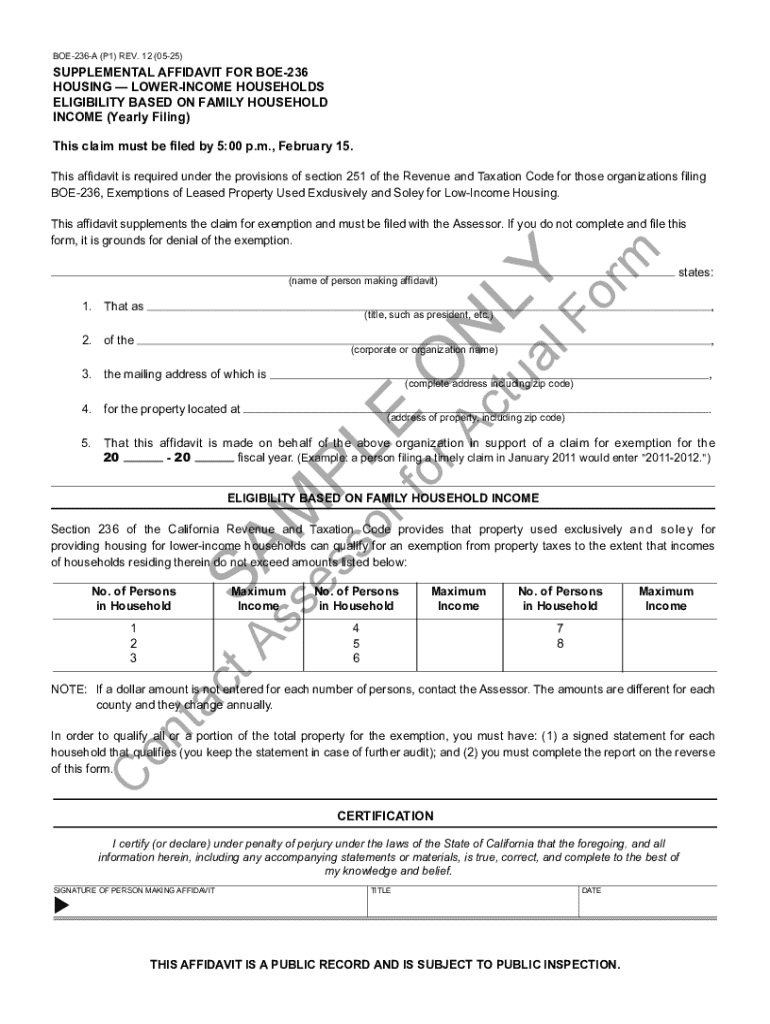

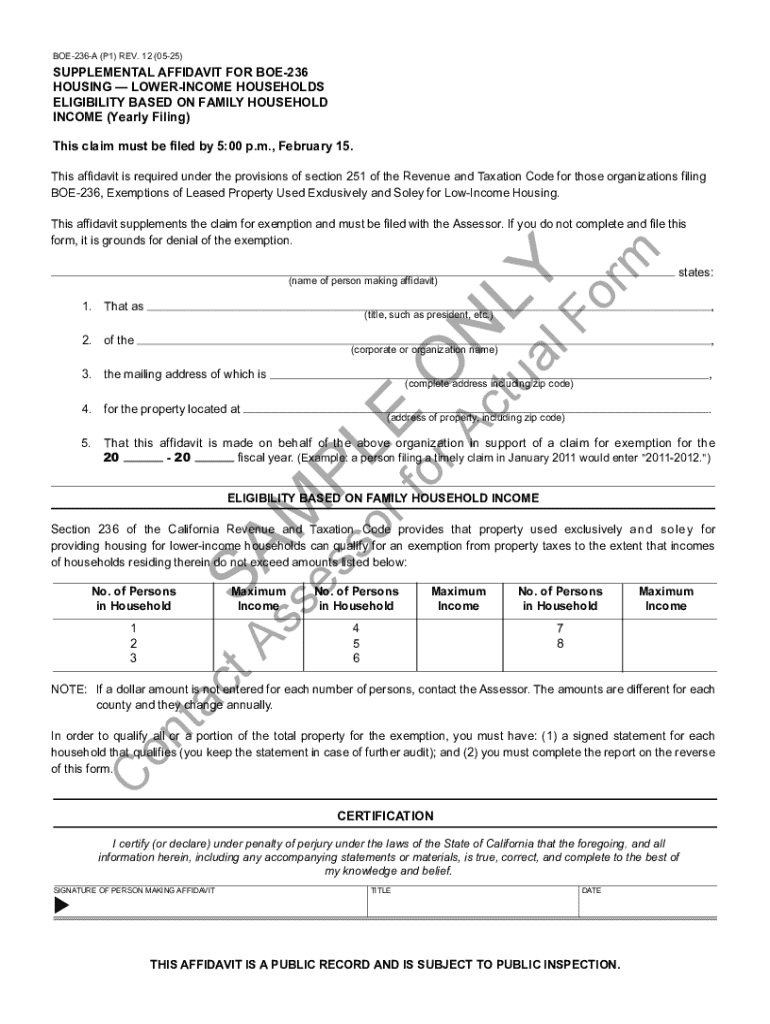

Get the free Contact Assessor for actual form - boe ca

Get, Create, Make and Sign contact assessor for actual

How to edit contact assessor for actual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contact assessor for actual

How to fill out contact assessor for actual

Who needs contact assessor for actual?

