Get the free FAQ - Anti-Steering Disclosure

Get, Create, Make and Sign faq - anti-steering disclosure

How to edit faq - anti-steering disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out faq - anti-steering disclosure

How to fill out faq - anti-steering disclosure

Who needs faq - anti-steering disclosure?

FAQ - Anti-Steering Disclosure Form

Understanding the anti-steering disclosure form

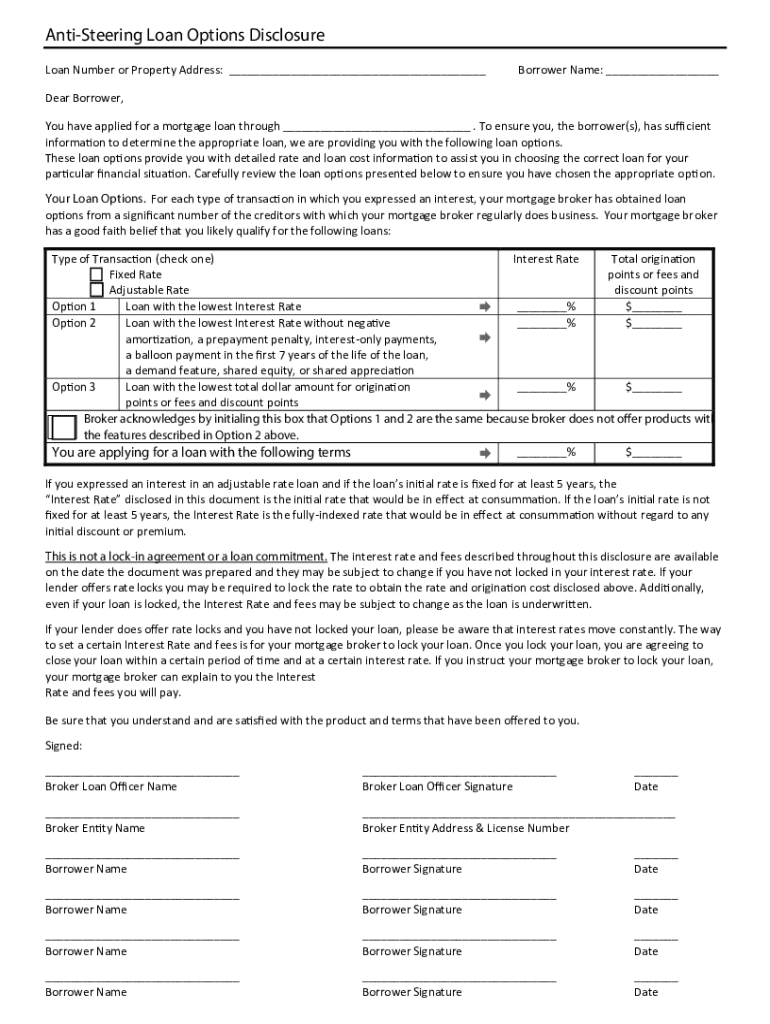

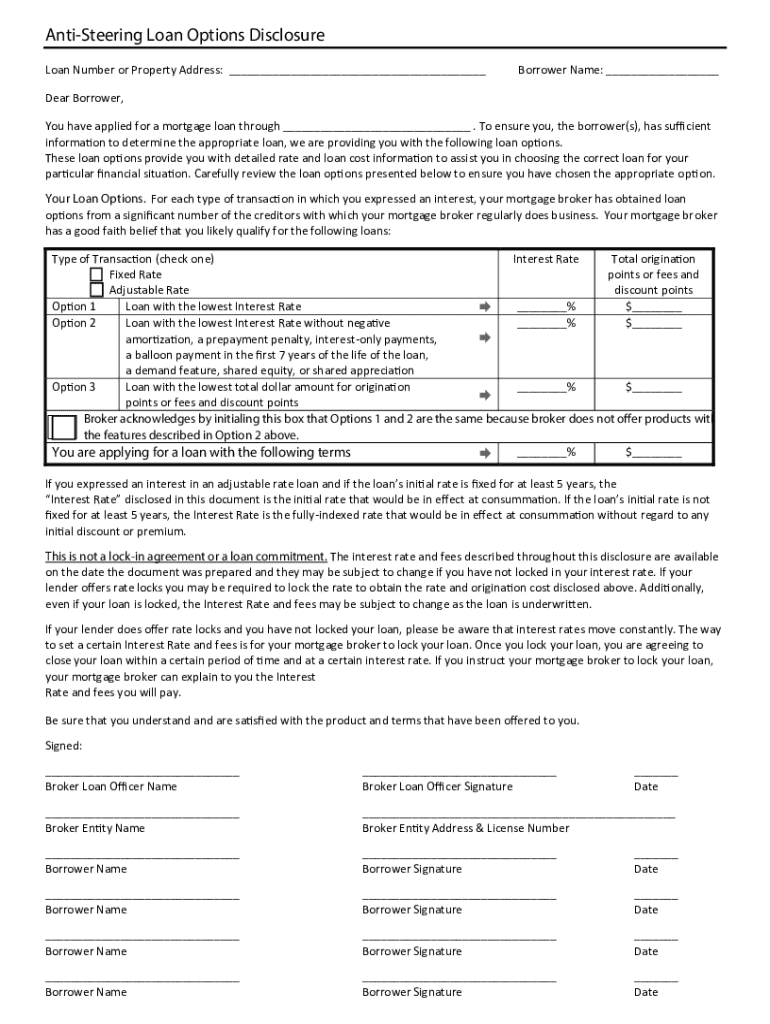

An Anti-Steering Disclosure Form is a crucial legal document designed to ensure transparency in the borrowing process. Its primary purpose is to inform borrowers about the loan options available and to clarify that lenders or brokers cannot steer a consumer towards specific products that may not be in their best interest. This form safeguards consumers against potentially misleading practices, ensuring they have full knowledge of their loan choices.

The importance of the Anti-Steering Disclosure Form lies in its role in protecting consumer rights. By requiring disclosure of the options available to borrowers, it empowers them to make informed financial decisions. This form is not only essential for ethical lending practices but also establishes trust between lenders and borrowers.

Legal background

The foundation for anti-steering practices is built on a framework of regulations meant to protect consumers in the lending market. Key legislation, including the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), emphasizes the necessity for clear and honest communication during the lending process.

