Get the free Credit Card Authorization Form - 2024

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding the credit card authorization form

A credit card authorization form is a crucial document used in financial transactions to secure payment permissions from a cardholder. It serves as a formal agreement that allows a business to charge a customer's credit card for a specified amount. This form is not only essential for processing payments but also plays a vital role in ensuring the legitimacy of transactions and protecting both the customer and the business from potential fraud.

The importance of this form in payment processing cannot be overstated. It acts as a safeguard against unauthorized charges, facilitating security and fraud prevention by retaining documented consent from the cardholder. Furthermore, it allows businesses to confirm the authenticity of the transaction, thereby minimizing disputes and ensuring timely revenue collection.

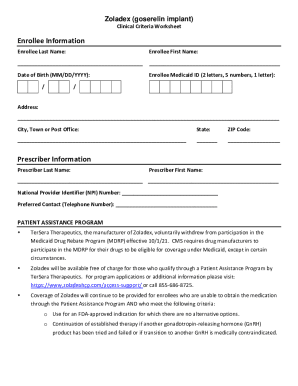

Credit card authorization forms are commonly utilized in various scenarios, including e-commerce transactions where customers may not be physically present. They are also used for recurring payments, such as subscription services or installment plans, and in service agreements where ongoing or future payments are expected.

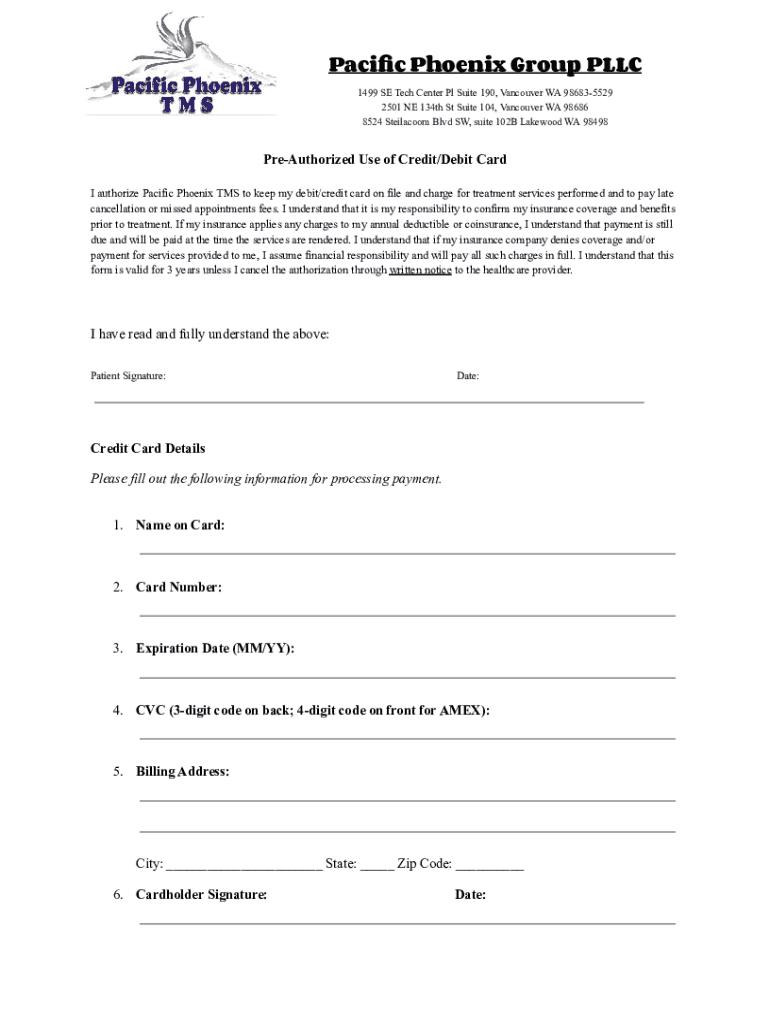

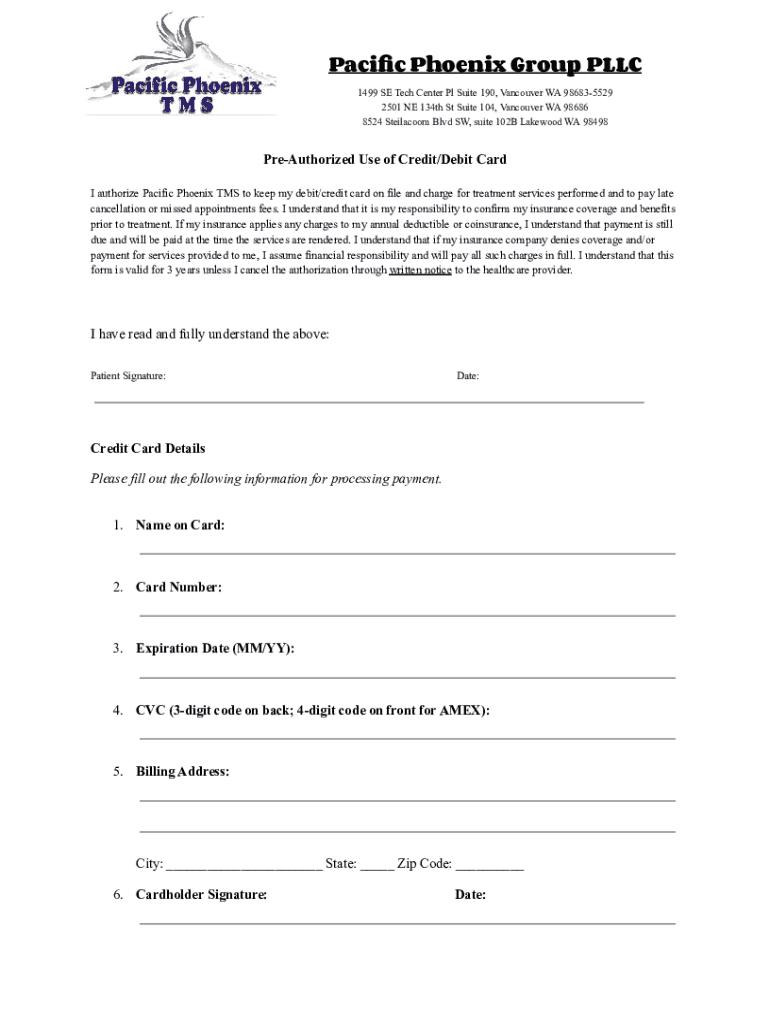

Key components of a credit card authorization form

A well-structured credit card authorization form contains several essential components to ensure clarity and completeness. First and foremost is the cardholder's name, which should match the name on the credit card. This detail establishes primary identification for the transaction.

Next, the form must include the credit card number and expiration date, allowing the business to charge the specified amount. The billing address is also critical because it verifies the cardholder's identity and minimizes the risk of fraud. Additionally, the form needs to clearly indicate the amount to be charged to avoid confusion or disputes.

