Get the free For tax-exempt organizations, cooperatives, homeowners associations, and political o...

Get, Create, Make and Sign for tax-exempt organizations cooperatives

Editing for tax-exempt organizations cooperatives online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for tax-exempt organizations cooperatives

How to fill out for tax-exempt organizations cooperatives

Who needs for tax-exempt organizations cooperatives?

Tax-Exempt Organizations Cooperatives Form: A Comprehensive How-to Guide

Understanding tax-exempt organizations and cooperatives

Tax-exempt organizations play a vital role in the economy, allowing certain entities to operate without the burden of federal income taxes. The IRS grants this status to organizations that meet specific criteria, which includes charitable, religious, educational, and social purposes. For cooperatives, obtaining tax-exempt status is essential, as it allows them to provide lower-cost services to their members while reinvesting revenues back into the community.

A tax-exempt cooperative must serve specific member interests, and the benefits that come from this status can include exemptions from certain taxes, increased fundraising opportunities, and eligibility for grants. Understanding these qualifications is key for cooperatives seeking to maximize their impact on the communities they serve.

Key IRS forms for tax-exempt organizations

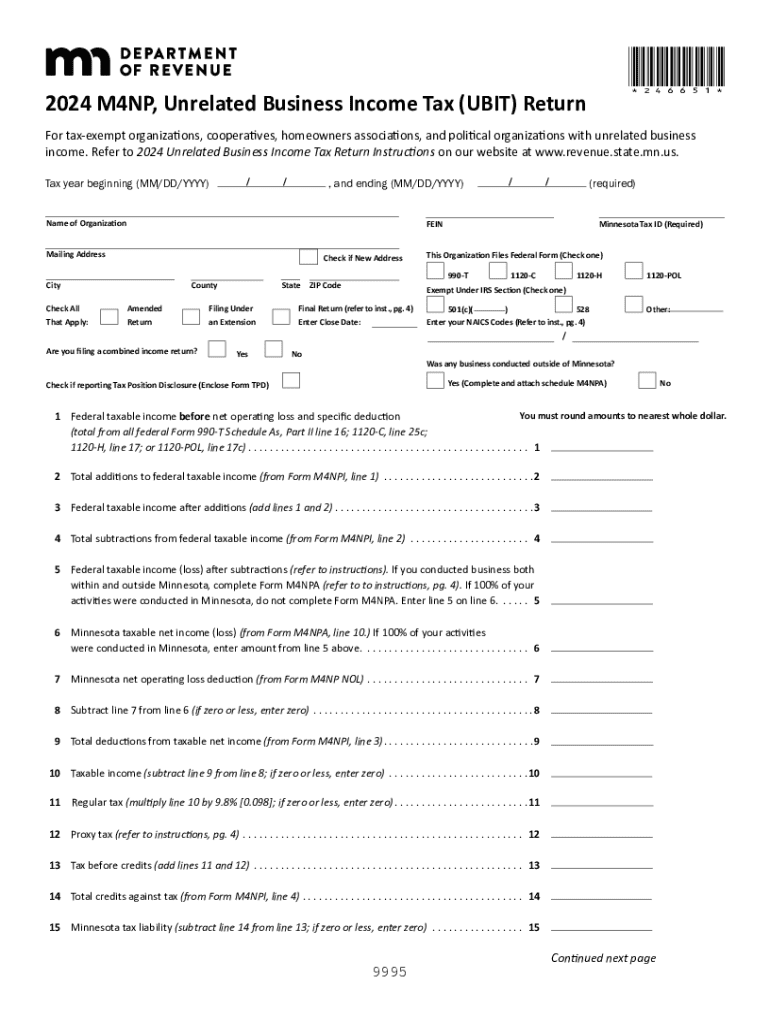

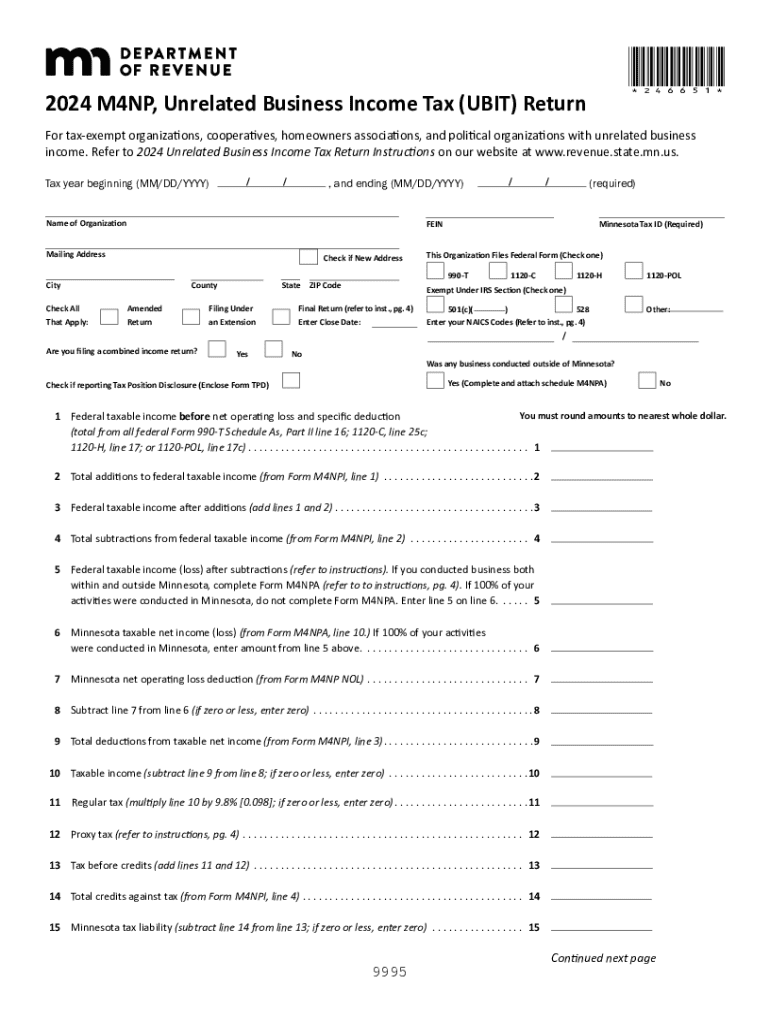

The cornerstone of compliance for tax-exempt organizations is IRS Form 990. This form serves as an annual information return, disclosing the organization’s financial complexities, governance, and operational activities. It is utilized by organizations with gross receipts surpassing $200,000 or total assets exceeding $500,000. Depending on size and revenue, organizations may need to file different variations of the form: Form 990, Form 990-EZ, or Form 990-N.

Filing these forms accurately is critical, as discrepancies can lead to penalties and even the loss of tax-exempt status. Compliance requirements not only demand detailed financial reporting but also transparency about executive compensation and governance practices, which are especially pertinent for cooperatives with a focus on member service.

Step-by-step guide to completing the Tax-Exempt Organizations Cooperatives Form

Before filling out the Tax-Exempt Organizations Cooperatives Form, gather all necessary documents and financial statements, including income statements, balance sheets, and member records. Utilizing pdfFiller can streamline this process, allowing for efficient document preparation. The form requires precise reporting in various sections, and familiarizing yourself with the guidelines can prevent missteps.

Let’s break down the specific sections you need to tackle systematically.

Strategies for successful filing and maintenance

Collaboration is key when completing the Tax-Exempt Organizations Cooperatives Form, as drawing collective input can significantly enhance accuracy and completeness. pdfFiller allows teams to work together effectively, sharing drafts and providing inputs digitally, thus streamlining the approval process. Regular communication among all stakeholders in the cooperative enhances transparency and ensures that everyone is informed, especially regarding compliance matters.

