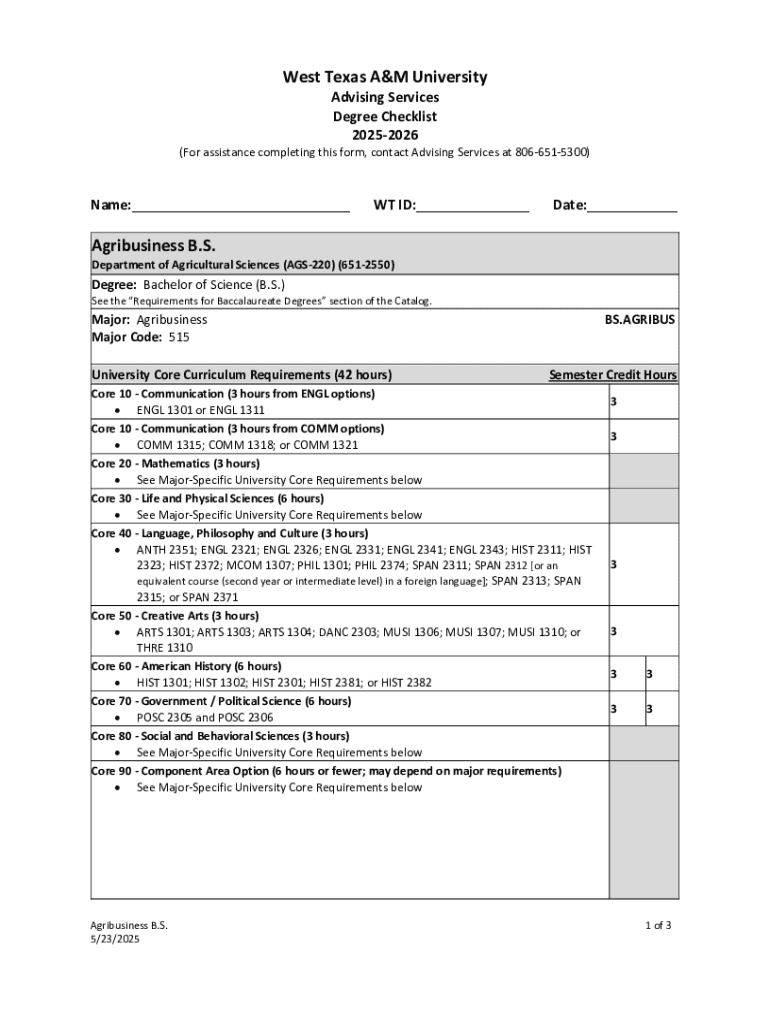

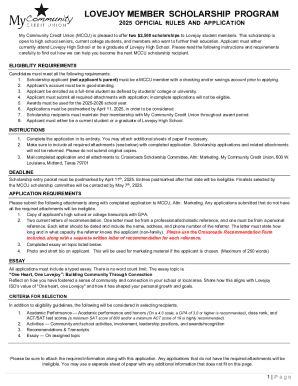

Get the free Agribusiness B

Get, Create, Make and Sign agribusiness b

How to edit agribusiness b online

Uncompromising security for your PDF editing and eSignature needs

How to fill out agribusiness b

How to fill out agribusiness b

Who needs agribusiness b?

Understanding the Agribusiness B Form: A Comprehensive Guide

Understanding the Agribusiness B Form

The Agribusiness B Form is a crucial document designed specifically for individuals and enterprises involved in the agricultural sector. It allows business owners to provide essential information about their agribusiness operations, facilitating a streamlined process for grants, licenses, and compliance with regulatory requirements. This form plays a vital role in ensuring transparency and accountability within the agribusiness sector.

In the context of an increasingly competitive marketplace, the Agribusiness B Form enhances the credibility of businesses by demonstrating adherence to legal and financial obligations. Properly filling out this form can be the difference between securing funding or licenses and facing delays or rejections. Therefore, understanding its significance is paramount for any agribusiness entrepreneur.

