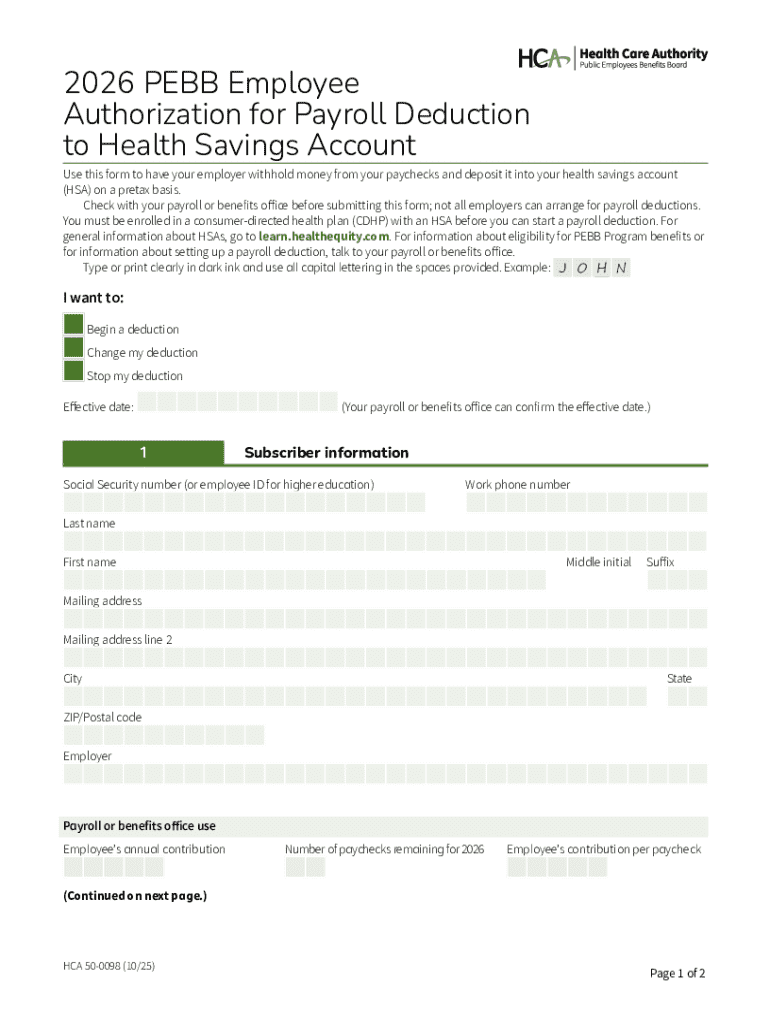

Get the free Employee Authorization for Payroll Deduction to Health Savings Account (PEBB)2026

Get, Create, Make and Sign employee authorization for payroll

How to edit employee authorization for payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee authorization for payroll

How to fill out employee authorization for payroll

Who needs employee authorization for payroll?

Understanding the Employee Authorization for Payroll Form

Understanding employee authorization for payroll

Employee authorization for payroll refers to the process by which employees give permission to their employer regarding how their payroll is processed. This form is critical as it ensures that employees' financial information is handled appropriately and securely. It encompasses various authorizations such as direct deposits, deductibles for benefits, and loan repayments, making it a pivotal document within the payroll system.

In organizations, having a clear and standardized employee authorization for payroll form helps streamline payroll processing, reducing errors and enhancing compliance with employment laws. Each employee’s preferences and choices are documented, making updates and audits more manageable.

Legal requirements surrounding employee authorization forms vary by jurisdiction but generally include guidelines to protect the rights of employees. Federal and state regulations require employers to secure explicit consent from employees regarding payroll deductions and authorizations before proceeding.