Various agencies, such as the Consumer Financial Protection Bureau (CFPB), are integral in overseeing compliance with these regulations. This oversight helps enforce fair lending practices and ensures that brokers and lenders adhere to ethical guidelines, thereby increasing accountability within the industry.

Key components of the anti-steering disclosure form

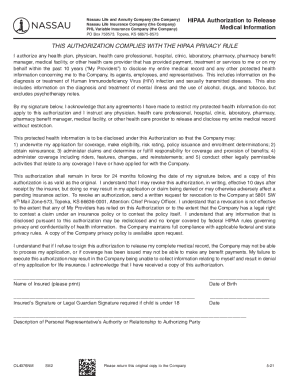

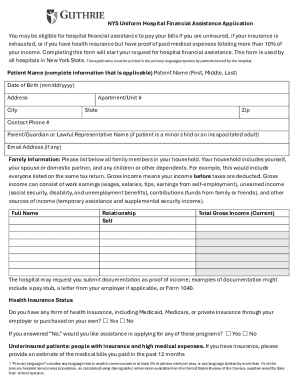

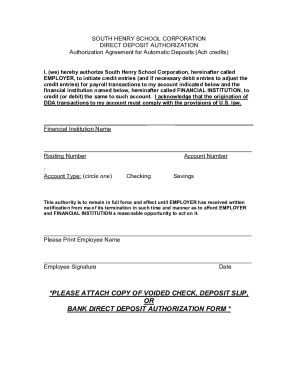

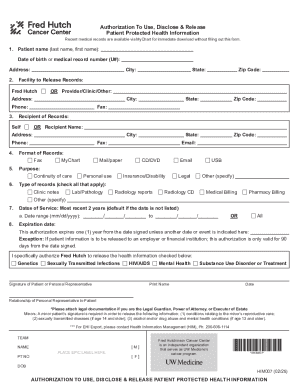

An Anti-Steering Disclosure Form comprises several key components that must be accurately completed to ensure its validity. Required information typically includes details about the borrower, the lender, and specific loan options contemplated by the borrower. Each piece of information serves to clarify the relationship between all parties involved and to create a transparent record of the lending situation.

Additionally, the form requires appropriate signatures from both parties, affirming the accuracy and understanding of the information disclosed. It is particularly important to note how and where to submit this form, as compliance is critical. While the form can often be submitted electronically, understanding the differences between e-signatures and handwritten signatures is essential for legal validity.

Who needs the anti-steering disclosure form?

The Anti-Steering Disclosure Form is primarily targeted at two groups: borrowers considering loans and loan originators or brokers facilitating the borrowing process. For borrowers, having a clear understanding of this form can protect their interests and guide their decisions about which loans to pursue. Loan originators and brokers, on the other hand, must be diligent in providing this information to comply with legal regulations and maintain ethical practices.

