Get the free Insurance Quote Proposal Template

Show details

This document serves as a proposal outlining the insurance coverage options, premiums, and terms available to the prospective insured based on risk assessment.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is insurance quote proposal template

An insurance quote proposal template is a standardized document used to present an estimated price for insurance coverage based on specific client needs.

pdfFiller scores top ratings on review platforms

Very helpful once I figured it out.

user friendly and effective

It helped me edit pdf's, so the service succeeded in what it's supposed to do

pdf filler was kinda a letdown

3/5 it was cool and yea sometimes know when to say no

I use it for specific content for signature and pdf

just didnt like the feel of the software so im moving on

John has been very efficient

John has been very efficient. He solved my problem.

So far so good

So far so good. Easy to use anywhere since it is web based and I don't have to worry about which computer I'm using, whether at home, office, or other.

Who needs insurance quote proposal template?

Explore how professionals across industries use pdfFiller.

Insurance Quote Proposal Template Guide

How can you understand your insurance quote proposal?

An insurance quote proposal serves as a comprehensive document presented by an insurance provider that outlines the specifics of coverage and pricing. Understanding this document is key to ensuring you receive the right insurance proposal format tailored to your needs.

-

This document details the coverage options available, the risk factors considered, and the premium pricing based on those factors.

-

Completing this form accurately ensures the insurance provider can gauge your risk and needs effectively.

-

Digital templates provide a streamlined experience, allowing for easy edits, eSigning, and storage, all from one user-friendly platform.

What are the key components of the insurance quote proposal?

An effective insurance quote proposal template must contain certain critical components that ensure clarity and accuracy. These include document reference details and the parties involved.

Document reference details

-

Reference numbers aid in the identification and retrieval of proposals, ensuring proper documentation.

-

Correct details prevent misunderstandings and assist in smooth processing of insurance claims.

Parties involved in the proposal

-

Clearly stating both parties helps in establishing the contractual relationship.

-

Accurate contact details allow easy communication for follow-ups and any required clarifications.

How do you draft the executive summary?

The executive summary is key to presenting the primary purpose of the insurance quote proposal and must be clear and concise. It typically highlights the validity of the document and the main components of coverage options along with their respective premiums.

Why is assessing insurance needs important?

Conducting a thorough assessment of your insurance needs helps tailor the proposal to suit your specific risk profile and coverage requirements. This not only ensures adequate protection but also optimizes premium costs.

Conducting a risk profile assessment

-

Understanding your unique situation and risks is essential for a relevant insurance proposal template.

-

Focus on assets that are critical to ensure they are adequately protected against possible risks.

Identifying exposures and prior claims

-

This discussion helps pinpoint potential vulnerabilities that may require more attention in the proposal.

-

Understanding past claims can provide insights into the types of coverages you may need moving forward.

What are your coverage options?

Exploring available coverage options allows you to select an insurance package that best suits your needs. The recommended coverage plan should include defined coverage types, limits, and deductibles.

Recommended coverage plan

-

Clearly outlining coverage terms will help you understand exactly what risks are covered and to what extent.

-

Annual premiums represent the overall cost of maintaining your coverage and will affect budgeting.

What alternative coverage options exist?

-

These options may provide basic coverage at a lower cost, but you may compromise on certain risks.

-

Consider upgraded coverage plans that provide additional benefits for a higher annual premium.

How do you summarize the proposed premium?

Summarizing the proposed premium is crucial to understanding the total financial commitment involved. This should include base premiums, endorsements, discounts available, and applicable taxes.

Premium breakdown

-

Endorsements may provide coverage for specific items or situations not included in the base policy.

-

Make sure to inquire about any potential discounts that could decrease your total premium costs.

How to fill out the insurance quote proposal template

-

1.Open the insurance quote proposal template on pdfFiller.

-

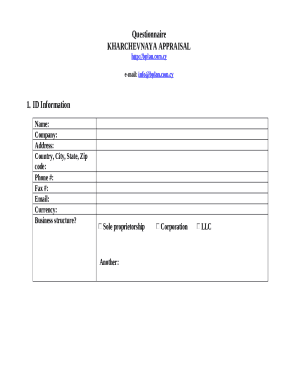

2.Begin by entering the client's personal details, such as name, address, and contact information, in the designated fields.

-

3.Next, specify the type of insurance coverage the client is interested in, such as health, auto, or home insurance.

-

4.Provide details about the coverage limits and deductibles the client is considering, as these will impact the quote.

-

5.Indicate any specific client requirements or preferences, including additional coverage options.

-

6.Review the automatic calculations of the premiums to ensure accuracy based on the provided information.

-

7.Attach any necessary documentation or notes that might support the quote request, using the upload function if needed.

-

8.Finally, save the completed proposal and consider sharing it directly via email or printing it for face-to-face discussions with the client.

What is an Insurance Quote Proposal Template?

An Insurance Quote Proposal Template is a structured document that allows users to present insurance quotes in a clear and professional format. This template typically includes essential details like coverage options, premium amounts, and terms of service, making it easier for clients to understand their options. Utilizing an Insurance Quote Proposal Template helps streamline the quoting process for insurance agents and ensures consistency across proposals.

How can I customize an Insurance Quote Proposal Template?

Customizing an Insurance Quote Proposal Template is straightforward with pdfFiller. You can easily edit text fields, add logos, or include specific details relevant to the client’s needs. This flexibility ensures that every proposal can be tailored to reflect your brand and meet the specific requirements of each insurance quote, enhancing the overall client experience.

Why is using an Insurance Quote Proposal Template important for agents?

Using an Insurance Quote Proposal Template is crucial for agents because it saves time and promotes professionalism. A well-structured template ensures that all necessary information is presented efficiently, reducing errors and miscommunication. This, in turn, helps to build trust with potential clients by showcasing attention to detail and organization in the presentation of insurance options.

Where can I find an effective Insurance Quote Proposal Template?

You can find an effective Insurance Quote Proposal Template on the pdfFiller platform, which offers a variety of customizable templates tailored for the insurance industry. By exploring our extensive library, you can select one that best fits your needs and easily modify it to include specific information about your insurance offerings. This ensures you have a professional and compelling proposal ready to share with clients.

Can an Insurance Quote Proposal Template be shared electronically?

Yes, an Insurance Quote Proposal Template can be shared electronically, making it convenient for remote interactions or quick communications. pdfFiller allows you to send the completed template directly to clients via email or share it through a secure link. This capability not only speeds up the review process but also enhances client engagement by providing immediate access to their insurance quote.

Is it possible to track the status of an Insurance Quote Proposal Template after sending it?

Absolutely! With pdfFiller, you can easily track the status of an Insurance Quote Proposal Template after it has been sent. The platform provides real-time updates, allowing you to see when the document is viewed or signed by the client. This feature helps agents follow up effectively, maintaining a professional approach to client communication.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.