sell in an open market.

Special considerations must be taken when gifting to spouses. Gifts between spouses can often be exempt from tax due to the marital deduction, whereas gifts to charitable organizations are also exempt and can earn you a charitable deduction against your income tax. Understanding these nuances is essential for effective estate planning.

Annual gift tax exclusion explained

The annual gift tax exclusion allows individuals to gift a specified amount without incurring gift tax. For 2023, this amount stands at $17,000 per recipient. This limit is adjusted periodically, making it critical for individuals to stay updated to best plan their financial strategies.

Planning your gifts strategically can maximize the annual exclusion limit. For instance, parents can give this amount to each child, and if both parents agree, they can use gift-splitting provisions to double that amount per child. This allows substantial transfers without impacting lifetime exemptions.

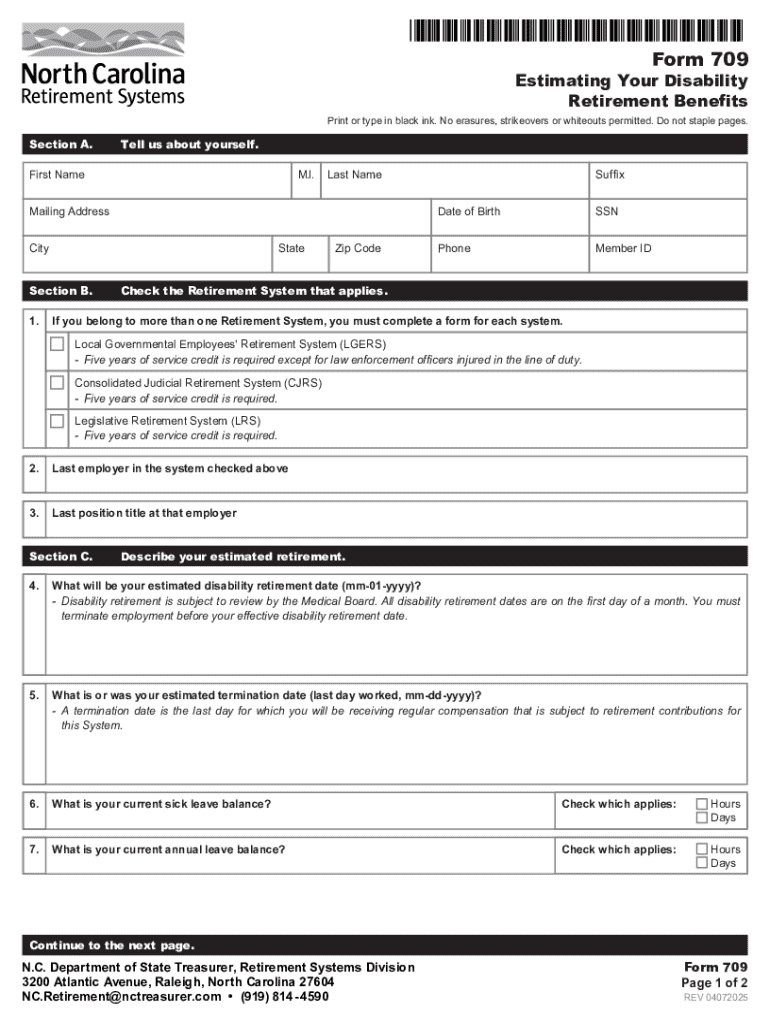

Detailed instructions on filling out Form 709

Filling out Form 709 requires careful attention to detail. Each section of the form serves a unique purpose and requires specific information. The process begins with the personal information section where you provide your name, address, and identification numbers. This information allows the IRS to accurately identify your tax filings.

Next, the section detailing gifts made during the year must be carefully filled out. This is where you will report each gift's value separately. Accurate reporting is essential to avoid future complications. For couples filing jointly, understanding gift splitting is vital to maximize your exclusion and ensure proper reporting.

Using pdfFiller for Form 709

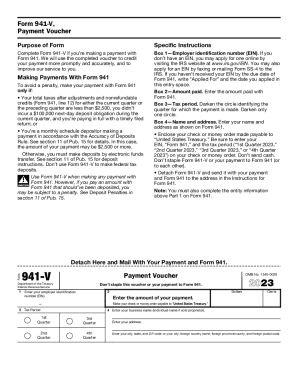

pdfFiller offers a user-friendly platform for accessing and editing Form 709. This cloud-based service supports a streamlined process for filling out and submitting the tax form. Simply navigate to the pdfFiller website, search for Form 709, and begin customizing it to fit your specific needs.

Collaboration becomes effortless with pdfFiller's document management capabilities. Users can easily share forms with advisors or family members for input. Additionally, utilizing the eSigning feature simplifies the process of finalizing and submitting Form 709, ensuring all parties are part of the digital signing process.

Additional tax filing tips

Keeping track of tax filing deadlines is crucial for smooth operation. For Form 709, the deadline generally aligns with your individual income tax return deadline, typically April 15. Marking this date on your calendar and understanding potential extensions can help avoid penalty fees.

Maintaining thorough records of all relevant documentation is equally important. This includes records of gifts given, appraisals of property, and correspondence with advisors. Should you miss a filing deadline, it's essential to consult with a tax advisor to explore options for filing late and addressing any penalties.

Bottom line: key takeaways for filing Form 709

Filing Form 709 does not have to be daunting. Understanding its purpose, the nuances of gift taxes, and adhering to the detailed instructions can lead to a smoother filing experience. Remember, being proactive can save headaches later. If at any point you feel overwhelmed, engaging a tax advisor can provide peace of mind.

Stay informed about changes in tax laws and limits to ensure compliance and optimize your financial strategies. Whether gifting cash or property, thorough knowledge will aid you in making informed decisions while adhering to IRS requirements.

FAQ section on Form 709 and gift taxes

FAQ sections can prove invaluable as you navigate the complexities of gift taxes. Common inquiries range from understanding the specifics of lifetime gift exemptions to questions about how joint filers can maximize their exclusions. Addressing these queries can demystify the gifting process and empower individuals to make informed choices.

Further, clarifying concepts like the difference between taxable and non-taxable gifts can alleviate misunderstandings that might lead to tax complications. The IRS's own descriptions and guidelines are beneficial resources, but professional assistance is sometimes needed to interpret complex scenarios.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irs form 709 instructions in Gmail?

How can I send irs form 709 instructions for eSignature?

How do I edit irs form 709 instructions in Chrome?

What is instructions for form 709?

Who is required to file instructions for form 709?

How to fill out instructions for form 709?

What is the purpose of instructions for form 709?

What information must be reported on instructions for form 709?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.