Get the free Creating Basic Form 990: Return of Organization Exempt

Get, Create, Make and Sign creating basic form 990

How to edit creating basic form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out creating basic form 990

How to fill out creating basic form 990

Who needs creating basic form 990?

Creating a Basic Form 990 Form: A Comprehensive Guide

Understanding Form 990: An overview

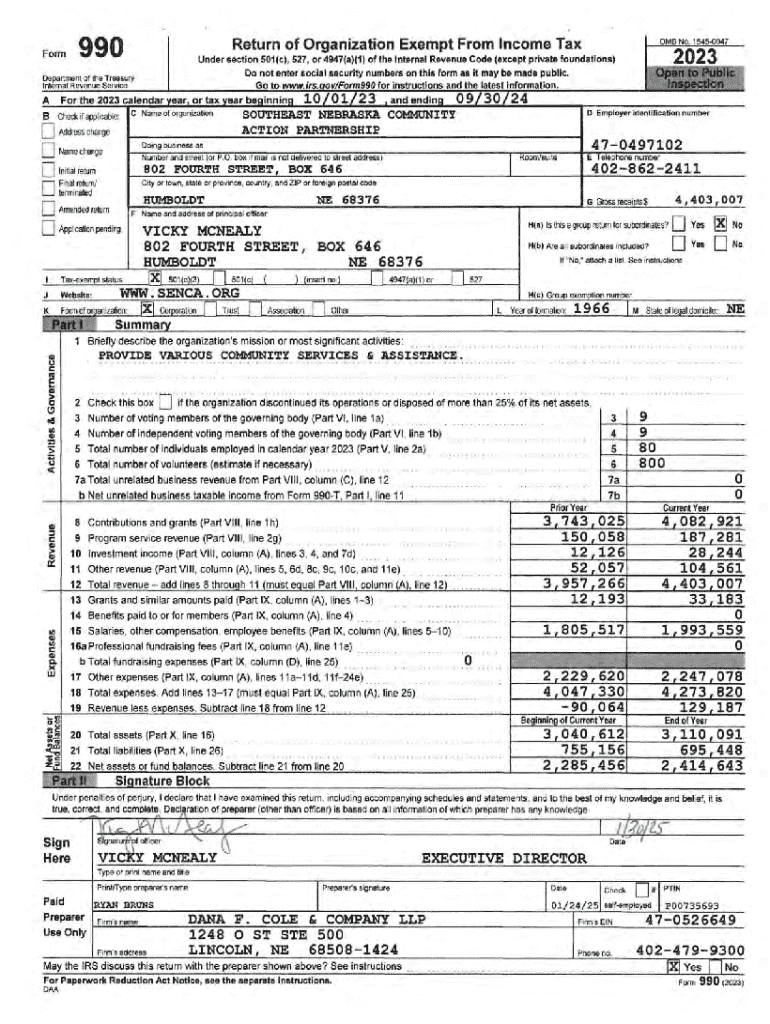

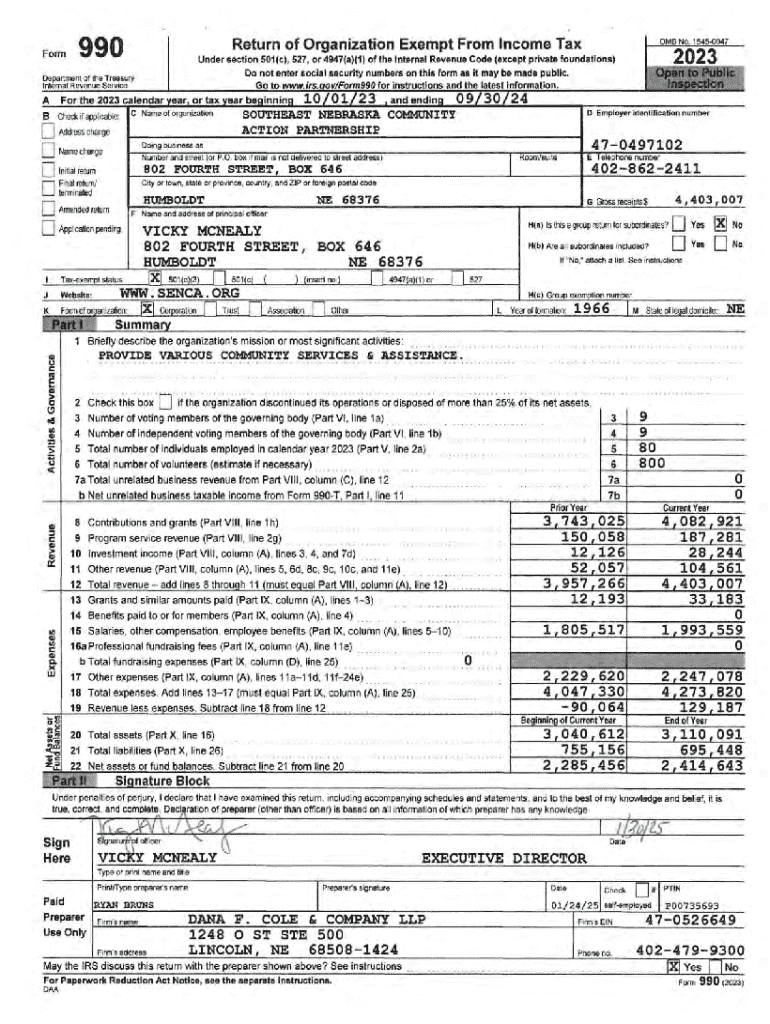

Form 990 is a crucial document for nonprofit organizations in the United States, serving as an informational return that the IRS requires. This form provides essential insights into the financial health, governance, and impact of an organization. Accurate and timely filing not only ensures compliance but also promotes transparency with donors, volunteers, and the public.

There are several variants of Form 990: Form 990, Form 990-EZ, and Form 990-N (e-Postcard). Choosing the right form depends on the size and gross receipts of your organization. Understanding which form to use is critical as it determines the depth of information required and filing requirements.

The importance of accurate filing cannot be overstated. Not only does it comply with IRS requirements, but it also builds trust with stakeholders who rely on the accuracy of the information provided.

Preparing for the Form 990 filing process

Preparation is key to a smooth filing process for Form 990. Start by gathering key documents and information that will be integral to accurately completing the form. This includes financial statements, details about the organizational structure, and specifics about your mission and programs.

Understanding your organization’s financial year is also critical. The IRS requires that Form 990 be filed based on your organization’s fiscal year, which might not align with the calendar year. Establishing a clear timeline for when documents need to be collected can help ensure a stress-free process.

Setting firm deadlines for document collection and review, as well as determining who will be responsible for which sections of the form, are paramount steps in the preparation process.

Step-by-step guide to completing Form 990

Completing Form 990 requires careful attention to detail. The form is divided into several sections, including basic information, financial information, program service accomplishments, governance and management, and disclosures.

Section A: Basic information

This section requires you to identify your organization with key details such as the name, address, and Employer Identification Number (EIN). Ensure that all information is accurate to prevent delays with the IRS.

Section B: Financial information

Here, you will report your organization’s revenue sources and expense breakdown. It's essential to categorize expenses into program, management, and fundraising costs. Doing so helps accurately portray your organization’s financial dealings.

Section : Program service accomplishments

Articulating your mission and showcasing your achievements is vital. Clearly define the metrics you used to measure the outcomes of your programs, as this information helps to demonstrate your organization's impact.

Section : Governance and management

Detail the composition and responsibilities of your board, including any policies regarding ethics and conflicts of interest. This not only showcases the accountability within your organization but also highlights your governance structure to the public.

Section E: Disclosure and accountability

This section requires the inclusion of necessary attachments and documents. Ensure that you understand the requirements for public disclosures to maintain transparency with your donors and stakeholders.