In addition to team collaboration, best practices for document management are crucial. PdfFiller enables users to store critical documents securely. Keeping updated files, maintaining clear records of all cooperative activities, and ensuring document accessibility protects against potential compliance issues.

Common challenges and solutions

Navigating IRS regulations can present significant hurdles for cooperatives seeking tax-exempt status. Many organizations face challenges such as incomplete records, misunderstood instructions, or misclassification of their services. These issues can lead to delays in approval or, worse yet, the revocation of tax-exempt status. Ensuring all members are aware of their roles and responsibilities regarding compliance can reduce the incidence of these challenges.

Staying informed about changing tax laws is equally vital. Continuous education through relevant workshops, webinars, and the latest IRS publications can equip members with the knowledge necessary to avoid compliance pitfalls. Digital solutions such as pdfFiller offer updates and notifications to remain aware of upcoming deadlines and changes that may affect the cooperative’s tax-exempt status.

Interactive tools for form completion

Using pdfFiller enhances your experience with the Tax-Exempt Organizations Cooperatives Form. The platform is equipped with features that allow users to edit forms directly, sign electronically, and share the documents seamlessly. These functionalities save time and reduce errors during the form completion process.

Incorporating templates into your workflow can also streamline the process. With pdfFiller, cooperatives can set up templates specific to their needs, simplifying repetitive tasks, and automating compliance checks. Moreover, digital document management serves to automate reminders for recurrent filings and helps maintain a comprehensive overview of organizational finances.

Real-life case studies and examples

Analyzing successful compliance practices from leading cooperatives can provide valuable insights into the best strategies for tax-exempt organizations. Extremely efficient cooperatives share characteristics such as strong community ties, comprehensive resource management systems, and proactive compliance measures. These organizations often maintain regular communication with members about financial matters and are transparent in their governance.

On the other hand, learning from common mistakes is equally instructive. Instances where cooperatives misfiled their forms or failed to collect adequate revenue documentation highlight the consequences of neglecting compliance. Such experiences underscore the importance of thorough record-keeping, establishing clear governance protocols, and leveraging user-friendly technologies like pdfFiller to enhance accuracy and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my for tax-exempt organizations cooperatives directly from Gmail?

How can I modify for tax-exempt organizations cooperatives without leaving Google Drive?

Can I sign the for tax-exempt organizations cooperatives electronically in Chrome?

What is for tax-exempt organizations cooperatives?

Who is required to file for tax-exempt organizations cooperatives?

How to fill out for tax-exempt organizations cooperatives?

What is the purpose of for tax-exempt organizations cooperatives?

What information must be reported on for tax-exempt organizations cooperatives?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.