Get the free INDIVIDUAL CREDIT AUTHORIZATION FORM

Get, Create, Make and Sign individual credit authorization form

Editing individual credit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual credit authorization form

How to fill out individual credit authorization form

Who needs individual credit authorization form?

Understanding the Individual Credit Authorization Form

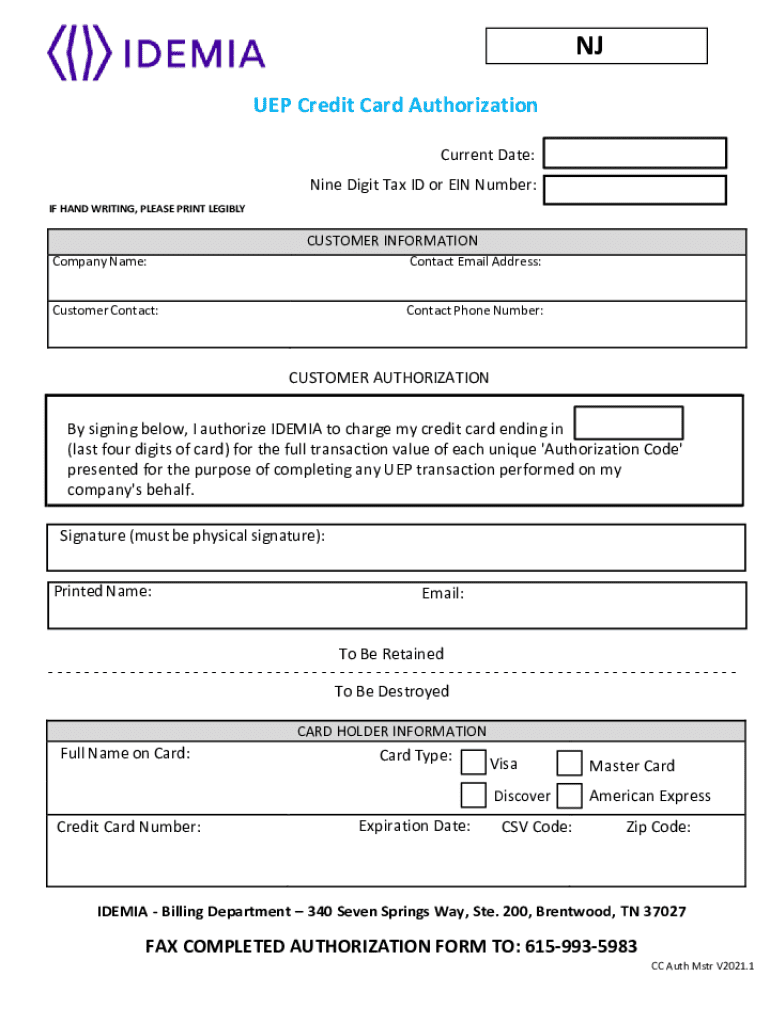

What is an Individual Credit Authorization Form?

