Get the free 2024 Instructions for Form FTB 3539 - Franchise Tax Board

Get, Create, Make and Sign 2024 instructions for form

Editing 2024 instructions for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 instructions for form

How to fill out 2024 instructions for form

Who needs 2024 instructions for form?

2024 Instructions for Form: Your Comprehensive Guide

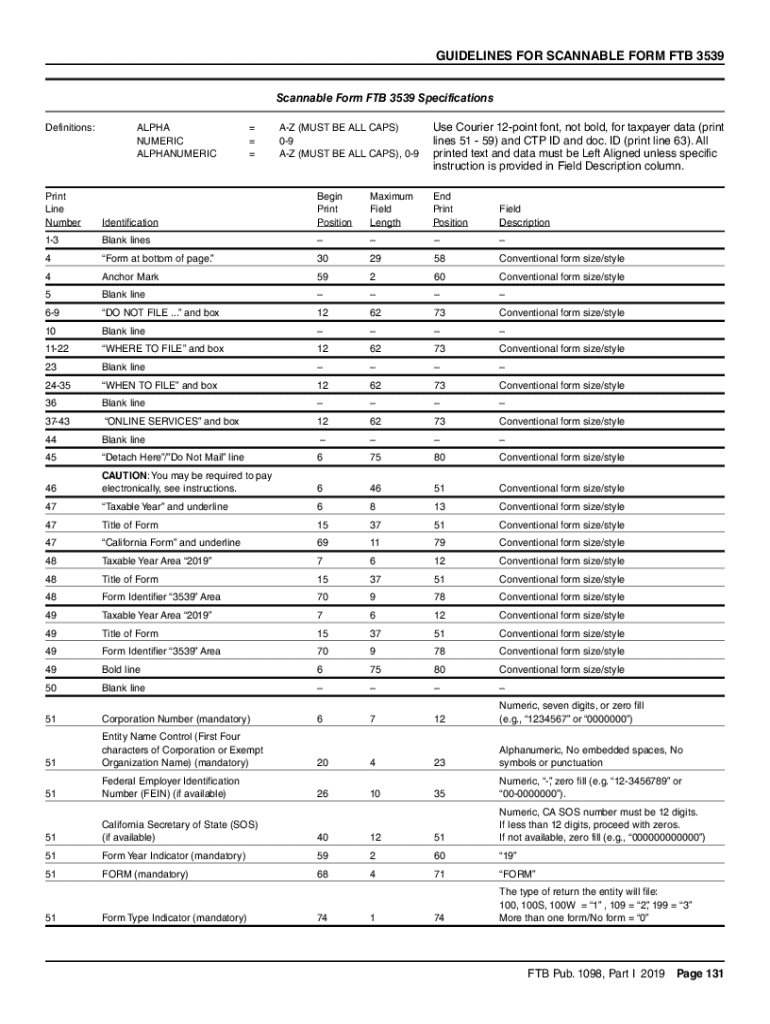

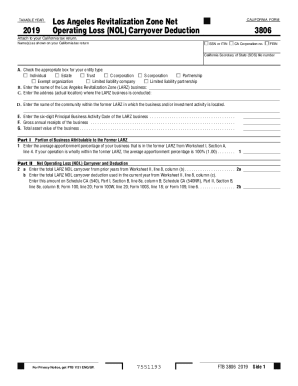

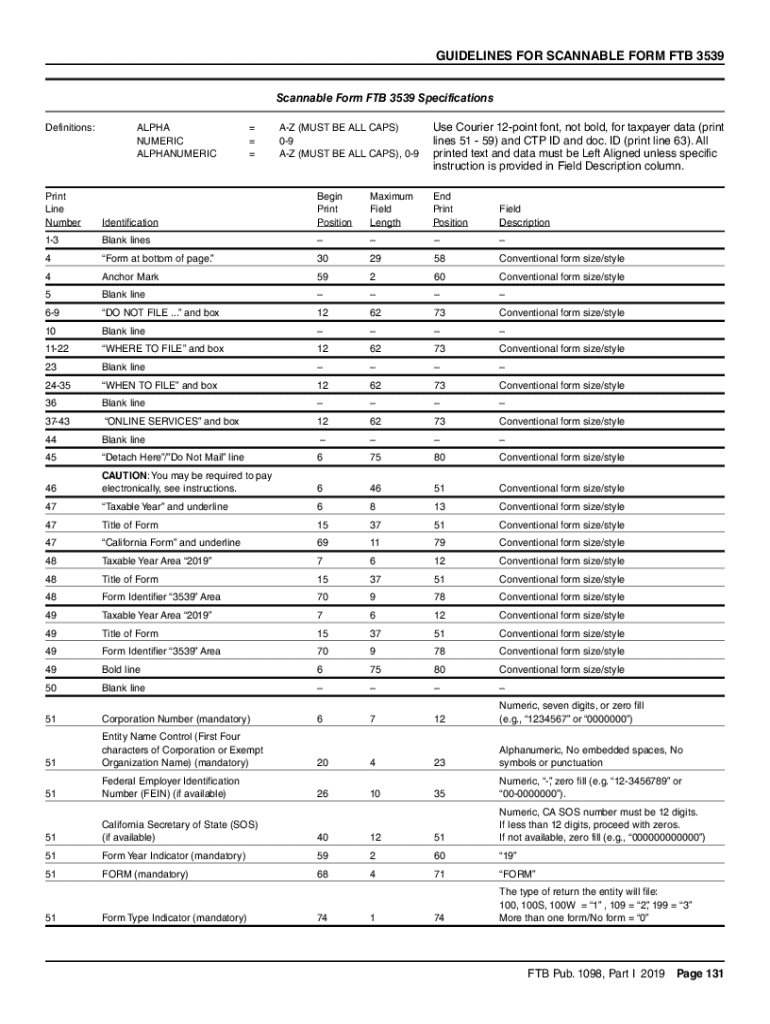

Overview of 2024 form requirements

The 2024 form serves a crucial role for residents, providing a clear framework for key tax reporting and compliance. Understanding the purpose and significance of the form is essential, as it directly impacts your legal responsibilities and potential tax liabilities. This year's form has been designed to be user-friendly, ensuring that individuals and teams can navigate the complexities of the tax filing process with ease.

Eligibility for the form is contingent on various factors, including filing status, income level, and specific tax credits applicable to individuals and businesses. Ensuring that you meet these criteria is fundamental to avoid pitfalls in the filing process. Users can easily access and download the form from pdfFiller, where templates are readily available for editing and submission.

Important dates and deadlines

Mark your calendars! Key filing dates for 2024 have been set to help residents stay on top of their tax responsibilities. The standard deadline for submitting your tax return is generally April 15, but it’s wise to double-check because this date can vary due to weekends or holidays.

Other essential deadlines include dates for amendments and appeals, typically allowing for possible adjustments to your filings. Leveraging pdfFiller’s scheduling tools can assist in managing timelines effectively, ensuring you won’t miss critical deadlines for submitting your tax documents.

Changes and updates for 2024

This year introduces several important changes to the form, reflecting new regulations in tax law. One substantial update includes adjustments in deduction caps and credits offered to residents, particularly in areas affecting business credits and income tax returns. Understanding these changes is essential to ensure compliance and optimize your tax return.

Updating your form to align with current regulations brings multiple benefits, such as avoiding penalties and potentially increasing your refund. Staying informed on regulatory changes and updating your forms accordingly ensure you maximize your deductions and adhere to the law.

Step-by-step instructions for completing the form

Pre-filling considerations

Before starting to fill out your 2024 form, gather all necessary documentation. This includes income statements, receipts for deductions, and any previous tax returns. Understanding the rules that apply to each section and any definitions related to terms on the form is crucial for accurate completion. Utilize pdfFiller's convenient resources to ensure you have all required information at hand.

Completed form sections detailed breakdown

Filling in personal information is straightforward but must be done accurately. Ensure your name, address, and Social Security number are correct, as discrepancies can lead to processing delays.