The legal and regulatory framework surrounding the Agribusiness B Form can be complex. Depending on the jurisdiction, various laws govern its completion and submission, ensuring that every business complies with industry expectations. It is essential for agribusinesses to stay informed about the latest regulations to avoid potential pitfalls.

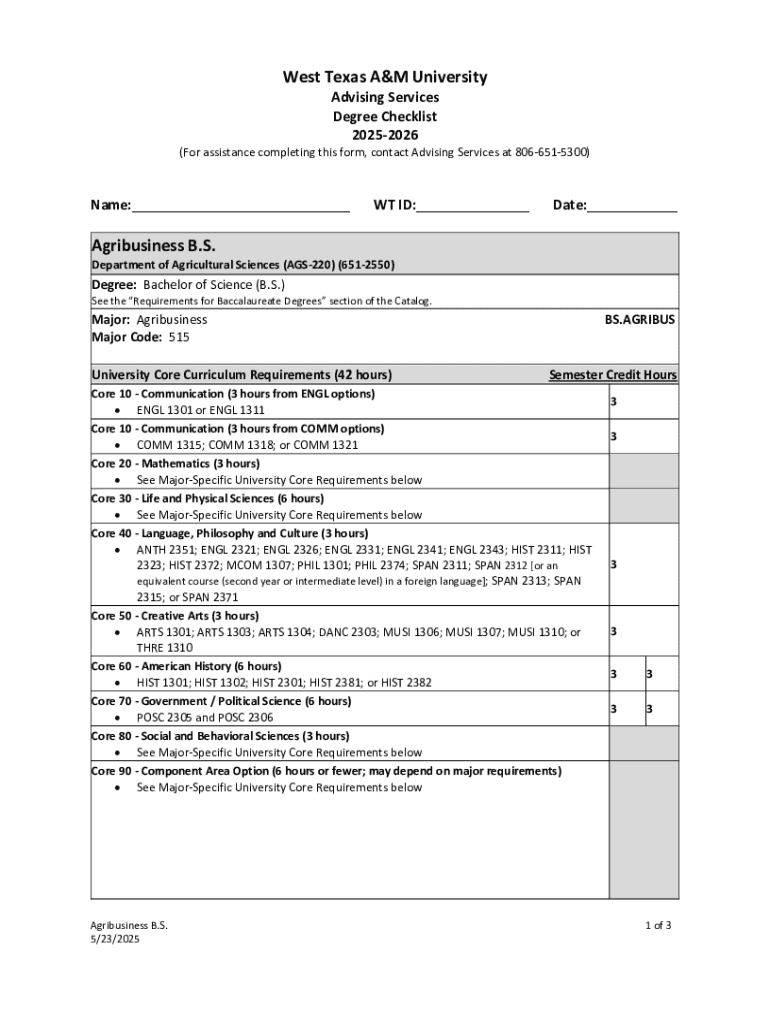

Essential components of the Agribusiness B Form

The Agribusiness B Form consists of several essential components that gather comprehensive insights into business operations. The primary sections include Identifying Information, Business Operation Details, Financial Disclosure Requirements, and Certification Statements. Each section is carefully designed to elicit relevant data necessary for assessing, monitoring, and supporting agribusiness ventures.

Familiarizing yourself with common terminology related to the Agribusiness B Form is crucial for effective communication during the filing process. Terms such as 'cash flow', 'balance sheet', and 'liabilities' frequently come up and understanding them enhances your proficiency in dealing with agribusiness documentation.

Step-by-step guide to filling out the Agribusiness B Form

Filling out the Agribusiness B Form requires careful attention to detail. Begin by gathering necessary documents such as business licenses, tax identification numbers, and financial statements. Creating a checklist of required information can simplify this process significantly.