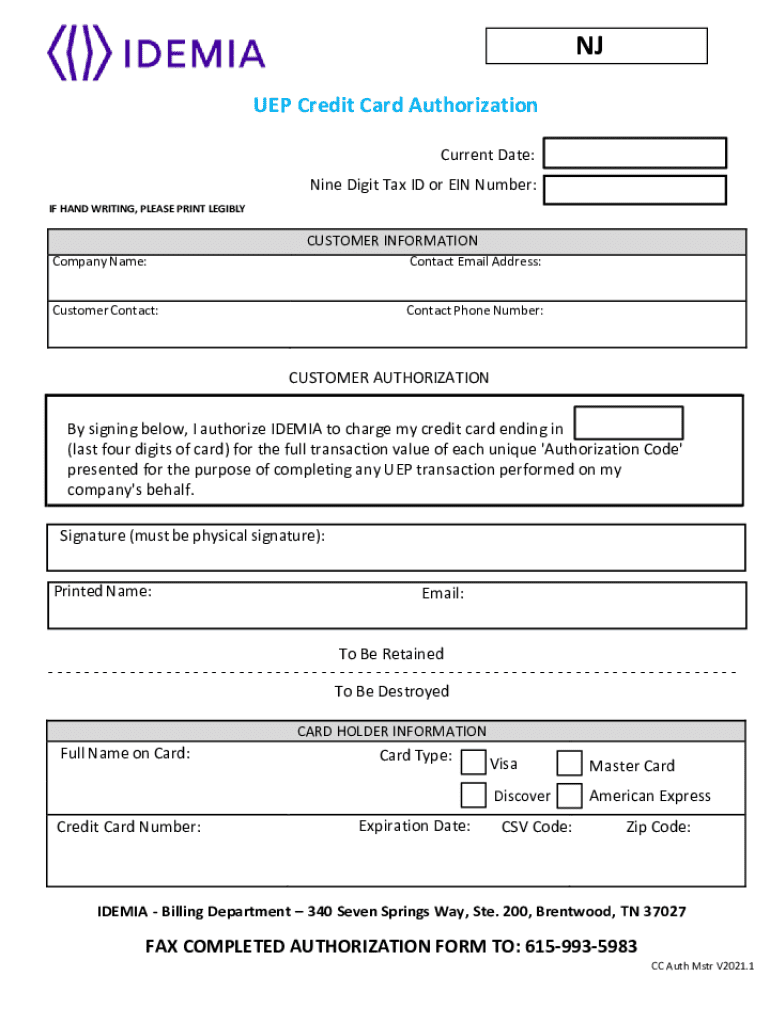

An individual credit authorization form is a critical document used primarily to obtain a customer's consent for charging their credit card. This authorization acts as a safeguard for businesses, ensuring that they have permission to process transactions on behalf of the cardholder. The form typically indicates that the customer agrees to a one-time payment or recurring charges, clarifying what services or products they are purchasing.

This form is commonly employed in various scenarios, such as subscription services, membership fees for gyms or clubs, and payments for one-off goods or services. Businesses ranging from restaurants to online retailers use this form to establish a clear contract with their customers regarding payment expectations.

Why is the Individual Credit Authorization Form Important?

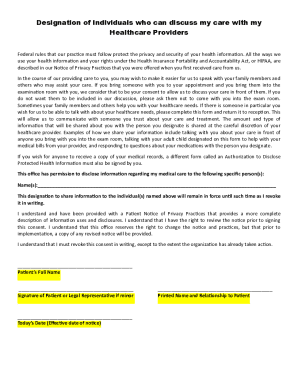

The individual credit authorization form serves several pivotal roles in financial transactions. First and foremost, it protects both parties involved — the customers and businesses. For companies, it legitimizes the transaction, providing a documented record of the customer's approval. This is essential for avoiding potential disputes or chargebacks, where a customer disputes a transaction they did not authorize.

Moreover, the form is an integral part of fraud prevention strategies. By requiring written authorization, businesses can significantly reduce the likelihood of fraudulent activities associated with credit card use. This formal consent provides a layer of security, assuring companies that they have the authority to charge the customer’s card without facing potential chargeback risks that could harm their financial stability.

Key components of the Individual Credit Authorization Form

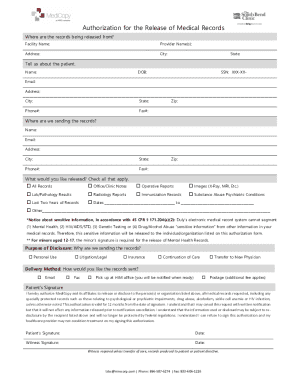

Understanding the essential components of the individual credit authorization form is crucial for both businesses and customers. The key elements typically include personal information fields, which gather the customer's name, address, and contact details. This information not only helps to identify the cardholder but also assists in ensuring that the billing details match the provided credit card information, thereby minimizing errors and fraud risks.

Additionally, there are payment information fields where customers enter their credit card number, expiration date, and CVV. This data is vital as it directly relates to the card used for the transaction. The authorization statement is another critical part of the form, where customers explicitly agree to the charges and terms set by the service provider.

Moreover, optional sections can enhance the usefulness of the form. For instance, there could be recurring payment terms when customers sign up for subscription services. Including a notification consent section for charge notifications can also keep customers informed about upcoming transactions, further fostering trust in the relationship.

Step-by-step guide to completing the Individual Credit Authorization Form

Completing the individual credit authorization form efficiently ensures that transactions move smoothly. The first step, gathering necessary information, is crucial. Customers should prepare personal identification, credit card details, and any additional information requested by the business. This not only helps in filling out the form promptly but also minimizes the chances of inaccuracies.