Common pitfalls and how to avoid them

Many organizations face challenges when filing Form 990, often stemming from incomplete or inaccurate information. The consequences can range from penalties to increased scrutiny from the IRS. Ensuring that all entries are double-checked can mitigate these risks.

Another common pitfall is missed deadlines. Proper timeline management is essential to avoid penalties, which can significantly impact your organization’s finances. Regular reminders and milestone check-ins can help keep the filing process on track.

Additionally, underestimating the complexity of financial reporting can lead to mistakes. It is highly advisable to allocate enough resources, including personnel or professional assistance, to enhance the quality of your submissions.

Utilizing interactive tools for form completion

pdfFiller offers a range of interactive features that simplify the process of completing Form 990. One of the key features includes interactive templates, which guide users through each section of the form, making it easier to enter both factual and financial data accurately.

The built-in collaboration tools allow for team input, which is particularly beneficial for organizations where multiple stakeholders may contribute to the filing process. Team members can comment, edit, and finalize the document seamlessly.

These features enhance the efficiency of the filing process, ensuring that users stay organized and on track with their Form 990 submissions.

Best practices for reviewing and finalizing your Form 990

Before finalizing your Form 990, conducting an internal review is crucial. Checklists are a useful tool here; consider including questions that prompt review of each section's accuracy, completeness, and alignment with your organizational goals.

It may also be worthwhile to seek external assistance, particularly if your organization has undergone significant changes in leadership or financial status during the year. Professional insight can ensure compliance with IRS regulations, reducing the likelihood of errors in submission.

As you prepare to file, ensure your final checks confirm all information aligns with IRS requirements to further solidify your organization's standing with donors and the IRS.

Post-filing considerations

Once Form 990 is filed, tracking submission and confirming receipt is essential for your records. Be proactive; ensure that the IRS received your form, as this maintains transparency and accountability.

Being prepared for common follow-up questions from the IRS is also important. These could pertain to specific figures or claims made in your filing. Understanding potential queries can speed up the process of resolving any issues.

Finally, consider future planning. Review the filing process and outcomes to identify areas for improvement for next year, ensuring you’re continuously enhancing your organization's compliance strategies.

Frequently asked questions about Form 990

Nonprofits often have specific inquiries about Form 990, especially regarding minimum requirements. If your organization doesn't meet them, you can still file Form 990-N, ensuring compliance while avoiding penalties.

Handling changes in leadership during the filing process can also raise questions. It's advisable to ensure that updated leadership names and titles are reflected accurately within the form to maintain proper records.

Resources for assistance can vary from IRS websites to professional networks focusing on nonprofit management.

Case studies: Successful filing of Form 990

Looking at real-world examples provides a valuable learning opportunity. Organizations that have effectively filed Form 990 typically showcase meticulous documentation and preparation. This has allowed them to pass audits with ease, gaining trust from donors and stakeholders.

Learning from mistakes is equally important. Case studies that highlight filing challenges illustrate common pitfalls such as late submissions or inaccuracies. By studying these scenarios, organizations can improve their processes, ensuring smoother future filings.

Tools and resources for ongoing compliance

Integrating pdfFiller with your existing document management systems streamlines the compliance process. By ensuring consistency in filing and documentation, organizations can maintain clarity in their operations.

Staying informed about regulatory changes is crucial for every nonprofit. Regular webinars and updates on IRS guidelines can help ensure you’re not caught off-guard during filing seasons.

Participating in community forums and support networks can further bolster your organization's readiness. Sharing experiences and strategies can be incredibly beneficial in navigating the complexities of nonprofit compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my creating basic form 990 in Gmail?

How can I send creating basic form 990 to be eSigned by others?

How do I make changes in creating basic form 990?

What is creating basic form 990?

Who is required to file creating basic form 990?

How to fill out creating basic form 990?

What is the purpose of creating basic form 990?

What information must be reported on creating basic form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.