Get the free American - DEADLINE EXTENDED! #AASL25 is accepting ...

Get, Create, Make and Sign american - deadline extended

Editing american - deadline extended online

Uncompromising security for your PDF editing and eSignature needs

How to fill out american - deadline extended

How to fill out american - deadline extended

Who needs american - deadline extended?

Understanding the American Deadline Extended Form: A Comprehensive Guide

Understanding the American deadline extended form

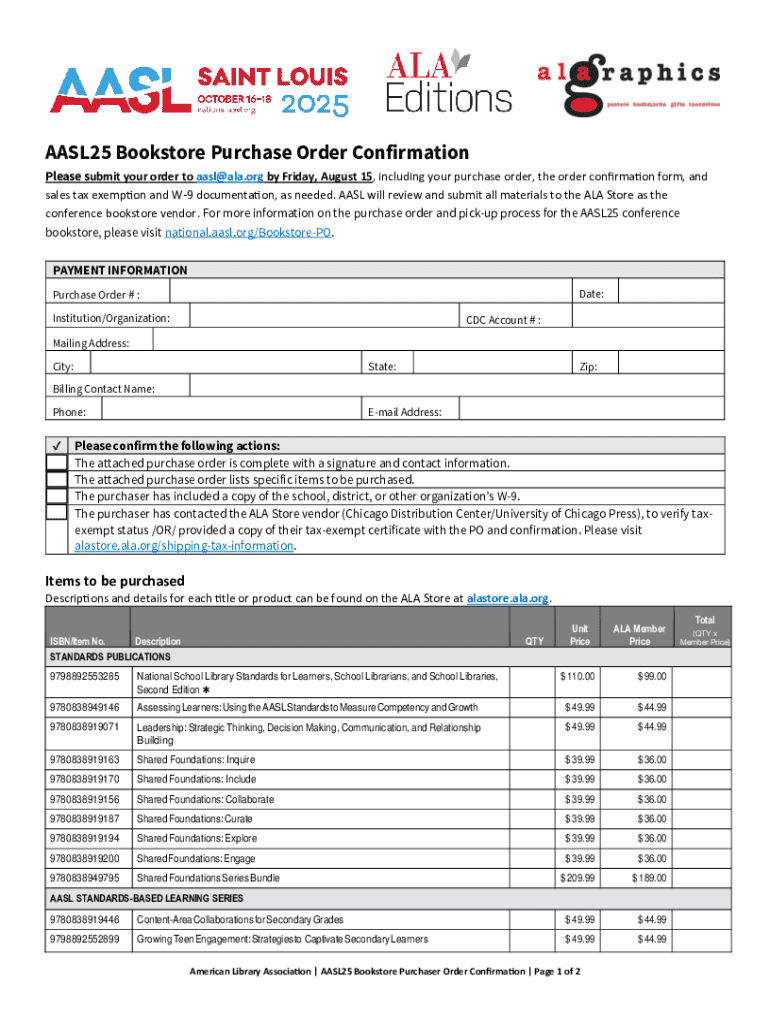

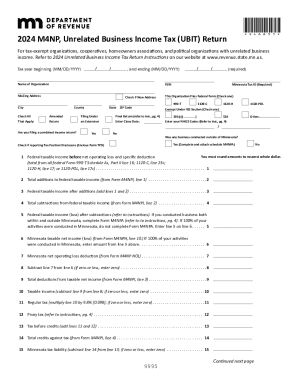

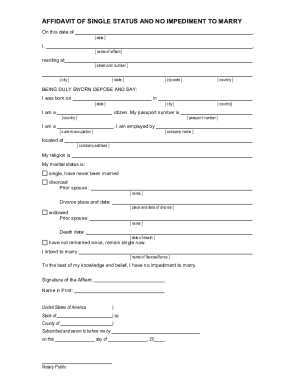

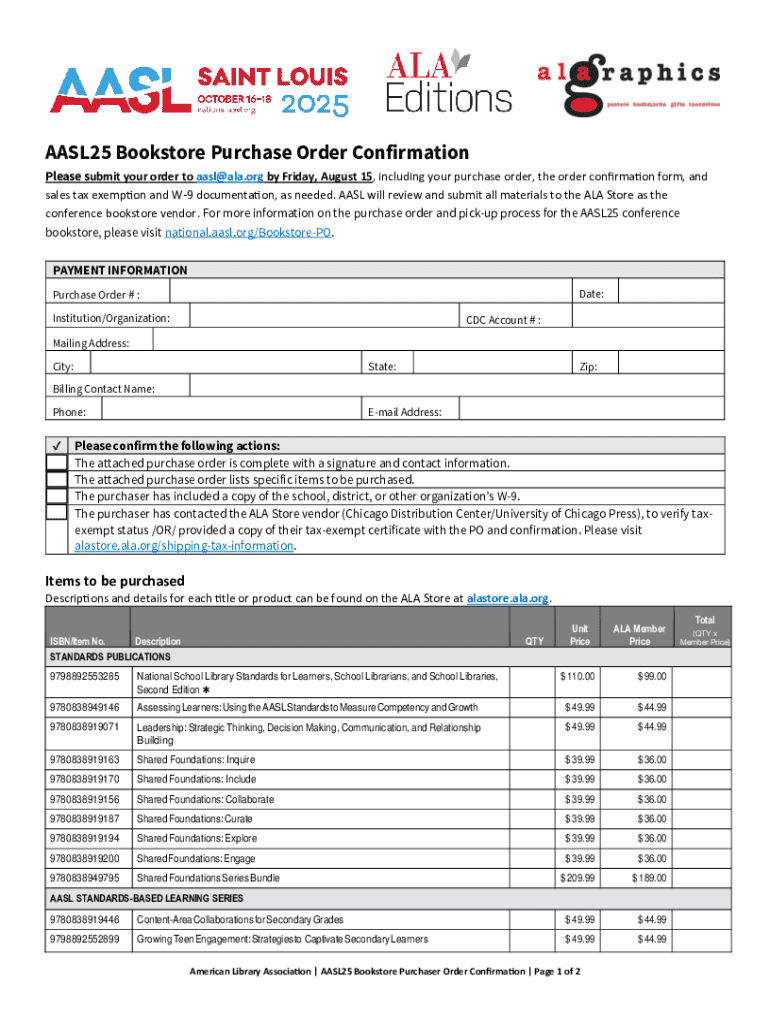

The American Deadline Extended Form is a crucial document that offers individuals and organizations a formal means to request extensions for deadlines in various contexts, including tax submissions and project approvals. This form is particularly relevant for U.S. taxpayers who require additional time to file their income tax returns or other critical documents. The use of this form ensures that all parties involved are aware of the new deadlines, thus providing clarity and organization.

Beyond tax filings, the American Deadline Extended Form plays an essential role in project management, allowing teams to communicate effectively about timeline adjustments. Whether you're a freelancer seeking an extension for a client project or part of a corporate team strategizing deadlines, this form aids in maintaining transparency and accountability. Key features of the form include sections for personal information, project details, and clear notifications of the new deadlines.

Who needs the American deadline extended form?

The American Deadline Extended Form is not restricted to any specific group; rather, it is utilized by a diverse range of individuals and professionals. For individuals, this form serves a practical purpose when requesting extra time from the IRS for income tax returns. Taxpayers often face unforeseen circumstances, such as illness or unexpected financial challenges, which can hinder timely filing. In such cases, this form provides a structured way to communicate their need for a filing extension.