Step two involves filling out the form. Begin with personal information, ensuring each entry is accurate. When entering credit card details, it's vital to double-check numbers, as a single mistake can lead to payment errors. Common pitfalls include transposing digits or missing out on required fields. Customers should therefore take their time to fill out each section without rushing.

Once completed, step three is reviewing and editing the form. Checking for accuracy is essential, as an incorrectly filled form can lead to payment failures. Utilizing tools, like pdfFiller, can facilitate easy edits and modifications, enabling users to correct any mistakes swiftly. Ensuring that the document is properly signed is also an important aspect that should not be overlooked.

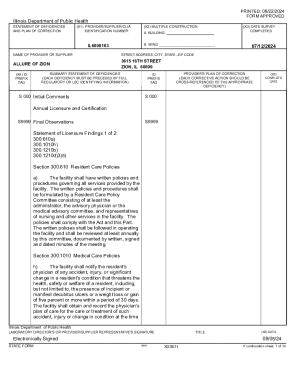

Enhancing security and compliance

Safeguarding sensitive information is of utmost importance when handling the individual credit authorization form. Businesses and customers should practice best practices for securely sharing the completed form, which may include encrypted emails and secure upload options to minimize the risk of unauthorized access. Physical copies of the form should also be stored securely to prevent identity theft or fraudulent charges.

Understanding the legal considerations attached to credit authorization forms is essential for compliance. Businesses must be aware of consent requirements, which often entail informing customers about how their data will be used. Compliance with financial regulations and consumer protection laws is a legal obligation that can save companies from potential lawsuits or penalties, emphasizing the importance of proper handling of these forms.

Utilizing pdfFiller for your individual credit authorization form needs

pdfFiller is an effective cloud-based platform that supports users in managing their individual credit authorization forms effortlessly. To access the Individual Credit Authorization Form template, navigate to the templates section of pdfFiller, where you'll find a variety of customizable documents available for your use. This feature allows users to create a document that meets their specific needs quickly.

The platform provides interactive tools for filling out the form, enabling users to complete sections intuitively. Furthermore, the eSigning feature allows both parties to sign the document electronically, streamlining the process significantly. Businesses can easily send forms out for signature and track the status, enhancing the efficiency of transaction processes.

Frequently asked questions (FAQ)

Mistakes can occur during the completion of the individual credit authorization form; thus, customers often wonder what to do if they make an error. The process for correction typically involves contacting the business or service provider to request a new form. Some companies may allow minor edits, while others may require a completely new submission.

Customers also frequently ask how long the authorization lasts. Understanding the timeframe for authorization is crucial, as some forms are valid until canceled, while others may have a set duration that requires renewal. Additionally, customers often inquire about cancellation procedures post-submission. Generally, revoking authorization involves notifying the business in writing, specifying the intent to cancel, and adhering to any terms set during the initial agreement.

Downloadable resources and templates

For those looking for resources, pdfFiller offers free individual credit authorization form templates that are easy to access and download. These templates are customizable to meet specific business requirements, ensuring users can tailor forms according to their operational needs. This facility ensures that individuals and teams can create professionally formatted documents in minutes without any hassle.

Using pdfFiller's templates efficiently involves familiarizing oneself with the editing tools available on the platform. Making modifications, adding contract terms, or updating contact information can be done swiftly inside the tool, paving the way for a seamless document handling experience.

Real-life applications and success stories

The practical applications of the individual credit authorization form extend to countless individuals and organizations. For example, businesses have streamlined their subscription services by using these forms effectively, resulting in increased revenue and improved customer satisfaction. Customers experience seamless transactions, which fosters loyalty and repeat business.

Experts advise that establishing clear communication concerning the use of the authorization form can significantly benefit both parties. Drawing upon real-life success stories, firms that have adopted clear procedures and transparent practices surrounding these forms report fewer disputes and an enhanced understanding among customers about payment processes, thus maximizing their operational efficiencies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send individual credit authorization form to be eSigned by others?

Where do I find individual credit authorization form?

How do I edit individual credit authorization form online?

What is individual credit authorization form?

Who is required to file individual credit authorization form?

How to fill out individual credit authorization form?

What is the purpose of individual credit authorization form?

What information must be reported on individual credit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.