Get the free California State Tax Replacement Check Guide After Bank ...

Get, Create, Make and Sign california state tax replacement

How to edit california state tax replacement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california state tax replacement

How to fill out california state tax replacement

Who needs california state tax replacement?

California State Tax Replacement Form - How-to Guide

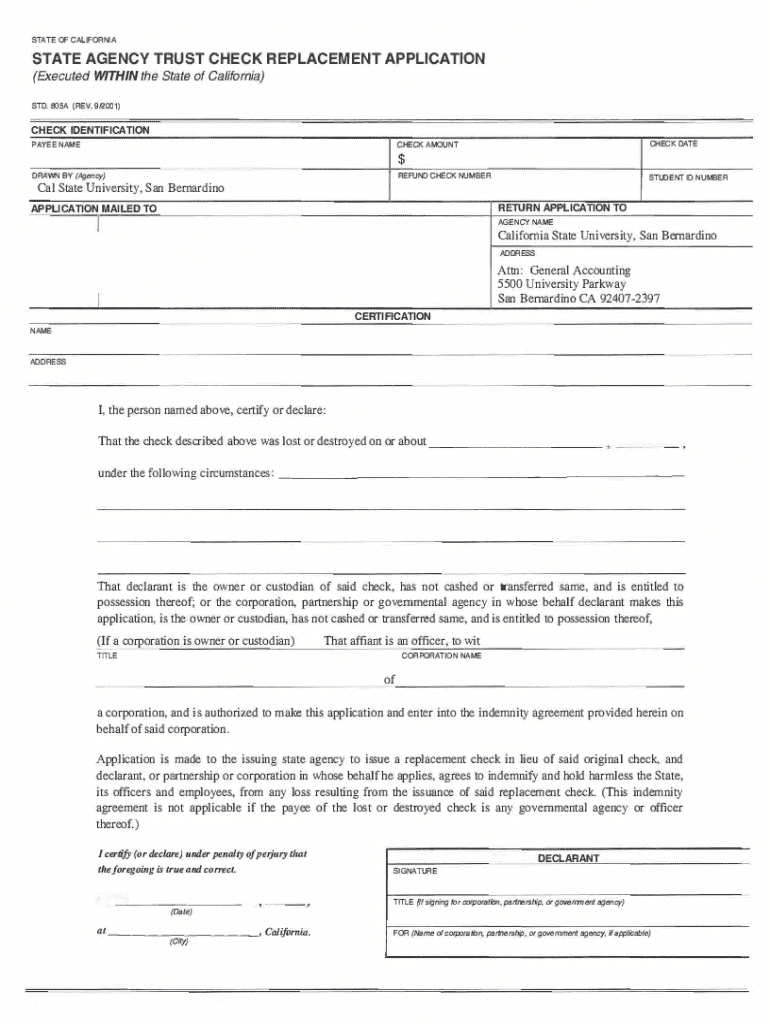

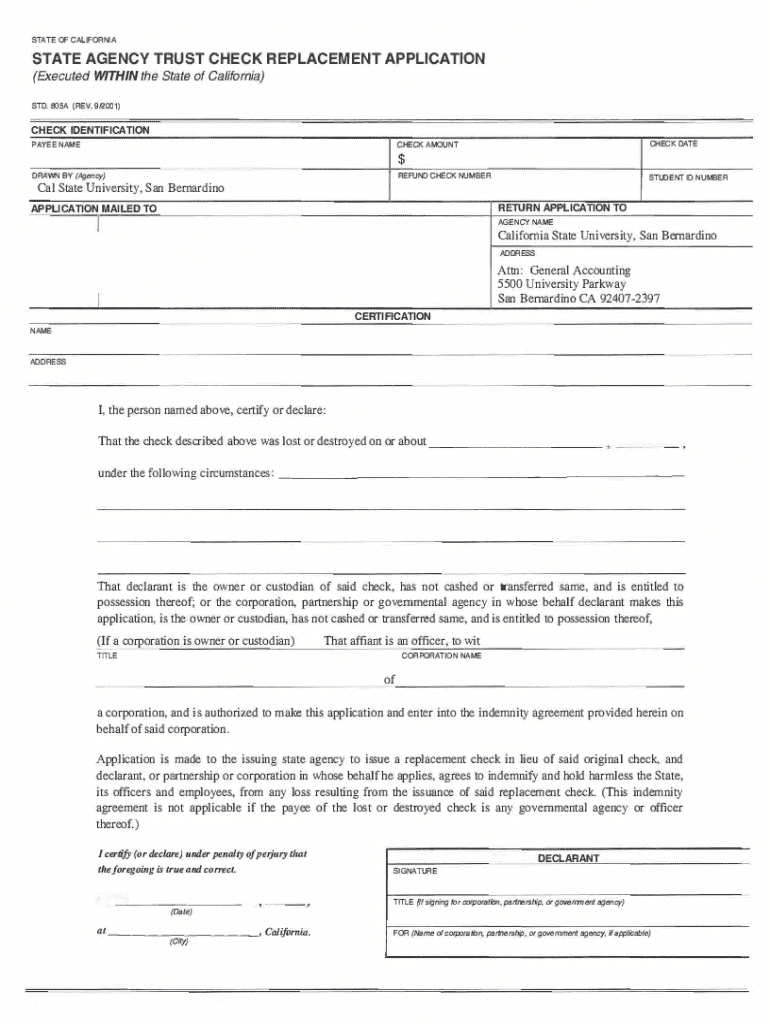

Understanding the California State Tax Replacement Form

The California State Tax Replacement Form is a specific document designed to streamline the process of replacing lost, misplaced, or otherwise incompletely submitted income tax returns. This form serves an essential purpose: it allows California residents to ensure that their tax records are accurate and up-to-date, facilitating a smoother communication process with the California Franchise Tax Board (FTB).

