Get the free Tax & Exemptions

Get, Create, Make and Sign tax amp exemptions

Editing tax amp exemptions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax amp exemptions

How to fill out tax amp exemptions

Who needs tax amp exemptions?

Tax amp exemptions form: A comprehensive how-to guide

Understanding tax exemptions

Tax exemptions are legal allowances that reduce the amount of income or property that is subject to taxation, providing financial relief to eligible entities or individuals. These exemptions can play a significant role in shaping one’s overall tax liability, making them an essential consideration for anyone looking to optimize their tax situation.

There are various types of tax exemptions available, including property tax exemptions, income tax exemptions, and exemptions for charitable organizations. Property tax exemptions are often granted to homeowners based on specific criteria, such as age or disability status, while income tax exemptions can vary depending on individual or family income levels. Understanding these distinctions is crucial to determining your eligibility to benefit from such exemptions.

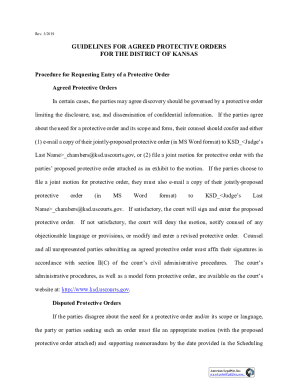

Eligibility for these tax exemptions often hinges on meeting specific criteria set by local or federal authorities. Documentation requirements may include proof of income, residency status, age, or disability. Gathering the right documents beforehand can streamline the exemption application process significantly.