Contact Assessor for Actual Form: A Step-by-Step Guide

Understanding the role of an assessor

An assessor is a professional responsible for evaluating, determining, and providing final estimates of the value of properties or documents. Their assessments play a critical role in tax collections, property exchanges, and legal documentation. This expertise ensures that all valuations are accurate and unbiased, which is essential for both individual owners and larger organizations. The importance of accurate assessment cannot be overstated; incorrect valuations can lead to financial discrepancies, legal issues, and compliance violations.

Assessors contribute to document management, especially within the PDF editing process. They ensure that forms reflect the true value of the properties or items being assessed, which is pivotal when adjustments are necessary. Their insights into market trends and changes aid in creating documents that are reliable and maintain integrity.

When to contact an assessor

There are several scenarios when reaching out to an assessor is essential. Notably, when there are changes in property ownership—be it through sale or inheritance—it’s critical to have the assessment updated to reflect the new ownership status. Additionally, if there are disputes regarding property tax assessments, assessors must be contacted to reassess values, ensuring fair taxation.

Legal documentation often requires the input of an assessor as well. This includes situations where property deeds need to be rectified or verified. Contacting an assessor in a timely manner is crucial; deadlines for tax assessments, filings, or legal disputes emphasize the need for swift communication. Delays can result in missed deadlines and potential financial penalties, making it imperative to understand when and how to reach the appropriate assessor.

Steps to contact an assessor for your actual form

1. **Identifying your needs**: Begin by clearly defining what information you need from the assessor. Are you looking for a new assessment, an adjustment to an existing form, or clarification about a document? Knowing exactly what you want will streamline your communication.

2. **Gathering required documentation**: Prepare essential documents for reference; this includes previous assessments, identification, or any forms related to your query. Having everything organized will help the assessor address your needs swiftly.

3. **Finding contact information**: Locate the contact information for your local assessor’s office. This information can often be found on government websites or through local directories.

4. **Preparing your inquiry**: Write a clear and concise message explaining your request to the assessor. Include key questions and state your specific needs regarding the actual form.

5. **Making the contact**: Determine the best method to reach out—whether by phone, email, or an in-person visit. Effective communication includes being polite, direct, and prepared with your documentation for reference during the discussion.

What to expect from the assessor

After reaching out, typical response times can vary based on the assessor’s workload. On average, you can expect a reply within a week, but busy periods may result in longer waiting times. During your interaction, assessors may ask clarifying questions to provide accurate information. Understanding their processes helps you anticipate the steps they will take following your request.

It’s beneficial to remain patient yet proactive in following up if you haven’t heard back in a reasonable timeframe. Knowing the timelines and procedures can help you navigate these situations efficiently.

Utilizing pdfFiller for efficient document management

pdfFiller provides an innovative platform to enhance your document management experience when dealing with assessors. With interactive tools, you can easily prepare forms by integrating the necessary information into your documents. This not only makes the process of contacting an assessor straightforward but also ensures your documents are well-organized.

Additionally, pdfFiller’s eSigning capabilities allow for quick approvals of documents needing assessor validation. This feature expedites processes and eliminates any unnecessary delays. Collaboration features enable teams to work together effectively, making it easier to manage and store completed forms, ensuring everyone is on the same page throughout the assessment process.

Troubleshooting common issues with assessors

When facing discrepancies in assessments, contacting your assessor directly is the best way to address any misunderstandings. Be prepared to provide documentation supporting your viewpoint. If delays in response occur, follow up politely to express the urgency of your situation. Remember, the assessor might be managing numerous cases, so your understanding can go a long way.

After your initial contact, ensure you follow up if necessary. Keeping a line of communication open can facilitate smoother resolutions and ensure that your requests are processed in a timely manner.

Best practices for maintaining clear records

Documenting all conversations with assessors is crucial. This not only provides a record of your inquiries but also serves as a reference for future communication. Using pdfFiller, organizing files with tags and comments makes it easy to retrieve important documents. This can help ensure compliance with documentation standards and keep all necessary information at hand when dealing with assessors.

Regularly updating this information and making sure it is accessible ensures you are prepared for any follow-up needs or inquiries. In doing so, you contribute to a more effective management of your documentation processes and interactions with assessors.

Frequently asked questions about assessors and actual forms

If you cannot reach your assessor, alternatives include checking online resources or contacting a local government office that may assist you. Fees can vary based on where you live and the type of assessment requested, so inquire about potential costs during your initial contact.

Understanding the limits of an assessor’s authority is also key. They may not provide legal advice or interpret property laws; instead, they focus on property values and assessments. A clear understanding of these limits can help set appropriate expectations when contacting your assessor.

How pdfFiller enhances your document management experience

With tailored solutions for contacting assessors, pdfFiller simplifies the process of managing assessments and related documents. Users can access their documents anytime, anywhere, ensuring that they are always prepared for interactions with assessors. By creating a collaborative environment, teams can work together to streamline their assessment processes, boosting efficiency.

The powerful features offered by pdfFiller not only enhance your experience but also ensure that you are equipped with the best tools to handle your actual forms and assessments. This seamless integration of document management fosters a productive workflow and reduces the hassle often associated with managing assessments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete contact assessor for actual online?

How can I fill out contact assessor for actual on an iOS device?

Can I edit contact assessor for actual on an Android device?

What is contact assessor for actual?

Who is required to file contact assessor for actual?

How to fill out contact assessor for actual?

What is the purpose of contact assessor for actual?

What information must be reported on contact assessor for actual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.