Optional elements of the credit card authorization form can enhance its functionality. Contact information, such as an email or phone number for notifications regarding transactions, can improve communication between the business and customer. Lastly, a signature field is vital for authorizing the charge, providing tangible proof of consent.

Benefits of using a credit card authorization form

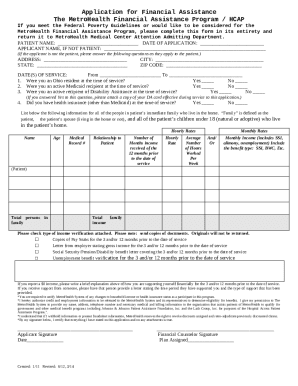

Utilizing a credit card authorization form brings numerous benefits to both businesses and customers. Primarily, it streamlines the payment process, ensuring that transaction approvals are swift and reducing potential delays and errors during payment processing. This efficiency is particularly valuable in high-volume sales environments, such as restaurants or online stores.

Moreover, incorporating this form enhances customer trust and transparency. By clearly outlining terms and ensuring that customers have authorized charges, businesses foster confidence in their payment practices. This is especially critical in cases involving substantial sums or ongoing commitments, helping to cultivate long-term relationships with clients.

Another significant advantage is the reduction of chargeback risks. By documenting the cardholder's permission and transaction details, businesses have solid evidence to contest any disputes that may arise, protecting their revenues and reputation.

How to complete a credit card authorization form

Completing a credit card authorization form accurately is crucial to avoid payment issues. Here’s a step-by-step guide to ensure effective use. First, navigate to the right template on pdfFiller and select the credit card authorization form. This dedicated platform simplifies the process by providing interactive fields that help gather required information.

