Get the free Student Loans - The Henry Strong Educational Foundation

Get, Create, Make and Sign student loans - form

Editing student loans - form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out student loans - form

How to fill out student loans - form

Who needs student loans - form?

Student loans - form: A comprehensive how-to guide

Understanding student loans and their forms

Student loans are critical for many individuals pursuing higher education, providing the necessary funds to cover tuition fees and living expenses. Understanding the different types of student loans is essential. Federal loans are funded by the government and usually offer lower interest rates and better repayment options, while private loans are offered by banks and financial institutions, often with variable terms and conditions.

Having a firm grasp of the application process is crucial to avoid common pitfalls. The key forms involved in obtaining student loans include the Free Application for Federal Student Aid (FAFSA), which determines eligibility for federal aid, as well as specific loan application forms provided by private lenders. Additionally, students may encounter various repayment plan application forms once they begin their repayment journeys.

Preparing to fill out student loan forms

Before diving into filling out forms, students should gather all necessary documentation required for the application process. This includes identification documents such as a Social Security card or driver's license, along with financial information like tax returns and income statements. Most lenders will require proof of school enrollment, including acceptance letters or current student registration.

Understanding your financial needs is crucial when determining how much to borrow. Calculate the cost of attendance accurately, considering tuition, fees, books, housing, and personal expenses. By knowing these costs upfront, you can make informed decisions about how much to request in loans, ensuring you cover your educational expenses without overwhelming yourself with debt.

Step-by-step guide to filling out the FAFSA

The FAFSA is your gateway to federal student loans and grants, so filing it accurately is paramount. Begin by creating a Federal Student Aid (FSA) ID, which is essential for logging into the FAFSA website. Navigate to the official FAFSA site and follow the prompts to initiate your application.

Each section of the FAFSA collects specific information. Personal information fields require your name, address, and date of birth. Financial information must include your income and any assets you own. Determine your dependency status by answering a series of questions, which will dictate if you need to include your parents' financial information.

After filling out the application, reviewing it for accuracy is crucial. Once submitted, you can track your FAFSA status through the same website, allowing you to check if your application has been processed and to view your Expected Family Contribution (EFC), which plays a critical role in financial aid package determination.