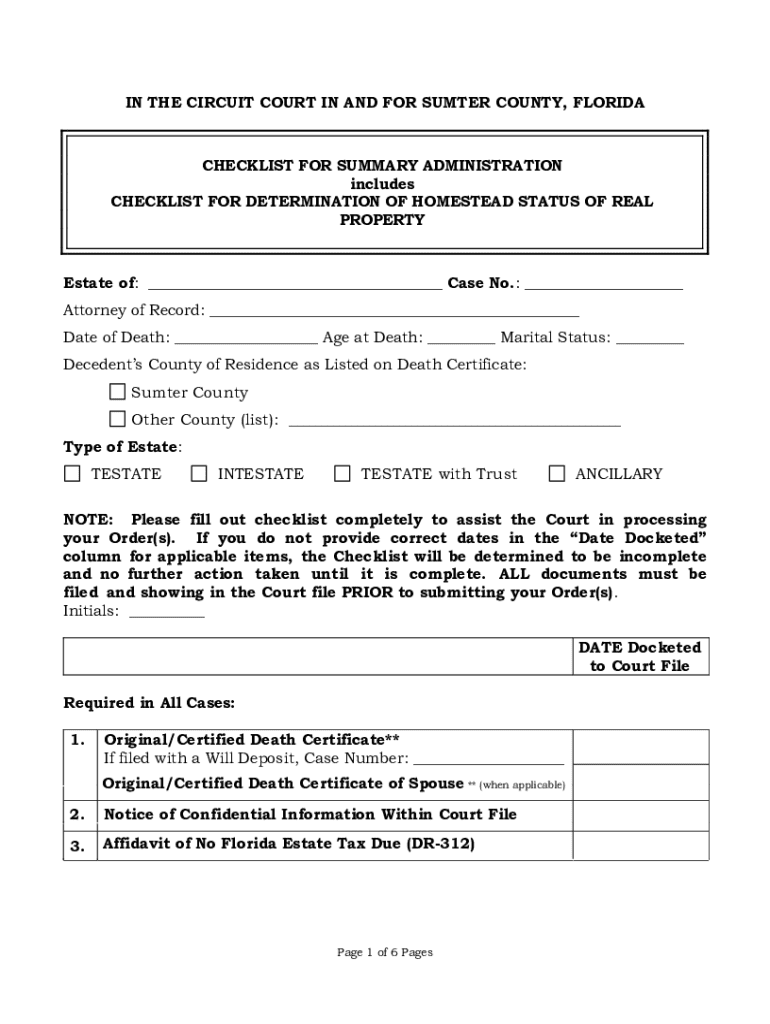

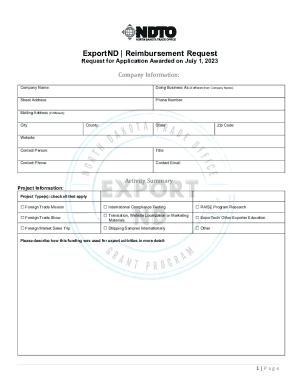

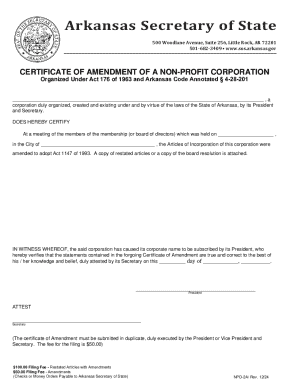

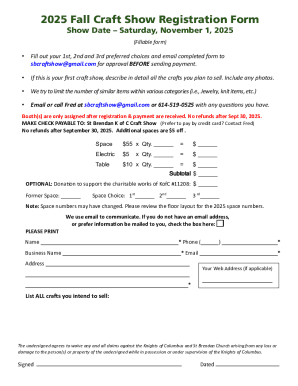

Overview of the tax amp exemptions form

The tax amp exemptions form serves as a crucial tool for those seeking to benefit from various tax exemptions. This form walks applicants through the necessary process, ensuring all vital information is captured to assess eligibility accurately. Understanding this form can significantly enhance your chances of securing the exemptions for which you qualify.

Indeed, anyone looking to reduce their tax burden may benefit from the tax amp exemptions form, from individual taxpayers to businesses that may qualify for property or sales tax exemptions. Knowing who should fill out this form is the first step in harnessing the potential benefits.

Key sections of the form may include personal information details, financial information, and fields where you articulate your reasoning for the exemption. Special attention should be given to accurately completing these sections to avoid complications later on.

Navigating the tax amp exemptions form

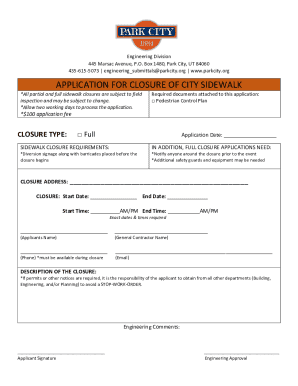

Completing the tax amp exemptions form requires careful attention to detail. Here’s a step-by-step guide to successfully navigate through this essential process.

Navigating each section methodically can prevent omissions and errors, which might otherwise lead to delays or rejections in processing.

Tips for a successful application

Filing the tax amp exemptions form can be a straightforward process, but avoiding common pitfalls can enhance your success rate. Awareness of frequent mistakes helps ensure a smooth application experience.

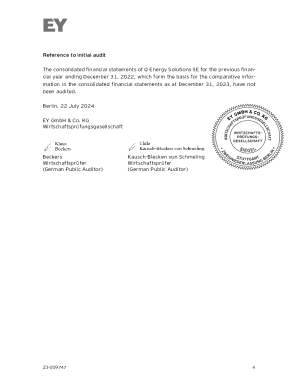

Utilizing tools available from pdfFiller can simplify this process. Features such as interactive editing, e-signature capabilities, and easy document sharing can elevate your form completion efficiency.

Submitting the tax amp exemptions form

Once your tax amp exemptions form is complete, the next step is submission. Knowing what options are available can ease this process. You typically have two submission methods: online and paper.

After submission, tracking the status of your application is key. Most tax departments provide a way to check your application status online, keeping you informed and prepared for any further actions needed.

Frequently asked questions (FAQs)

Applicants often have additional queries surrounding the tax amp exemptions form, particularly regarding denials and amendments.

Being informed about these common questions prepares you for any challenges you might face during the application process.

Additional tools and resources

As you navigate through the process, leveraging resources from pdfFiller can further enhance your experience. pdfFiller offers a range of interactive features that assist with document management and collaboration, ensuring seamless access from any location.

For further assistance, consider reaching out to official tax websites or support services to clarify any lingering questions not addressed in this guide.

Was this content helpful?

At pdfFiller, user feedback is essential in shape the materials we provide. Sharing your experience with the tax amp exemptions form can help others in the community navigate their applications more effectively.

Connecting with others on the pdfFiller platform can foster a sense of community as users share experiences and solutions about tax exemptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the tax amp exemptions in Chrome?

How do I fill out the tax amp exemptions form on my smartphone?

How do I fill out tax amp exemptions on an Android device?

What is tax amp exemptions?

Who is required to file tax amp exemptions?

How to fill out tax amp exemptions?

What is the purpose of tax amp exemptions?

What information must be reported on tax amp exemptions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.