Teams and organizations also benefit significantly from the American Deadline Extended Form. In project management, for instance, collaboration among team members requires clear communication about deadlines. By using this form, teams can formally notify one another about extensions on project deadlines, fostering a culture of accountability. Organizations must comply with government regulations and funding deadlines, making this form essential for maintaining operational continuity.

Key components of the American deadline extended form

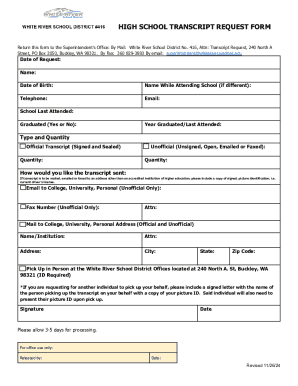

Filling out the American Deadline Extended Form begins with understanding its key components. First, the form typically includes a section for personal information, which encompasses the name, address, and other contact details of the filer. This information ensures that any communications regarding the extension are directed to the right individual.

Next is the project details section where users must provide information about the specific project or tax return associated with the extension. Clear documentation of deadlines and the nature of the extension is crucial here. It's also important to include accurate signatures from all parties to validate the document. Special attention should be paid to common fields like the original deadline date and the new proposed deadline, as errors here can lead to unnecessary complications.

Step-by-step guide to fill out the American deadline extended form

Before diving into filling out the American Deadline Extended Form, it’s essential to prepare adequately. Gather all necessary information, including your individual or organization's details, the original deadline, and reasons for the extension. This foresight will streamline the process significantly.

