Get the free Connecticut Department of Revenue R824 Sample 1

Get, Create, Make and Sign connecticut department of revenue

Editing connecticut department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out connecticut department of revenue

How to fill out connecticut department of revenue

Who needs connecticut department of revenue?

A Comprehensive Guide to Connecticut Department of Revenue Forms

Overview of Connecticut Department of Revenue Forms

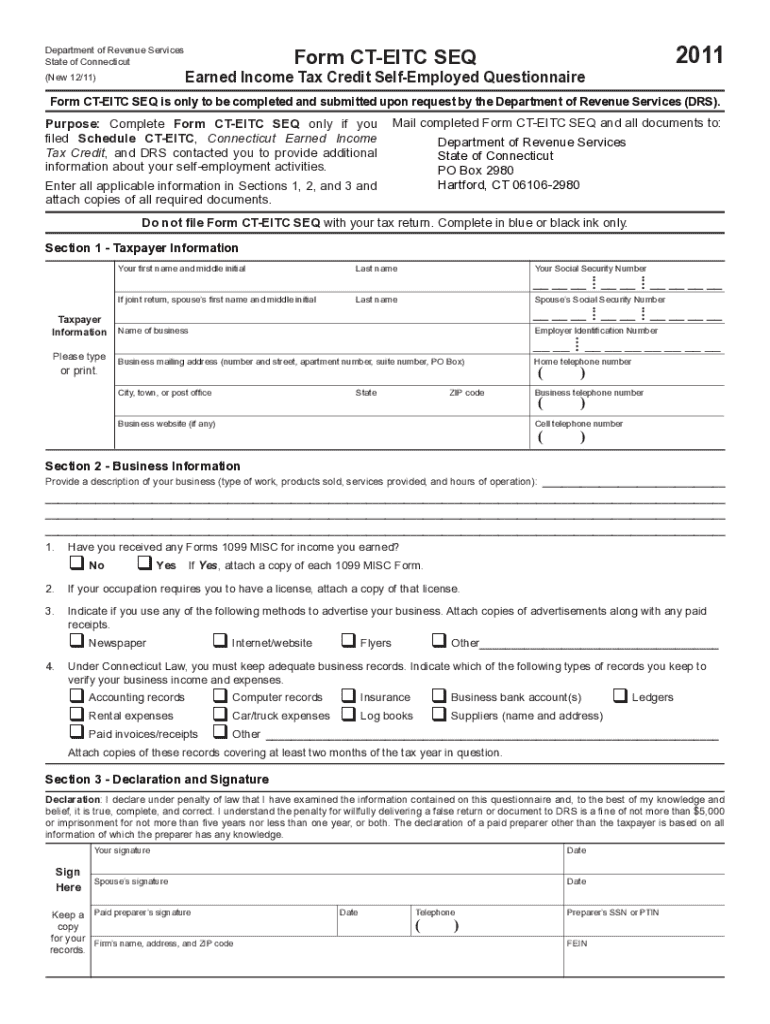

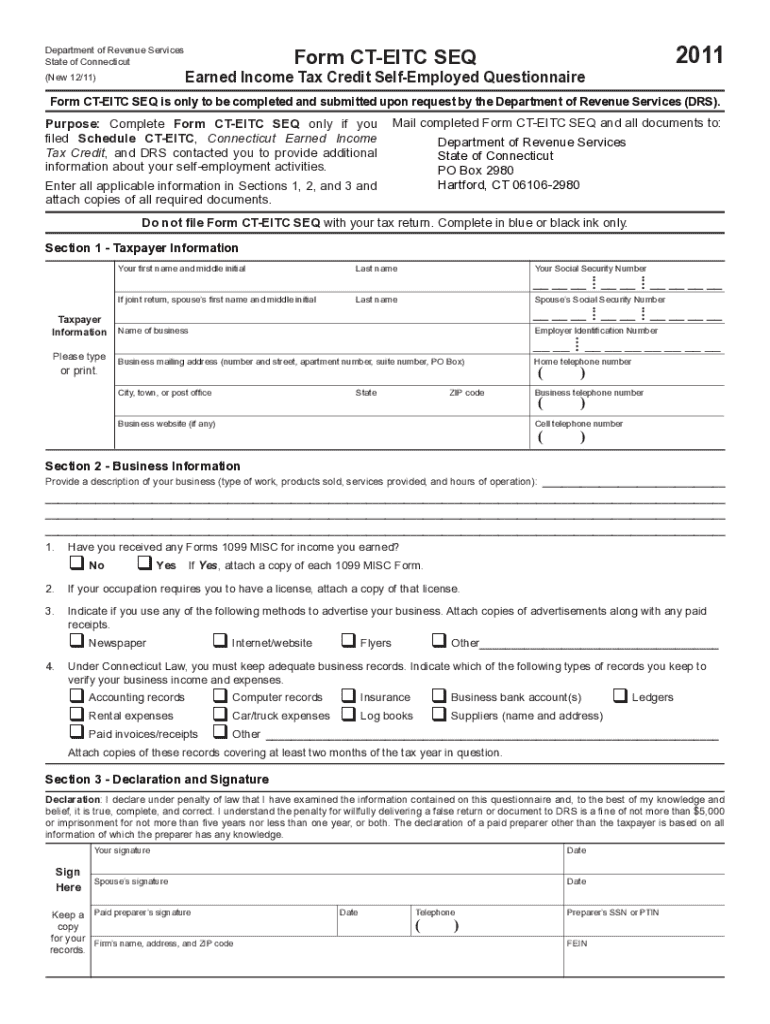

Connecticut Department of Revenue forms serve as crucial documents that individuals and businesses must fill out for tax compliance in the state. These forms provide the necessary platform for reporting income, deductions, and credits to the state government. Understanding these forms is essential to ensure that every taxpayer meets their obligations, thus avoiding potential penalties or audits.

