Get the free Personal Finance - Maine Adult Education

Get, Create, Make and Sign personal finance - maine

How to edit personal finance - maine online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal finance - maine

How to fill out personal finance - maine

Who needs personal finance - maine?

Personal Finance - Maine Form: A Comprehensive Guide

Understanding personal finance in Maine

Personal finance encompasses a range of financial decisions and strategies which significantly influence the quality of life for individuals and families. In Maine, understanding personal finance is paramount, especially given the state's unique economic landscape. With a relatively higher cost of living and rural demographic challenges, residents often face specific hurdles in managing their finances effectively.

Maine's economy includes a strong emphasis on agriculture, tourism, and manufacturing. Nevertheless, residents may grapple with issues like seasonal employment, which can cause income fluctuations. Therefore, comprehensive knowledge in personal finance can help individuals make informed decisions that enhance their financial stability and growth.

Introduction to Maine financial forms

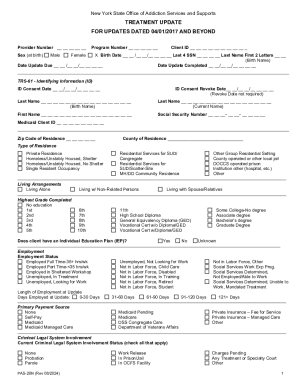

In Maine, financial forms serve as essential tools for managing various aspects of personal finance, from filing taxes to applying for assistance programs. Understanding and properly completing these forms can significantly affect one's financial health. Accuracy in form completion ensures compliance with state laws and maximizes potential benefits.

Utilizing platforms like pdfFiller can enhance the effectiveness of document management. pdfFiller provides features that simplify the form completion process, allowing users to edit, sign, and store documents securely and conveniently.

Detailed breakdown of essential Maine forms

Maine's financial landscape requires residents to navigate several essential forms to manage their financial obligations smoothly. Understanding the types of forms on a deeper level is crucial for effective personal finance management, especially for those new to the process.

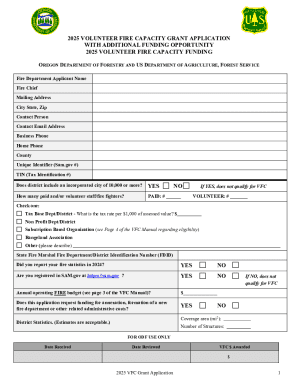

One of the most important categories is tax forms. For individuals, the Maine Individual Income Tax Form is vital for accurately reporting income and calculating taxes owed. Businesses have their distinct requirements, such as the Corporation Tax Forms, which tackle specifically the corporate financial activities in the state.

Step-by-step guide to completing Maine financial forms

Completing Maine financial forms doesn’t have to be daunting. A systematic approach ensures you gather all necessary information and complete forms correctly. Begin by preparing your information, which includes gathering documentation that substantiates your financial history, such as income statements, previous tax returns, and identification documents.

Once you have organized your documents, you'll need to fill out the forms, taking note of the commonly used fields. Tips for accurate completion include double-checking each entry and ensuring that you are using current forms. After filling out the form, utilize pdfFiller’s editing tools to make any necessary adjustments and perform quality checks.

Electronic signing and submission process

Maine recognizes the legality of electronic signatures, which streamlines the process of submitting financial forms. Using pdfFiller, users can eSign their documents efficiently. This feature enhances the convenience of document management significantly, eliminating the need for physical paperwork.

When submitting forms electronically, certain best practices should be adhered to, such as verifying that all information is correct before the final submission. Tracking the submission status through pdfFiller can give peace of mind and ensure that your forms have reached the appropriate entities.

Managing and storing your financial documents

Proper document management is crucial in maintaining organized financial records. Every resident in Maine should consider adopting a systematic approach to storing financial documents to avoid clutter and enhance accessibility. Utilizing tools like pdfFiller allows users to securely store important files and easily retrieve them when needed.

pdfFiller provides cloud storage solutions that keep your documents safe, along with collaborative tools that are beneficial for teams. These features enable multiple users to work on shared documents seamlessly, making it an excellent choice for families and business partners alike.

Resources for Maine residents

Maine residents are fortunate to have access to various local support organizations that offer financial literacy workshops and advice. These resources can significantly improve understanding of financial principles, from budgeting to investment strategies, which are tailored to the unique challenges of living in Maine.

Moreover, residents can benefit from online financial planning tools, such as budgeting calculators and investment tracking tools, which can further aid in personal finance management. These tools facilitate informed decision-making and better financial outcomes.

Success stories: How Mainers have used financial forms effectively

Across Maine, numerous families and businesses have successfully leveraged financial forms to improve their economic situations. For instance, many families have used assistance application forms to secure funding for education, thus altering the course of their financial futures.

Similarly, entrepreneurs who meticulously filled out their business registration forms and tax documentation have set a foundation for stable and thriving businesses. These successes illustrate the critical role that understanding and utilizing financial forms plays in achieving personal and financial goals.

Frequently asked questions (FAQs) about Maine financial forms

Navigating financial forms can raise several questions, especially among new residents or those unfamiliar with the forms' usage. Common inquiries include the types of financial documents needed and where to find assistance. Additionally, troubleshooting common issues that arise during completion or submission is often necessary.

It is essential for Mainers to know where to turn for further assistance in case of trouble, ensuring that no one feels overwhelmed by the process. Local resources and online tools can offer timely guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my personal finance - maine in Gmail?

How do I fill out personal finance - maine using my mobile device?

Can I edit personal finance - maine on an iOS device?

What is personal finance - maine?

Who is required to file personal finance - maine?

How to fill out personal finance - maine?

What is the purpose of personal finance - maine?

What information must be reported on personal finance - maine?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.