Individuals who find themselves in need of a replacement form include those who have received notifications of missing documents or discrepancies in their submitted tax returns. Additionally, anyone who has experienced a significant life change—such as marriage, divorce, or relocation—might also find that their previous forms no longer reflect their current circumstances. Ultimately, the key reasons for submitting a replacement form revolve around accuracy, compliance, and ensuring that the state possesses the most current information regarding an individual's financial status.

Key features of the California State Tax Replacement Form

One significant advantage of using pdfFiller’s platform is the ease of access and use it provides for filling out the California State Tax Replacement Form. The platform allows users to access the form directly from any location, eliminating the hassle of paper forms or complicated filing procedures. This convenience empowers users to efficiently manage their tax-related documents.

Furthermore, pdfFiller features a range of interactive tools that make the process of completing the replacement form seamless. Users can easily navigate through different sections of the form, utilizing auto-fill capabilities and prompts that ensure no fields are left unattended. The ability to eSign directly within the platform enhances security and expedites the submission process. Additionally, collaboration options are available for teams, allowing multiple users to review, edit, and approve the document before final submission.

Step-by-step instructions for filling out the replacement form

Successfully completing the California State Tax Replacement Form involves a series of structured steps. To start, gathering necessary information is paramount. Required personal details typically include your name, Social Security number, and any pertinent financial information relevant to your income tax return. To ensure you’re fully prepared, having documentation like your previous tax return, W-2s, and any correspondence from the FTB on hand is crucial.

Next, you must create an account on pdfFiller. This process is straightforward—simply visit their website and sign up. The cloud-based solution offers a multitude of features, enabling you to store and access your documents anytime, anywhere. Once your account is set up, accessing the California State Tax Replacement Form is easy. Follow these steps: navigate to the forms section, type 'California State Tax Replacement Form' in the search bar, and select the correct option.

Now, moving on to filling out the form, key sections include your identifying information and the reason for requesting a replacement. Make sure to provide all data accurately to avoid common pitfalls, such as listing incorrect amounts or dates. After inputting your information, take a moment to thoroughly review your entries for accuracy and completeness. Utilize pdfFiller’s review tools to help identify any errors before eSigning the form.

Finally, eSigning the form is straightforward. Use pdfFiller’s secure eSignature tool to add your signature digitally. If collaborating with team members, utilize the sharing features to obtain all necessary approvals before finalizing the document.

Managing and submitting your replacement form

Once you’ve filled out and signed your California State Tax Replacement Form, managing and storing the document is crucial. pdfFiller offers robust document management solutions, allowing you to save and store your document securely in the cloud. This component is especially vital for ongoing accessibility and organization, ensuring that your tax records remain structured and retrievable whenever needed.

Submitting your replacement form can be done in several ways. You may decide to submit online through the FTB’s secure portal, or send a physical copy via mail to the appropriate address indicated on the form. Remember to take note of deadlines conforming to California tax laws—being aware of these dates can save you from penalties and complications down the road.

Troubleshooting common issues

While utilizing the California State Tax Replacement Form, you might encounter various issues. Common problems include difficulties in filling out specific sections, issues with the eSigning process, or uncertainties surrounding submission guidelines. Should these issues arise, reaching out to support through pdfFiller is available. Their customer service team is equipped to assist you with problems and guide you toward successful completion.

Additionally, pdfFiller provides a wealth of resources, including FAQ sections and step-by-step tutorials, which can help mitigate some of these obstacles. Familiarizing yourself with these materials can save you time and frustration while completing your form.

Additional related forms and resources

Understanding that other forms may also be necessary for your tax filings is essential. Popular forms related to tax submissions include the California Income Tax Return, Request for Taxpayer Identification Number, and various deduction-related documents. Being equipped with knowledge about these forms helps ensure compliance and simplicity in your overall tax preparation process.

For comprehensive guidance, pdfFiller links to various publications and documents that can further assist with understanding not just the replacement form but the entire spectrum of tax-related documentation. Leveraging these resources can enhance your awareness and preparation significantly.

Staying updated on California tax regulations

It's vital for California residents to stay informed about any changes in tax regulations that may impact their submissions, including the California State Tax Replacement Form. pdfFiller offers several tools to help you keep track of relevant updates. By subscribing to notifications or regularly checking their educational resources, you can ensure you remain compliant with state laws.

In addition, understanding how updates to tax regulations may impact the California State Tax Replacement Form can assist in preparing you for any necessary adjustments in your submissions. Changes often influence income tax return requirements, formatting, and instructions, which means being aware of these developments can enhance your filing experience.

Best practices for document management with pdfFiller

Engaging with a collaborative strategy for managing documents is crucial, especially when dealing with important forms like the California State Tax Replacement Form. pdfFiller is designed to enable teams to create, edit, and manage documents effectively. By establishing clear communication pathways, you can ensure all members are on the same page regarding document updates and changes.

Furthermore, maintaining organized tax records is essential for compliance and simplified auditing processes. pdfFiller facilitates this by offering cloud storage solutions that allow for easy retrieval and review of past submissions. Consistently categorizing and tagging documents ensures you can locate what you need in an instant, making tax management a less daunting task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find california state tax replacement?

Can I create an electronic signature for the california state tax replacement in Chrome?

How can I edit california state tax replacement on a smartphone?

What is california state tax replacement?

Who is required to file california state tax replacement?

How to fill out california state tax replacement?

What is the purpose of california state tax replacement?

What information must be reported on california state tax replacement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.