Accurate completion of these forms not only reflects a taxpayer's financial situation but also plays a pivotal role in the state’s revenue collection processes. Inaccuracies or delays in filing could result in significant financial repercussions, highlighting the importance of thoroughness and attention to detail.

Key Connecticut Revenue Forms

Navigating the various forms required by the Connecticut Department of Revenue can be overwhelming. Here is a breakdown of the essential forms every taxpayer should be aware of:

An interactive tool available on the Connecticut Department of Revenue website allows users to quickly locate the appropriate form based on specific circumstances. Whether you are filing as an individual, a business, or claiming specific deductions, this tool streamlines the process.

Commonly viewed tax types

Tax categories are vital in understanding the forms you’ll need to fill out. Here is a brief overview of the major tax types in Connecticut, with commonly filed forms for each:

Step-by-step guide to completing Connecticut tax forms

Completing Connecticut tax forms necessitates a well-organized approach. Here’s how you can effectively fill out your tax forms:

Gather required information

Start by compiling all necessary personal and financial information. Key details you need to include are your Social Security Number, home address, and filing status. It's crucial to have your financial documents ready, such as W-2 forms from your employers, 1099s if you have freelance income, and any other documents that illustrate your financial situation.

Utilizing interactive tools on pdfFiller

For ease of completion, pdfFiller offers an intuitive way to access fillable PDF forms. Users can leverage the platform to fill out forms electronically without the need for printing and scanning.

To use pdfFiller, navigate to the form you want, select the fillable option, and begin entering your information. The platform allows for convenient revisions, enabling you to correct any errors directly.

Tips for filling out forms accurately

One of the most significant challenges when completing tax forms is ensuring accuracy. Common pitfalls include numerical errors or omitting vital information. To avoid these mistakes, always double-check your entries before submission. Utilize calculator features, if available, to verify your figures.

Guidance on form submission

Submitting your completed forms can be done through several methods, each with its own benefits. Choosing the correct submission method aligns with ensuring your forms reach the Connecticut Department of Revenue without unnecessary delays.

Methods of submission

You can either e-file your tax forms via secure online platforms or mail them as paper documents. E-filing is often deemed superior due to its efficiency; pdfFiller provides seamless e-filing options that minimize errors and expedite processing times.

Deadlines and important dates

It's crucial to be aware of filing deadlines, as late submissions can incur penalties or interest charges. Typically, individual tax returns are due by April 15th. It's advisable to check the Connecticut Department of Revenue website for specific dates, as they may vary year by year.

Editing and managing forms with pdfFiller

Managing your tax forms effectively can save time and ensure you stay organized. pdfFiller offers advanced editing features that allow users to make changes post-completion, which is particularly beneficial if you discover new financial information.

Advanced editing features

With pdfFiller, adding electronic signatures to your forms comes easily, ensuring compliance without the hassle of printing. Additionally, collaboration tools allow for team reviews, perfect for businesses needing multiple inputs on tax liabilities.

Storing and retrieving forms

The platform also boasts cloud-based document management that helps users keep their tax forms organized and easily accessible. This feature is particularly useful when you need to retrieve past submissions quickly, such as during audits or when applying for funding SNAP benefits.

Frequently asked questions (FAQs)

Tax forms can generate numerous questions from the public. Here are some common inquiries regarding Connecticut tax forms:

Tax tables and calculators

Understanding the tax rates that apply to your income bracket can provide significant clarity alongside your forms. The state offers various tax tables to calculate your obligations accurately.

Moreover, utilizing interactive calculators can greatly assist in estimating the taxes owed. These tools streamline the planning process for upcoming tax years, ensuring you're better informed and prepared.

Special considerations

Certain situations may necessitate additional considerations for tax filings in Connecticut. For example, self-employed individuals need to track various expenses and be aware of personal deductions they can claim.

Contact information for assistance

If you require knowledgeable assistance regarding your forms or specific inquiries, the Connecticut Department of Revenue offers valuable resources. Their website includes a contact section for inquiries about forms or filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute connecticut department of revenue online?

How do I fill out the connecticut department of revenue form on my smartphone?

How do I edit connecticut department of revenue on an Android device?

What is connecticut department of revenue?

Who is required to file connecticut department of revenue?

How to fill out connecticut department of revenue?

What is the purpose of connecticut department of revenue?

What information must be reported on connecticut department of revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.