Components of the employee authorization form

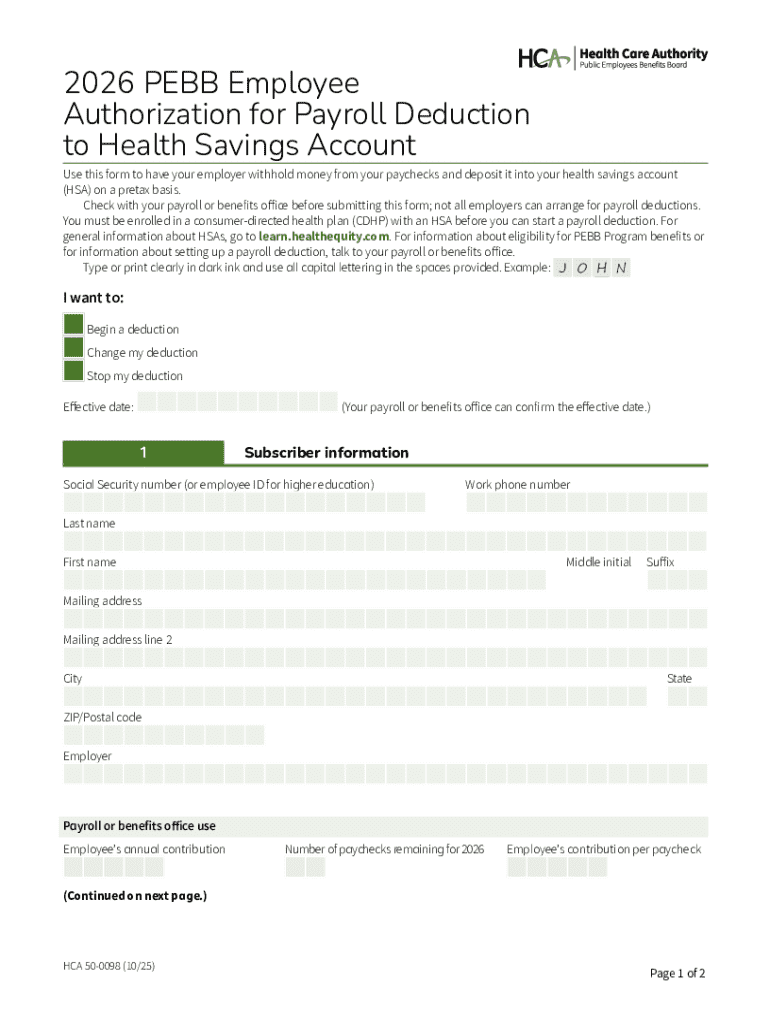

A comprehensive employee authorization for payroll form typically includes several critical components to ensure clear communication and understanding between the employee and employer. Initially, basic information such as the employee's name, identification number, position, and department is required. This foundational data helps the payroll department accurately process transactions.

Further details include specific authorization for types of payroll deductions the employee agrees to, such as health insurance, retirement contributions, or any voluntary deductions. Moreover, ensuring that the form contains signature fields for the employee and a date is essential. This acknowledgement validates the consent given, protecting both the employee and employer.

Types of authorizations included in payroll forms

Payroll forms typically encompass several types of authorizations that facilitate smooth financial transactions for employees. One of the most common is the direct deposit authorization. This option enables employees to have their wages deposited directly into their bank accounts, a system that has grown increasingly popular due to its convenience and security. Employees do not have to wait for checks to be cleared, which significantly streamlines their access to funds.

Additionally, deductions for benefits are often included in these forms. Employees can authorize deductions for various benefits, including health, dental, and retirement plans. Other deductions can be voluntary as well, such as contributions to charitable organizations or personal savings plans. Loan repayment authorizations are also crucial for employers offering educational or personal loans to their staff, facilitating easy repayments through payroll deductions.

Steps to fill out the employee authorization for payroll form

Filling out the employee authorization for payroll form requires attention to detail to ensure accuracy and completeness. The first step is gathering all necessary information. Employees should prepare a checklist that includes their name, employee ID, and any other relevant personal information to ensure nothing is overlooked during completion.

Next, the form should be completed accurately. Employees need to pay close attention to each section, particularly when indicating types of deductions or authorizations. Common pitfalls to avoid include failing to sign the form or entering incorrect banking information for direct deposits, which can delay payroll processing.

After filling out the form, it's crucial to review and verify all entered information. Double-checking entries can prevent errors that may affect payroll outcomes. Finally, employees should submit the completed form. Employers might offer both digital and paper submission options, thus providing flexibility in how the forms are processed.

Editing and managing the payroll authorization form

Managing an employee authorization for payroll form is essential for companies that prioritize accuracy and efficiency in their payroll processes. Tools such as pdfFiller can significantly simplify the editing and management of these forms. A step-by-step guide for accessing and editing the form typically begins with logging into the pdfFiller platform, where users can easily upload their documents.

Collaborating with HR for any amendments is crucial. Ensuring that both parties agree on changes can help avoid discrepancies later on. The platform features built-in tracking capabilities that log all changes made to the document, promoting transparency and accountability in the management process. This is particularly important in the case of compliance audits or if discrepancies arise.

Frequently asked questions (FAQs)

Changes in payroll deductions can happen due to various personal or organizational reasons. Employees who need to make changes must follow specific steps to update their authorizations. They should contact payroll or HR representatives and may need to fill out a new employee authorization for payroll form reflecting the desired changes. Timely communication of these changes is crucial to ensure correct deductions.

Missing submission deadlines for payroll forms can have significant implications, including delayed payments or unintended deductions. Employees are encouraged to immediately discuss missed deadlines with their HR representatives to explore potential solutions or exceptions. Revoking authorization is also a possibility and involves formally notifying the employer. Employees must be aware that revoking certain authorizations might lead to changes in benefit eligibility or payroll processing.

Conclusion and next steps

Maintaining compliance and accuracy in payroll authorizations is essential for both employers and employees. Regularly reviewing and updating records ensures that all payroll deductions align with current employee preferences and legal requirements. It's vital that both parties remain engaged and informed.

Leveraging pdfFiller for future authorizations can significantly ease document management tasks. The platform's capabilities enhance the efficiency of managing payroll documents, allowing easy access, editing, and submission from anywhere. By maintaining clear and effective communication with HR and utilizing modern document solutions, employees can navigate their payroll authorizations confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my employee authorization for payroll in Gmail?

How can I send employee authorization for payroll to be eSigned by others?

How can I get employee authorization for payroll?

What is employee authorization for payroll?

Who is required to file employee authorization for payroll?

How to fill out employee authorization for payroll?

What is the purpose of employee authorization for payroll?

What information must be reported on employee authorization for payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.