The first step involves entering your personal information accurately. Following that, complete the project details section by providing necessary context about the specific project or tax obligations involved. For Step 3, specify the deadlines and extensions, ensuring accuracy in the dates provided. After completing these sections, move to Step 4, which entails a review and approval process. It’s vital to have all signed copies stored securely. Finally, in Step 5, execute the form electronically, utilizing pdfFiller’s eSignature feature for a seamless and secure signing process.

Editing and customizing the American deadline extended form

One of the notable advantages of using the American Deadline Extended Form through pdfFiller is the ability to edit and customize the document easily. Users can take advantage of pdfFiller’s impressive set of tools that allow for effortless modifications. This feature is particularly beneficial if circumstances change or if there are additional details to include post-submission.

Annotating the form with comments or supplementary notes can provide extra clarity, especially in collaborative environments. Adapting the form to fit specific individual or organizational needs is seamlessly achievable, making it adaptable for various situations, whether dealing with IRS extensions or project deadlines among team members.

Electronic signatures: Completing the process

Completing the American Deadline Extended Form with an electronic signature is a pivotal step in the process. The significance of eSigning this document extends beyond mere formality; it provides legal validity to the requests being made. pdfFiller’s eSignature feature allows users to sign documents securely, ensuring that the signer's identity is verified.

When utilizing eSignatures, it's essential to understand the verification process. Secure signatures reduce the risk of fraud and illegitimate claims. Always ensure that the signing process is carried out on a secure platform to safeguard personal and sensitive information. This added layer of security strengthens the integrity of the American Deadline Extended Form.

Managing and storing your American deadline extended form

Once the American Deadline Extended Form is completed, proper management and storage of the document are critical aspects to consider. Utilizing pdfFiller’s secure storage solutions ensures your forms are preserved safely in the cloud, readily accessible whenever needed. This organization is particularly vital for tax documents, where maintaining timely records is essential for compliance with IRS regulations.

When sharing the completed form with stakeholders, use pdfFiller’s sharing options, which promote seamless collaboration. This feature allows multiple users to access the document for review or further modification. Additionally, keeping track of changes and version history is essential, especially in professional settings, where clarity around project alterations is a priority.

Troubleshooting common issues

Filling out the American Deadline Extended Form can come with its own challenges. Common pitfalls include submitting forms without proper documentation or neglecting to change the original deadline. Pay particular attention to every field, ensuring all necessary information is correct before submission to prevent delays.

Troubleshooting electronic signature issues may also arise. If you encounter problems with signing, verify your internet connection and ensure you are logged into your pdfFiller account. If issues persist, reaching out to pdfFiller’s customer support can provide guidance, allowing you to address concerns efficiently.

Frequently asked questions (FAQs)

The American Deadline Extended Form naturally raises several questions from users. Common inquiries include the circumstances under which one might need to use the form and whether it applies to various taxpayer situations. For example, if a taxpayer is unable to file income taxes on the original due date, they can utilize the form to request an extension.

Another prevalent question concerns the specific scenarios where extensions are granted. Factors such as natural disasters or sudden personal issues often lead to relaxed deadlines through the extended form, ensuring taxpayers comply with the IRS's requirements without penalties. Clarifications on how deadlines impact future submissions are also crucial for maintaining clear expectations.

Maximizing the benefits of using pdfFiller

pdfFiller stands out as a leading platform for document management, particularly for those using the American Deadline Extended Form. Its features facilitate easy editing, electronic signing, and collaboration on documents in a smooth and centralized manner. By incorporating this form into your workflow, the process of requesting extensions becomes streamlined, thereby enhancing productivity.

Testimonials from users who have successfully navigated the American Deadline Extended Form through pdfFiller highlight the positive impacts on their operations. Case studies reflect how businesses have reduced processing times and improved accountability, thanks to the document management capabilities pdfFiller offers. It allows users to focus more on their tasks and less on logistics, which underscores its efficiency.

Interactive tools to enhance your experience

Engaging with the American Deadline Extended Form becomes even more beneficial through pdfFiller's interactive tools. Users can explore a variety of additional resources that help in understanding and optimizing the completion of the form. This includes demo features showcasing how to navigate the editing tools and the eSignature process effectively.

PDF editing best practices enhance user productivity significantly. Adopting strategies such as collaborating in real-time on the document or incorporating specific formatting can elevate the quality of submissions. Keying into these tools can drastically improve user engagement and document management strategies when dealing with the American Deadline Extended Form and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit american - deadline extended on a smartphone?

Can I edit american - deadline extended on an iOS device?

Can I edit american - deadline extended on an Android device?

What is american - deadline extended?

Who is required to file american - deadline extended?

How to fill out american - deadline extended?

What is the purpose of american - deadline extended?

What information must be reported on american - deadline extended?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.