When filling out each section of the Agribusiness B Form, ensure that the identifying information is complete and accurate. Businesses should provide a thorough description of their operations, including the type of products they cultivate or sell, and the size of their enterprise. Financial disclosures should reveal a true and fair view of the business's economic health, while the certification section should be signed with utmost confidence in the information provided.

After completing the form, double-check all entries for accuracy. This may include having a colleague review the form for any inaccuracies or assumptions. Verification methods can include cross-referencing your data with financial records or business plans.

Editing and managing your Agribusiness B Form

Utilizing digital tools is essential in today's fast-paced business environment. Services like pdfFiller enable users to edit and manage their Agribusiness B Form efficiently. With pdfFiller's intuitive PDF editing tools, modifications can be made quickly and accurately, ensuring that the submitted document reflects the current status of the business.

Moreover, as a cloud-based platform, pdfFiller allows for easy access and management of documents from anywhere. This flexibility can be particularly beneficial for agribusiness leaders operating in remote areas or requiring constant updates on their forms.

Collaboration within teams can also be streamlined with pdfFiller. Team members can share their feedback directly on the document, enhancing communication and ensuring that all suggestions are incorporated before final submission.

Signing the Agribusiness B Form

The introduction of eSignatures has revolutionized how documents are signed and submitted in agribusiness. ESignatures hold legal standing and are widely accepted, making them a convenient option for business owners looking to save time.

To electronically sign your Agribusiness B Form using pdfFiller, simply upload the filled-out document, navigate to the signature field, and follow the on-screen instructions to create or insert your eSignature. For businesses with multiple stakeholders, facilitating multi-party signatures is straightforward—each party can review and sign the form sequentially, streamlining the signing process.

Submitting the Agribusiness B Form

Once the Agribusiness B Form is complete and signed, the next step is submission. There are several options available for submitting your form, including online, via mail, or in person. Many governing bodies have migrated to digital submissions, making online submission often the most efficient choice.

Following submission, it’s not uncommon to receive confirmation of receipt. Depending on the system used, you may be provided with tracking information or guidance on follow-up actions you may need to take.

Best practices for managing agribusiness forms

Proper record keeping is essential for any agribusiness. Strategies for organizing and storing filled-out Agribusiness B Forms include utilizing cloud storage options for easy access, creating dedicated folders for regulatory documents, and employing document management systems to streamline workflow.

Regular updates and revisions of the Agribusiness B Form are critically important for maintaining compliance. As regulations change and business operations evolve, reassessing the form to reflect current data is necessary. Monitoring industry changes will also help ensure that your agribusiness remains compliant with all necessary legal requirements.

Troubleshooting common issues

Many individuals encounter common pitfalls while filling out the Agribusiness B Form. Frequent errors include incomplete sections, inaccurate data, and failing to adhere to submission guidelines. To avoid these issues, it’s beneficial to familiarize oneself with the guidelines and checklists prior to filling out the form.

If issues arise during the completion or submission of the Agribusiness B Form, several resources can provide support. Consulting agribusiness association guidelines, engaging with local agricultural agencies, or seeking professional assistance are all excellent options for navigating potential challenges.

Real-world examples and case studies

Success stories abound from individuals and businesses that have effectively utilized the Agribusiness B Form. For example, several agribusiness entrepreneurs leveraged accurate documentation to secure funding, grow their operations, and ensure compliance with industry standards. Their testimonials showcase how precise form completion bolstered their business endeavors.

Moreover, many of these success stories highlight key lessons learned during the form-filling process, such as the importance of clean data and the value of consulting experts. By sharing insights, aspiring agribusiness owners can gain invaluable knowledge that prepares them for potential challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete agribusiness b online?

Can I create an electronic signature for the agribusiness b in Chrome?

How do I complete agribusiness b on an iOS device?

What is agribusiness b?

Who is required to file agribusiness b?

How to fill out agribusiness b?

What is the purpose of agribusiness b?

What information must be reported on agribusiness b?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.