Get the free CONDUCTOR CAPITAL MANAGEMENT, LLC

Get, Create, Make and Sign conductor capital management llc

Editing conductor capital management llc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out conductor capital management llc

How to fill out conductor capital management llc

Who needs conductor capital management llc?

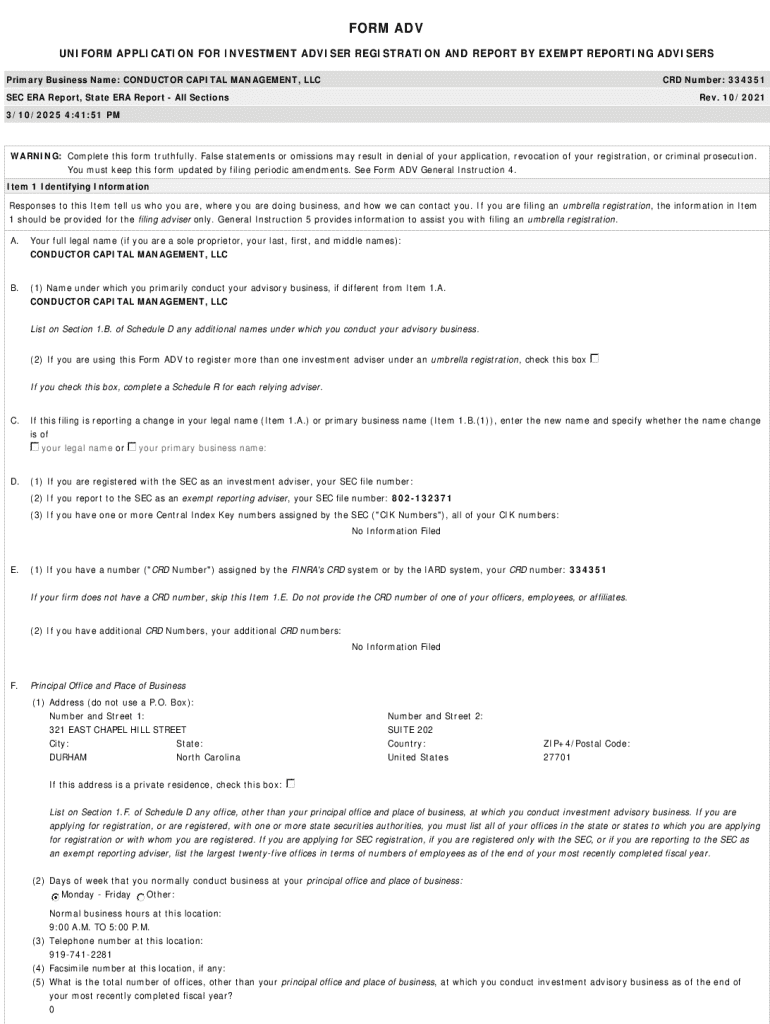

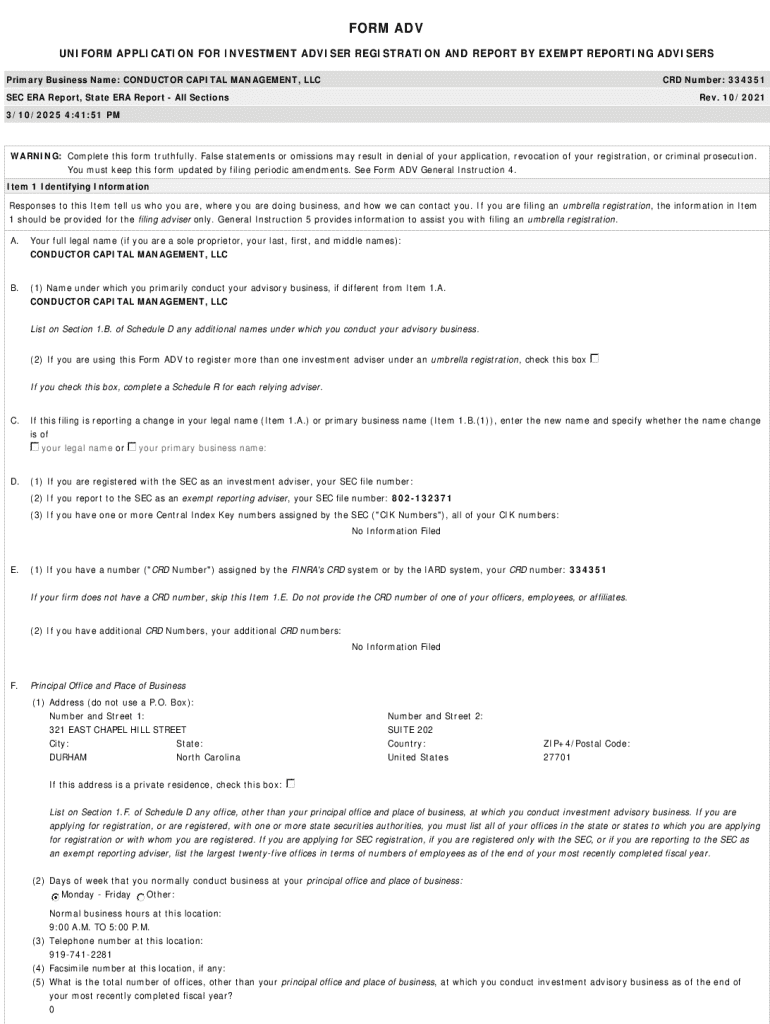

Understanding the Conductor Capital Management Form

Overview of conductor capital management form

The Conductor Capital Management LLC form serves as a vital document in the foundation and management of Limited Liability Companies (LLCs) focused on capital management. This form outlines the capital structure of an LLC, detailing how funds will be managed, contributed, and distributed among members. Its primary importance lies in providing a clear framework for financial collaboration and governance, fostering transparency and accountability among members, especially crucial when dealing with collective investments in various asset categories such as hedge funds or ETFs.

Common applications of this form include the establishment of investment clubs, venture capital firms, and other financial entities where collective capital raises are a fundamental aspect. It's not just a regulatory requirement; it also serves as a strategic tool for effective management of capital within an increasingly competitive investment landscape.

Understanding the components of the conductor capital management form

Delving into the Conductor Capital Management LLC form, we find that it consists of several key sections, each designed to address specific aspects of capital management within the LLC framework. These components include an Executive Summary, Capital Contributions, Distribution of Profits and Losses, and Management Structure. Together, they provide comprehensive insights regarding the financial operations of the LLC.

Each of these components plays an integral role in ensuring that the LLC functions smoothly, especially in managing portfolios and capital raises effortlessly.

Step-by-step guide to filling out the conductor capital management form

Filling out the Conductor Capital Management LLC form can appear daunting at first glance. However, by breaking it down into manageable steps, anyone can successfully complete it. The first step is to gather all necessary information, which includes identifying member details, financial contributions, and any agreements regarding profit distribution.

Effective strategies for checking your entries include having a second pair of eyes review the form or utilizing digital tools to catch any missing information that could lead to compliance issues.

Interactive tools for form management

