Get the free Connecticut Third Party Designation Request

Get, Create, Make and Sign connecticut third party designation

Editing connecticut third party designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out connecticut third party designation

How to fill out connecticut third party designation

Who needs connecticut third party designation?

Understanding the Connecticut Third Party Designation Form

Understanding the Connecticut third party designation form

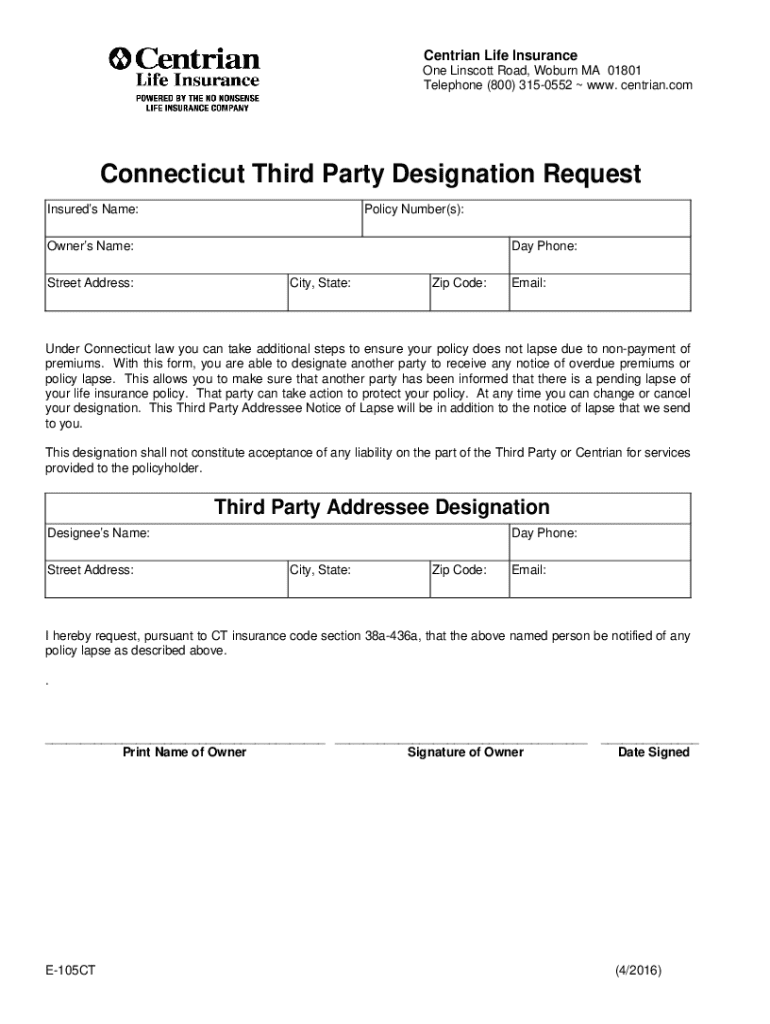

The Connecticut third party designation form is a legal document that allows an individual to designate a third party to receive information about their financial accounts or legal matters. This form serves several purposes, providing assurance that chosen individuals can be notified concerning important changes or decisions, especially in situations where the account holder may be unable to act.

In Connecticut, this form is particularly important for residents who maintain banking accounts, investment accounts, and various insurance policies. It creates an additional layer of communication and support for individuals who may need someone else to manage their financial affairs or to be kept in the loop regarding critical updates.

Who might need this form?

The Connecticut third party designation form is beneficial for anyone managing finances. Individuals may include seniors who require assistance with their accounts, caretakers, or family members overseeing financial obligations. Moreover, organizations that manage multiple accounts may utilize this form to streamline communications among various stakeholders.

Estate planners and advisors also find this form essential, as it allows them to keep families informed about any changes in investments or policies that pertain to an estate plan. By using a third party designation, individuals empower trusted people to engage in important financial matters when needed.

