10 Mandatory Electronic Invoicing Template Form

Understanding electronic invoicing

Electronic invoicing, or e-invoicing, transforms traditional paper invoices into digital formats that can be sent, received, and processed electronically. This innovation streamlines the billing process, significantly reducing time and costs associated with manual handling. Benefits of electronic invoices include immediate delivery, decreased processing times, and reduced reliance on physical paperwork, which in turn mitigates environmental impact.

The use of electronic invoices not only increases efficiency but also enhances accuracy. As the digital format minimizes common human errors found in paper invoices, businesses can ensure that billing and payment processes run smoothly. Furthermore, electronic invoices typically integrate seamlessly with accounting systems, simplifying financial reporting and auditing.

The importance of compliance

Compliance with electronic invoicing standards is essential. Many countries have established legal frameworks that dictate how invoices must be generated and maintained, which helps facilitate tax collection and reduces fraud. By adhering to these standards, companies can ensure their billing practices are aligned with local laws and tax authority requirements.

Failing to comply can lead to penalties and complications when rectifying invoicing mistakes. Understanding those regulations and provisions is key for businesses looking to optimize their accounting functions without facing legal repercussions. Thus, companies are encouraged to familiarize themselves with these guidelines and stay updated on changes in the law.

Key features of mandatory electronic invoicing

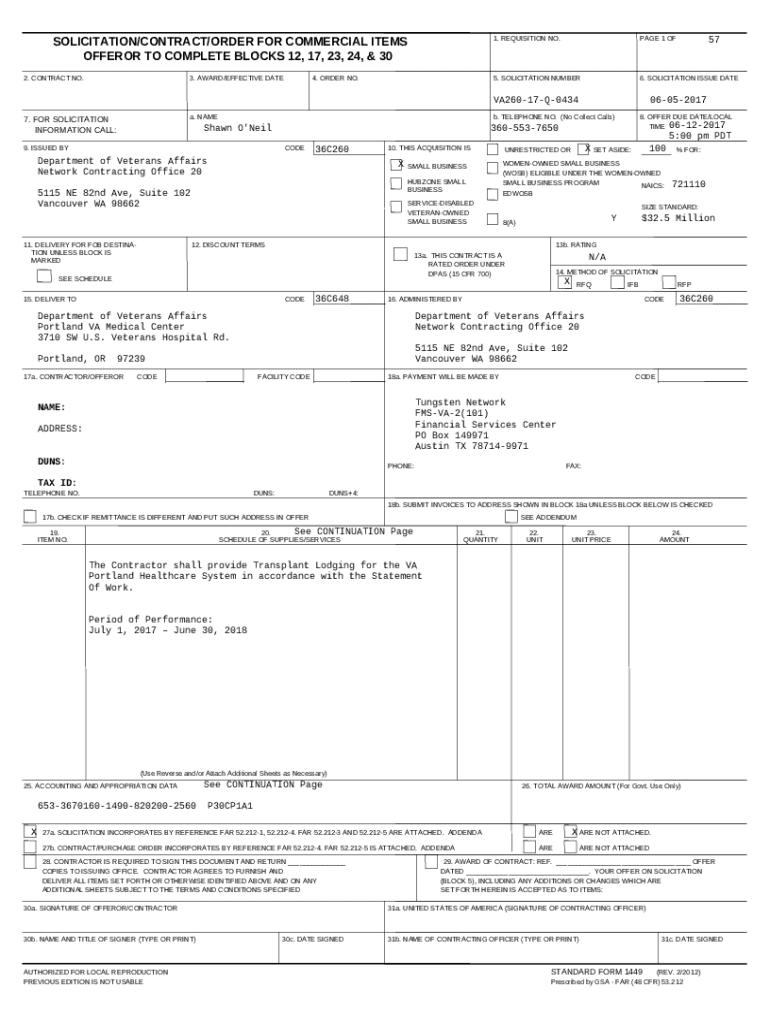

Mandatory electronic invoicing must adhere to specific characteristics that maintain standardization and ensure seamless integration across various systems. Typically, formats such as XML and PDF are required, allowing for easier data exchange between platforms. Electronic invoices are equipped with essential data elements to facilitate proper processing, including invoice number, seller and buyer details, and information about the transaction.

Additionally, there are common variants of electronic invoices, including standard, simplified, and recurring invoices. Each type serves different business needs, with standard invoices offering detailed itemizations, while simplified invoices provide basic information for easier processing in straightforward transactions. Understanding these variations is vital for selecting the correct invoice type that complies with mandatory electronic invoicing requirements.

Introducing the 10 mandatory fields in electronic invoicing

Invoice Number: Each invoice must have a unique invoice number to facilitate tracking and referencing, a crucial element for accounting clarity.

Date of Issue: Correctly listing the issue date helps both sellers and buyers in determining payment deadlines.

Seller Information: Essential details include the name, address, and tax identification number (TIN) of the seller.

Buyer Information: Accurate buyer details — name, address, and TIN — ensure proper billing and compliance with tax regulations.

Description of Goods/Services: Clearly outlining what was sold or provided aids in transparency and potential disputes.

