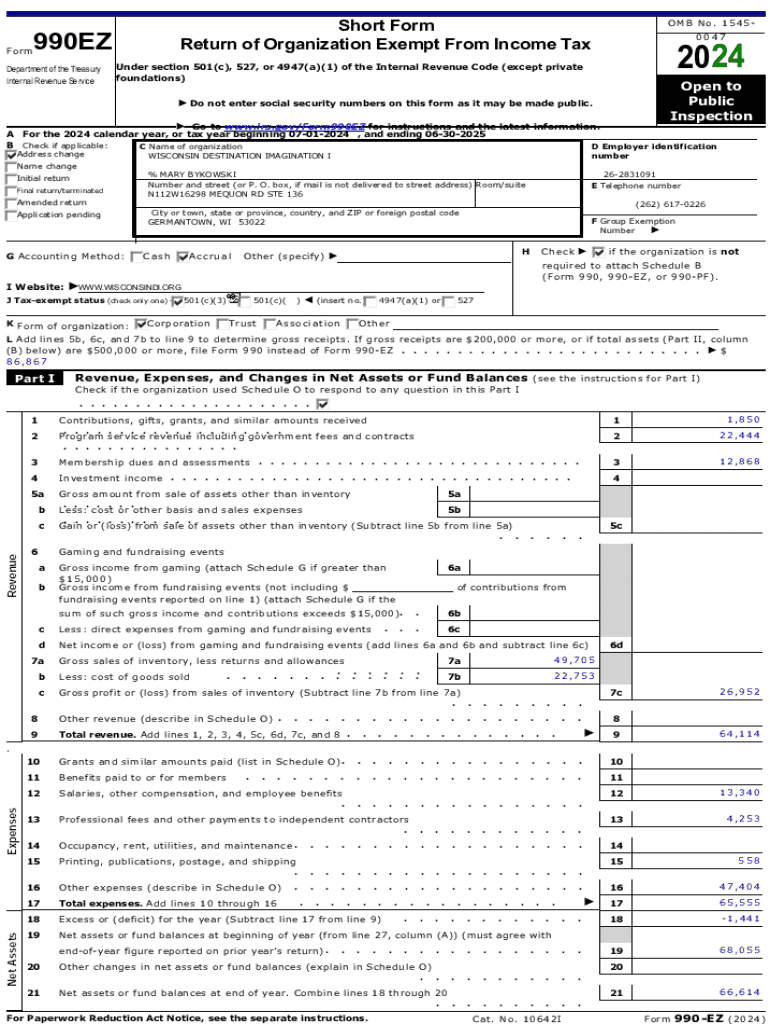

Get the free A For the 2024 calendar year, or tax year beginning 07012024 , and ending 06302025

Get, Create, Make and Sign a for form 2024

How to edit a for form 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a for form 2024

How to fill out a for form 2024

Who needs a for form 2024?

A comprehensive guide to filling out the a for form 2024 form

Understanding the 'a for' form

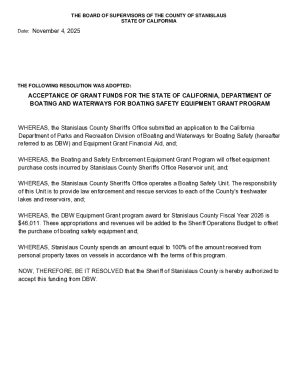

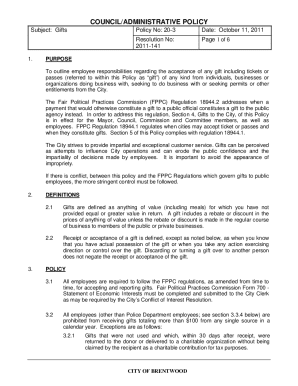

The 'a for' form is a crucial document designed to streamline the application process across various sectors. In 2024, its importance has notably increased as numerous stakeholders rely on it for accurate reporting and compliance. This form serves several functions, ranging from tax filings to grant applications, making it a versatile tool for individuals and organizations alike.

Who needs to use the 'a for' form?

The target users of the 'a for' form include independent contractors, small business owners, and non-profit organizations. Each demographic must adhere to specific guidelines and deadlines that govern their submissions. Stakeholders from government sectors, financial institutions, and the education sector also find this form essential in their operations.

Individuals in various professions must understand when to use the 'a for' form to ensure compliance with regulatory requirements and avoid potential penalties. Consequently, mastering this form can serve as a significant advantage in navigating bureaucratic processes in 2024.

Key features of the 2024 'a for' form

2024 brings several significant updates to the 'a for' form. These changes address both user feedback and evolving regulatory requirements. Understanding these updates is essential as they may affect how users fill out the form and the information they need to provide.