Income reporting is the next essential step. When declaring income, include wages, freelance earnings, and any other sources of income. Common documentation such as W-2 forms and 1099s will be necessary to ensure correct reporting.

Next, account for deductions and credits available to you. Knowing the deductions you qualify for can significantly lower your taxable income, so be sure to include all qualified expenses. After completing the form, review it thoroughly. pdfFiller offers tools for self-checking that can catch common errors before final submission.

Common errors and how to prevent them

Mistakes on your tax return can have significant repercussions, from delays in processing to penalties. Common issues include miscalculations, especially in income reporting, incorrect personal data, and failures to report all income sources. Taking the extra time to double-check your entries can save you stress later.

Utilizing pdfFiller's validation tools can enhance accuracy, ensuring every entry adheres to guidelines, and mitigates the risk of erroneous submissions. This proactive approach greatly reduces the likelihood of making common errors associated with form completion.

Managing your form with pdfFiller

pdfFiller provides a seamless experience for managing your tax documents. The platform allows users to save and edit forms quickly while offering secure e-signature options. Collaborating as a team can be easily facilitated, helping different members contribute to the document without the risk of version confusion.

Moreover, pdfFiller's tracking features enable users to monitor changes made to the document, ensuring that you always have access to the latest version. With such tools, managing your form becomes a straightforward task that integrates seamlessly into your daily workflow.

Resources for further assistance

For additional guidance while navigating the 2024 form, various resources are available. The official government website provides detailed guides and FAQs to clarify any remaining questions. If personal assistance is needed, reaching out to tax professionals through pdfFiller’s platform can also be beneficial.

Additionally, community forums and user support groups offer valuable platforms for individuals to share experiences, ask questions, and receive advice on common challenges faced during the filing process.

Conclusion: simplifying your form journey

Employing pdfFiller can transform your approach to filling out the 2024 form by streamlining every aspect of the process. From accessing necessary resources to collaborating in real time, pdfFiller empowers users with the tools needed to manage documents efficiently.

Encouraging the use of digital tools not only enhances productivity but also promotes a more organized way of handling tax responsibilities. By leveraging the capabilities of pdfFiller, you can feel confident in staying current with the latest updates and ensuring accuracy in your filings for the 2024 tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 instructions for form straight from my smartphone?

How can I fill out 2024 instructions for form on an iOS device?

How do I fill out 2024 instructions for form on an Android device?

What is 2024 instructions for form?

Who is required to file 2024 instructions for form?

How to fill out 2024 instructions for form?

What is the purpose of 2024 instructions for form?

What information must be reported on 2024 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.