Get the free IRS Form 8283 Checklist

Get, Create, Make and Sign irs form 8283 checklist

Editing irs form 8283 checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 8283 checklist

How to fill out irs form 8283 checklist

Who needs irs form 8283 checklist?

IRS Form 8283 Checklist Form: A Comprehensive Guide

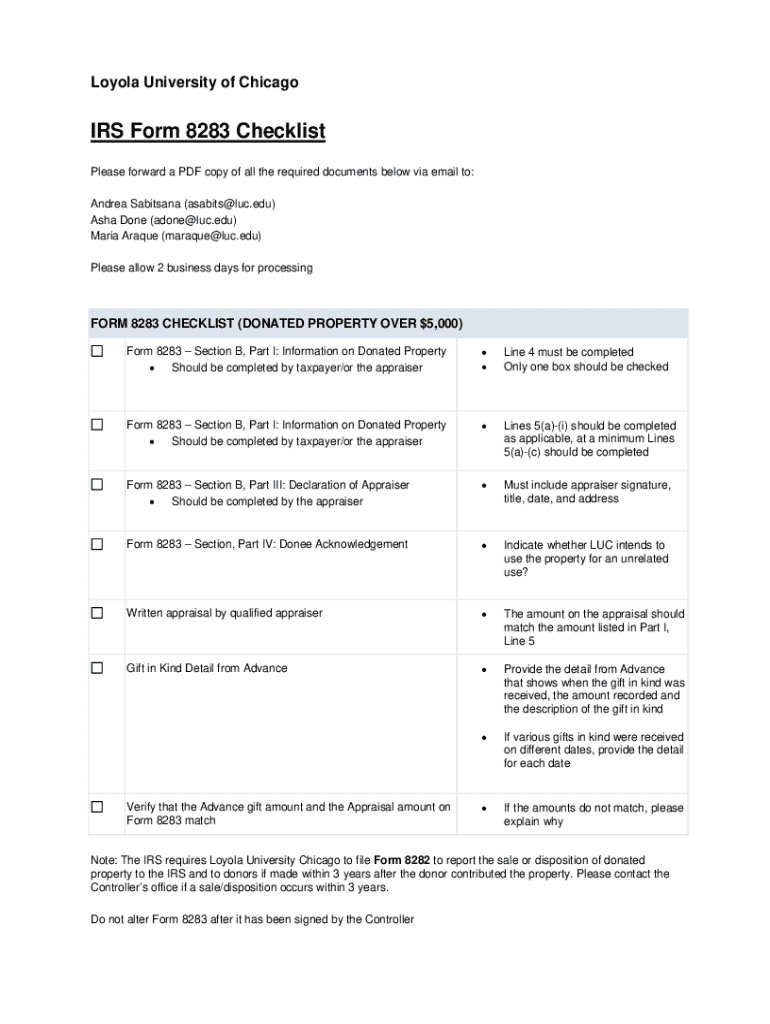

Overview of IRS Form 8283

IRS Form 8283 serves a pivotal role in the documentation and validation of noncash charitable contributions made by individuals and businesses during a tax year. This form is crucial for taxpayers who aim to claim a deduction for their generous donations, as it provides the IRS with detailed information about the donated property, including its estimated fair market value. By completing Form 8283, donors ensure they are compliant with IRS regulations and can effectively manage their tax liabilities.

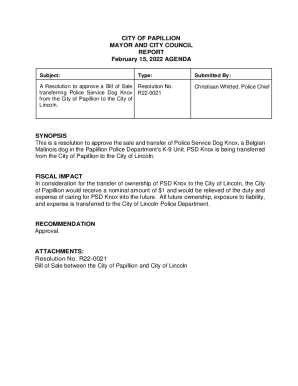

The form is specifically designed for two main categories of noncash contributions: Section A for donations under $500, and Section B for those exceeding this threshold. Understanding the distinctions between these sections is essential for proper filing. Section A is generally simpler and facilitates the summary of basic donation details, while Section B requires more comprehensive disclosures and potentially an independent appraisal for validating higher value gifts.

Who should file Form 8283?

Filing IRS Form 8283 is not limited to a specific group; it is essential for a variety of taxpayers including individuals, corporations, and partnerships. Any entity that plans to claim a deduction for contributions of noncash items should be aware of this form's requirements. Particularly, businesses or individuals who frequently donate significant assets like vehicles, art, or real estate should be ready to submit this form to ensure compliance and avoid penalties.

Common scenarios that necessitate the use of Form 8283 include donating property worth more than $500, such as stocks, collectibles, or tangible goods. Higher-value contributions may even attract additional scrutiny from the IRS, making meticulous record-keeping critical. Understanding which specific scenarios trigger the need for Form 8283 can streamline the tax preparation process and facilitate effective claims.

Preparing to complete Form 8283

Embarking on the completion of IRS Form 8283 requires careful preparation and organization. Donors should begin by collecting all necessary information related to the donated property. Key data points include a thorough description of the property, a reliable assessment of its fair market value, and documentation substantiating the donation. Each of these elements is critical for successfully filing and supporting the claimed deductions.