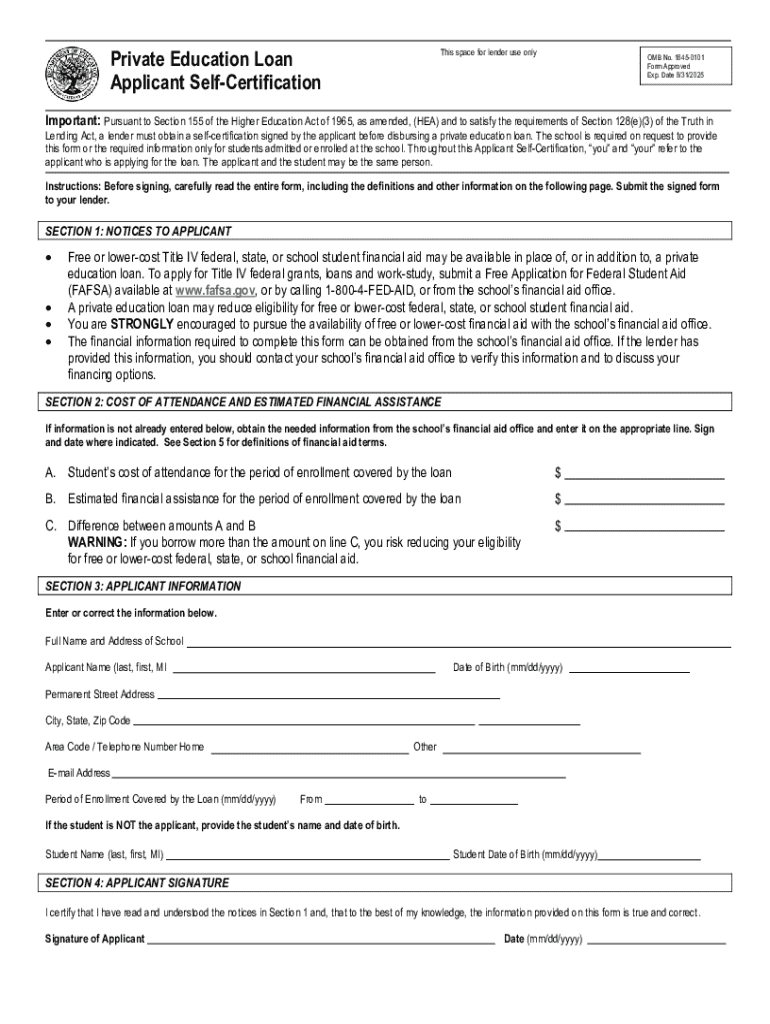

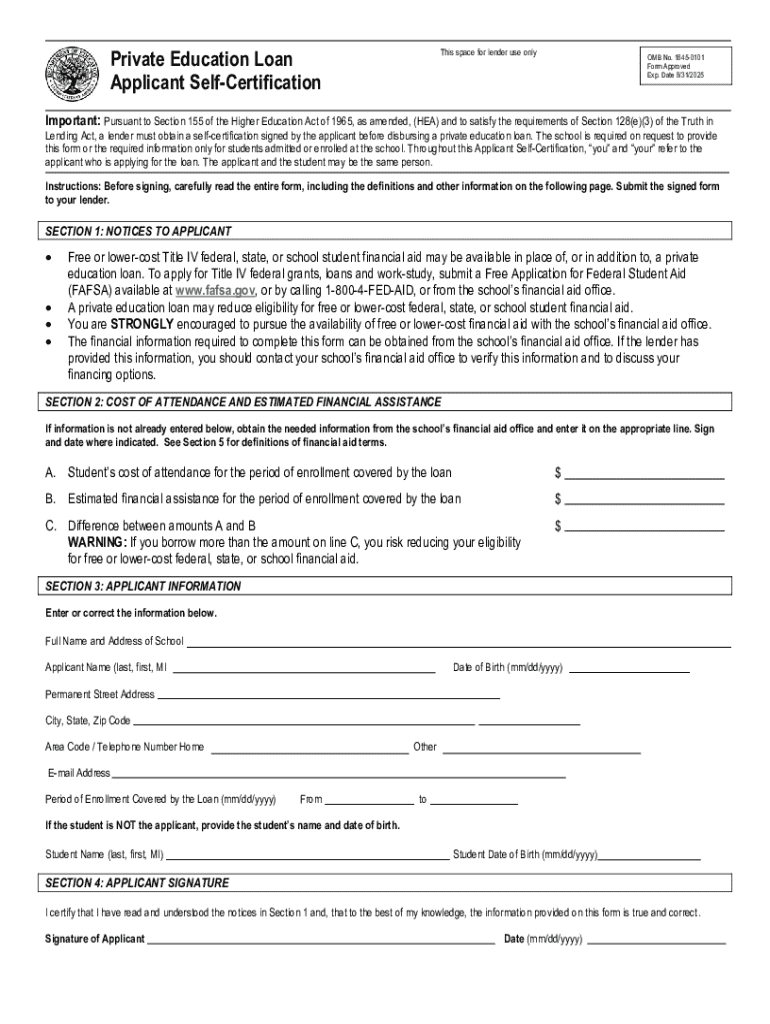

Navigating private student loan applications

When considering private student loans, research is vital. Compare lenders based on interest rates, loan terms, and benefits offered. Understanding the difference between variable and fixed interest rates can help make a more informed decision, as a fixed rate will remain constant throughout the loan's life, while a variable rate may fluctuate.

Completing the application typically requires detailed financial and demographic information. You may need to provide information about your college, expected graduation date, and possibly a co-signer. Being accurate in your financial disclosures will expedite the loan approval process.