Legal framework in Connecticut

Connecticut has specific laws that govern third party designations. According to Connecticut General Statutes, several sectors, including banking and insurance, recognize the validity of third party designations. These statutes ensure that financial institutions must accept and respect third party designation forms, providing legal backing for the designated individual.

Moreover, the Connecticut Department of Banking oversees regulations surrounding these forms to protect consumer rights. It’s essential to understand how these laws apply within your specific context, especially if there are disputes or challenges regarding the designation’s validity.

Key benefits of designating a third party

Designating a third party offers numerous benefits that improve individual financial management and security. One of the most significant advantages is enhanced security and accountability. By designating a trusted individual, you ensure that someone knowledgeable can make informed decisions or take action when necessary, thereby safeguarding your interests.

Furthermore, streamlined communication between financial institutions and designated parties reduces confusion and miscommunication over important changes or updates. This flexibility empowers individuals by allowing them to plan for future needs and appoint someone who understands their financial goals and can support them accordingly.

Step-by-step guide to completing the Connecticut third party designation form

Completing the Connecticut third party designation form requires careful attention to detail. Here’s a step-by-step guide to ensure accuracy and compliance.

Managing your third party designation

After your Connecticut third party designation form is complete and submitted, ongoing management is vital. Regular updates to your designation should occur in line with your personal circumstances, such as changes in relationships, changes in health status, or significant financial shifts.

Keeping comprehensive records of your designations is also crucial. These records serve as legal references, providing clarity and a paper trail should the need arise to validate the designations.

Utilizing pdfFiller for your document needs

pdfFiller offers a seamless platform for managing your Connecticut third party designation form. With its user-friendly interface, you can fill and edit the form with ease, ensuring that the process remains hassle-free and efficient. Additionally, pdfFiller allows you to access your files from anywhere, which is particularly useful for individuals or teams that need to work remotely.

Collaboration is made easy with pdfFiller’s cloud capabilities. Teams can share the form for review and discussion, enabling simultaneous editing and ensuring everyone is on the same page. This feature is especially valuable when multiple stakeholders manage accounts or policies, further streamlining the process.

Common FAQs about the Connecticut third party designation form

Many questions arise regarding the Connecticut third party designation form. Addressing common concerns can alleviate confusion and ensure proper use of the document.

Best practices for Connecticut residents navigating third party designation

When dealing with third party designations, it's essential to practice clear communication. Be explicit about what the designation entails, limits, and communicate these details to both your designated parties and financial institutions. Consulting with professionals in estate planning or financial management ensures compliance with local laws and best practices.

Remaining informed about any legislative changes that could impact third party designations is crucial. This insight ensures that your financial and estate planning remains robust and current, addressing newly enacted laws that could alter the landscape.

Final notes on the importance of third party designations in Connecticut

Third party designations play a vital role in financial and estate planning, providing a safety net for individuals and ensuring that their interests and endeavors are respected. It's about empowering individuals to take charge of their financial journeys while protecting their interests, particularly during times of uncertainty.

Understanding the importance of these designations and utilizing the Connecticut third party designation form correctly enhances communication and promotes security for all involved parties.

Related topics and further exploration

Expanding your knowledge of related topics can further enrich your understanding of financial management and estate planning. Subjects such as the power of attorney in Connecticut, the role of trusts in estate planning, and frequently asked questions on life insurance beneficiary designations are interconnected with third-party designations and provide added insights into managing your financial affairs.

About pdfFiller

pdfFiller supports users through efficient document management, enabling them to edit PDFs, eSign, and collaborate on documents easily. Its cloud-based platform empowers individuals and teams to streamline their document-handling processes effectively, making it a vital tool for managing forms like the Connecticut third party designation form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit connecticut third party designation from Google Drive?

How do I edit connecticut third party designation online?

How do I fill out connecticut third party designation on an Android device?

What is connecticut third party designation?

Who is required to file connecticut third party designation?

How to fill out connecticut third party designation?

What is the purpose of connecticut third party designation?

What information must be reported on connecticut third party designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.