Documentation requirements can vary based on the value of the donated item. For items valued at over $5,000, the taxpayer is often required to obtain a qualified appraisal. Additionally, obtaining the necessary signatures on the form is essential. The donor must sign the document, and if an appraisal is conducted, the appraiser's signature is also mandated. Ensuring every piece of information is accurate can significantly enhance the credibility of the claim.

Step-by-step guide to completing Form 8283

Filling out Form 8283 can be straightforward if you follow these structured steps. Start with Section A, which focuses on donations valued under $500. You will need to provide critical donor information, including name, address, and taxpayer identification number, and outline the basic property description. Next, enter the date of donation and the fair market value of the item. Remember, you must estimate this value based on reliable sources or comparable sales.

For Section B, which deals with contributions over $500, you need to furnish more detailed descriptions of the donated property and, importantly, any appraisal information. This section provides the IRS with a deeper insight into the valuation process of the donated item. A checklist for supporting documents, such as sales receipts, pictures of the item, or any correspondence related to the donation, is vital to ensure a complete and effective filing.

Common mistakes to avoid

When it comes to IRS Form 8283, attention to detail is paramount. One frequent mistake is miscalculating or inaccurately stating the fair market value of donated items. Such errors can lead to severe consequences including penalties from the IRS. Donors need to ensure they thoroughly assess item value and consult reliable sources to support their claims.

Another common pitfall involves missing signatures, either from the donor or the appraiser if applicable. Without these signatures, the form could be rendered invalid, impacting the donor’s ability to claim tax deductions. Additionally, submitting an incomplete form can raise red flags. Documenting everything meticulously is not merely good practice; it's essential for substantiating donations and avoiding future tax disputes.

Managing and editing your form 8283 with pdfFiller

Managing IRS Form 8283 is made considerably simpler through the use of pdfFiller's platform. Users can easily access the form digitally, upload necessary documentation, and utilize interactive tools designed to guide completion. Whether filling out the form alone or collaborating with team members, pdfFiller’s platform supports the seamless integration of information and signatures.

The user-friendly interface allows individuals to directly interact with the form, ensuring a smooth filling process. eSigning capabilities enable quick completion, allowing donors to finalize the document rapidly without the hassles of physical paperwork. Furthermore, enabling collaboration with team members enhances the review process and ensures all required elements are perfectly captured.

Resources for assistance

Navigating the intricacies of IRS Form 8283 can be daunting, but numerous resources are available to assist. The IRS provides comprehensive FAQs about Form 8283 on its website, which can help clarify common queries and challenges encountered during the filing process. Additionally, seeking professional advice from tax professionals can provide personalized insights tailored to distinct situations.

Official IRS instructions and guidelines can be accessed online, offering detailed support on completing Form 8283 correctly. Engaging with these resources can help minimize errors and bolster the effectiveness of the tax return regarding charitable contributions.

Tax implications of noncash charitable contributions

Understanding the tax implications of noncash charitable contributions is critical for informed decision-making during tax season. Claiming a deduction can substantially reduce tax liabilities, but donors must recognize the risks of overstating the value of donated items. Overvaluation can not only lead to a rejection of the deduction but may also result in penalties from the IRS, making it essential to stay within reasonable and justifiable valuation ranges.

Form 8283 is a transformative tool in this context; it provides transparency and detail about contributions, ensuring that claims for deductions are substantiated. The effective use of this form during tax filing can dramatically improve the accuracy of the return while allowing taxpayers to enjoy the benefits of their charitable generosity.

Related forms and documents

In the landscape of IRS forms related to charitable contributions, Form 8283 is accompanied by a set of other critical documents. For instance, Form 8282, also known as the Return of Property, becomes relevant when a donor sells or otherwise disposes of an item that was previously donated. Familiarity with these forms ensures that donors maintain compliance throughout the lifecycle of their contributions.

Tracking charitable contributions diligently not only aids in current tax filings but also prepares donors for future accountability. Establishing a robust documentation process related to donations helps streamline any future audits or inquiries from the IRS, ensuring taxpayers are fortified against potential tax penalties.

Interactive tools available on pdfFiller

pdfFiller offers users interactive capabilities that enhance the document completion process, particularly for IRS Form 8283. Through advanced document tracking features, users can monitor the status of their submissions and make adjustments as necessary. Moreover, pdfFiller provides editable templates to assist with filling out various forms, allowing users to switch easily between documents while maintaining consistent data.

The e-signature functionality elevates collaboration, enabling users to share forms with stakeholders for review and signature effortlessly. Such methods streamline workflows and contribute positively to the overall management of charitable contributions and their documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs form 8283 checklist without leaving Google Drive?

Can I create an electronic signature for signing my irs form 8283 checklist in Gmail?

How do I fill out irs form 8283 checklist on an Android device?

What is IRS Form 8283 checklist?

Who is required to file IRS Form 8283 checklist?

How to fill out IRS Form 8283 checklist?

What is the purpose of IRS Form 8283 checklist?

What information must be reported on IRS Form 8283 checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.