In today’s digital world, the ability to manage forms effectively is paramount. pdfFiller offers a suite of interactive tools designed for managing the Conductor Capital Management LLC form seamlessly. These tools enhance the experience of filling out, signing, and managing documents, which can be particularly beneficial for teams that need to collaborate on form completion.

Common mistakes to avoid when using the conductor capital management form

Completing the Conductor Capital Management LLC form requires careful attention to detail. Common errors include missing essential information, incorrectly calculating capital contributions or profit distributions, and failing to update fiscal details that affect compliance. Such oversights can result in serious complications, not only jeopardizing member trust but also leading to regulatory issues that could impact operations.

By consciously avoiding these mistakes, you can enhance the smooth operation of your LLC and foster a positive environment for all members involved.

Frequently asked questions about the conductor capital management form

Navigating the complexities of the Conductor Capital Management LLC form may generate questions. It’s important to be informed to ensure a successful management experience. Here are some common queries addressed.

Conductor capital management form best practices

When managing the Conductor Capital Management LLC form, adhering to best practices can lead to significant improvements in efficiency and compliance. Regular updates to the form in line with operational changes can enhance accuracy, demonstrating responsible management of capital.

Implementing these best practices can aid in maintaining a robust capital management strategy that supports longevity and viability for your LLC.

Resources for additional help

For those seeking further assistance with the Conductor Capital Management LLC form, various resources are available. Accessing relevant regulations and statutes is crucial, as they can provide clarity on any legal obligations that must be met.

Taking advantage of these resources can further enhance your ability to effectively navigate the Conductor Capital Management LLC process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify conductor capital management llc without leaving Google Drive?

How do I edit conductor capital management llc online?

How do I fill out the conductor capital management llc form on my smartphone?

What is conductor capital management llc?

Who is required to file conductor capital management llc?

How to fill out conductor capital management llc?

What is the purpose of conductor capital management llc?

What information must be reported on conductor capital management llc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.