The interactive elements of the 2024 'a for' form allow users to navigate seamlessly through each section, ensuring that they don’t overlook critical data. The user-friendly design encourages individuals to complete their applications accurately and efficiently.

Step-by-step instructions for filling out the 'a for' form

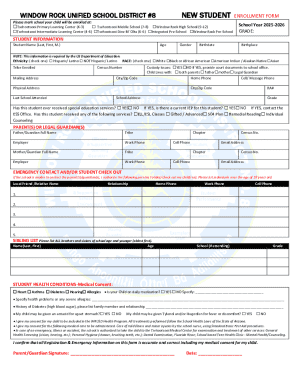

Preparing to fill out the 'a for' form is critical to ensure all information is accurate and comprehensive. Before you even begin to fill out the form, collect all necessary documents, such as financial statements, identification, and previous submission copies. Organizing this data can save you time and prevent errors during completion.

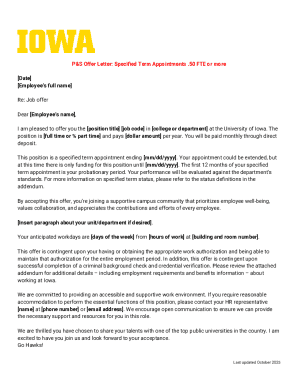

Understanding each section of the form is vital. For example, Section 1 typically requires personal or business information, while Section 2 focuses on financial data. Ensure each entry is accurate, as common pitfalls include incorrect identification numbers or mismatched financial figures. Section 3 generally involves signatures and certifications, which must be properly filled to validate your submission.

Editing and customizing the 'a for' form

While filling out the 'a for' form, users may need to make edits or adjustments. pdfFiller offers robust editing tools, allowing users to modify entries with ease. If a mistake is made, reviewing the editing capabilities can help in correcting the form without starting over. Ensuring accuracy in the data presented is essential in avoiding delays or rejections.

Adding digital signatures is another essential step in the process. In 2024, eSigning is not only convenient but also secure. Users can follow straightforward steps to electronically sign the form, enhancing the efficiency of the submission process. This modern method reduces paperwork and keeps a digital audit trail.

Collaborating on the 'a for' form

Collaboration is a vital aspect, especially for teams working together on the 'a for' form. pdfFiller provides options for real-time collaboration and sharing, making sure that all team members can contribute effectively to the document. This enables multiple users to access and edit the form simultaneously, which is particularly beneficial in a business setting.

Keeping track of changes is crucial in collaborative environments. pdfFiller's version control features allow users to review the history of edits, ensuring that everyone remains updated with the most accurate version of the document.

Submitting the 'a for' form

Before submitting the 'a for' form, it's essential to understand the submission procedures fully. In 2024, there will be set timelines and deadlines outlined by relevant regulatory bodies that mandate timely submissions. Adhering to these deadlines is critical to avoid penalties or compliance issues.

After submission, users should be aware of what to expect. The review process can vary, but users should prepare for possible follow-up communications. Understanding the expected timeline for responses can help users remain informed about their application’s status.

Managing your 'a for' form after submission

Tracking your submission status is crucial once the 'a for' form has been submitted. pdfFiller offers integrated tools that provide real-time updates on submission status, allowing users to stay informed throughout the process. This feature can greatly reduce the anxiety associated with waiting for official responses.

In cases where revisions are needed post-submission, knowing how to approach this process is crucial. Users should familiarize themselves with specific requirements and deadlines regarding resubmissions to ensure compliance and timely processing.

Frequently asked questions (FAQs)

Common issues that users face while engaging with the 'a for' form can often be resolved with clarity. Frequently encountered challenges include submitting the form without required information or misunderstanding deadlines. It's crucial to prepare adequately to avoid these pitfalls.

Implementing expert tips can significantly enhance the 'a for' form experience. Best practices include starting early, seeking assistance when necessary, and utilizing tools available on platforms like pdfFiller to simplify the process.

Additional tools and features by pdfFiller for document management

Integrating the 'a for' form with other applications can boost productivity. pdfFiller allows users to connect with popular cloud service providers seamlessly, ensuring that documents are always aligned with user needs. This integration can hugely benefit teams working in diverse environments.

Enhancing productivity with pdfFiller goes beyond basic document editing. The platform integrates various features to improve efficiency, such as advanced search capabilities and reporting tools that give users actionable insights into their document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my a for form 2024 in Gmail?

How can I send a for form 2024 to be eSigned by others?

How do I make changes in a for form 2024?

What is a for form 2024?

Who is required to file a for form 2024?

How to fill out a for form 2024?

What is the purpose of a for form 2024?

What information must be reported on a for form 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.