Quantity and Unit Price: These fields must be meticulously entered to ensure correct financial calculations and clarity.

Total Amount Due: This field presents the final amount payable, inclusive of relevant calculations and tax.

Payment Terms: Clearly defined payment terms help mitigate confusion and late payments, outlining when payment is expected.

Tax Information: This includes applicable sales tax, allowing compliance with governmental tax requirements.

Additional Notes/Comments: Utilized for any supplementary information or special instructions relevant to the transaction.

Step-by-step guide to filling out the electronic invoicing template

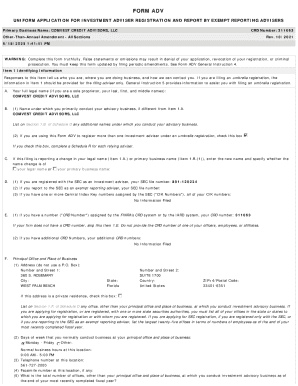

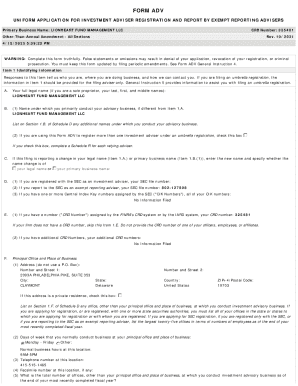

When filling out the 10mandatory electronic invoicing template form, start by accessing and downloading the template from pdfFiller. The platform offers an intuitive interface that facilitates easy navigation through the invoicing process. Once downloaded, fill out the required fields meticulously. For instance, ensure the invoice number is unique and sequential, while double-checking that all dates conform to local time zones and formats.

Validation is critical; after completing the invoice, review for any discrepancies or missing information that could cause issues during processing. Utilize pdfFiller’s built-in tools for this purpose, which can highlight potential errors. Lastly, save the document in your preferred format, whether PDF or another suitable format, ensuring it meets the necessary electronic invoicing requirements.

Tools and features to enhance your electronic invoicing experience

pdfFiller offers a plethora of interactive features that can significantly enhance your e-invoicing experience. Collaborating with team members on invoicing becomes seamless on this platform, as real-time editing capabilities allow multiple users to contribute effectively. This feature promotes accuracy and speeds up the invoicing process, particularly for businesses with extensive or complex billing.

Additionally, eSigning invoices directly through pdfFiller simplifies the approval process significantly. Users can follow step-by-step instructions to apply eSignatures, maintaining both security and compliance. Tracking and managing your invoices has never been more straightforward, as pdfFiller equips users with tools for effective management, enabling businesses to monitor invoice statuses and follow up on outstanding payments efficiently.

Common questions about electronic invoicing

The urgency of implementing electronic invoicing varies across regions, governed by specific deadlines mandated by local governments. Businesses should assess their current processes and transition accordingly to avoid penalties. Moreover, concerns surrounding the security of e-invoicing are valid, yet platforms like pdfFiller utilize encryption and secure data storage to protect sensitive information and mitigate risks.

Customization options within pdfFiller enhance user experience, allowing companies to adapt invoicing templates to their branding needs. In the event of encountering issues, pdfFiller’s customer support can assist in troubleshooting common problems, further ensuring that users can navigate their invoicing requirements effortlessly.

Implementation and best practices for electronic invoicing

Adopting mandatory e-invoicing requires a pragmatic strategy for businesses. Begin with educating staff about the new system, providing training on compliance with local regulations, and ensuring everyone understands the importance of accuracy in information entry. By gradually transitioning to an electronic system, companies can tackle the practicalities involved with fewer disruptions.

Best practices for efficient and compliant invoicing involve regularly reviewing invoicing processes and policies. Incorporating electronic invoicing into your workflow should include routine audits to ensure adherence to tax authority standards while seeking feedback from staff to continuously optimize processes. Leveraging technology smartly will further enhance your e-invoicing experience.

Global trends in electronic invoicing

Around the world, e-invoicing is being adopted rapidly, driven by governments pushing for modernization in tax collection practices. Countries like Italy and Mexico are leading the charge with comprehensive electronic invoicing mandates that facilitate taxation transparency and reduced fraud. In contrast, businesses in regions without strict mandates are often slower to change, demonstrating varying levels of adoption depending on local circumstances.

Emerging technologies such as artificial intelligence and blockchain are predicted to shape the future of e-invoicing. AI can assist in automating data entry and processing, while blockchain technology could enhance security and transparency, eliminating concerns over fraudulent invoices. Businesses must stay attuned to these trends to leverage technology effectively and maintain a competitive edge in the evolving landscape.

Related news and updates about electronic invoicing

The landscape of electronic invoicing is continually evolving, with recent changes in regulations impacting several countries. New laws emphasized standardizing electronic invoicing, aiming for seamless compliance across various sectors. Being vigilant about updates in legislation is crucial for businesses to avoid being caught off-guard by compliance deadlines or alterations in tax provisions.

Case studies have emerged showcasing businesses that successfully adopted electronic invoicing and significantly improved their operational efficiency. These examples serve as valuable learning opportunities for organizations contemplating the implementation of mandatory electronic invoicing, highlighting both best practices and potential pitfalls.