There are specific scenarios where the Anti-Steering Disclosure Form is mandatory. For instance, when a broker presents multiple loan options to a borrower, this form must be issued to ensure transparent communication. Failure to provide this disclosure could result in regulatory penalties and damage to the lender's reputation, as well as potential financial repercussions for borrowers who may have been misled.

Detailed instructions for completing the form

Completing the Anti-Steering Disclosure Form accurately is important for legal compliance and consumer protection. Here’s a step-by-step guide to ensure the form is filled out correctly and effectively:

Common mistakes to avoid include inaccurate borrower details and failing to provide all loan options presented. Double-checking your work can help mitigate these errors and ensure compliance with all required standards.

Interactive tools for the anti-steering disclosure form

Utilizing the right digital platforms can simplify the process of creating and managing the Anti-Steering Disclosure Form. One such resource is pdfFiller, which offers a comprehensive suite of tools for document management, including form creation and collaboration capabilities.

Important features of pdfFiller include the ability to edit forms easily, apply eSignatures, and collaborate with other parties efficiently. These capabilities not only save time but also enhance the overall user experience by providing a cloud-based platform that enhances accessibility and usability.

Using templates for efficiency

Using templates is crucial for streamlining the form-filling process. Templates available on pdfFiller can significantly reduce the time taken to complete the Anti-Steering Disclosure Form, allowing users to avoid repetitive entry of information. Accessing these templates is straightforward and can dramatically enhance efficiency in document management for both borrowers and brokers.

Troubleshooting common issues

Despite the clarity of the Anti-Steering Disclosure Form process, users may encounter common issues during submission. Problems with electronic submission, such as technical errors or format incompatibility, can impede the completion of this essential document.

Additionally, understanding what to do when the form is rejected or when more information is requested is vital. Being aware of the typical reasons for rejection can help users prepare better and avoid pitfalls during the submission process.

Contacting support for help

If issues arise, reaching out for assistance can help resolve them efficiently. pdfFiller offers support resources that users can leverage—whether it’s through live chat, email, or a comprehensive FAQ section. Understanding how to utilize these support avenues can minimize delays and ensure a smooth experience with the Anti-Steering Disclosure Form.

Real-life examples and case studies

Examining successful use cases of the Anti-Steering Disclosure Form reveals how crucial this document can be in borrowing situations. For instance, consumers who have taken the time to properly scrutinize their options, supported by the Anti-Steering Disclosure Form, often find loans that are more suitable to their financial circumstances. These individuals illustrate the value of being informed in regard to loan terms and conditions.

On the contrary, failed cases, where borrowers neglected to use the form or misunderstandings arose, highlight the risks involved. These anecdotes emphasize the importance of diligence and transparency in lending, reinforcing the benefits of utilizing the Anti-Steering Disclosure Form.

Best practices for handling the anti-steering disclosure form

Maintaining compliance with lending regulations is critical for both borrowers and lenders. Staying updated on regulatory changes is essential to ensure all forms, including the Anti-Steering Disclosure Form, adhere to the current legal requirements. Engaging in continual education about consumer rights and lender responsibilities can provide the necessary insight to navigate the lending landscape effectively.

Additionally, maintaining detailed records of completed forms is important. This not only aids in compliance but provides a resource for resolving potential disputes or misunderstandings. Document management can significantly reduce risks for both parties, hence ensuring a transparent and trustworthy lending relationship.

Conclusion: enhancing fair lending practices

The Anti-Steering Disclosure Form plays a vital role in consumer protection within the lending process. By promoting transparency, it encourages responsible lending practices that benefit both borrowers and lenders alike. Understanding this form is fundamental in navigating the complexities of loans, ensuring that consumers can make sound financial decisions.

As the lending landscape evolves, ongoing awareness of guidelines surrounding the Anti-Steering Disclosure Form will continue to be essential. Such diligence fosters an environment where everyone operates fairly and ethically, aiding in the establishment of trust throughout the financial marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send faq - anti-steering disclosure to be eSigned by others?

How do I edit faq - anti-steering disclosure straight from my smartphone?

How do I edit faq - anti-steering disclosure on an Android device?

What is faq - anti-steering disclosure?

Who is required to file faq - anti-steering disclosure?

How to fill out faq - anti-steering disclosure?

What is the purpose of faq - anti-steering disclosure?

What information must be reported on faq - anti-steering disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.