After submitting an application, expect communication from the lender regarding approval. You will receive disclosure documents that explain the loan's terms, including interest rates, repayment plans, and any fees associated with borrowing.

Managing your student loan forms post-submission

Once you have submitted your student loan forms, staying organized is key. Keep a file—whether physical or digital—for all application confirmations and relevant documents. This organization will help you handle deadlines effectively and maintain communication with your lenders.

Understanding the types of loan servicing forms that may be required later is also critical. For instance, should you encounter financial challenges, you may need to fill out forms for deferment or forbearance. Familiarizing yourself with these documents beforehand eases the process of communication with your loan servicer when the need arises.

Editing and signing student loan forms digitally

The digital age has made managing student loan forms easier than ever, with tools like pdfFiller empowering users. Having a cloud-based platform allows for seamless editing and signing of forms. Students can upload their documents, make necessary changes, and use electronic signatures to expedite the process.

Using pdfFiller streamlines collaboration, especially if a co-signer is required. You can invite family members or trusted individuals to review and sign documents, ensuring that all required signatures are collected efficiently, significantly reducing turnaround times associated with traditional paper methods.

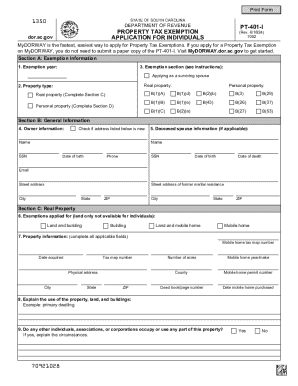

Special considerations for students with unique circumstances

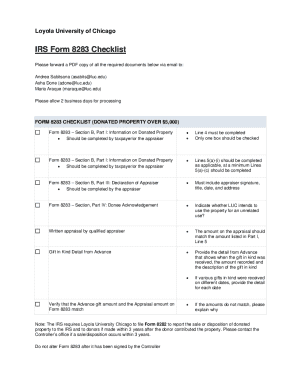

Certain groups of students may face additional complexities when navigating their student loans. For example, individuals seeking student loan forgiveness typically must complete specific application forms that require detailed documentation of employment and income. Understanding these requirements upfront can help streamline the process.

Military and veteran students often have unique benefits available to them, with forms necessary to access these resources. Non-traditional students, such as adult learners returning to education, may also need tailored guidance and forms. Finding resources specific to these demographics can greatly enhance their borrowing and repayment experience.

Troubleshooting common issues with student loan forms

Common mistakes in student loan applications can lead to delays in processing. One frequent issue is providing inaccurate financial information, which can lead to incorrect aid calculations. Always double-check entries before submission, as simple errors can cause significant setbacks.

If issues arise, contacting support for assistance is crucial. Review FAQ sections on lender or FAFSA websites to troubleshoot common problems. When necessary, escalate your concerns to higher authorities for timely resolutions, ensuring that you maintain proactive communication throughout the process.

Utilizing resources and tools for ongoing student loan management

Ongoing management of student loans requires access to reliable resources. Government and nonprofit websites provide comprehensive information regarding student loans, ensuring that you remain informed about potential changes in policy or repayment options.

Utilizing financial planning tools can help students create budgets tailored to their loan repayment schedules. Online calculators can provide loan estimators and repayment forecasts, giving students a clearer picture of their financial commitments.

Maximizing your student loan experience with pdfFiller

Integrating pdfFiller into your student loan process can significantly improve your document management experience. Its cloud-based solution allows for seamless collaboration, editing, and signing, ensuring that applications are completed without unnecessary delay.

Feedback from users highlights the efficiency of pdfFiller in managing their educational forms. Users appreciate the ability to edit documents on the go and the streamlined user interface, which helps keep their financial education organized and accessible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my student loans - form directly from Gmail?

How do I complete student loans - form online?

Can I create an electronic signature for the student loans - form in Chrome?

What is student loans - form?

Who is required to file student loans - form?

How to fill out student loans - form?

What is the purpose of student loans - form?

What information must be reported on student loans - form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.