Begin by inputting the cardholder's information, including their name, card number, and expiration date. Don’t forget to add the billing address to enhance security. Next, specify the transaction details, including the total amount to be charged. Once all fields are completed, it’s essential to review the information carefully to confirm its accuracy.

Employing tips for data entry accuracy, such as double-checking numbers and ensuring proper format, can significantly reduce the risk of mistakes. A well-completed form lays the groundwork for successful financial transactions and helps maintain a positive relationship between businesses and their customers.

Editing and customizing your credit card authorization form

Editing and customizing your credit card authorization form using pdfFiller’s interactive tools can enhance your document's functionality and branding. Users can easily add or remove fields depending on their specific needs. For instance, if your business requires additional permissions or checks, you can include those in the updated form.

Inserting branding elements such as logos, custom colors, and fonts can further personalize the document, aligning it with your brand identity. This not only makes the form more visually appealing but also reinforces your commitment to professionalism. Additionally, pdfFiller allows collaboration among team members, enabling real-time editing and feedback features that enhance accuracy and effectiveness.

Securing your credit card authorization form

Security is a paramount concern when handling credit card information. Implementing best practices for data protection is essential. This includes encrypting sensitive information stored within the authorization form and regularly updating permissions and access to ensure only authorized personnel can view or edit it.

Understanding compliance with payment regulations, such as PCI DSS (Payment Card Industry Data Security Standard), is also crucial for businesses processing card payments. These regulations outline the requirements for securely handling credit card data. Recognizing legal requirements will help businesses mitigate risks associated with credit card fraud and data breaches.

Frequently asked questions (FAQ)

Questions surrounding credit card authorization forms are common. For instance, what should you do if a customer refuses to authorize a charge? It's essential to review the situation with the customer to understand their concerns, providing alternatives if needed. Additionally, businesses should retain credit card authorization forms for a designated period—typically at least three years—to comply with legal standards and for their own records.

Another frequent query is whether the same form can be used for recurring payments. Yes, with the appropriate modifications to indicate ongoing authorization, businesses can streamline their billing processes. Lastly, businesses must implement security measures, including encryption and secure storage methods, when handling credit card information to protect their interests and their customers'.

Practical tips for implementing credit card authorization forms

To effectively implement credit card authorization forms in your business, start by choosing the right template from pdfFiller that fits your specific needs. This decision is fundamental, as it affects the ease of use for both your staff and customers. Ensuring the template captures all necessary details while being straightforward will enhance user experience.

Additionally, training your staff on the proper usage of these forms is essential. Knowledgeable employees will facilitate a smoother transaction process, minimizing errors and educating customers efficiently. Furthermore, creating a streamlined process for customers can significantly improve their experience—making it easy and quick for them to authorize payments will encourage ongoing business relationships.

Real-life applications and case studies

Real-life applications of credit card authorization forms showcase their effectiveness across various industries. For instance, a restaurant chain improved its payment processing speeds and reduced chargebacks by implementing a standardized authorization form. By clearly outlining terms and securing customer agreements, they ensured customer understanding and decreased disputes.

Similarly, an e-commerce business experienced a significant reduction in fraudulent transactions after integrating credit card authorization forms into its checkout process. Customers felt more secure knowing their transactions were documented, leading to increased trust and higher conversion rates. These case studies illustrate how effectively managing payment authorization forms can impact business operations positively.

Downloadable resources

For readers interested in utilizing credit card authorization forms, pdfFiller offers accessible templates tailored to different business needs. These templates can be downloaded and customized to align with specific branding guidelines. Additionally, a worksheet for analyzing payment authorization processes can provide valuable insights into optimizing your payment system.

Gather your feedback

Engagement with users is paramount. Businesses are encouraged to gather feedback from customers regarding their experiences with credit card authorization forms. Understanding customer perspectives can highlight areas for improvement and build better practices. Companies can also connect with the pdfFiller support team to receive personalized assistance in implementing these forms effectively.

Lastly, subscribing to a newsletter focused on document management solutions will keep users informed about fresh insights, resources, and updates on effective practices for utilizing credit card authorization forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How can I fill out credit card authorization form on an iOS device?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.